ETF Trends: Fixed Income, Currencies, and Commodities – 11/7/17

Bespoke’s Global Stock Market Trading Range Screen

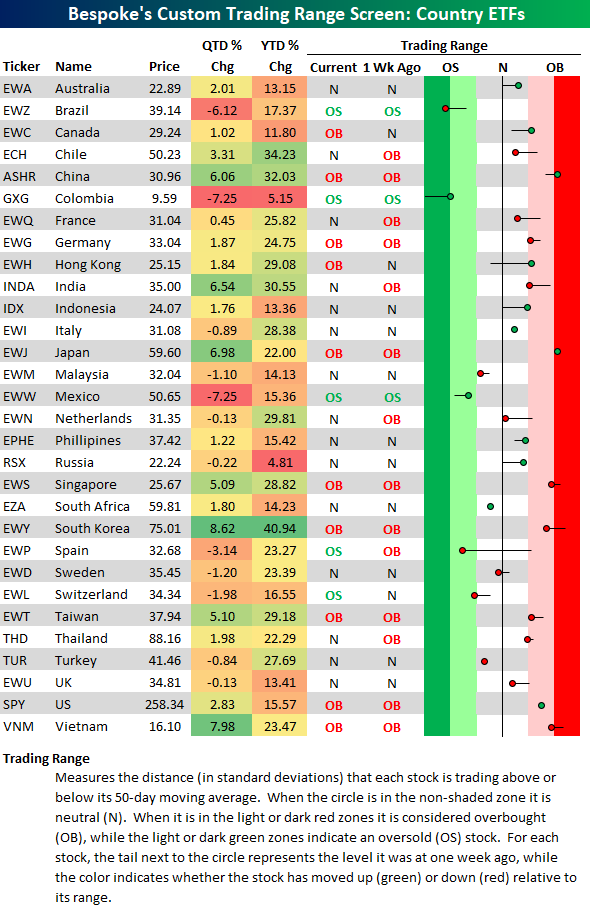

Below is an updated look at our global stock market trading range screen using 30 of the largest country ETFs traded on US exchanges. For each country, the dot represents where it’s currently trading, while the tail end shows where it was trading one week ago. The black vertical “N” line represents each country’s 50-day moving average, and moves into the red or green zones are considered “overbought” or “oversold.”

While it seems like markets have been doing nothing but go up lately, there’s actually been quite a bit of movement in both directions recently. Of the 30 ETFs in our screen, 10 are currently overbought while 5 are oversold. Brazil (EWZ) and Spain (EWP) are examples of countries that have moved lower down into oversold territory over the last week.

Even still, the average country ETF in our screen is still up more than 20% on a year-to-date basis. Quarter-to-date, the average country ETF is up just over 1%. Brazil, Colombia, and Mexico have done the worst this quarter, while China, India, Japan, South Korea, and Vietnam have done the best.

Chart of the Day: Dollar & Energy In Step

Longest Overbought Streak For S&P 500 Since 2012

It’s been quite a run for the S&P 500 over the last several weeks, and the chart below illustrates just how consistent the equity market’s strength has been. The chart comes from the second page of our daily Morning Lineup report, which is available to all Bespoke Premium and Institutional clients. In it, we show the S&P 500’s daily close relative to its 50-day moving average (DMA) where overbought levels are considered to be readings where the S&P 500 closes one or more standard deviations above its 50-DMA, while oversold levels are readings where the S&P 500 closes one or more standard deviations below its 50-DMA. As shown in the chart, ever since September, a period now covering 42 trading days, the S&P 500 has closed at either an overbought or extreme overbought level.

Looking at the chart, the current streak of overbought closes is easily the longest of the last year, but looking further back at the current bull market, there have only been three other periods where the S&P 500 closed at overbought levels for 40 or more trading days. The chart below shows the S&P 500 through the course of the entire bull market dating back to March 2009. As shown, two of those prior streaks occurred within ten trading days of each other when a 45 trading day streak ended on 11/12/10 and another one began on 12/1/00. Besides those two streaks, the only other streak of 40 or more trading days was back in early 2012 when a 43 trading day streak came to an end in March 2012. Finally, while it may be hard to see on the chart, in both the one and six months that followed these prior streaks coming to an end, the S&P 500 was up all three times. Three months later the S&P 500 was up two out of three times with the one down period coming after the March 2012 streak when we saw a decline of 5.8%.

Bespoke Stock Scores: 11/7/17

ETF Trends: International – 11/06/17

The Closer — SLOOS & Crude — 11/6/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the quarterly Senior Loan Officer Outlook Survey (SLOOS). We also take a look at global oil stocks per the IEA’s monthly oil market report.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke Stock Seasonality: 11/6/17

Chart of the Day: Lacing Up To Buy The Dip

Bespoke’s Earnings Triple Plays Report — 11/6/17

Here at Bespoke, our job is to identify winners and losers, and one of the ways we try to find earnings-season winners is through our list of “triple plays.”

Long-term Bespoke subscribers know how much we like triple plays, but for those that haven’t heard of the term, we came up with it back in the mid-2000s for companies that beat analyst earnings estimates, beat analyst revenue estimates and also raise guidance. Investopedia.com is one of the best online resources for financial markets education, and they’ve actually given us credit for coining the “triple play” term on their website. We consider triple play stocks to be the cream of the crop of earnings season, and we are constantly finding new long-term buy opportunities from this basket of names each quarter.

Since earnings season began back in early October, there have been 130 total triple plays. That’s a high reading indicative of a healthy corporate environment. Throughout earnings season, Bespoke sends Premium and Institutional members its “Earnings Triple Plays Report.” The report keeps a running tally of recent triple plays, and it also provides a list of “Top Triple Plays.” This is a list of the triple-play stocks that we think look the best from a fundamental and technical perspective coming out of their most recent earnings reports. We’ve just published our Earnings Triple Plays Report for the current earnings season. Learn how to see the stocks below!

See our Top Earnings Season Triple Plays by signing up for a Bespoke Premium membership now. Click this link for a 14-day free trial.