The Bespoke Report — Coddled and Entitled — 11/10/17

ETF Trends: US Sectors & Groups – 11/10/17

The Closer: End of Week Charts — 11/10/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

S&P 500 Quick-View Chart Book — 11/10/17

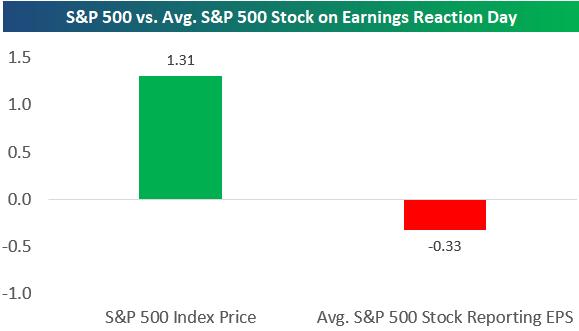

Underlying Earnings Season Weakness

More than 2,300 companies have now reported their Q3 2017 earnings results since earnings season began back on October 9th. With just a week left until the unofficial end of the reporting period, the S&P 500 is up 1.3% since the start of earnings season. While the S&P’s gain is nice to see, the underlying price action of S&P 500 stocks that have reported has been weak. This is a concerning sign. As shown in the chart below, the average S&P 500 stock that has reported EPS this season has fallen 0.33% on its earnings reaction day. This means investors have been doing more selling than buying of individual stocks that make up the S&P 500 in reaction to their earnings news.

Bespoke’s Sector Snapshot — 11/9/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

Below is one of the many charts included in this week’s Sector Snapshot, which is our trading range chart for S&P 500 sectors. The black vertical “N” line represents each sector’s 50-day moving average, and as shown, 6 of 10 sectors are currently above their 50-days. This week we’ve seen the Industrials sector break below its 50-day, and the Financial sector is getting close. At the same time, we’ve seen the Consumer Staples sector finally pick up a bit and move higher within its range.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

The Closer — Global Equity Momentum Fades — 11/9/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the slowing momentum of global equity markets and GDP growth forecasts for the US and the Eurozone.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

ETF Trends: Hedge – 11/9/17

Chart of the Day: Food Services Suffering

Biggest Market Cap Gainers Since the 2016 Election

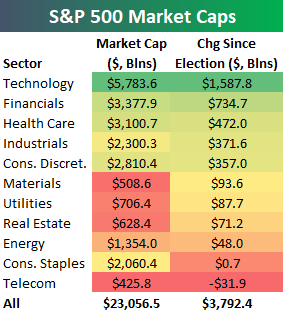

Yesterday we published an in-depth recap of asset class performance since the 2016 Presidential Election. You can view the full report here if you’re interested. One of the stats included in the report was the change in market cap experienced by the S&P 500 and its eleven sectors since last November’s election. As shown below, the S&P 500 has seen its market cap grow by $3.792 trillion since 11/8/16, leaving it with a total market cap of more than $23 trillion as of today.

In terms of sectors, Technology has grown by far the most with an increase in market cap of more than $1.5 trillion. The Financial sector has grown the second-most at only half that amount.

In terms of individual stocks, below is a list of the 35 S&P 500 stocks that have seen the biggest increases in market cap since last November’s Election. Six companies have seen growth of more than $100 billion! Apple (AAPL) has grown the most at $310 billion, followed by Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Facebook (FB), and Bank of America (BAC).