Bespoke Stock Scores: 11/14/17

B.I.G. Tips – CAT Sales Accelerate

The Closer — Deficit, Retail, Positioning — 11/13/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the latest monthly deficit data, review retail employment at the industry level, and update our trackers for futures market positioning per the CFTC’s Commitment of Traders report.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

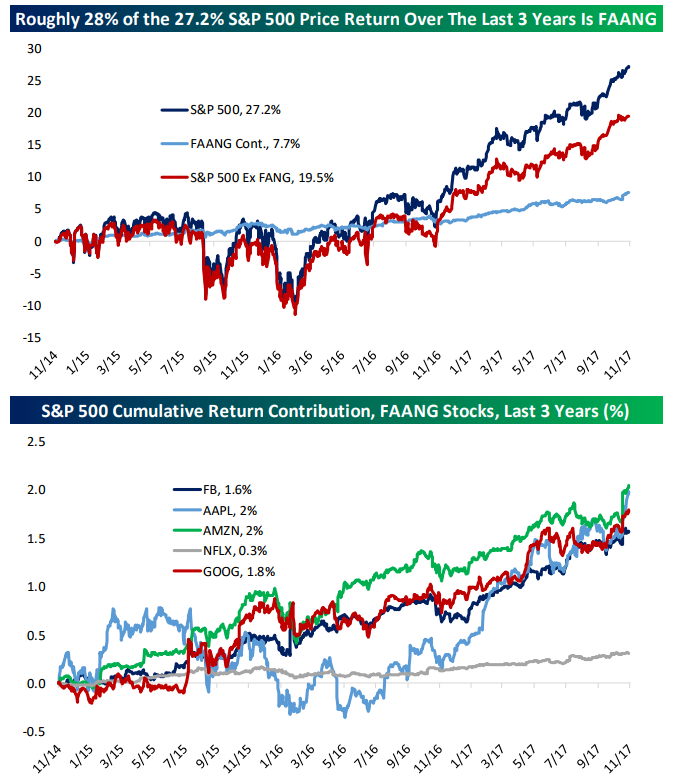

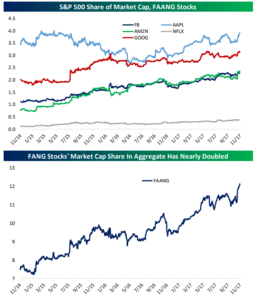

S&P De-FAANGed

One of our most-read reports is The Closer, which goes out each evening to Bespoke Institutional clients. Last week, a client was curious about the impact of the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Alphabet, née Google). These tech high-fliers have seized the conversation in equity markets over the last few years, and rightfully so given their strong performance, huge market caps, and torrid growth. As shown in the chart below, their aggregate weight in the S&P has increased from about 7.5% to over 12% in the last three years. It hasn’t been entirely smooth sailing the whole way – notably Apple had a period of declining weight which it has since shaken off. It’s also worth pointing out that Netflix is much smaller, and despite growing share of market cap strongly, it’s still very low-weighted in the index.

With higher weights comes a higher contribution to return. As shown below, of the 27% 3-year return for the S&P 500 through last week, 7.7 percentage points were because of the FAANGs, punching well above their market share weight. Of the 5 FAANG stocks, all except NFLX had added between 1.6 and 2.0 percentage points to S&P 500 performance over the past three years.

The YTD performance of the stocks versus the index is a similar story, with about 27% of the S&P’s gain in 2017 attributable to these 5 stocks. The rest of the index has added 11.5% to total performance YTD, which isn’t bad, but there’s a lot of outperformance from these large tech gainers. Of the 5, Apple is by far the biggest single driver, adding 1.5% to the aggregate S&P 500 return.

Tonight in The Closer, we’ll be discussing US economic data, specifically retail employment and the government deficit. If you’d like to receive a copy in your inbox, make sure to sign up for a free two week trial of our monthly or annual Institutional subscription today.

ETF Trends: International – 11/13/17

Bespoke Stock Seasonality: 11/13/17

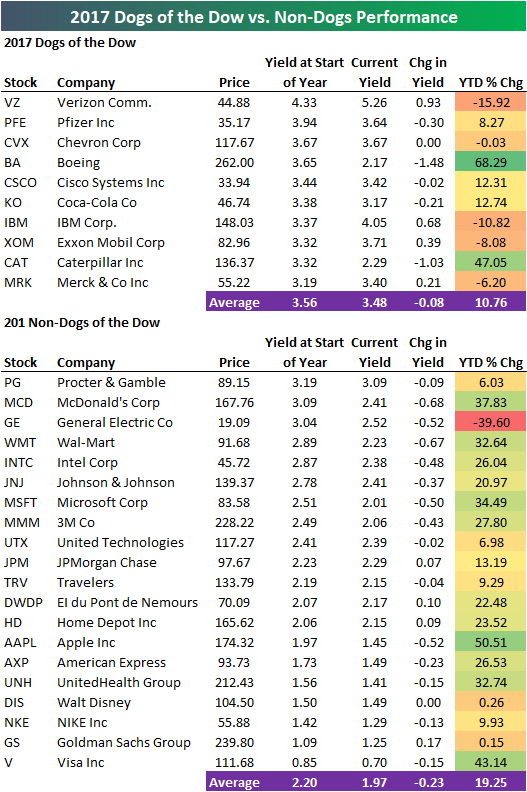

Rough Year for Dogs and Dividends

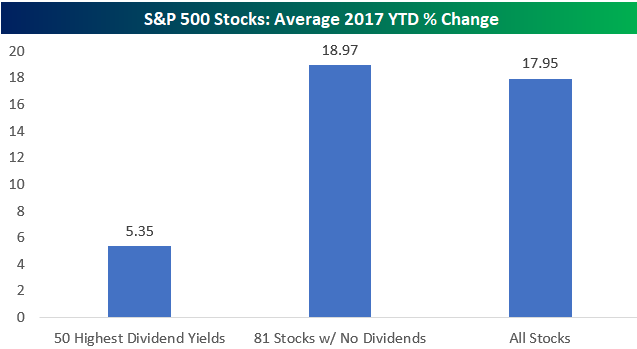

There are now less than 50 calendar days left in 2017, and below is an updated look at how the “Dogs of the Dow” strategy has been performing so far this year. The “Dogs of the Dow” strategy says to simply buy the 10 highest yielding stocks in the Dow at the start of each year. So far this year, the Dogs strategy has had two big winners in BA and CAT, but on average, the ten stocks are up 10.76%. That’s just over half the 19.25% gain that the 20 non-Dogs have averaged.

The Dogs strategy highlights a trend we’ve seen throughout 2017 of underperformance from higher yielding stocks. As shown below, the 50 highest yielding stocks in the S&P 500 at the start of 2017 are up in price by just 5.35% YTD, while the 81 stocks in the S&P 500 that paid no dividends are up 18.97%.

Investors in more conservative equity strategies that invest mostly in higher yielding stocks have had a rough 2017 compared to the returns of the S&P 500 or Nasdaq 100. The weakness can’t last forever, though, so if you’ve managed to avoid this area of the equity market, it may be time to take a look.

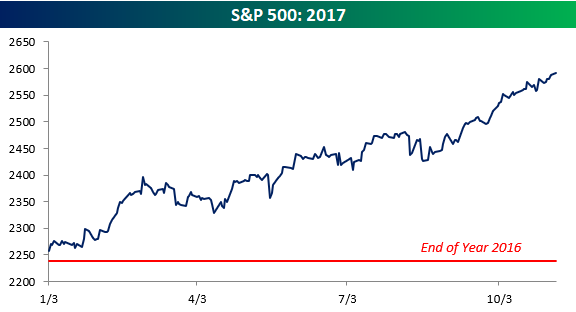

All Year In the Black

With the S&P 500 currently up 15% year-to-date, we’d basically need to see a market crash for the index to close down on the year when all is said and done on December 29th, 2017 (the last trading day of the year). If the market doesn’t crash, the S&P will likely go the entire year without trading into negative territory at any point.

As shown below, there have only been ten prior years where the S&P went the entire year without trading into negative territory. The last two were relatively recent in 2012 and 2013. What’s notable in the table is the performance in the following year after the S&P goes an entire year “in the black.” Following the ten prior occurrences, the index traded up the next year nine times and down just once. On average, the next-year gain was +12.52%. Investors would surely sign up for another 10%+ gain in 2018!

Chart of the Day: Investors Souring on the Year Ahead

Bespoke Brunch Reads: 11/12/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Wages

Why Is U.S. Wage Growth So Low? It’s All About the Top 80% by Matt Boesler (Bloomberg)

The low end of the wage pile (occupations with average hourly earnings in the bottom quintile of the distribution) have seen drastically higher wage growth recently. [Link; auto-playing video]

Bubbles

In 2017, Investors Can Either Buy Bubbles or Be Left Far Behind by Luke Kawa (Bloomberg)

An index of trades pundits have broadly agreed are unsustainable “bubbles” has drastically outperformed of late. [Link; auto-playing video]

Europe

European leaders seem determined to remake the “global savings glut” on a massive scale by Matthew C. Klein (FTAV)

Running persistent current account surpluses may reduce exposure to external shocks, but it creates problems elsewhere by forcing borrowing into economies that may not be able to use it productively. [Link; registration required]

On collateral: implications for financial stability and monetary policy by Stefano Corradin, Florian Heider, Marie Hoerova (ECB Working Papers)

This new discussion paper makes the argument that collateralizing lending is not sufficient to maintain financial stability; this is an intuitive result for anyone that’s spent time reading about previous financial crises. [Link; 51 page PDF]

The Hanseatic League 2.0 by Jim Brundsen and Michael Acton (FT)

The 13th century federation of trading nations in northern Europe is getting something of a revamp as a similar geographic lineup seeks to navigate Brexit and the future of the EU. [Link; paywall]

Blowups

America’s ‘Retail Apocalypse’ Is Really Just Beginning by Matt Townsend, Jenny Surane, Emma Orr and Christopher Cannon (Bloomberg)

This mix of text and graphics does a good job showing the scale of America’s dependence on retail; if the worst possible outcomes play out for the industry, it’s going to have a big impact. [Link]

Venezuelan debt: ‘Qué Pasa?’ by Lee C. Buchheit and Mitu Gulati (FT)

The dons of the sovereign restructuring world outline a strange set of developments in the Venezuelan bond market, which could point to a possible out for the country in its restructuring. [Link; paywall]

Crypto

Cryptocurrency Mania Fuels Hype And Fear At Venture Firms by Erin Griffith (Wired)

A review of how venture capital firms – the traditional gatekeepers of early stage tech funding – are reacting to the world of cryptocurrencies, blockchains, and ICOs. [Link]

Security Alert (Parity Technologies)

A cryptocurrency wallet provider was struck by a major vulnerability discovery this week, which put users’ portfolios at risk of theft. [Link]

Regulators begin to tackle the craze for initial coin offerings (The Economist)

A review of the current intersection between regulation, speculation, and abuse in the cryptocurrency space, especially ICOs. [Link; soft paywall]

Conspiracy

‘Fat Leonard’ probe expands to ensnare more than 60 admirals by Craig Whitlock (WaPo)

Have you heard about the massive corruption across the highest ranks of the Navy that’s currently being rooted out? We hadn’t either. A remarkable review of the effort to reign in the admirals. [Link; soft paywall]

Something is wrong on the internet by James Bridle (Medium)

A disturbing review of the darker side to kids’ favorite videos on YouTube, and in a more sinister sense, how and why those videos become popular. [Link]

Leaked Documents Expose Stunning Plan To Wage Financial War On Qatar – And Steal The World Cup by Ryan Grim and Ben Walsh (The Intercept)

A leaked presentation proposed to the UAE that FX trades, CDS positions, and a cornered bond market be used to disrupt Qatar. If this sounds like an absolutely ridiculous plan that could never work, you’re barking up the right tree, but the details are still highly entertaining. [Link]

Harvey Weinstein’s Army of Spies by Ronan Farrow (The New Yorker)

Potential accusers of Harvey Weinstein and the journalists working with them faced a sophisticated counterintelligence operation which included former Israeli spies and gross misconduct from lawyers. [Link]

Baseball Fakes

Teen Girl Posed For 8 Years As Married Man To Write About Baseball And Harass Women by Lindsey Adler (Deadspin)

In what may be the strangest story of the week, Adler reveals the details of a young woman who pretended to be a man on the internet so she could write about baseball…with very dark results. [Link]

Operation Stolen Base by Luke Winn (SI)

The story of a minor league washout’s road from behind home plate to behind bars, all part of the largest sports memorabilia fraud in history. [Link]

Anthropology

Most scientists now reject the idea that the first Americans came by land by Annalee Newitz (Ars Technica)

While there’s no dispute that the Clovis people of ~13,500 years ago crossed from Siberia to North America by a land bridge, it’s almost certain they were proceeded by island-hopping peoples of the Pacific. [Link]

Have a great Sunday!