The Bespoke Report 2018 — Valuations

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Valuations” section of the 2018 Bespoke Report, which looks at a variety of different valuation metrics for the broader market as well as individual sectors. We answer just how overvalued (or undervalued?) this market really is.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

S&P 500 Quick-View Chart Book – 12/15/17

A Record for Record Highs

As long as the Dow closes above 24,585.43 today, it will mark the index’s 69th record closing high of the year, and that would tie 2017 with 1995 for the record of most record closes in a given year. The chart below shows the annual number of record closing highs for the Dow going back to 1900. In the last 117 years, there have only been two other years (1925 and 1995) where the index saw more than 60 record highs in a given year. If you’re a bull, you have to like the fact that even though those years saw big gains, the year after was also positive. In 1926, the DJIA was essentially flat (+0.35%), but in 1996 the Dow rallied another 26%.

The Bespoke Report 2018 — Yield Curve & The Fed

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Yield Curve & The Fed” section of the 2018 Bespoke Report, which lays out our views on the path for interest rates in 2018.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Bespoke Report 2018 — Sentiment

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Sentiment” section of the 2018 Bespoke Report, which looks at current and historical levels of stock market sentiment and economic sentiment. We analyze whether investors and consumers are currently overly optimistic, negative, or simply complacent.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Bespoke Report 2018 — The Year in Headlines

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Year in Headlines” section of the 2018 Bespoke Report, which provides a month-by-month and day-by-day look at the major financial news headlines that impacted markets throughout 2017. It’s an excellent way to refresh your memory of the news events that impacted markets over the past year. You’ll likely have forgotten more than you’d like to believe, which shows that while certain events might seem important and impactful at the time, the market usually moves past things pretty quickly!

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Bespoke Report 2018 — Seasonality

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Seasonality” section of the 2018 Bespoke Report, which highlights the seasonal tendencies of large, mid, and small cap stocks throughout the trading year, as well as individual sectors and additional asset classes.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Bespoke Report 2018 — Thematic Performance

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Thematic Performance” section of the 2018 Bespoke Report, which highlights the various market themes like large caps versus small caps, value versus growth, and stocks versus bonds that are currently outperforming and underperforming as we get set to enter the new year.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Closer — More Price Pressure, Banxico Hikes — 12/14/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the Banxico policy decision today and the trade prices report for November from the US Census.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 12/14/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

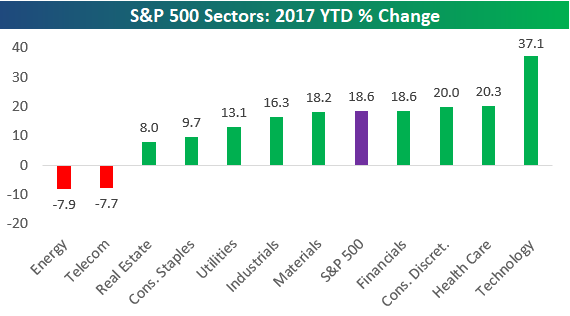

Below is one of the many charts included in this week’s Sector Snapshot, which highlights the year-to-date performance of the S&P 500 and its eleven sectors. As shown, along with Tech, both Consumer Discretionary and Health Care have now crossed above the +20% mark.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.