The Closer — Minutes Review, Chinese Credit & PBoC, Existing Home Sales — 8/22/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review Fed Minutes, existing home sales, and EIA data from the US today. We also dive into the growth of Chinese credit, including both the total lending figures for the broad economy and the recent evolution of the central bank’s balance sheet.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Will US Equities Continue to Outperform?

Bullish Bank Charts

Last night in The Closer we showed that S&P 500 Banks have been underperforming the market relative to the level of short-term yields and the shape of the UST curve. In addition to that analysis for the group as a whole, we also identified 4 charts with constructive patterns which look likely to outperform. First, JP Morgan (JPM) is in the process of forming a multi-month cup-and-handle. While the stock has not yet broken out, the set-up has potential. SunTrust (STI) has already broken out from a similar formation and is leading the group higher. PNC Financial (PNC) and M&T Bank (MTB) have already broken out of downtrends, but are much further below recent highs. While these patterns are all somewhat different, they all suggest good things ahead for banks, in addition to the positive signal from interest rates.

Get access to our post-market macro report — The Closer — with a two-week free trial to Bespoke Institutional.

Fixed Income Weekly – 8/22/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

We assess which emerging market economies have the most risky profiles based on external debt growth and reserve adequacy.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 8/22/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — Banks Cheap, Going Fishing In Europe — 8/21/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we make the case that bank stocks are cheap relative to the broader market based on macro factors. We also identify specific banks that have attractive chart patterns. We follow that analysis up with a look at index earnings growth versus valuation, and identify European stocks with strong growth but low valuation.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Best and Worst S&P 500 Stocks on the Road to Nowhere

Many are out making a big deal about the fact that the S&P 500 traded back to a new all-time high today, but the reality is that the S&P 500 has been ‘dead money’ for nearly seven months now. Along with the index itself being unchanged since late January, a very slight majority of stocks (256) in the S&P are lower now than they were on 1/26, and overall, the average change of the 500 individual stocks in the index since then is a decline of 0.35%. At the extremes, though, there have been some big winners and losers. We’ll start with the good news.

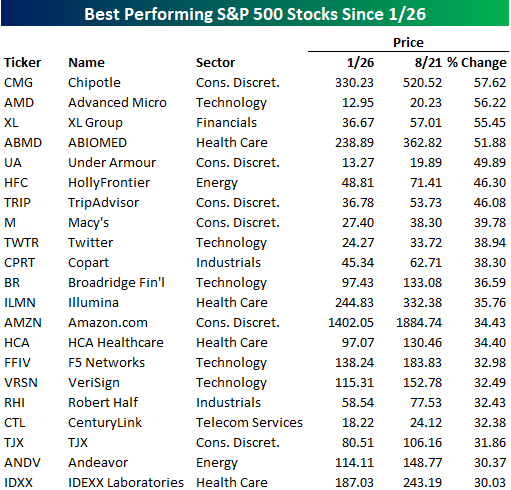

The table below lists the 21 stocks in the S&P 500 that have gained more than 30% since the S&P 500’s 1/26 closing high. Topping the list of biggest winners is Chipotle (CMG), which has been on quite a run, gaining more than 57% even after taking a skid last week on reports of further health issues with customers eating their food. Right behind Chipotle, although it may not want to get too close, is AMD, which is up 56%. Behind these two leaders, two other stocks (XL Group and ABIOMED) are up over 50%. Other notable names on the list of biggest winners include Under Armour (UA) and Twitter (TWTR). Also worth pointing out is that besides Amazon.com (AMZN), none of the other FAANG stocks made the list. So much for the argument that FAANG stocks are the only ones going up.

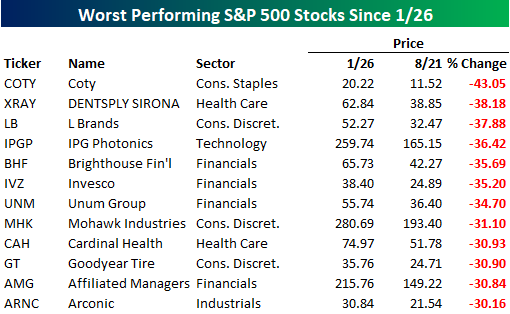

While there have been 21 S&P 500 stocks that have rallied 30% or more since 1/26, 12 stocks in the S&P 500 have lost more than 30% during that span. The biggest loser of them all has been Coty (COTY), which is down over 43%, including a drop of 7% today. L Brands (LB) is another big loser as it has seen its stock fall more than 37% since 1/26. Thankfully for most investors, there are not a lot of high-profile names on this list, but if you’re a holder of any of these names, it has definitely been a frustrating six months.