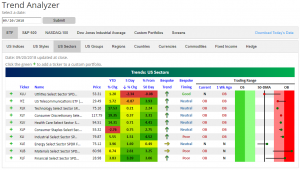

Trend Analyzer – 9/24/2018 – Small and Mid Cap Lag Behind

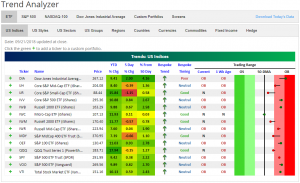

We are starting off the week with our Trend Analyzer showing most major US Index ETFs as overbought. Currently, 9 are overbought, 5 are neutral, and none are oversold. The Dow (DIA) still leads the group having seen the largest gains last week. Micro-Cap (IWC) is back at its 50-DMA. This is below where it was on Friday but still is an improvement from where it was for the better portion of last week.

As we mentioned last week, small and mid cap ETFs have been underperforming recently. Most of these funds have seen either losses or are barely positive in this time span. Notably, the Core S&P Small-Cap (IJR) has the second greatest gains YTD, but over the past week it has been selling off. At its current level, the ETF has fallen 1.15% over the last week, moving from overbought to just above its 50-DMA.

September has so far been a month that has seen the equity market gain, but new leadership has emerged as the year’s previous winners have experienced mean reversion. This is a sign of a healthy market.

Bespoke Morning Lineup – 9/24/18

US equities look like they are going to kick off the week on a down note today as the latest tit for tat trade spat between the US and China continues. Both Chinese and Japanese equities were closed for holidays overnight, and European equities are broadly (but not sharply) lower to kick off the week.

As noted in last week’s Bespoke Report, the US stock market is coming off a strong period for the bulls as the S&P 500 has rallied in eight of the last ten sessions completing what was a textbook technical pattern breaking out, testing the original breakout point, and then making a run for new highs.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

B.I.G. Tips — New Highs For Brent, Chinese Tariffs, IFO, And UK Volatility Start The Week Off

Bespoke Morning Lineup – Pre-Market News and Analysis

US equities look like they are going to kick off the week on a down note today as the latest tit for tat trade spat between the US and China continues. Both Chinese and Japanese equities were closed for holidays overnight, and European equities are broadly (but not sharply) lower to kick off the week.

As noted in last week’s Bespoke Report, the US stock market is coming off a strong period for the bulls as the S&P 500 has rallied in eight of the last ten sessions completing what was a textbook technical pattern breaking out, testing the original breakout point, and then making a run for new highs.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 9/23/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Economics

Heterogeneous effects of trade agreements across product types by Rebecca Freeman and Samuel Penknagura (Voxeu)

This assessment of modern trade agreements gauges which groups of goods see the most volume gains in response to new agreements. Just like in real estate, the answer comes down to location, location, location. [Link]

Record-Low 12% Cite Economic Issues as Top U.S. Problem by Frank Newport (Gallup)

Gallup has been asking consumers how they feel about the economy for almost 30 years now and they’ve never been less concerned about the state of the economy. [Link]

Conspicuous Consumption

Pimp Your Ride: Splurge on a Lower License-Plate Number by Scott Calvert (WSJ)

A new – or maybe an old made new again – trend in high dollar consumer goods: license plates with low numbers are attracting huge interest from those with money to burn. [Link; paywall]

How Puerto Rico Became the Newest Tax Haven for the Super Rich by Jesse Barron (GQ)

A look at the latest tax dodge employed by the wealthiest Americans, featuring an easily dodged requirement to relocate to the gorgeous, friendly, and fiscally strapped US territory of Puerto Rico. [Link]

Insurance

Life Insurance Offering More Incentive to Live Longer by Paul Sullivan (NYT)

While the idea of reporting your step count to your insurer via an Apple Watch is appealing to some, John Hancock’s new policy of requiring reporting of wellness activity also has a faintly dystopian angle. [Link; soft paywall]

Gaming

Fortnite has now been cited in more than 200 divorce proceedings by William Hughes (AV News)

Given the obsessive activity from millions of players, it shouldn’t be a surprise that Fortnite is being cited as a reason (admittedly, probably only one of many in most cases) as a cause of divorce. [Link]

Sports

For you sports fans out there (and/or gamblers), here are our week 3 NFL picks versus the spread.

North Texas explains the (amazingly elaborate) FAKE FAIR CATCH touchdown trick by Alex Kirshner (SBNation)

A detailed analysis of one of the most impressive trick plays that’s been run in years: a fake fair catch which North Texas ended up taking back for a touchdown against Arkansas. [Link]

Tech

Europe’s New Copyright Law Could Change The Web Worldwide by Klint Finley (Wired)

Following closely on the heels of wide-reaching GDPR privacy regulation, the European Parliament passed sweeping copyright legislation that would force the use of “upload filters”, preventing upload of copyrighted material. [Link]

Comedy

Soviet Jokes for the DDCI (CIA)

Declassified jokes collected by the CIA in the old Soviet Union are a good source of laughs, both in their own right and as part of a meta joke that they were ever classified in the first place. [Link; 2 page PDF]

A resident of New Bern, NC, may in fact have a new boat by Brendan Greeley (FTAV)

This classic of the FT Alphaville blogging genre takes a throw-away comment by the President and runs through the full legal and economic analysis, with a healthy dose of policy implications alongside. [Link; registration required]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

2018 Week 3

Week 2 Results: 8-6, Overall: 17-11 (60.7%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 3.

After going 9-5 versus the spread in Week 1, we were 8-6 in Week 2 with one push. This brings our overall record through 2 weeks to 17-11 (60.7%).

2018 NFL Week 3 Bespoke Picks:

New Orleans at Atlanta (-1.5): New Orleans +1.5

San Francisco at Kansas City (-6.5): Kansas City -6.5

Oakland at Miami (-3): Miami -3

Buffalo at Minnesota (-16.5): Minnesota -16.5

Indianapolis at Philadelphia (-7): Indianapolis +7

Green Bay (-2.5) at Washington: Green Bay -2.5

Cincinnati at Carolina (-3): Cincinnati +3

Tennessee at Jacksonville (-9.5): Tennessee +9.5

Denver at Baltimore (-5.5): Denver +5.5

NY Giants at Houston (-6): NY Giants +6

LA Chargers at LA Rams (-7): LA Rams -7

Chicago (-4.5) at Arizona: Chicago -4.5

Dallas at Seattle (-1.5): Seattle -1.5

New England (-7) at Detroit: New England -7

Pittsburgh (-1) at Tampa Bay: Pittsburgh -1

Week 3 Picks: 9 Favorites, 6 Dogs; 5 Home, 10 Away

2018 NFL Week 2 Bespoke Results:

Carolina at Atlanta (-6): Carolina +6 (Loss)

LA Chargers (-7.5) at Buffalo: LA Chargers -7.5 (Win)

Minnesota at Green Bay (Even): Minnesota Even (Push)

Houston (-3) at Tennessee: Tennessee +3 (Win)

Cleveland at New Orleans (-9.5): New Orleans -9.5 (Loss)

Miami at NY Jets (-2.5): NY Jets -2.5 (Loss)

Kansas City at Pittsburgh (-5): Kansas City +5 (Win)

Philadelphia (-3) at Tampa Bay: Philadelphia -3 (Loss)

Indianapolis at Washington (-6): Indianapolis +6 (Win)

Arizona at LA Rams (-13.5): LA Rams -13.5 (Win)

Detroit at San Francisco (-6): San Francisco -6 (Loss)

Oakland at Denver (-6.5): Oakland +6.5 (Win)

New England (-1.5) at Jacksonville: Jacksonville +1.5 (Win)

NY Giants at Dallas (-3): NY Giants +3 (Loss)

Seattle at Chicago (-3): Chicago -3 (Win)

The Bespoke Report — Passing With Flying Colors

School has been back in session for less than a month now, but the S&P 500 already had its first test of the semester and came out passing with flying colors. After breaking out to new highs at the end of August, the S&P 500 pulled back in early September and found support right at its prior highs from January. After holding that level, the S&P 500 has now traded higher on eight of the last ten trading days, rallying to higher highs. It doesn’t get much more textbook than that!

Heading into the week,the DJIA was the only major US index that had yet to take out its January high, but that changed this week as the index closed out the week with four straight days of gains. While most other indices ran into resistance on their first attempts to take out their highs from January, the DJIA just buzzed right through it.

We’ve just published our latest weekly Bespoke Report newsletter, which is available to subscribers across all three of our membership levels. Sign up here to read the report.

To get up to speed on our thoughts regarding the market’s direction going forward, choose any membership option and access this week’s full Bespoke Report newsletter after signing up! You won’t be disappointed. Some of the topics discussed in this week’s report include:

- Index and sector breadth checkup

- US economy update

- What major indicators say about the odds of a recession

- How recent earnings report stack up

- An ‘Industrious’ rally

- Commodities and the Materials sector

- Mutual fund and ETF flows

- High yield spreads

- Rotational forces

- Model Growth Portfolio update

The Closer: End of Week Charts — 9/21/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

Below is a snapshot from today’s Closer highlighting the current positioning of speculators in US interest rate markets. If you’d like to see more, start a free trial below.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

B.I.G. Tips — A Busy End To The Macro Week Abroad

Trend Analyzer — 9/21/18

Coming off of the Dow and S&P 500 both hitting all-time highs during yesterday’s session, our Trend Analyzer is showing a sea of green. Yesterday we highlighted several of these ETFs as being down versus a week ago. Today, every one of the fourteen major US Index ETFs are higher than they were heading into last Friday. Additionally, eleven are currently overbought, three are neutral, and none are oversold.

This week, there has been a recurring theme in our Trend Analyzer that while most ETFs have been overbought, it was not by much. This is no longer the case today. Many of the ETFs are considerably more overbought than before with some nearing extreme overbought levels. Two that have neutral readings—Core S&P Small-Cap (IJR) and the Russell 2000 (IWM)—are on the cusp of moving into overbought territory. Meanwhile, the Micro-Cap ETF (IWC) has traded below its 50-DMA all week but has finally moved above. The Dow (DIA) is flexing its muscles from yesterday’s gains with a gain of 2.01% on the week (double the next highest) and is the most overbought ETF up 4.15% from its 50-DMA.

Finally, as we discussed yesterday in our Bespoke Sector Snapshot, the Financials and Materials sectors have recently lagged, but that hasn’t been the case this week. Both Materials (XLB) and Financials (XLF) have experienced the largest gains of the sector ETFs over the past week moving well into overbought territory.