The Closer — Bonds Breaking, Hawkish Talk, Brazilian Polls Firming — 10/3/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we discuss the rip higher in bond yields today. While investors may focus on the outright levels of yields, more impressive was the steepening of the curve as yields moved up. We also review hawkish Fed speakers that helped precipitate the move as well as a discussion of weekly EIA petroleum market data. Finally, we chart the consolidation of Brazilian polling behind two specific candidates ahead of Sunday’s election.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke Consumer Pulse Report — September 2018

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in year two of Trump’s economy. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Chart of the Day — Intel (INTC) and Others Breaking Out Of Downtrends

Bitcoin Lingers

With bitcoin down over 66% from its highs earlier in the year, it may sound pretty unbelievable, but the standard bearer of the crypto-currency space is still up over 50% on a y/y basis. That’s right, back in early October 2017, bitcoin was trading at a price of just $4,283 compared to today’s price of $6,463. Bubbles can take quite a long time to fully deflate!

With bitcoin still trading up over 50% from where it was a year ago, it is actually outperforming all but 12 individual stocks in the Nasdaq 100 during that span. Just to show how timing really is everything when it comes to investing, while just 12 Nasdaq 100 stocks are outperforming bitcoin over the last year, on a YTD basis every single one of them has outperformed bitcoin.

Eurozone Real Retail Sales Miss Again

Last night, data was released for Eurozone Real Retail Sales. For the 7th month in a row, the indicator missed economist estimates. This is the second longest streak of misses since 2007 when the indicator missed for 9 straight months ending in December 2007.

Sales reported for August were down -0.2% versus estimates of a gain of 0.2%. The prior month also saw a large downward revision to -0.6% from the original -0.2% number. This is on the back of less than exciting releases—especially on a YoY basis—for Markit Composite and Services PMIs for the Eurozone area that also came out last night.

As you can see in the chart below, historically, Retail Sales have been reliably correlated to Consumer Confidence. But in the past few years we have witnessed the two indicators begin to diverge. The silver lining to this divergence is it helps to explain the misses. Since the two have moved in sync in the past, economists rely on confidence data to predict upcoming sales, and the two moving further apart throws off estimates.

Fixed Income Weekly – 10/3/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we review the outlook for the ten year yield based on seasonality and positioning.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

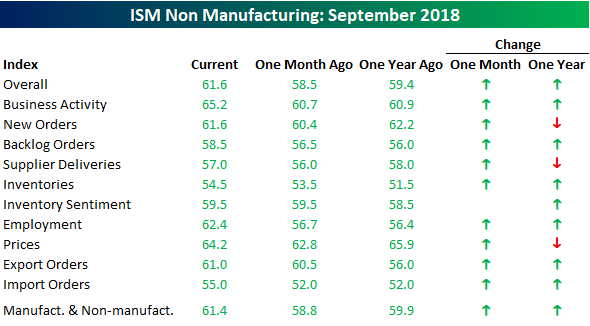

Services Sector on Fire

Within the commentary section of the September ISM Non-Manufacturing report today, one of the respondents noted that “Every day is a bit better than the last.” Looking at the details of this month’s report, that person’s comment may actually be an understatement. At the headline level, the September ISM Non-Manufacturing report came in at 61.6 versus estimates of 58.0. That 61.6 reading is the second highest reading in the history of the series dating back to 1997 and the strongest report relative to expectations since last October. As the top chart below also illustrates, the headline index has also surged in the last two months, rising from 55.7 up to 61.6. That 5.9 point increase is the largest two-month increase in the history of the index. The only other times where the headline index has increased more than five points over a two-month period were in January 2009 and last September. A little ‘bit’ better? Looks more like a lot.

Taking today’s reading and combining it with Monday’s ISM report on the manufacturing sector and weighting each sector accordingly, the combined composite ISM for September came in at a record 61.6 versus August’s reading of 58.5.

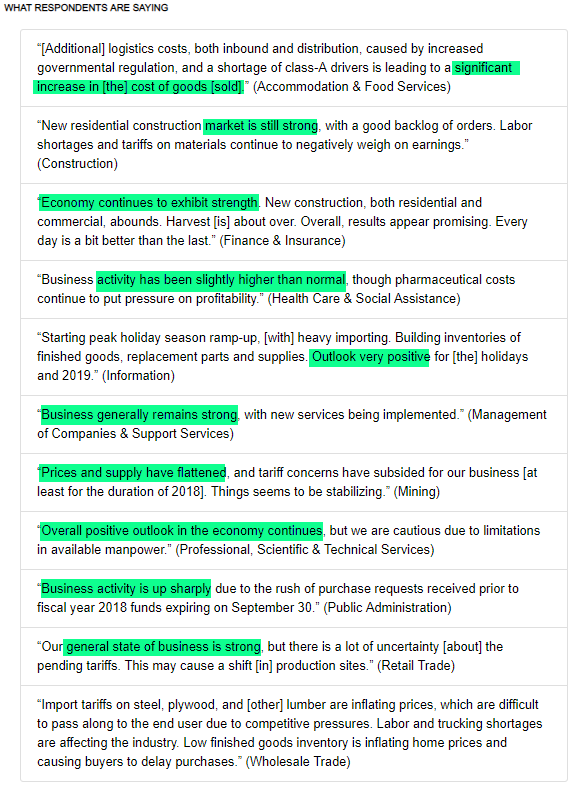

Looking at the commentary section of this month’s report shows a good deal of positive sentiment. In addition to the over-riding optimism, there was also mention of pricing pressures, worker shortages, and tariffs, although the discussion of tariffs was not nearly as widespread as it was in the Manufacturing report.

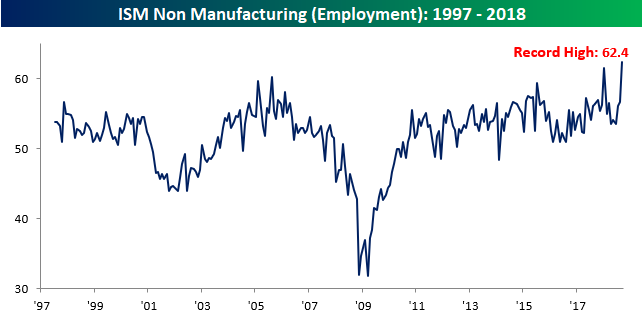

Looking at the internals of this month’s report, the m/m numbers were really strong as not a single sub-index was down versus August. Going all the way back to 1997, there has never been another month where not a single sub-index declined on a m/m basis. The biggest gainers were Employment (chart below), which surged to a record high, and Business Activity, which hit its highest level since January 2004. With the Employment component at record highs and today’s ADP Private Payrolls report coming in handily above forecasts, it’s hard to imagine a weak Non-Farm Payrolls report on Friday. On a y/y basis, trends were also strong with just three components falling y/y.

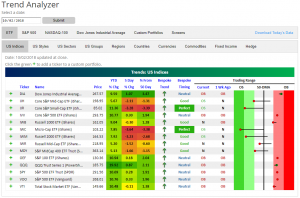

Trend Analyzer – 10/3/18 – More Momentum to the Downside

Other than the Dow, most major indices saw losses on the day yesterday. These downward movements helped to push the small-cap ETFs further into oversold territory. Recently, these ETFs have had far greater momentum downwards as we have been highlighting the divergence between small-cap and large-cap focused ETFs. For example, the Dow (DIA) has remained one of the best performers recently while the Micro-Cap (IWC) has greatly underperformed. Our Trend Analyzer today is showing a continuation of this with 7 overbought, 3 neutral, and 4 oversold. Like yesterday, most of the overbought ETFs are in a similar place to where they were one week ago, mostly sitting only slightly higher. On the other hand, the ones that have moved down have moved big. Core S&P Small-Cap (IJR) and Micro-Cap (IWC) have both gone into extreme oversold territory. Along with the Russell 2000 (IWM), these three ETFs are all down over 3% from mid-week last week.

Bespoke’s Global Macro Dashboard — 10/3/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – Relief Out of Italy

Relief out of Italy that the country may reign in spending a bit more than previously planned has European equities trading higher this morning, and Us equity futures are following along in the footsteps.

Two of the most hated sectors in the market right now are homebuilders and semis, and this morning there is news that could impact both sectors. One good and one bad.

First the good news. In the homebuilder space, Lennar (LEN) reported better than expected earnings on revenues that were slightly better than estimates. The stock is trading up over 2% in reaction, but it will be important to see if those gains can hold. Recent positive news for the sector hasn’t had much staying power.

In the semiconductor space, Morgan Stanley cut estimates on the group after downgrading the sector back in the Summer. There’s been a lot of negative commentary towards the semis in recent weeks, so how the group reacts to today’s negative commentary could provide a good tell for the fourth quarter.

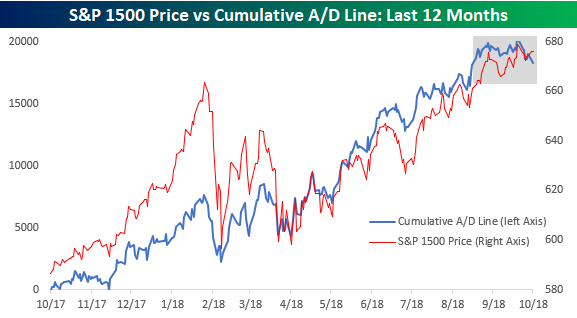

As the number of stocks hitting 52-week lows has increased in recent sessions, there’s been a lot of talk about weakening breadth in the market over the last several sessions. We have repeatedly highlighted the fact that breadth among large-cap stocks continues to be strong, but we’ll be the first to admit that among smaller and mid-cap stocks, breadth hasn’t been as positive.

The chart below shows the S&P 1500 (which comprises large-cap stocks in the S&P 500 as well as mid-cap stocks from the S&P 400 and small-cap stocks from the S&P 600). While the picture here isn’t quite as strong, it is hardly showing signs of a major negative divergence either. In fact, both the cumulative A/D line and the index’s price both hit their most recent all-time highs on the same day (9/20). That said, there is a clear case to be made that in the short-term breadth among the S&P 1500 stocks has flattened out, even as equities have rallied. In fact, while the S&P 1500’s cumulative A/D line is at the same levels it was at on 8/20- a month before the peak- the S&P 1500’s price is 2.3% higher. Not a major divergence yet, but something worth keeping an eye on.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.