Relief out of Italy that the country may reign in spending a bit more than previously planned has European equities trading higher this morning, and Us equity futures are following along in the footsteps.

Two of the most hated sectors in the market right now are homebuilders and semis, and this morning there is news that could impact both sectors. One good and one bad.

First the good news. In the homebuilder space, Lennar (LEN) reported better than expected earnings on revenues that were slightly better than estimates. The stock is trading up over 2% in reaction, but it will be important to see if those gains can hold. Recent positive news for the sector hasn’t had much staying power.

In the semiconductor space, Morgan Stanley cut estimates on the group after downgrading the sector back in the Summer. There’s been a lot of negative commentary towards the semis in recent weeks, so how the group reacts to today’s negative commentary could provide a good tell for the fourth quarter.

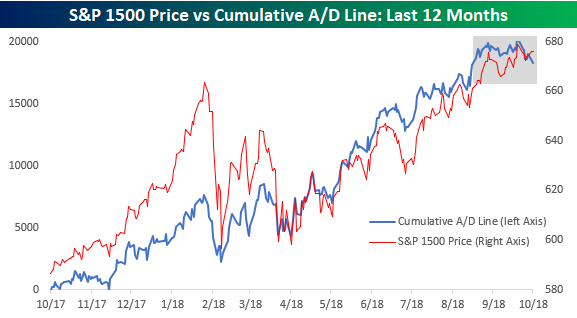

As the number of stocks hitting 52-week lows has increased in recent sessions, there’s been a lot of talk about weakening breadth in the market over the last several sessions. We have repeatedly highlighted the fact that breadth among large-cap stocks continues to be strong, but we’ll be the first to admit that among smaller and mid-cap stocks, breadth hasn’t been as positive.

The chart below shows the S&P 1500 (which comprises large-cap stocks in the S&P 500 as well as mid-cap stocks from the S&P 400 and small-cap stocks from the S&P 600). While the picture here isn’t quite as strong, it is hardly showing signs of a major negative divergence either. In fact, both the cumulative A/D line and the index’s price both hit their most recent all-time highs on the same day (9/20). That said, there is a clear case to be made that in the short-term breadth among the S&P 1500 stocks has flattened out, even as equities have rallied. In fact, while the S&P 1500’s cumulative A/D line is at the same levels it was at on 8/20- a month before the peak- the S&P 1500’s price is 2.3% higher. Not a major divergence yet, but something worth keeping an eye on.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.