Individual Investors Leaving The Bullish Camp

With the market’s reversal over the past week, as expected, investor sentiment has been becoming less bullish. From the AAII survey of individual investors, bullish sentiment had its largest one week drop since mid-November 2017, falling 15.05 percentage points. Bullish sentiment is now down to 30.6% from 45.66% last week. This is the lowest level for bullish sentiment since the first week of August, but it’s still pretty far from the lowest level on the year that we saw in April when it fell to 26.09%.

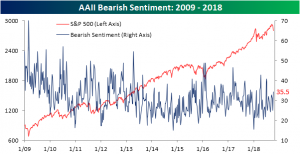

Investors flooded into the bearish camp this week with the largest one week rise in bearish sentiment since June. Bearish sentiment rose to 35.5%; the highest level since the first week of July.

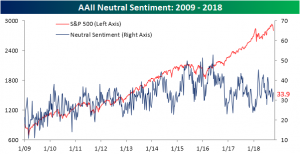

Not all investors that are no longer bullish have become bearish, though. Neutral sentiment has seen an uptick this week moving to 33.9%, which is back to around where it was a couple weeks ago. Since this survey was released this morning, the current reading may not have picked up on the full impact of yesterday’s movements on investor sentiment, which we would expect to cause investors to heavily flock towards uncertainty. If this small lag is the case, next week we could be in for an interesting release.

Trend Analyzer – 10/11/18 – US Index ETFs Are Deeply Oversold

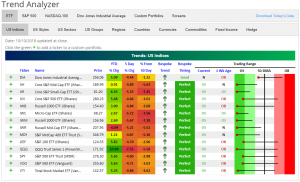

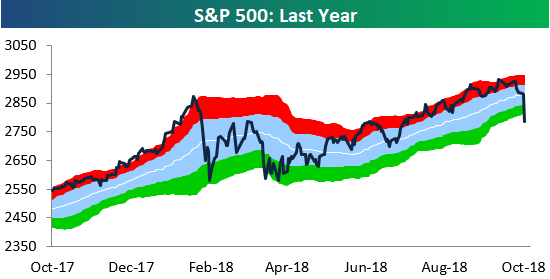

Unless you went off the grid yesterday, you probably already know of the major selling seen throughout the market. So far this October has not been a kind month to US equities, and yesterday was far from an exception with the Dow falling 3.15%, the S&P 500 down 3.29%, and the Nasdaq down 4.08% on the day. Our Trend Analyzer is showing the severity of the selloff. Currently, there is only one major US Index ETF that is not oversold, the Dow (DIA). The DIA has recently been one of the best performers of this ETF group. While all others were pushing towards their 50-DMA or oversold territory, the Dow has been holding firm; that is until this past week where it has joined its peers. It has moved from deeply overbought all the way down past its 50-DMA on the cusp of oversold. With it set to open lower today, it should come as no surprise if it becomes oversold. All the other ETFs of this group are now deeply oversold and well below their 50-DMAs. You can see through the long tails in the Trading Range just how severe of a movement these assets have had in the past week. Every one is now down well over 4% from this time last week.

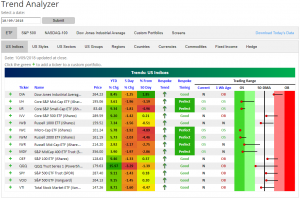

For comparison, below is the Trend Analyzer for yesterday before the open. As you can see, in the past week things have not been great. Selling off has been widespread before yesterday’s large movements with every ETF down from 5 days prior. But most of these ETFs had held their strong gains YTD. Today that is not the case. Most ETFs are still edging out gains since the beginning of 2018, but you can see the major difference in how much those gains were between today and yesterday. The Nasdaq (QQQ) is about 5% lower than it was YTD. On top of this, it has been the biggest loser of the group in the past 5 days, falling 7.55%. For the Russell Mid-Cap ETF (MDY), the situation is not as rosy. Losses yesterday have actually made the ETF fall 0.09% YTD after being up 2.92%!

Morning Lineup – Shaky Start

It’s not looking like a pretty morning for equity bulls today, but with the DJIA futures indicating an opening decline of just over 200 points, things look a lot better than they did a few hours ago. As always when the market’s get into one of their moods, things tend to move in fits and starts before calming down, so expect to see some violent swings throughout the day. The opening bell is only an hour away, but we could just as easily see an up open when the bell rings as we could see a down 400+ open. In the big picture, while today’s early weakness is disappointing, positive futures following a day like yesterday are often met with selling.

In today’s Chart of the Day, which was just sent out a short time ago, we looked at S&P 500 performance figures following 3% down days. Be sure to check it out.

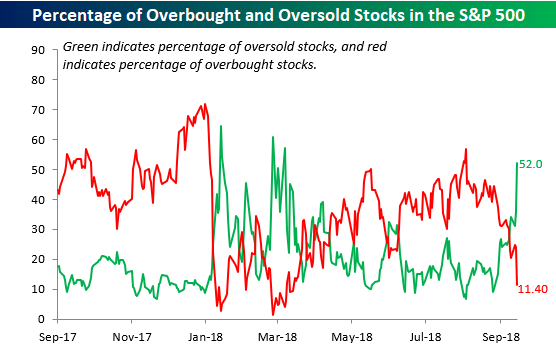

Yesterday’s fifth straight day of declines has really moved the S&P 500, most of its sectors, and a lot of stocks into oversold territory. Among individual S&P 500 stocks, more than half (52%) are now trading more than one standard deviation below their 50-DMA, which is the highest reading in over six months.

Among the S&P 500’s major sectors, just three (Energy, Health Care, and Utilities) are not oversold and three (Financials, Materials, and Technology) are trading more than three standard deviations below their 50-day moving average- a level that we would unscientifically call ‘waayyy’ oversold. The S&P 500 is also trading at oversold levels, but still hasn’t quite reached those ‘waayyy’ oversold levels.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Chart of the Day: Wicked Wednesday, Turnaround Thursday?

the Bespoke 50 — 10/11/18

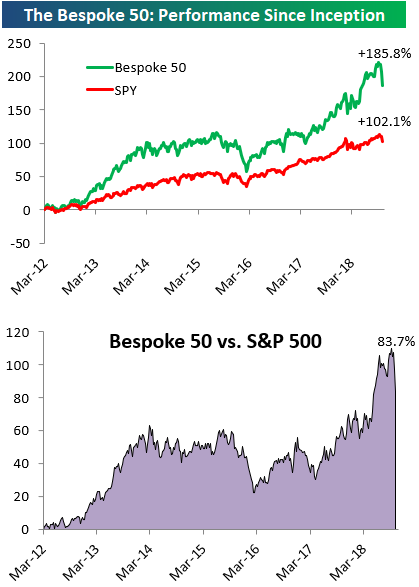

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 83.7 percentage points. Through today, the “Bespoke 50” is up 185.8% since inception versus the S&P 500’s gain of 102.1%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

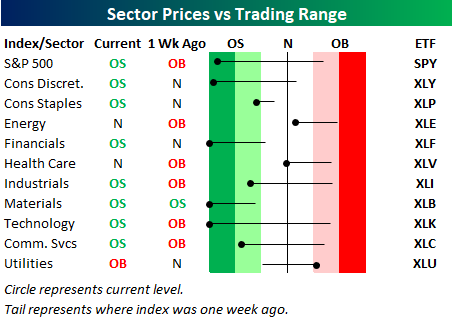

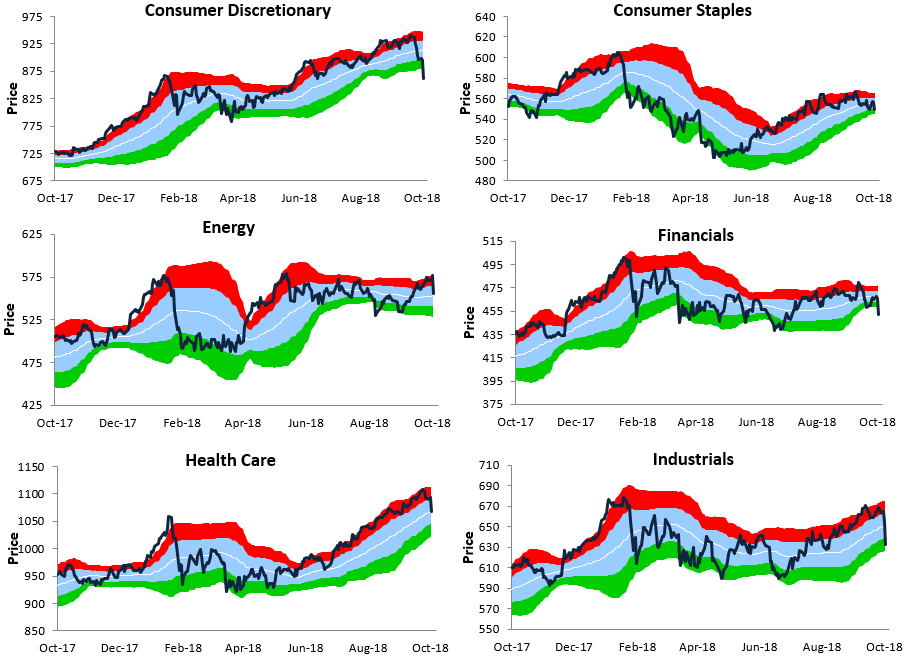

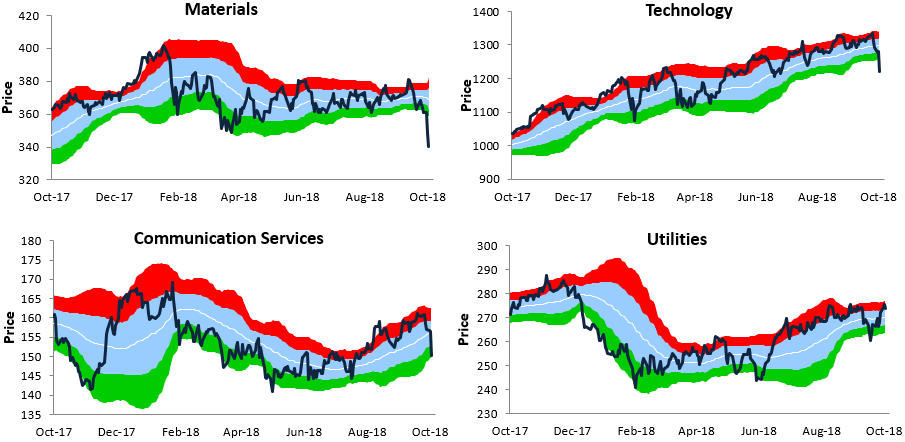

Bespoke’s Sector Trading Range Charts

The S&P 500’s 3.3% drop on Wednesday (10/10) leaves the index down 4.4% month to date already. Below is a look at our updated Bespoke sector trading range charts to see what’s left in the rubble after a truly horrific start to the month for stocks.

The light blue shading in each chart represents each index’s “normal” trading range, which is one standard deviation above and below the 50-day moving average. Moves into the red or green zones mean the index has gotten “overbought” or “oversold.” An “oversold” reading means price is more than one standard deviation below the 50-DMA, and vice versa for an “overbought” reading.

After yesterday’s drop, the S&P 500 has reached its most oversold level since the end of the first quarter when the index successfully re-tested its February correction low.

Looking at individual sectors, a number of them broke down badly yesterday and are now trading at or close to their most extreme oversold levels of the last year. These include Consumer Discretionary, Materials, and Technology.

The Closer — Stocks Smoked — 10/10/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we go into detail on today’s equity market selloff, including index technicals, the collapse of growth versus value, a huge decline in the Nasdaq 100, and the role interest rate term structure has played in equity selling.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

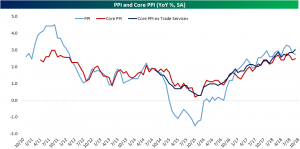

PPI Maintains Its Pace

The BLS released September Producer Price Index numbers this morning. PPI has been gradually accelerating since late 2015/early 2016, but recent months saw PPI begin to slow by its headline measure. The headline PPI decelerated again last month down to 2.73% YoY from 2.83% the month before. This continues a trend over the past few months of the headline measure surprising lower. Meanwhile, Core PPI which removes food and energy accelerated slightly to 2.48% YoY from 2.4%. A more refined measure of PPI excluding foods, energy, and trade services increased the most, up 3.02% YoY compared to 2.84% in August. This is the first time this measure of core PPI has been higher than the headline number since June 2017. While the headline data may confirm multiple recent Fed members claiming to not see any striking issues concerning inflation on the horizon, the core measures indicates pretty broad price pressures after removing volatile components (food, energy) and margins for retail and wholesale operators.

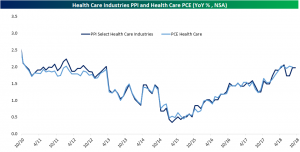

We also like to look at the PPI index for Select Health Care Industries, which the BEA uses as a direct input for PCE Health Care. As shown below, the PPI measure shows that health care inflation continues to run at a reasonably strong clip and about in-line with core inflation.

B.I.G. Tips – Analyst Ratings Update

B.I.G. Tips – Analysts Increasingly Pessimistic

Earnings season kicks off this week as the first of the major companies start to report Q3 numbers. Most of the big names reporting are Financials like Citigroup (C), JPMorgan Chase (JPM), PNC, and Wells Fargo (WFC), which all report on Friday morning. Besides these names, the only non-Financials of note are Delta Air Lines (DAL) and Walgreens Boots (WBA), which both report before the open on Thursday.

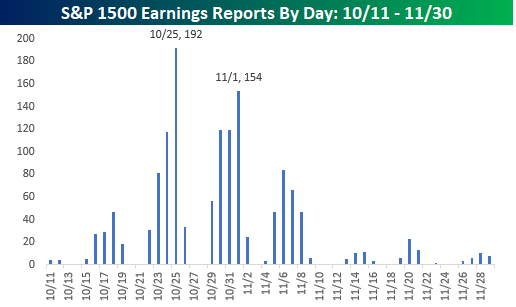

While the pace of reports is quiet this week, things will pick up next week when 126 companies in the S&P 1500 are expected to report. The peak period of earnings season, though, will be in the two weeks that follow as more than 900 companies in the S&P 1500 are scheduled to report. That’s 60% of the entire index in just two weeks! The busiest day during that period will be on 10/25 when 192 companies in the S&P 1500 are expected to report in a single day, while the second busiest day of earnings season is one week later on 11/1 when another 154 companies will report. For a more detailed rundown of the earnings schedule for the upcoming season, please see our Interactive Earnings Calendar, and to prepare for how individual companies tend to react to earnings, check out our Earnings Screener (available to all Institutional clients).

Just in time for earnings season, in a just-published B.I.G. Tips report, we presented an analysis of how analyst sentiment heading into earnings season impacts stock market performance during the ensuing reporting period. For access to this must-see report, sign up for a monthly Bespoke Premium membership now!