Bespoke Brunch Reads: 10/21/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Labor Markets

Strong Economy Draws Women into U.S. Labor Force by Harriet Tory (WSJ)

After peaking north of 77% back at the start of the 2000s, the female prime-age LFPR has started to climb again, more in-line with other global economies than the uncharacteristic declines in the 15 years ending 2015. [Link; paywall]

J.B. Hunt Says 10% Raises Are the Antidote to the Truck-Driver Shortage by Sarah Foster (Bloomberg)

Who would have thought that the anecdote to a worker shortage was to pay a higher price for labor? J.B. Hunt is doing ground-breaking work, apparently! [Link; soft paywall]

Gambling

Mega Millions drawing yields no winners, jackpot swells to $1.6B (AP/NYP)

With no tickets claiming the massive draw on Friday, the multi-state Mega Millions lottery jackpot rose to $1.6bn; the next draw will be on Tuesday. [Link]

2018 Week 7 (Bespoke)

Part of our ongoing series picking NFL games against the spread; so far our picks are 44-38 on the year or 53.7%, which isn’t bad but hopefully will improve with Week 7 action. [Link]

Real Estate

This Small Bank Could Signal Trouble for the Biggest Ones by Stephen Gandel (Bloomberg)

Significant markdowns in the CRE lending portfolio of rapidly-growing Bank OZK (formerly Bank of the Ozarks) suggests the riskier parts of the commercial real estate market could be in trouble. Bank OZK may be familiar; we’d previously mentioned (link) their rapid, aggressive growth strategy in a market that they hadn’t previously been very involved in. [Link; soft paywall]

How Manhattan Became a Rich Ghost Town by Derek Thompson (The Atlantic)

Over 20% of Manhattan real estate is either vacant or set to become vacant, with tens of thousands of retail jobs disappearing in recent years. Surging incomes and real estate prices have made the city a victim of its own success. [Link]

Tech

How Autonomous Vehicles Will Reshape Our World by Samuel I. Schwartz (WSJ)

We’ve previously thrown cold water on the idea that autonomous vehicles will be rapidly introduced and adopted (link) but they are coming eventually. When they do, they will rapidly remake our physical world and economy. [Link; paywall]

Jony Ive on the Apple Watch and Big Tech’s responsibilities by Nicholas Folkes (FT)

An interview with Apple’s chief designer, in the FT’s famed lunch format. Plenty of discussion of high society sprinkled in (also the classic FT style) makes for an entertaining read despite some dark overtones from the man who has shaped Apples devices for years. [Link; paywall]

China

China’s Factory Heartland Braces for Trump’s Big Tariff Hit (Bloomberg)

Exporters aren’t terribly worried about 10% charges, but the possibility of 25% tariffs on Chinese goods looms for companies that send the vast majority of their goods to the United States. [Link; soft paywall, auto-playing video]

With Growth Sagging, China Shifts Back to Socialism by Benn Steil and Benjamin Della (Council on Foreign Relations)

With growth flagging and trade war looming, Chinese strategy has shifted back to squeezing private business in order to support state owned enterprises. [Link]

Government & Taxes

The Cum Ex Files (Cum Ex Files)

A massive investigation of fraudulently obtained tax refunds (for taxes which had never been paid in the first place) in Germany; a very long but incredibly useful read on the genesis and persistence of stolen money from the German state. [Link]

Governments Should Be Run More Like Businesses by Matthew C. Klein (Barron’s)

Forget trying to aim for a balanced budget, it’s the asset and liability accounting of governments that need to be updated to the most basic private sector practice, in the eyes of Matthew Klein. [Link; paywall]

Why a Private Landowner Is Fighting to Keep the Homeless on His Property by Mitch Smith (NYT)

An Akron property owner wanted to give homeless neighbors a place to pitch a tent, but the city has ordered the organized, self-regulating encampment torn down for zoning violations. [Link; soft paywall]

Personal Exploits

Daniel Sickles by George Pearkes (Thread Reader)

A biography of one of the most dubious characters of the Union Army, New York City’s Daniel Sickles. Machine politics, an underage bride, getting away with murder, Gettysburg, a Medal of Honor, and a leg in a box mailed to a museum; quite a story from Bespoke’s Macro Strategist and occasional history dabbler. [Link]

Original Big Bird, Caroll Spinney, Leaves ‘Sesame Street’ After Nearly 50 Years by Dave Itzkoff (NYT)

The man who has played Big Bird on Sesame Street since 1969 is retiring after almost 5 decades bringing joy to children across the country and around the world. [Link; soft paywall]

Industry Analysis

Lithium miners’ dispute reveals water worries in Chile’s Atacama desert by Dave Sherwood (Reuters)

Mineral-rich brine from the Atacama salt flats in Chile is the most available source of lithium in the world, and one of the operators in the area may be over-drawing its allocation of the valuable and rare resource. [Link]

How 2 Upstart Retailers Want to Reinvent the Traditional Department Store by Michelle Cheng (Inc)

A new concept features rotating online brands, event space, and restaurants to being a new model to the department store retail space. [Link]

Stocks

Goldman says the sell-off is just about over and tells investors to get back into growth stocks by Jeff Cox (CNBC)

GS equity strategist David Kostin thought the bottom was in for growth stocks back on Monday, a call that looked good for about 24 hours but has some room for skepticism later in the week. [Link]

U.S. SEC mulls consultation on easing quarterly reporting rules by Katanga Johnson (Yahoo!/Reuters)

Slower reporting cycles may be in the pipeline for smaller firms, though the SEC notes larger firms aren’t going to avoid quarterly filings anytime soon. [Link]

Weird News

Divers swim through 90 feet of raw sewage to unclog giant, hairy ‘fatberg’ by Joshua Rhett Miller (NYP)

A clog featuring thousands of baby wipes, a baseball (?) and a large piece of metal (???) was causing trouble for pumps in Charleston, SC. Divers ended up swimming through 90 feet of raw sewage to extract the mess. [Link]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

Have Cyclical/Defensive Ratios Peaked?

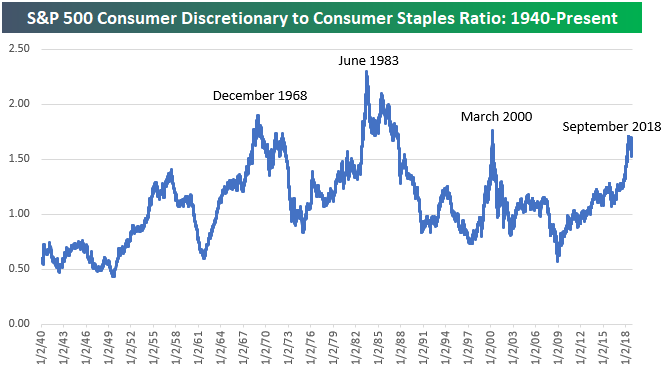

Below is an updated look at the price ratio between the S&P 500 Consumer Discretionary and Consumer Staples sectors. When the line is rising, Discretionary is outperforming Staples, and vice versa when the line is falling.

Prior to late September, the ratio had been skyrocketing as investors plowed into Consumer Discretionary and avoided the low-growth, defensive Consumer Staples sector. Over the last month, however, we’ve seen a big rotation out of Discretionary and into Staples.

With the Staples sector rallying recently and Discretionary falling, the ratio has suffered a big drop. The last time this ratio peaked was back in March 2000 at the end of the Dot Com bull market.

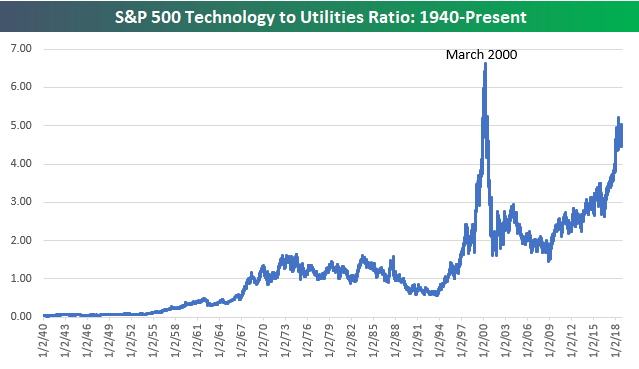

The ratio between Technology and Utilities had also been soaring over the last year or so as the Tech sector took off. While the ratio hasn’t quite gotten to the levels seen at the end of the Dot Com boom in March 2000, it’s still extremely elevated relative to all other periods over the last 65+ years. Back in early 2009, the ratio was at 1.5. It recently crossed above 5 at its peak a few weeks ago. This month we’ve seen Utilities rally and Tech fall sharply, which has caused the ratio between the two to dip a bit. If a peak has been put in, however, it has a long way to fall.

2018 Week 7

Week 6 Results: 7-6, Overall: 44-38 (53.7%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 7.

We were 7-6 in week 6, bringing our overall record through 6 weeks to 44-38 (53.7%).

2018 NFL Week 7 Bespoke Picks:

Tennessee at LA Chargers (-7): Tennessee +7

New England (-3) at Chicago: Chicago +3

Buffalo at Indianapolis (-7.5): Indianapolis -7.5

Detroit (-3) at Miami: Miami +3

Minnesota (-3.5) at NY Jets: Minnesota -3.5

Carolina at Philadelphia (-4.5): Carolina +4.5

Cleveland at Tampa Bay (-3.5): Cleveland +3.5

Houston at Jacksonville (-4): Houston +4

New Orleans at Baltimore (-2.5): New Orleans +2.5

LA Rams (-9.5) at San Francisco: LA Rams -9.5

Dallas at Washington (Even): Washington Even

Cincinnati at Kansas City (-6): Kansas City -6

NY Giants at Atlanta (-4): NY Giants +4

2018 NFL Week 6 Bespoke Results:

Tampa Bay at Atlanta (-3): Tampa Bay +3 Loss

Pittsburgh at Cincinnati (-1.5): Pittsburgh +1.5 Win

LA Chargers at Cleveland (-1): LA Chargers +1 Win

Seattle (-2.5) at Oakland: Oakland +2.5 Loss

Chicago (-4) at Miami: Miami +4 Win

Arizona at Minnesota (-10): Minnesota -10 Push

Indianapolis at NY Jets (-1): Indianapolis +1 Loss

Carolina (-1) at Washington: Washington +1 Win

Buffalo at Houston (-11): Buffalo +11 Win

LA Rams (-7.5) at Denver: LA Rams -7.5 Loss

Jacksonville (-3) at Dallas: Dallas +3 Win

Baltimore (-2.5) at Tennessee: Tennessee +2.5 Loss

Kansas City at New England (-3.5): Kansas City +3.5 Win

San Francisco at Green Bay (-9.5): Green Bay -9.5 Loss

The Closer: End of Week Charts — 10/19/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

Below is a snapshot from today’s Closer highlighting positioning of speculators in foreign exchange futures. If you’d like to see more, start a free trial below.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

The Bespoke Report — Baby Out With The Bathwater

While intraday performance for stocks in the back half of this week was uninspiring at best, the S&P 500 actually closed up on the week. Some of the price action is getting extreme, especially in cyclical sectors around the world. Today 266 stocks in our Chart Scanner closed at new 52-week lows, while just 17 closed at new highs. You can get a good look at the weakness in our asset class performance matrix below.

Is the baby being thrown out with the bathwater? We discuss in detail in this week’s Bespoke Report.

We’ve just published our latest weekly Bespoke Report newsletter, which is available to subscribers across all three of our membership levels. Sign up here to read the report.

To get up to speed on our thoughts regarding the market’s direction going forward, choose any membership option and access this week’s full Bespoke Report newsletter after signing up! You won’t be disappointed. Some of the topics discussed in this week’s report include:

- Does Buying Dips Below the 200-DMA Work?

- The Relationship Between Correlation & Volatility

- Seasonal Patterns In Volatility

- Dire Economic Expectations From Analysts Around The World

- Rolling Over Global Cyclical Economic Indicators

- European Equity Sectors Collapse

- Slow Eurozone Inflation

- Yields Around The World Rise

- Solid But Slowing Manufacturing Data In The US

- A Dearth Of Workers And Rising Turnover

- Weakening Housing Activity

- A One-Off Collapse In The Deficit

- Surging Transportation Costs

- An Economic Cycle Not Likely To End Soon

B.I.G. Tips – Earnings Season Starts Weak

Morning Lineup – The Scariest Day

Yesterday wasn’t a fun day to be a bull. While the S&P 500 was close to unchanged late in the morning, sellers stepped in around lunch time and didn’t let up the entire day. Companies reporting earnings were even harder hit as the average stock reporting earnings after the close Wednesday or before the bell, Thursday fell an average of over 1.7% for the day. Today, equities are looking to make up some of that lost ground, but it’s still early on a Friday morning in October, so anything can really happen between now and the closing bell.

The economic calendar is pretty light today, with Existing Home Sales the only scheduled report, but we’ll also hear commentary from the Presidents of the Atlanta (Bostic) and Dallas Fed (Kaplan). In geopolitical/trade news, there’s a hint of optimism in the air as President Trump and Xi are expected to meet on the side at the G20 meeting later this month.

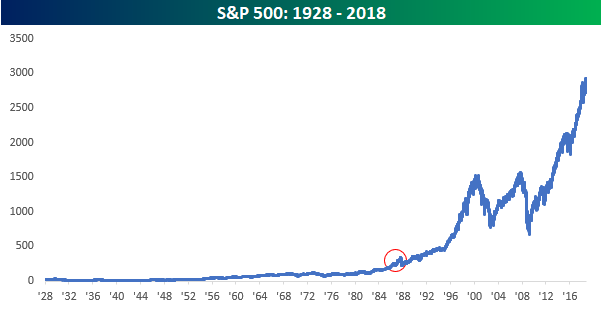

While Halloween is still 12 days away, the scariest day of the year for many equity investors is today, as it represents the anniversary of the 1987 stock market crash 31 years ago today. When you consider the fact that the S&P 500 fell 20% in a single day back in October 1987, the recent weakness seems like peanuts.

For anyone who was sitting around a trading desk at the time, we’re told that it was the scariest day of their careers. That being said, look at a simple historical chart of the S&P 500 since 1928. You can barely see the 1987 crash.

More importantly, though, remember the number 9.9% because that is what your annualized total return would have been if you had ‘bought’ the S&P 500 at the end of September 1987 before the crash and held through today. While anyone making that trade in 1987 would have felt pretty stupid pretty quickly, over the long term, even buying equities at one of the worst possibly timed points in the last 50 years would have netted you an annualized return of 9.9%. Nobody knows where the market is going in the short term, but time and time again throughout history, the long-term direction has been the same.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer: Thursday Thoughts — Vol, Trucking, Manufacturing, Leading Indicators — 10/18/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at market trends including the fact that all S&P 500 sectors are in drawdowns over 3%, the yield curve is still steepening despite equity market declines, and the relative performance of stocks and commodities. We also take a close look at the volatility market and correlations across stocks before moving on to economic data. While the economic signal from Conference Board leading indicator data was positive today, manufacturing activity indices look toppy and high transportation costs are starting to tamp down freight volumes.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 11/18/18

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

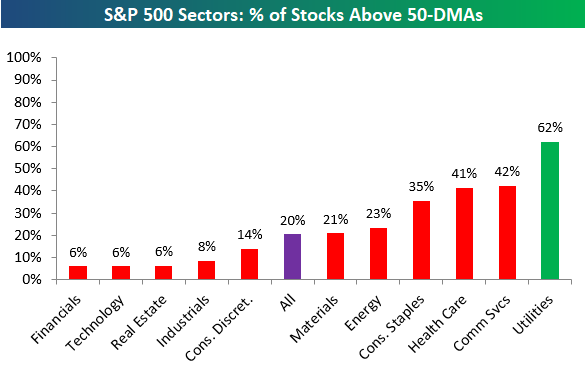

Below is one of the many charts included in this week’s Sector Snapshot, which shows the percentage of stocks above their 50-day moving averages by sector. As shown, just 6% of Tech and Financial stocks are above their 50-day moving averages, an extremely oversold reading for two of the three largest sectors of the market.

To find out what this means and to see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.