the Bespoke 50 — 11/15/18

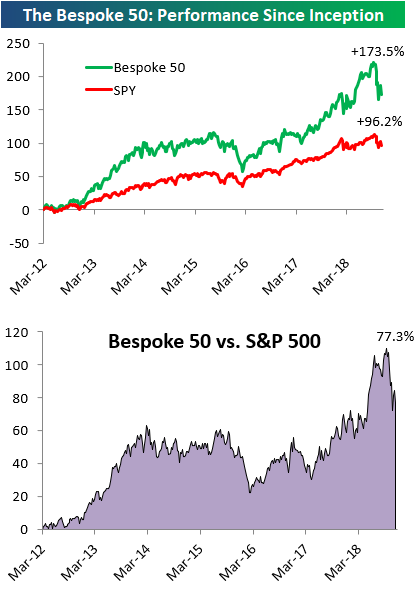

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 77.3 percentage points. Through today, the “Bespoke 50” is up 173.5% since inception versus the S&P 500’s gain of 96.2%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

The Closer — Valuation Contraction, Inflation Acceleration, Brexit Makes Progress — 11/14/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we compare how valuations have stacked up during bull and bear markets as well as recent intraday movement trends. Then we review this morning’s CPI release, and we finish with a rundown of the most recent Brexit news.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day – The Dreaded Death Cross in Small Caps

Fixed Income Weekly – 11/14/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

After crude oil’s rough run of late, this week we take a look at how high yield energy spreads have reacted.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

B.I.G. Tips – Asset Class Performance by Weekday

Bitcoin Breaks Down

It’s been a long 2018 for bitcoin, but because the price ran up so much towards the end of 2017 and into January, up until this point it stayed off the new low list even after losing more than two-thirds of its value. Partly because of lower numbers falling off and a 10% breakdown in prices today, bitcoin made its first 52-week low of 2018 today. What’s pretty amazing about the chart of bitcoin is how prior to today support at the $6K level was so strong. Once that support failed, though, prices fell fast.

Bespoke’s Sector Trading Range Charts

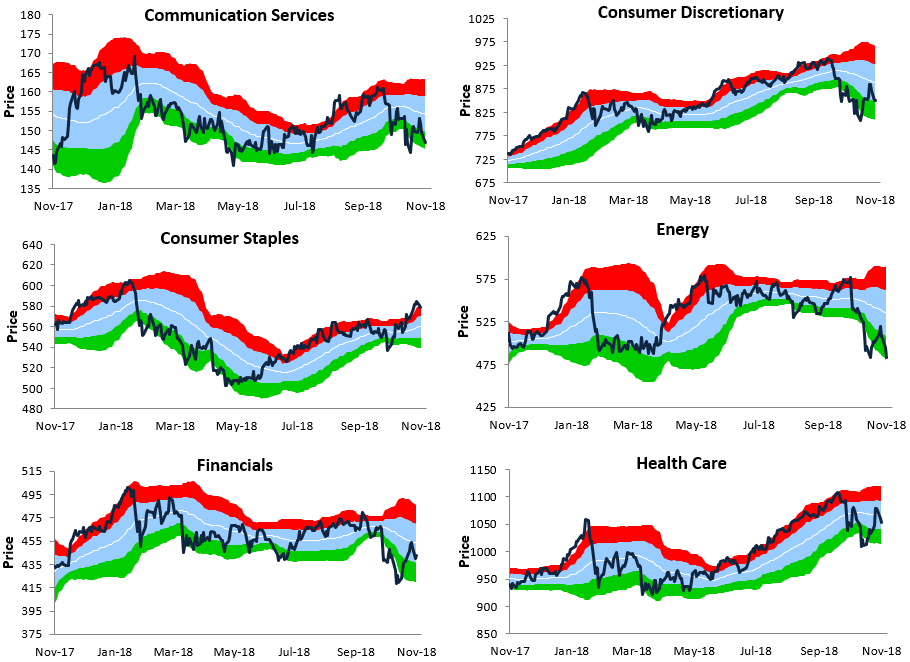

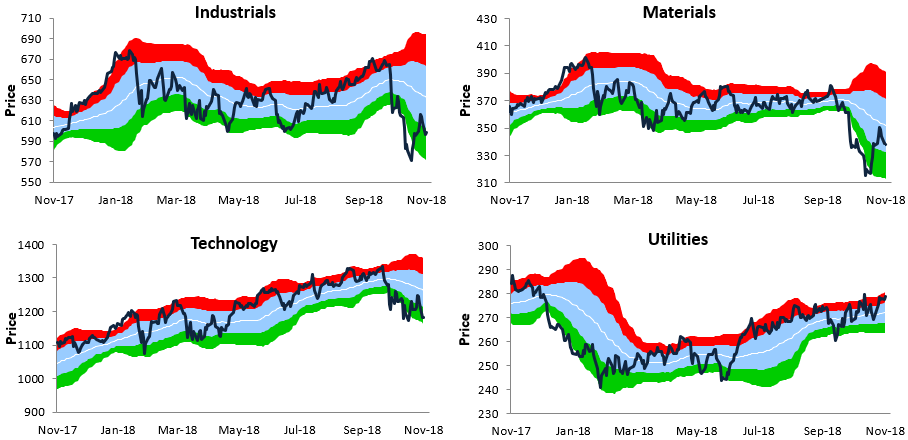

Below is an updated look at our trading range charts for the S&P 500 and its major sectors (Real Estate not included). In each chart, the light blue shading represents the sector’s “normal” trading range, which is one standard deviation above and below the 50-day moving average (white line). The red zone represents overbought territory, which is between one and two standard deviations above the 50-DMA, while the green zone represents oversold territory.

As major indices have switched from trending higher to trending lower over the last two months, stocks are spending a lot more time in oversold territory. For the S&P 500, the index is back into oversold territory after failing right at resistance at its 50-day moving average. The technical set-up for the S&P is not good right now.

The only sectors with positive technicals right now are the two defensive sectors — Consumer Staples and Utilities. That should tell you something. The market is trading like we’re headed for an economic slowdown.

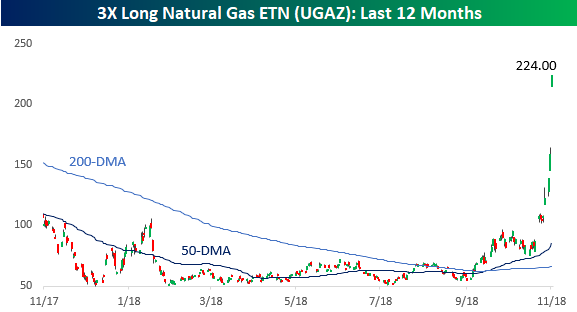

Morning Lineup – Friends Don’t Let Friends Buy Leveraged ETFs

Crude oil prices are trying to recover this morning as Natural Gas prices continue to go bananas. Equity futures are picking up steam to the upside, and CPI came in right inline with expectations.

With the surge in natural gas over the last couple of days and into this morning, one security that has been absolutely on fire over the last week is the Natural Gas Triple Leveraged ETN (UGAZ). While it was trading around $80 per share a week or so ago, it closed yesterday at $158 and is trading above $220 in the pre-market this morning. When you see moves like this in such a short period of time, it’s tempting for some to want to get in on the action.

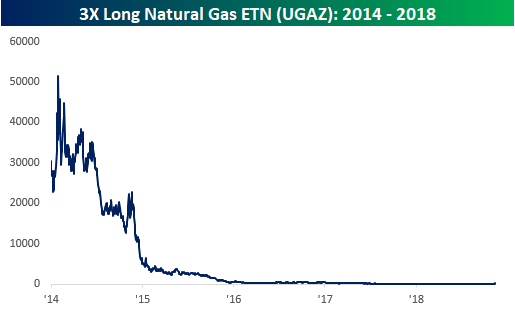

Besides the fact that these leveraged ETNs go down just as fast as they go up, it is important to remember that the way they are structured makes holding them for any extended period of time a sucker’s bet. Just take a look at the long-term chart of UGAZ below. After taking all of the reverse splits into account over the years, of which there were three (1-10, 1-25, 1-5), UGAZ’s price in early 2014 was over $50,000 per share. So, even though the price has tripled in the last two weeks, UGAZ is still down over 99.5% from its high less than five years ago. Next time you hear someone talk about buying one of these ETNs do them a favor and take their money instead.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Oil Bears, Dollar Soars, Hong Kong Band Plays On — 11/13/18

Log-in here if you’re a member with access to the Closer.

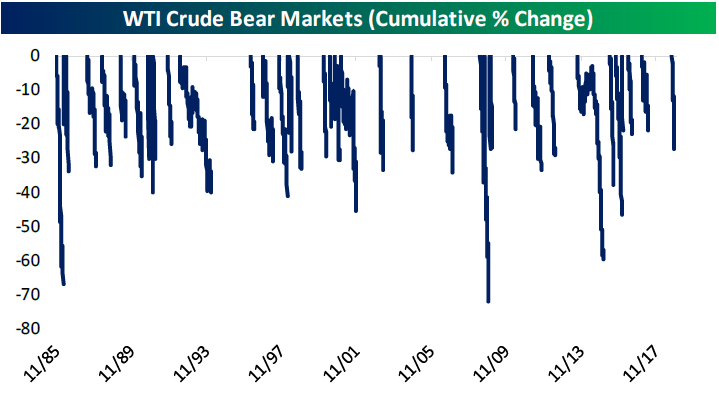

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we focus on crude oil’s recent plummet compared to other oil bear markets, our interest rate differential-based valuation of the US dollar, and finally how the dollar has stacked up against HKD.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!