Crude oil prices are trying to recover this morning as Natural Gas prices continue to go bananas. Equity futures are picking up steam to the upside, and CPI came in right inline with expectations.

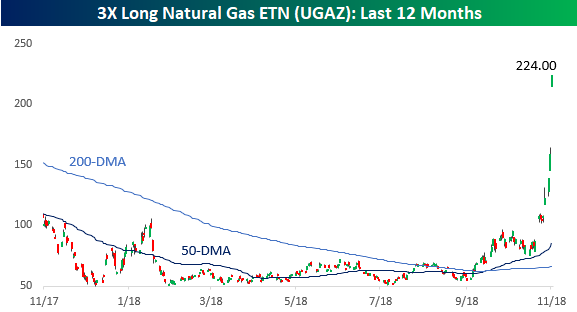

With the surge in natural gas over the last couple of days and into this morning, one security that has been absolutely on fire over the last week is the Natural Gas Triple Leveraged ETN (UGAZ). While it was trading around $80 per share a week or so ago, it closed yesterday at $158 and is trading above $220 in the pre-market this morning. When you see moves like this in such a short period of time, it’s tempting for some to want to get in on the action.

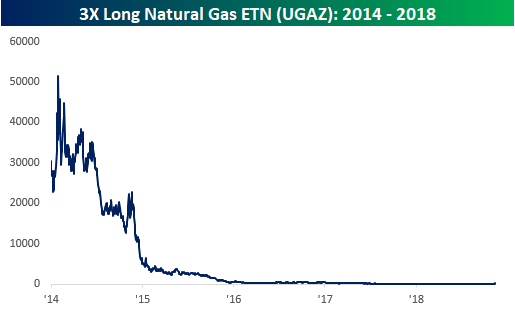

Besides the fact that these leveraged ETNs go down just as fast as they go up, it is important to remember that the way they are structured makes holding them for any extended period of time a sucker’s bet. Just take a look at the long-term chart of UGAZ below. After taking all of the reverse splits into account over the years, of which there were three (1-10, 1-25, 1-5), UGAZ’s price in early 2014 was over $50,000 per share. So, even though the price has tripled in the last two weeks, UGAZ is still down over 99.5% from its high less than five years ago. Next time you hear someone talk about buying one of these ETNs do them a favor and take their money instead.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.