Thanksgiving Market Returns

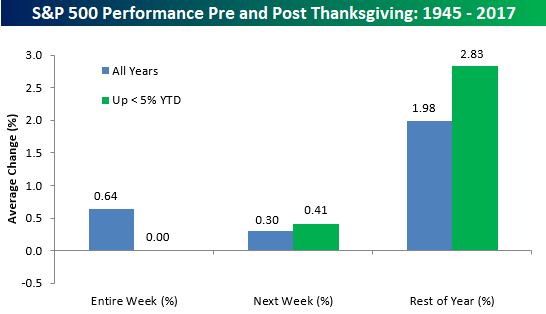

Thanksgiving week has historically been a positive time for the equity market. Since WWII, the S&P 500 has averaged a gain of 0.64% during Thanksgiving week with gains three-quarters of the time. Market trends heading into this Thanksgiving aren’t as positive for the bulls, though. As shown in the table below, during years where the S&P 500 was positive but up less than 5% YTD heading into Thanksgiving week, the index’s average change during the week has been 0.00% with gains less than half of the time.

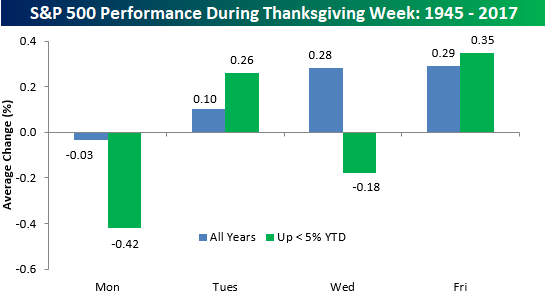

On a day to day basis, for both all years since WWII and in years where the S&P 500 was up less than 5% heading into Thanksgiving week, Monday has been the worst trading day as it is the only day of the week with negative average returns and positive returns less than half of the time. Tuesdays and Friday, however, have been positive days, though, with average gains of 0.10% and 0.29%, respectively. Additionally, for those years where the S&P 500 was up YTD but up less than 5%, Tuesdays and Fridays have been even stronger with average gains of 0.26% and 0.35%, respectively.

As we move past Thanksgiving, though, seasonal trends for the market based on this year’s performance so far improve. In those years where the S&P 500 was up less than 5% YTD heading into Thanksgiving week, the average gains the week after Thanksgiving was 0.41% with positive returns 55% of the time. For the remainder of the year, average returns were even stronger at +2.83%. Not bad for a period of just over five weeks!

Morning Lineup – What Positive Reversal?

Well, it was good while it lasted. After yesterday’s 2%+ rally off the early morning lows, some may have been starting to think that the market was taking a step in the right direction. Then, the after-hours came. With earnings tape bombs from Applied Materials (AMAT), Nordstrom (JWN), and Nvidia (NVDA), bulls are back in full retreat mode as futures are implying a moderate decline to the downside. On second thought, maybe the bulls aren’t in retreat but instead just still stuck in the massive northeast nightmare commute home from Thursday night.

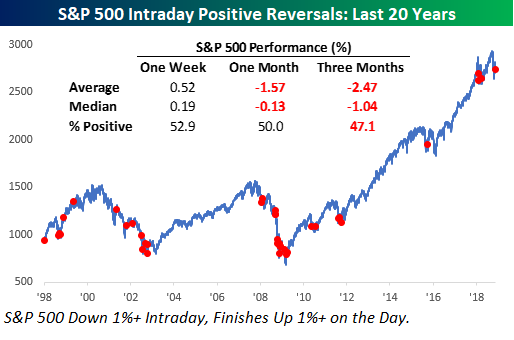

As mentioned in last night’s Closer report, over the last 20 years, Thursday’s reversal was the 35th time in the last 20 years that the S&P 500 was down 1%+ intraday but reversed higher to close up over 1% on the day. The chart below of the S&P 500 shows every occurrence in the last 20 years where we saw similar intraday reversals for the S&P 500. There’s no specific type of market environment that these declines occur in, as there were occurrences in both bull and bear market environments.

Looking ahead, average and median one-week returns were positive following these prior occurrences, but average and median returns in the one and three month periods were actually negative. Just like yesterday, positive reversals feel good at the moment, but it is pretty common for those good feelings to quickly wear off.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Positive Reversals, Earnings Season Ends, Five Fed Steady, EIA — 11/15/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we recap the end of earnings season and take a first look at our Five Fed Manufacturing Composite for November. In the wake of what has been a crazy week in oil and gas, we finish tonight with weekly data from the EIA.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 11/15/18

Chart of the Day: Video Game Stocks Tumble

B.I.G. Tips – FANG+ Now Trending Lower

Individual Investors Showing Uncertainty

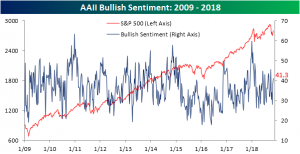

The weekly AAII survey released this morning showed the first downtick in bullish sentiment (41.28% down to 35.09%) in three weeks. Given the weakness in the broader equity market, the move lower in bullish sentiment is completely understandable.

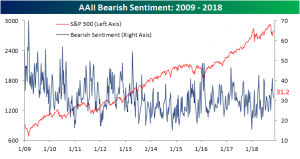

As equity prices have fallen over the past week, bearish sentiment rose to 35.96%. This week’s bearish reading is right around what we saw for most of October, so much like bullish sentiment, it is right within it recent range.

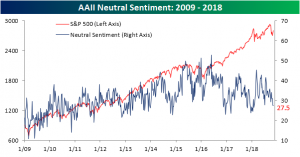

Neutral sentiment moved only slightly higher this week, as shown in the chart below.

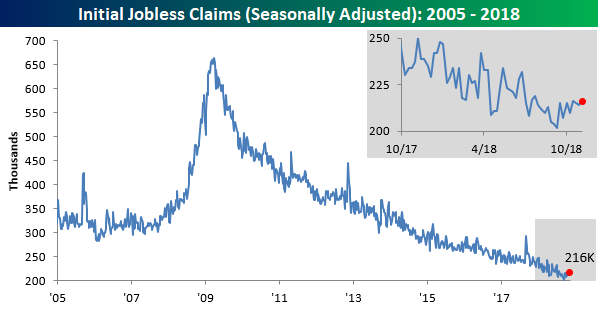

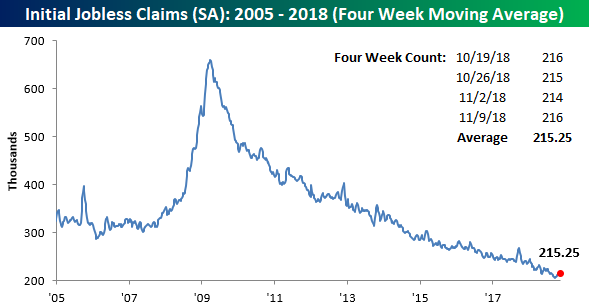

Jobless Claims Steady

This week’s report on jobless claims was slightly higher than expected coming in at a level of 216K versus estimates for 214K, but what has been pretty remarkable is how consistent claims have been over the last four weeks. On 10/19, claims came in at 216K, the next week they were 215K, the week after they fell another 1K to 214K, and now this week they are back at 216K. It’s also important to keep in mind that even though claims were higher than expected, they remain low on a historical basis with a record 193 straight weeks at or below 300K, 58 straight weeks at or below 250K, and 19 straight weeks at or below 225K.

With claims barely budging over the last month, the four-week moving average came in right at 215.25K, which is 9.25K above the cycle low of 206K we saw back in mid-September.

On a non-seasonally adjusted (NSA) basis, jobless claims came in at 230.6K. While this is more than 120K below the average of 353.4K for the current week of the year dating back to 2000, in this same week two years ago, claims were actually lower.

Trend Analyzer -11/15/18 – Trends Take a Turn

Following further declines yesterday, every major US Index ETF in our Trend Analyzer tool is once again oversold. The Micro-Cap ETF (IWC) and the Nasdaq (QQQ) have led the way down over the past week, falling 5.67% and 5.91%, respectively. Ironically, looking at YTD returns, the similarities vanish. IWC is now down the most YTD at 3.51% versus QQQ which is the leader YTD up 6.66%. Regardless, this is still way off of the Nasdaq’s double-digit YTD returns earlier this fall.

In other words, it is harder to keep an optimistic outlook for longer-term trends anymore and this is reflected in the Bespoke Trend scores section of the tool. Currently, only the Dow (DIA) has managed to keep an uptrend through all of the market turmoil. Every other name has left uptrends and is now trending sideways; with IWC and the Russell 2000 (IWM) actually in downtrends.

Morning Lineup – Homebuilders Crushed

It’s been one of the busier days in quite some time for economic data, and relative to expectations, it has been a mixed bag. Jobless Claims came in slightly higher than expected, Empire manufacturing was better than expected while Philly missed, Retail Sales were stronger than expected at the headline level, but a bit weaker underneath the surface, and Import and Export Prices both came in higher than expected. All in all, there was nothing here to put in doubt FOMC Chair Powell’s view Wednesday evening that the US economy remains on solid ground.

In terms of individual stock news, Walmart (WMT) concluded earnings season with an earnings beat and is trading higher, while JC Penney (JCP) had disappointing results and is down nearly 10%. Homebuilders are down across the board this morning after KB Home (KBH) lowered guidance last night and is trading down over 10% and dragging the rest of the group lower in the process.

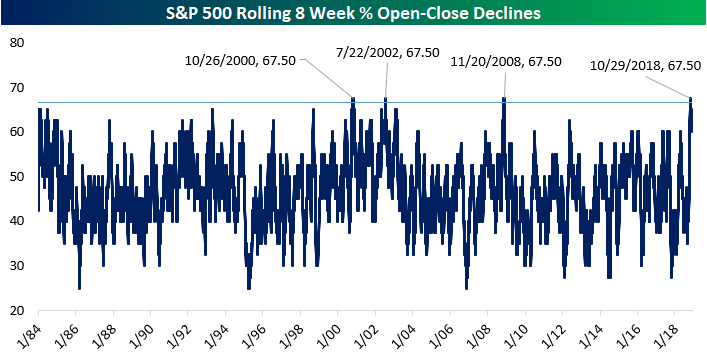

If it feels lately like the market does nothing but go down, well, that’s basically because it’s true. As noted in last night’s Closer report, over the 8 weeks ending October 29th, the percentage of open-close declines was the joint-highest for any period since 1984, with the start and finish of the 2000s bear market and the near depths of the financial crisis the only other periods when stocks declined intraday so frequently. Unfortunately, there’s not a lot to take away from the prior periods in terms of forward returns; one occurred early in a bear market, the other towards the end, and the third right in the middle. What this chart does confirm, though, is how lousy the recent market environment has been for anyone holding equities.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.