Bespoke Stock Scores — 12/4/18

2018 Commodity Performance

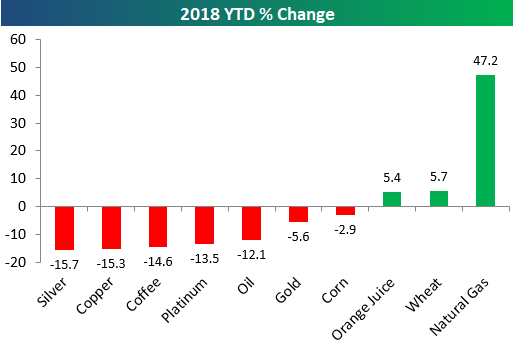

Below is a look at the 2018 YTD performance of major commodities. As shown, natural gas is up 47.2%, which is by far the biggest gainer of the bunch. Wheat and orange juice are the only other two commodities in the green on the year with gains of 5%+.

While corn and gold are down single-digit percentage points, the remaining five commodities in the chart are down more than 10%. Silver and copper lead the way lower with declines of 15%+, while coffee is down 14.6%, platinum is down 13.5%, and oil is down 12.1%.

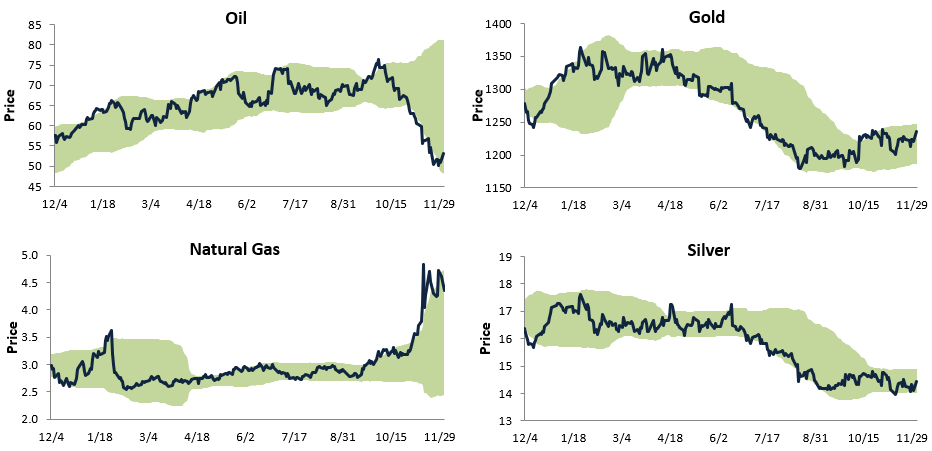

Below are trading range charts for four of key commodities in the chart above — oil, gold, natural gas, and silver. The green shading in the chart represents between two standard deviations above and below the 50-day moving average. Moves to the top of this range are considered overbought, while moves to the bottom of the range are considered oversold.

Oil’s sharp decline from its highs a couple months ago has widened out its trading range dramatically, and it’s still trading right near the bottom of its range after a bounce over the last couple of days. To get back to overbought levels from here, oil needs to rally 50%!

Natural gas, on the other hand, is trading at the top of its trading range after experiencing a dramatic spike higher in November.

For the two precious metals, gold has started to trade positively lately after breaking out of its long-term downtrend with a series of higher lows over the last few months. The same can’t be said for silver, though, which hasn’t made as positive of a move as gold.

Morning Lineup – China Hopes Wear Off Fast

Well, that didn’t last long. The shelf life of news headlines these days is increasingly short, and the weekend’s positive trade headlines between the US and China are just another example. Less than 24 hours after a strong positive opening Monday morning, when we combine the decline off the highs yesterday and this morning’s weakness, US equities are on pace to give up 40% of their initial gains after the S&P 500 failed to make a higher high in its rally yesterday. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/4/18

While the reported trade truce between the US and China over the weekend was supposed to remove a cloud of uncertainty over the economy, the yield curve (10yr vs 3m) didn’t seem to think so. While the curve steepened initially on Monday morning, it steadily flattened throughout the trading day and has continued to do so overnight and today. Today’s 8 bps flattening of the curve is the largest one day decline in over six months, and at the current level of 55 basis points, the curve is the flattest it has been since January 2008. While flat yield curves aren’t necessarily signs of economic weakness, they don’t suggest a whole lot of confidence in growth either.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

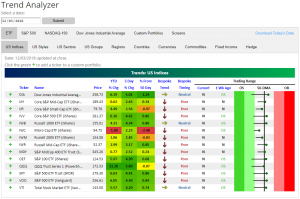

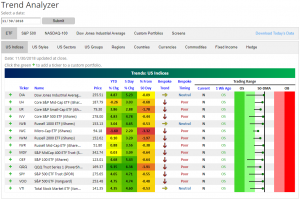

Trend Analyzer – 12/4/18 – Climbing 50-DMAs

Markets came roaring out of the gates this week, gapping up significantly higher yesterday. Fortunately, as we mentioned in a blog post yesterday, this gap up was all that was needed to lift 10 of the 14 US Index ETFs tracked in our Trend Analyzer tool above their 50-day moving averages. With the exception of the Micro-Cap ETF (IWC) which is still sitting significantly below its 50-DMA at -2.48%, even those that have not yet moved back above are within one percentage point of retaking the average. The Nasdaq (QQQ) is by far the closest sitting only 7 basis points below. Despite this, the overall picture is still not glaringly bullish as the majority of these names remain in longer-term downtrends. For the S&P 500, 2,800 is the resistance area that everyone is watching.

November 2018 Asset Class Total Returns

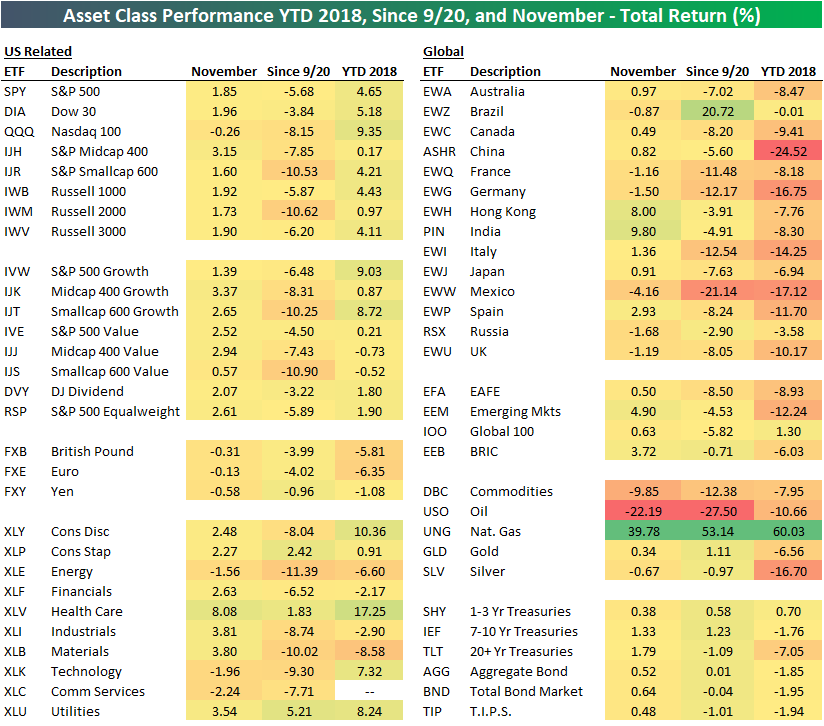

Below is a look at the performance of various asset classes in November using our key ETF matrix. Along with November total returns, we also include returns since the 9/20 high for the S&P 500 as well as year-to-date.

Both the S&P 500 (SPY) and the Dow 30 (DIA) gained just under 2% in November, while the Tech-heavy Nasdaq 100 (QQQ) finished in the red. The Technology (XLK), Energy (XLE), and Communication Services (XLC) sectors were all down in November, while Health Care (XLV) was up huge at +8%. With gains of 3.8%, Industrials (XLI) and Materials (XLB) were the next best performing sectors behind Health Care.

Outside of the US, the best performing countries were Hong Kong (EWH) and India (PIN) with gains of 8% and 9.8%, respectively. On the flip side, Mexico (EWW) was the worst performing country with a decline of 4.16%.

The real action in November came in the commodities space. The broad commodities ETF (DBC) fell 9.85% on the month, which was due to oil’s (USO) dramatic drop of 22.19%. Natural gas, on the other hand, caught a massive bid and gained 39.78% on the month! Nat gas is now up 60% on the year.

Treasury ETFs were slightly higher in November as rates pulled back a bit.

B.I.G. Tips — November 2018 Decile Analysis

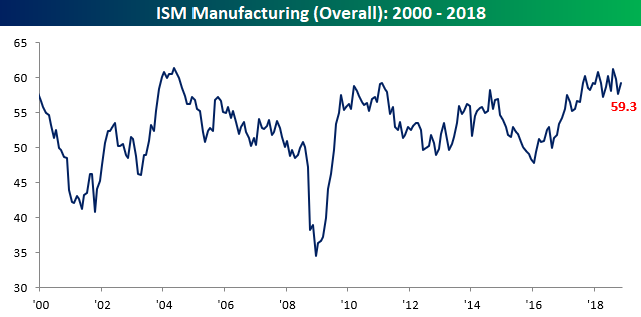

ISM Manufacturing Rebounds

Today’s release of the ISM Manufacturing report for November broke a string of back to back declines in the index and easily surpassed expectations. While economists were forecasting the headline index to come in at a level of 57.5, the actual reading came in at 59.3.

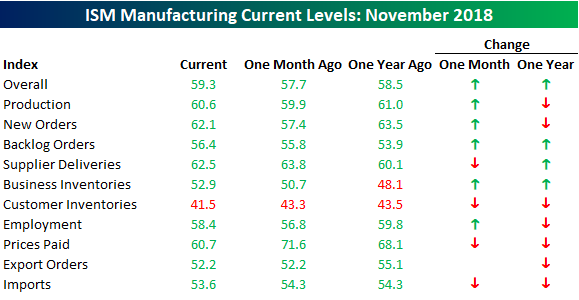

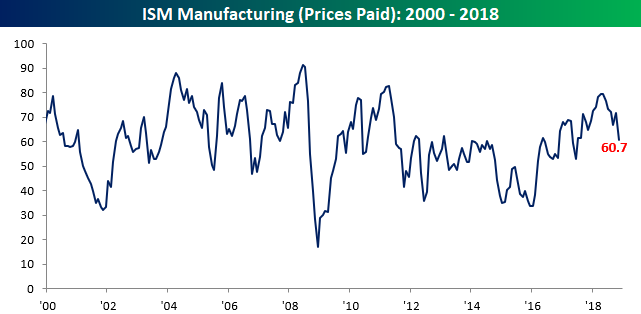

Breadth in this month’s report was pretty much split right down the middle as five categories showed increases, four declined, and one was unchanged. On a y/y basis, it was less positive. Although the headline index is higher than it was at this time last year, seven out of ten components are down. The biggest decliner on a m/m and y/y basis was Prices Paid. In November, Prices Paid declined from 71.6 down to 60.7, which was the largest m/m decline since June 2012. For those worried about rising inflation, this month’s decline provides some comfort.

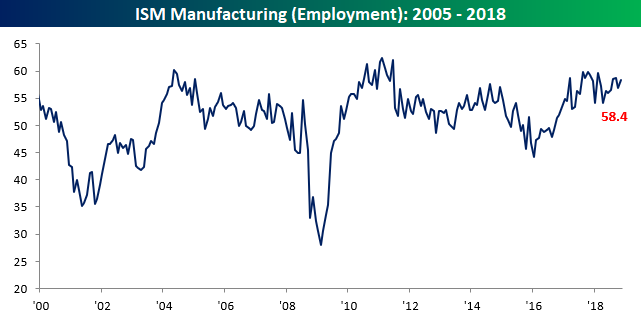

Finally, with the November jobs report coming up Friday, we wanted to note that the employment component of this month’s report increased from 56.8 up to 58.4, indicating another healthy jobs reading for the manufacturing sector at least. We’ll be paying closer attention, however, to the ISM Services report which will be released on Thursday morning. The Services sector makes up roughly 80% of the US economy compared to just 20% for the manufacturing sector.

Ford Truck Sales Slow

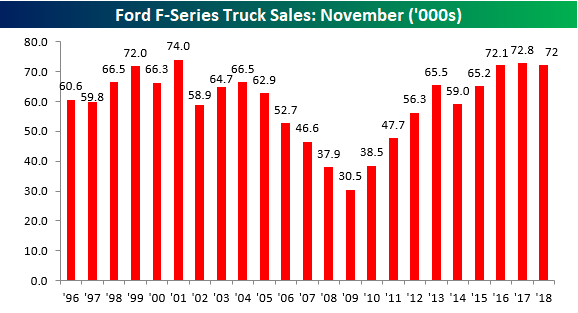

Sales of F-Series trucks from Ford slowed slightly in the month of November relative to the same month last year, even as both months had the same number of industry selling days (25). Total sales came in at 72,108 compared to 72,769 last year. For the last three years now, November F-Series sales have been pretty much stuck at the 72K level. Looking back over time, though, the last three Novembers have been the 2nd, 3rd, and 4th best Novembers for sales going all the way back to 1996. Sales of pickup trucks (specifically at Ford) are often a sign of strength or weakness in the small business and construction sectors, so it’s good to watch these readings for signs of strength of weakness.

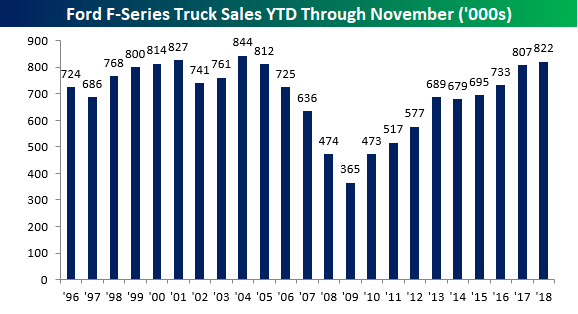

With 11 months in the books, total sales of F-Series trucks by Ford now stands at 822K, which is a 1.8% increase from the first 11-months of 2017. The only two years where sales were stronger through the end of November were 2004 (844K) and 2001 (827K). Depending on how things shake out in December, this year will likely go down as one of the top three years for Ford F-Series truck sales on record.

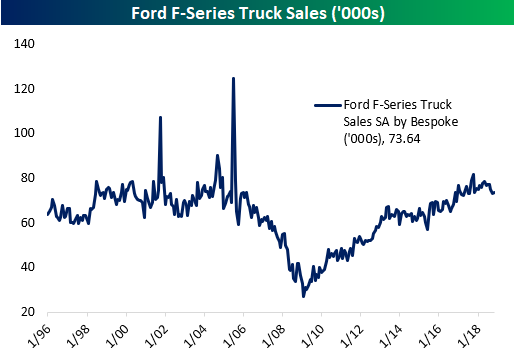

Finally, the chart below shows seasonally adjusted monthly F-Series truck sales by Ford. Similar to overall auto sales in the US, sales appear to have plateaued for the time being. They aren’t quite rolling over, but they certainly aren’t rising either.

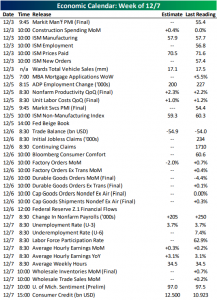

This Week’s Economic Indicators – 12/3/18

Last week was a busy one for economic data. Of the 28 releases, the majority (16 data points) either missed estimates or declined relative to prior readings. The Chicago and Dallas Feds’ manufacturing indices kicked off the week with Chicago seeing a nice beat, but the opposite held true for the Dallas Fed which declined more than expected. The next and final input for our Five Fed Index—Richmond—was released on Wednesday and came in slightly below estimates. Housing data continued to show weakness across the board with both Case-Shiller and FHFA price indices falling short while new and pending home sales also fell—pending sales missed badly. The second release for Q3 GDP was on Wednesday with the aggregate number coming in right in-line with expectations, although consumption, trade, and government all were revised lower. Jobless claims hit a six month high. To cap off the week, the Chicago PMI blew away expectations, hitting the best level of the year.

Manufacturing data kicks off December and another busy week with ISM and Markit manufacturing PMIs releasing later this morning. It will be a hush Tuesday with no releases scheduled for tomorrow. Things are scheduled to pick back up on Wednesday with productivity numbers, the ISM and Markit PMI for Services, ADP Private Payrolls, as well as the Fed’s Beige Book report; although these are subject to change due to the National Day of Mourning in honor of former President Bush. With the government closing for the day, it is likely Nonfarm Productivity and the Beige Book will get postponed. Thursday will have trade balance numbers and the final print for manufacturing orders and shipments. Finally, on Friday we see the monthly Non-Farm Payrolls report which is currently expected to come in at +205k. Consumer Credit then releases late in the day to finish the week.

Trend Analyzer – 12/3/18 – Open Above 50-DMAs

It is still early in the holiday season but this morning investors are waking up to quite the gift as assets are rallying on positive trade news out of the G20. Taking a look at our Trend Analyzer, every major US index ETF ended November at neutral levels with most sitting just below their 50-day moving averages (DMA). With futures pointed sharply higher this morning, it is likely we will see a majority of these ETFs open above their 50-DMAs. Additionally, each name in this group is up from the start of last week when they were coming off of a post-Thanksgiving selloff. Things have come a long way in a week’s time. The Core S&P Mid-Cap ETF (IJH) and the Micro-Cap ETF (IWC) are the only ones with YTD losses, but even these could easily be reversed if they see the same upward movement as the broader market today.