Morning Lineup – They Can’t Go Down Every Day… Can They?

US stocks are looking to start the day higher in what bulls are hoping is a turnaround Tuesday. After two straight daily declines of nearly 2%, you would expect at least some sort of bounce. After all, stocks can’t go down every day, can they? Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/18/18

Heading into today, the S&P 500 is now down 7.8% for the month of December. If the month were to end today, it would go down as the worst month for the S&P 500 since May 2010, so clearly, these kinds of declines are not typical of bull markets. Furthermore, for the month of December declines of this magnitude are practically unheard of. The last time the S&P 500 had a weaker MTD December performance through the close on 12/17 was in 1931!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Trend Analyzer – 12/18/18 – Nasdaq Hanging On

Yesterday marked yet another day of steep losses across the major indices. Each of the ETFs that track the major US indices in our Trend Analyzer have now moved both deep into oversold territory as well as into downtrends. They are also all substantially below their respective 50-DMAs with the Core S&P Small-Cap (IJR) and the Micro-Cap (IWM) trading over 10% below. Year to date performance is no better with substantial losses across the board; some of which have hit double-digits. Just about the only positive to draw is the Nasdaq (QQQ). It is an island of green in a sea of red as it is the only ETF that is positive YTD. Granted, it is only up 1.64% which could be easily be erased with another session like yesterday.

50-DMA Breadth Measure Barely Hangs On

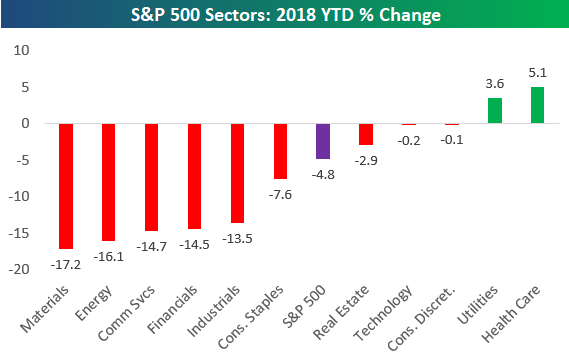

The S&P 500 has moved well into negative territory on the year now with a decline of 4.8%. As shown below, Technology and Consumer Discretionary — two sectors that were up double-digit percentage points YTD just a couple months ago — have now crossed into negative territory on the year as well. The only two sectors still in the green on the year are Health Care and Utilities, while five sectors are down double-digit percentage points. Materials are down the most with a huge drop of 17.2%, followed by Energy at -16.1%. Communication Services, Financials, and Industrials are the other three sectors down 13%+. For more in-depth market analysis, try out one of our three premium research offerings.

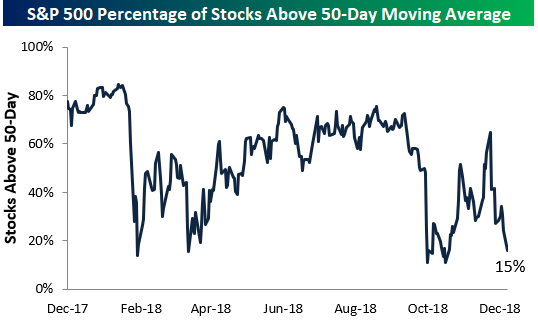

Below is a chart showing the percentage of stocks in the S&P 500 trading above their 50-day moving averages (DMA). While the S&P closed at a new 52-week low yesterday, this breadth reading hasn’t quite broken below the lows it saw back in October. For now, breadth using this measure has a slight positive divergence.

Looking at S&P 500 sectors, it’s not a pretty picture for cyclicals. Five sectors have less than 10% of their stocks above their 50-day moving averages, with Energy’s reading at 0%. The Industrials sector ranks second worst with just 3% of stocks above their 50-DMAs, followed by Materials at 4%. Technology’s reading of 14% is just a bit weaker than the reading of 15% for the broad S&P 500.

Utilities is the only sector with a strong reading at the moment with 69% of stocks above their 50-DMAs. The second best sector — Real Estate — has just 41% of its stocks above their 50-DMAs.

B.I.G. Tips – Friday, Monday Losses

B.I.G. Tips – FOMC Preview: Hike Odds, Market Expectations

Housing Keeps Getting Worse

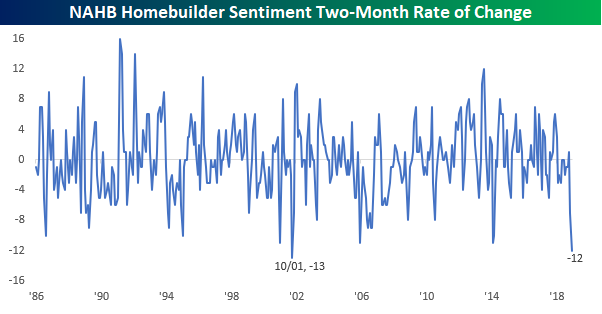

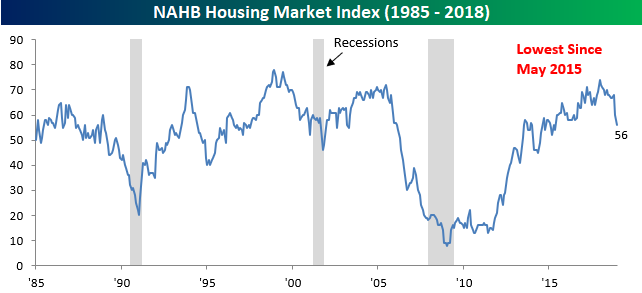

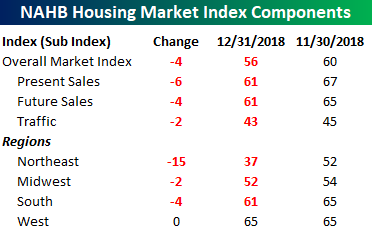

Just when you think that housing-related data can’t get any worse, the December report on homebuilder sentiment came in with a big stinker. After last month’s report where the actual level missed expectations by seven points, today’s report for December missed estimates by four points with a reading of 56 compared to expectations of 60. Combining the declines of the last two months, homebuilder sentiment has now dropped by a total of 12 points, which is the second largest two-month drop in the history of the report. Not even during the housing crisis did sentiment drop at this fast of a rate, and the only time it dropped faster was in the two months that followed the 9/11 attacks.

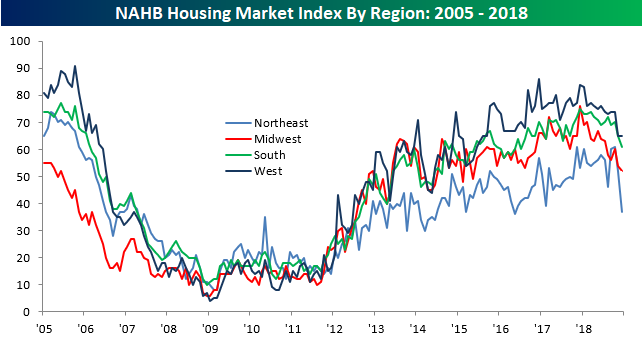

The chart of the actual level of the NAHB Sentiment index doesn’t look pretty either. Following this month’s decline, the index is at its lowest level since May 2015. One thing to take note of with regards to the NAHB Housing Index, though, is that peaks haven’t historically been associated with the onset of recessions. At the start of each of the last three recessions, this index was well past its peak by a matter of years rather than months.

The chart below shows the breakdown of this month’s report by traffic and region. We saw broad-based declines in traffic trends in December, and the bulk of the weakness came in the Northeast. Sentiment in that region dropped by 15 points, which was the largest one month decline since June 2011 and capped off the largest two-month decline on record. It was said a year ago that the Trump tax cuts would have the greatest negative impact on housing in the high tax states of the northeast, and recent data has borne this out.

While homebuilder sentiment in the northeast has seen the sharpest declines, the trend is the same around the country- sentiment has peaked.

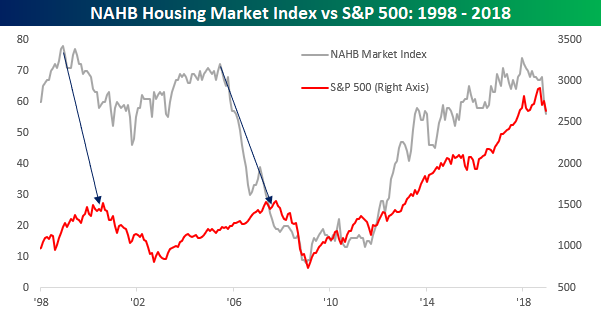

As mentioned above, homebuilder sentiment hasn’t been strongly correlated to trends in the business cycle over time, and with respect to stock market performance, that has been the case as well. Leading up to each of the prior bear markets in the last twenty years, homebuilder sentiment peaked well over a year before the market peak. While not pictured below, we have also seen similar trends play out in prior bear markets since 1985 (when the NAHB survey data begins).

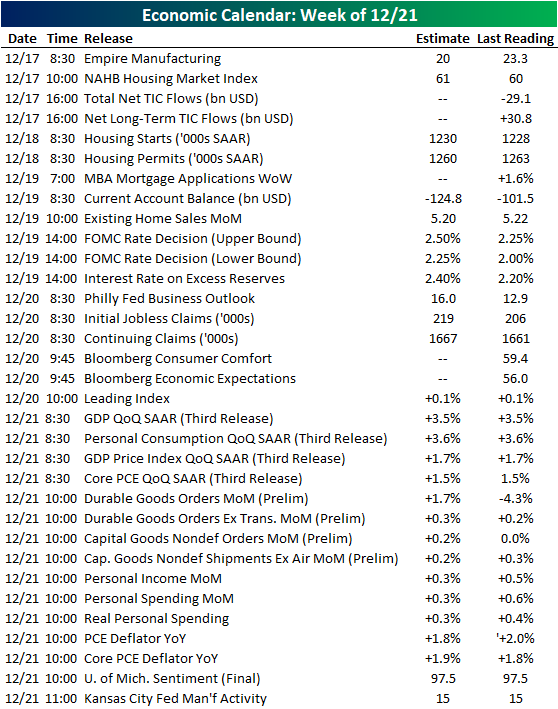

This Week’s Economic Indicators – 12/17/18

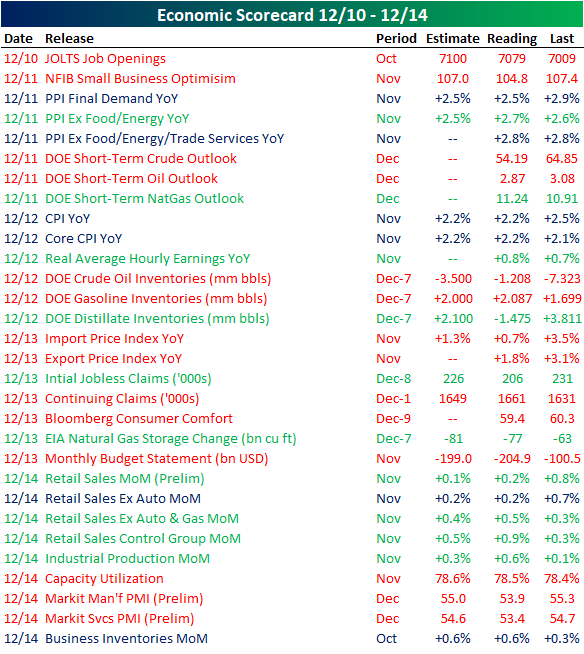

Last week’s economic data came in somewhat disappointing with a little less than half of the 30 releases below estimates or the previous period’s reading. JOLTS kicked off the week still strong and higher than the September reading, but below estimates. Small business optimism saw a decline for November. Inflation data through PPI and CPI both came in mostly in line with forecasts with core PPI being the only measure to release above estimates. However, export and import price indices both came in well below October’s levels. Jobless claims saw a substantial beat. Despite a strong Industrial Production reading, preliminary Markit PMIs for manufacturing as well as services pointed to a weaker release for December.

This week will see a heavy slate of data. Empire manufacturing didn’t start the week off on the best note with the index cutting nearly in half. Homebuilder sentiment and TIC flows report later today. Housing starts and permits are the only releases Tuesday, but Wednesday through the end of the week will be busy. On Wednesday, the FOMC will have their rate decision where interest rates are expected to rise a quarter of a percent. This will by far be the most talked about event of the week. Thursday we will get the Philly Fed’s business outlook and the leading index. There will be many releases to finish the week on Friday with The third GDP release, goods orders, personal income and spending, PCE inflation data, and the Kansas City Fed’s manufacturing activity.

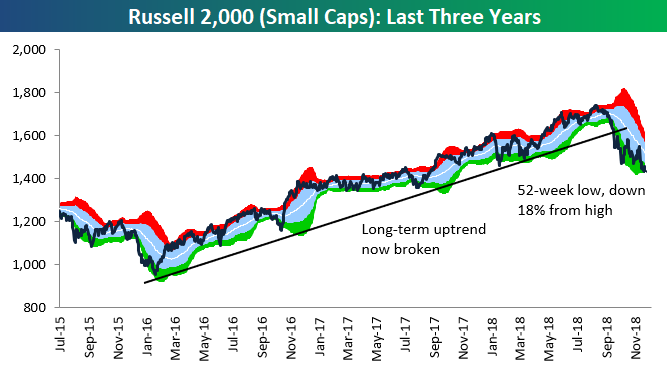

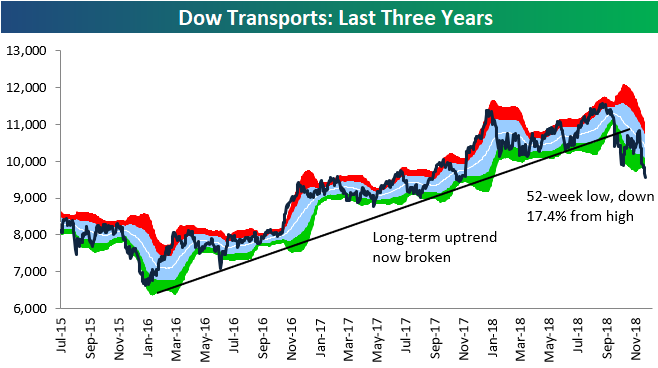

Small-Caps, Transports Getting Close to Bear Market Territory

The two charts below were published in our weekly Bespoke Report newsletter that went out to research clients on Friday. They show long-term three-year price charts of two equity indices that are generally thought of as “leading” indicators — that is, they’re thought to lead the broader indices like the S&P 500.

Unfortunately for market bulls, both appear to be in serious trouble from a technical perspective.

As shown, the Russell 2,000 (small-cap) and Dow Transportation indices have recently broken below long-term uptrend channels, and they have yet to find any kind of support during this correction. The Russell 2,000 is down 18% from its 52-week high, which puts it just two percentage points away from a new bear market. The Dow Transports aren’t far behind. The Transports index is down 17.4% from its 52-week high, meaning a bear market isn’t far away for this area of the market either.

Keep an eye on these two indices in the coming days and weeks as 2018 comes to an end. If they slip into bear market territory, it’s not a good sign for the major indices like the S&P 500 and the Dow Jones Industrial Average. For more analysis of leading indicators and market internals, try out one of our three premium research offerings.

Chart of the Day – S&P 500 Performance After Strongly Bearish Sentiment Readings

Trend Analyzer – 12/17/18 – Few Positives

Following Friday’s steep declines, our Trend Analyzer shows that every major index ETF is now oversold just like they were at this time last week. Some of these, such as the Russell 2000 (IWM) and Core S&P Small-Cap (IJR), are deeply oversold. Losses from last week also eliminated most YTD gains for these index ETFs. The Nasdaq (QQQ) has been the best performer only falling 0.28% over the past week. It is also the lone survivor in regards to YTD gains. All other ETFs are now down on the year, with the Micro-Cap (IWC) being the worst of these down almost 10%. With another down week, long-term trends have also gotten further beaten down with all but the Dow (DIA) moving into downtrends.