Claims Bounce Off Multi-Decade Lows

After coming in at one of the lowest levels on record last week, seasonally adjusted initial jobless claims bounced up to 185K this week. While higher, jobless claims are still historically strong having spent a record eight straight weeks with sub-200K readings.

As we noted last week, seasonal adjustments overstated the strength of claims as unadjusted claims experienced a seasonally unusual decline. This week was more normal from a seasonal perspective with initial claims rising from 194.4K to 222.5K and the first reading above 200K since the week of March 11. As shown in the second chart below, the current week of the year has consistently seen claims move higher week over week marking a temporary high before resuming the seasonal downtrend through the next couple of months. That means the slight uptick this month is likely mostly seasonal and far from any sort of a change in trend.

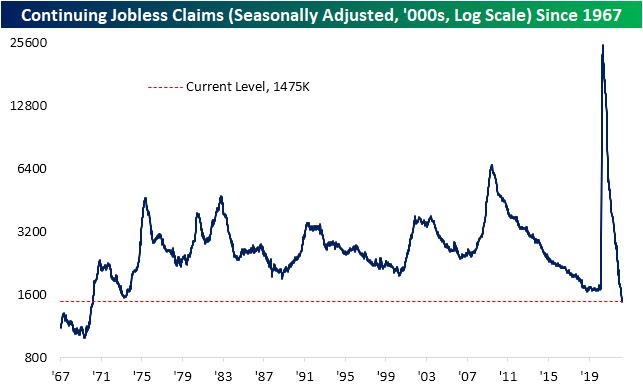

Lagged one week to initial claims, continuing jobless claims fell to a new low of 1.475 million. That is the lowest level of claims since March 1970. Click here to view Bespoke’s premium membership options.

Where Have All the Bulls Gone?

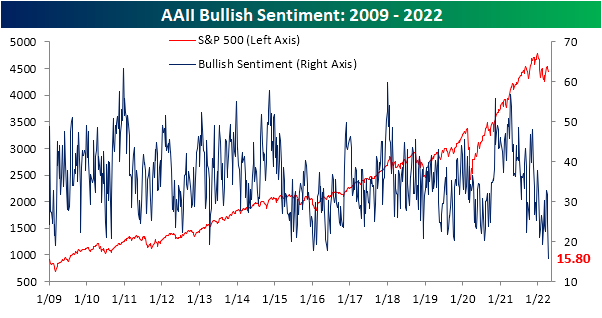

Heading into this week, bullish sentiment on the part of individual investors, measured by the weekly AAII survey, was already depressed with less than a quarter of respondents reporting optimistic sentiment. One week later with the S&P 500 continuing to move lower and a couple of hot, but not exactly unexpected, inflation readings in the interim, bullish sentiment has collapsed another 8.9 percentage points to the lowest level since the week of September 3rd, 1992. That’s right, bullish investor sentiment never got this low even at the depths of the pandemic, during the Global Financial Crisis, or during the Dot Com bubble burst. This week marks one of only 35 weeks since the survey began in 1987 that bullish sentiment was below 20%; the most recent being only back in February when it fell to 19.2%.

As could be expected, the huge drop and the historic low in bullish sentiment was met with a coincident increase in bearish sentiment. Bearish sentiment rose 7 percentage points to 48.4%. While that is an elevated reading, there have been a couple of even more elevated readings as recently as March 17 (49.8%), February 24 (53.7%), and January 27 (52.9%).

Even though bearish sentiment is not at a new high, the still-elevated reading on pessimism paired with the extremely depressed reading on bullishness has resulted in the bull-bear spread to fall much deeper into negative territory. Only two weeks ago, bulls actually outnumbered bears. Today, bears outnumber bulls by 32.6 percentage points. The 37 point drop since that positive reading marks the largest two-week decline in the bull-bear spread since April 2013. It is also the lowest level of the spread since that same period.

While bearish sentiment picked up, not all of those gains came from the decline in bulls. Neutral sentiment was slightly higher rising 1.8 percentage points to 35.7%. That is a few percentage points above the historical average, but it is also well below the multiple highs of the past year. You can read Bespoke’s full analysis of investor sentiment and its contrarian aspects with a two-week trial to Bespoke Premium.

The Bespoke 50 Growth Stocks — 4/14/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Morning Lineup – 4/14/22 – Whoa

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You only get out of it what you put into it. If you are a sheep in this world, you’re not going to get much out of it.” – Greg Norman

As bad as you think you think you have it right now with the weakness in the stock and bond market this year, just consider yourself lucky you weren’t in Greg Norman’s shoes 26 years ago today at Augusta. Actually, at this point in the day, as the birds chirped, the morning dew on the fairways glistened in the sun, and the scent of azaleas filled the air, Norman probably had a pretty big smile sitting on a six-stroke lead over Nick Faldo heading into the final round of the Masters. When the round started, though, the path got a lot rougher. Norman started with a bogey on the first but got back on track with a birdie on two. Then, after a par on the third, Norman bogeyed the par-three fourth and then bogeyed again on the par-four eighth.

One over for the front nine wasn’t bad, but coming out on the back nine, Norman put up bogey, bogey, and double-bogey on 10, 11, and 12 and finished the round with a six over 78. What looked like a Sunday formality for Norman turned into one of the biggest collapses in Masters history as Nick Faldo countered with an epic 67 and was fitted for the green jacket in the clubhouse. 26 years later, Norman’s round is still considered the worst collapse in Masters history; almost like the golf equivalent of the 1987 crash (or at least Marlboro Friday). As a columnist for the Tampa Tribune described it, “For Greg Norman’s lifetime, for yours, for mine, for eternity, wherever golf is played and remembered, in pro shops, pawnshops, locker rooms, card rooms, bars, churches, in Augusta, Ankara, and Alaska, the 1996 Masters will be recalled simply as the one Greg Norman blew.” See, things aren’t so bad.

Even with that collapse, most of us would change places with Greg Norman in a second. Winston Churchill once said, “Success consists of going from failure to failure without loss of enthusiasm.” And while Norman never went on to win another major and only managed to win a handful of other tournaments, he went on to enjoy an extremely successful professional career in clothing, golf course design, wines, real estate, and a number of other endeavors. In other words, he adapted to and capitalized on the environment he found himself in. Similarly, the stock market is always evolving. While a certain approach works in one environment, as circumstances change, investors need to adapt and capitalize on the opportunities that present themselves.

Economic data this morning was mixed with Initial Jobless Claims coming in slightly ahead of forecasts while Continuing Claims were weaker. Headline Retail Sales were just shy of forecasts while the reading ex-autos and gas came in at 1.1% compared to forecasts of an increase of 0.9%. The reaction from futures has been muted as a lot of traders may already be starting their holiday weekend early.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Sometimes we look at an indicator and just say, “Whoa”. That was out reaction this morning when we saw the latest sentiment survey from the American Association of Individual Investors (AAII). After dropping to an already depressed level of 24.7% last week, this week’s reading plummeted to 15.8%. To find a lower reading you have to go back even further than Greg Norman’s collapse at the Masters. The last time there were fewer bullish investors in the AAII survey was in September 1992 when Boyz II Men topped the charts with “End of the Road”. While the period from 1992 through 1994 wasn’t the best time period for the stock market, it certainly wasn’t the end of the road either.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Short Interest Trade Mirrors Last Year

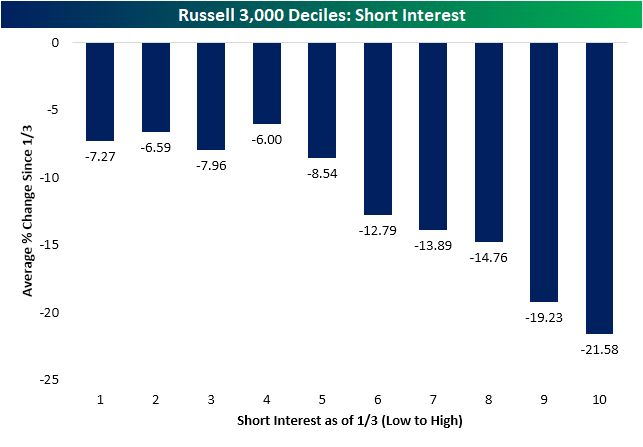

The first quarter of last year was marked by a period of massive short squeezes leading to outperformance of stocks with high levels of short interest. A little over one year later, the opposite has held true. As shown below, the stocks with the highest levels of short interest at the time of the last all time high on January 3rd have been the worst performers over the past few months. The decile of Russell 3,000 stocks with the highest levels of short interest at the start of the year have fallen 21.5% since January 3td while the first four deciles of stocks with the lowest levels of short interest have only fallen mid-single digits.

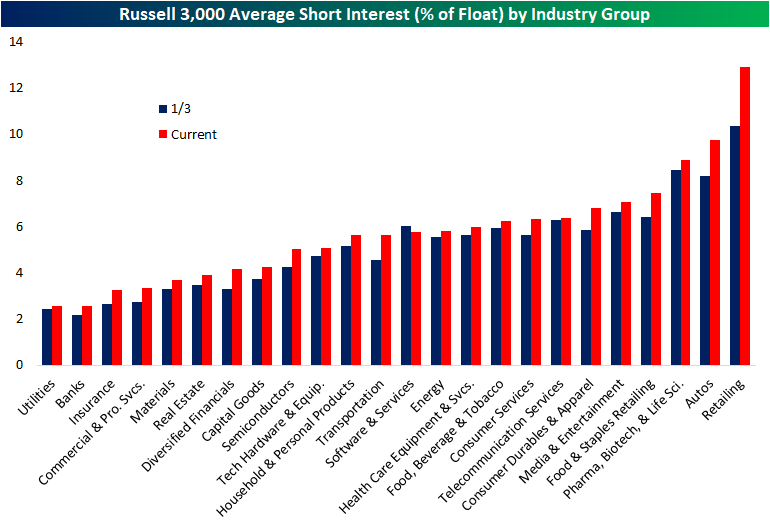

The latest update of short interest data through the end of March hit the tape earlier this week. The average level of short interest as a percent of float for all Russell 3,000 stocks fell sequentially from the mid-March update but with an average short interest reading of 5.78%, current readings are roughly half of one percentage point higher than at the start of the year.

Breaking it down by industry group, retail has seen the biggest increase in average short interest and now has the highest level of any industry group. Autos are the runner-up in both departments as short interest has climbed from 8.2% on January 3rd to 9.75% today. Utilities, Banks, Insurance, Commercial and Professional Services, Materials, and Real Estate, meanwhile, are on the other end of the spectrum as the only sectors with short interest as a percentage of float below 4%.

Turning to individual stocks, Rent the Runway (RENT) now has the most elevated level of short interest as the only stock in the index with over half of its free-floating shares sold short. Conn’s (CONN), however, comes close with 49.16% of its float sold short. Both stocks have seen sharp increases in bearish bets this year as those readings compare to 26.82% and 14.58%, respectively for RENT and CONN. Most of these heavily shorted names have been pain trades this year, but there are a small handful of exceptions. Gogo (GOGO) and Arch Resources (ARCH) have seen substantial rallies of 66.3% and 72.45%, respectively, as the broader market has pulled back. While not as strong of a performance, Dillard’s (DDS) has also rallied solidly gaining 16%.

As previously mentioned, CONN finds itself near the top of the list of the most heavily shorted Russell 3,000 stocks, but it has been the one with the largest increase in short interest of the whole index since the January 3rd high. No other name has seen short interest rise by more than 30 percentage points in that time, but MedAvail (MDVL), Rent the Runway (RENT), and Frontier (ULCC) have seen readings rise over 20 percentage points. Click here to view Bespoke’s premium membership options.

Chart of the Day: Expensive Defensives and Cheaper Cyclicals

Bespoke’s Morning Lineup – 4/13/22 – It Begins

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels – but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine. – Jamie Dimon

Earnings season basically kicked off this morning as JPMorgan Chase (JPM) reported first-quarter results and is trading down 2% in reaction to the release. While top-line numbers were basically in line with forecasts, bottom-line EPS missed consensus forecasts ending a streak of seven straight quarters where the company topped EPS results. While this may sound like an ominous signal, we would note that despite topping EPS forecasts, the stock has traded lower on its earnings reaction day for six straight quarters.

The quote above is from this morning’s earnings release from JPM, and you better get used to it as we think it is likely to be a major theme of the Q1 earnings season. Consumer balance sheets remain strong coming out of COVID (for now) due to increased savings and a flood of stimulus payments but faced with higher costs and geopolitical uncertainty, there is a major disconnect between how consumers feel and the current health of their checking accounts.

Equity futures are basically flat this morning after a much stronger than expected PPI and some relatively hawkish FOMC commentary from Bullard and Barkin, but they were much higher overnight and have been drifting lower all morning as investors simply can’t find much in the way of positive news to grasp lately.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

This morning we wanted to play a little game to test your chart reading abilities and see how good of a technical analyst you are. Take a look at the chart below. It’s a one-year stock chart of a US company in the period spanning January 2016 through January 2017. Looking only at the chart pattern do you think the stock was higher or lower one year later? Make a decision and click on one of the buttons below to find out if you picked the right trade (the answer will appear in a new tab). Good luck!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Small Business Disconnections

Sentiment on the part of small businesses deteriorated further in the month of March as the NFIB’s Small Business Optimism Index dropped 2.5 points to 93.2. That took out the January 2021 level for the weakest print for the index since the start of the pandemic in the spring of 2020.

Considering the headline index is only a couple of points above the pandemic low, last month’s reading is only in the 16th percentile of all months on record going back to the start of the report in 1986. The month-over-month decline was also historically large ranking in the bottom decile of all monthly changes. The same could be said for multiple other categories. For example, expectations for the economy to improve and expectations for higher real sales came in at or close to record lows as the month-over-month declines were in the bottom 2% of all monthly moves. This downbeat sentiment was a complete disconnect from the levels of actual sales changes (more on this below). On the other hand, there is a wide variation across categories with top decile readings for several indices like plans to increase employment, current inventories, job openings hard to fill, and compensation-related indices.

Many of the strongest readings of the report are related to employment. Plans to increase employment have pulled back significantly from pandemic highs and are back within the range of readings from the few years prior to the pandemic. Regardless, March’s reading was in the top decile of historical readings. Actual reported changes to employment, however, have continued to fluctuate around zero and were negative in March meaning small businesses saw a decrease in hiring. That lack of hiring comes as businesses continue to report historic difficulty in filling open roles. This reading too has been rolling over though. That is echoed by fewer businesses reporting the cost or quality of labor as their single biggest concern. That combined reading has fallen from a high of 40% in September of last year to only 30% today. As other issues (namely inflation) have taken precedent as the main concern of small business owners, cost of labor remains elevated with near-record but peaked readings in compensation and compensation plans.

As employment metrics remain elevated but show signs of rolling over, readings on expectations for general conditions and sales remain weaker. Outlook for general business conditions stands out as the weakest reading of the report as the index dropped another 14 points in March to set the bar even lower for a record low. Given the pessimism surrounding business conditions, the share of businesses reporting now as a good time to expand fell for the third month in a row to match the February 2021 low. One likely reason for the aforementioned pessimism is soaring prices shown through yet another record high set by the higher prices index.

Not only has the outlook for general business conditions soured, but so too have sales expectations. Small businesses reported the worst expectations for sales since the spring of 2020. The only other period in the history of the data going back to 1986 with as weak of an optimism reading for sales was during the Great Recession. That stands in stark contrast with the actual reported sales changes. Small businesses actually reported positive momentum for sales, though, higher costs are likely eating into profitability as actual earnings changes went unchanged at deeply negative levels. In the release, the NFIB highlighted that of those respondents who reported lower profits, 35% blamed higher material costs and 13% reported higher labor costs. Another 23% blamed weaker sales. Click here to view Bespoke’s premium membership options.

Chart of the Day: Inflation Concerns Dominate But What About Sales?

A Lot Can Change in a Year

It was a little more than a year ago that we remember reading the following article in The Wall Street Journal and articles like it all over the place:

The gist of it was that COVID pushed older Americans out of the labor force in droves, and many of them weren’t coming back. This exodus from the labor force would have major societal implications as it would weigh on overall economic growth, decrease worker productivity, and push labor costs higher. As one economist in the article noted, “Historically, the likelihood of seeing workers who decided to retire come back into the labor force is quite low, so we do think that some of the drop in the participation rate with older workers is likely to remain permanent.”

What a difference a year makes. While inflation, which was supposed to be transitory, has ended up looking a lot more permanent, it appears as though the exodus of older Americans from the labor force, which was initially thought to be permanent, may end up being more transitory in nature. The Wall Street Journal highlighted this trend today:

While it may not be for the best reasons, many older Americans who left the labor force when COVID hit found that after accounting for inflation at multi-decade highs, their nest eggs will not be as supportive of their retirement plans as they originally thought, and that’s pushing them back into the labor force.

While the implication of workers leaving the labor force was for slower growth, lower productivity, and higher labor costs, an influx of workers should increase growth, increase productivity, and put downward pressure on labor costs. It’s all about supply and demand. The reason for workers returning back to the labor force may not be the most favorable for them, but amazingly, the exodus of older Americans from the labor force didn’t even last as long as the “farewell’ tours from the Eagles or The Who! Click here to try out Bespoke’s premium research service.