The Bespoke 50 Growth Stocks — 5/5/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were four changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Chart of the Day: Earnings Season Summary

The Quitter Market

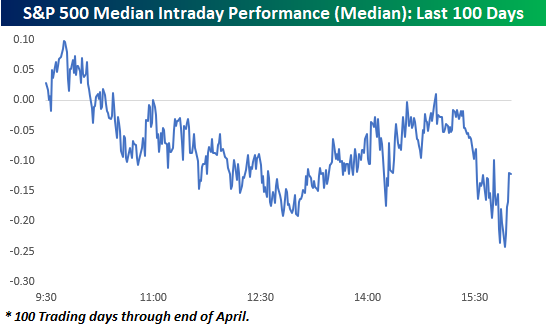

If it seems to you like the market simply can’t hold on to gains this year, you aren’t mistaken. The chart below shows an intraday composite of the S&P 500 on a median basis over the last 100 trading days through the end of April. The general pattern during this period has been for the market to open modestly higher, but then sell off for the remainder of the morning. It has then regained its footing shortly after mid-day but then sells off into the close.

How does the last five months or so compare to history? The charts below really put the recent trend of intraday weakness into perspective.

The first chart shows the number of days over a rolling 100-trading day period that the S&P 500 tracking ETF (SPY) traded in positive territory on an intraday basis but finished the day down. The reading currently stands at 38 and was as high as 40 (red line) in the last week of April. As shown in the chart below, there hasn’t been another period that the S&P 500 has had so much trouble holding onto intraday gains in more than a decade (October 2010)!

For the Nasdaq 100 (QQQ), it has been a similar story. As recently as April 22nd, the trailing number of times in the last 100-trading days that QQQ traded in positive territory on an intraday basis but finished the day lower reached 42 and currently stands at 40. Like SPY, the recent reading of 42 was the highest number of occurrences in a 100-trading day span since October 2010.

For both indices, the currently elevated frequency of giving up intraday gains has been extremely uncommon for the post-financial crisis period. Interestingly enough, though, in the ten years before the financial crisis, these types of periods were a lot more common, especially for the Nasdaq. Could it have anything to do with the fact that the last 12 years have also been one of the more accommodative monetary environments investors have ever experienced? Click here to learn more about Bespoke’s premium financial markets research.

Bespoke’s Consumer Pulse Report — May 2022

Chart of the Day: Breadth Far From Extreme Levels

Asset Class Performance

The S&P 500 (SPY) is down nearly 4% since the last FOMC meeting on March 16th when the Fed lifted off of the “zero bound” by hiking rates 25 basis points. As we approach the second rate hike of this cycle tomorrow, below is a snapshot of recent asset class performance using our key ETF matrix. For each ETF, we show its total return since the close on the date of the last FOMC meeting (3/16) as well as its total return since February 19th, 2020, which was the stock market’s closing high prior to the start of the COVID pandemic.

Starting with performance since the Fed hiked rates for the first time back in March, we’ve seen across-the-board declines in US equities with the exception of a few sectors. Small-caps and the Nasdaq have been hit hardest since the March rate hike, while the Dividend ETF (DVY) has managed to post a small gain. Communication Services and Financials have been the hardest hit sectors with declines of 8%+, while Energy and Consumer Staples are both up more than 5%. Outside of the US, not one country ETF is up since the Fed hiked rates, and Germany and China are both down ~10%. The China ETF (ASHR) is down more than any ETF in our matrix since the first rate hike, but the 20+ Year Treasury ETF is right on its heels with a decline of 10.1%. Even gold and silver are now down since 3/16, while energy and agricultural commodities are in the green.

As asset prices have fallen in 2022, we’ve seen quite a few areas of financial markets really start to give up post-COVID gains. The S&P 500 has still posted a total return of nearly 28% since pre-COVID, but the small-cap Russell 2,000 is up less than 15% at this point. Looking at US sectors, Energy is up the most since 2/19/20 with a gain of 61%. Materials and Technology are still up 40%+, while Industrials and Financials are up just 18%. Two sectors — Utilities and Communication Services — have posted total returns of less than 10% since the pre-COVID high.

Outside of the US, India and Canada are both solidly green since the pandemic began, but countries like Brazil, Germany, Hong Kong, Italy, and Spain are all in the red. Commodity ETFs have been some of the best since the pandemic, although USO (oil) specifically is actually down 14% since the close on 2/19/20.

Treasury ETFs are down on a total return basis since pre-COVID, with TLT down the most at 15%. The only bond ETF that has offered some protection post-COVID is the inflation-protected TIP, which is up 8.42%. Click here to learn more about Bespoke’s premium financial markets research.

Bond Market Massively Oversold

The sell-off in bond prices over the last six months has been extreme to say the least. There are a number of ways we could highlight the carnage for bond investors, but one way is to look at how far bond indices are trading below their 200-day moving averages. As shown below, the Bloomberg US Aggregate Bond Market Total Return index is currently 8.5% below its 200-day moving average.

Going back to 1988 when daily price data begins, the 200-DMA spread is currently 2x more negative than any prior extreme oversold reading. Click here to learn more about Bespoke’s premium financial markets research.

Chart of the Day: New Low in 52-Week Lows

Bespoke Market Calendar — May 2022

Please click the image below to view our May 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Near Record Consistency for the US Dollar in April

The US dollar performed incredibly strong in the month of April, gaining a total of 4.7%. In addition, there were only three trading days in which the US Dollar Index traded lower, which constitutes a monthly positivity rate of 86%. Notably, this is the third-highest positivity rate on record (since 1971), falling short of just July 1975 and May of 2012. In this week’s Bespoke Report, we conducted a deep dive into the dollar’s recent strength. You can access this report by becoming a paid subscriber today. Click here to view Bespoke’s premium membership options.

The month where the Dollar Index experienced the highest consistency of positive returns was in May 2012 when it finished higher on just under 87% of the month’s trading days. During that month, the Dollar Index recovered after falling 175 basis points between the end of 2011 and the start of May. In May alone, it rallied 542 basis points, more than erasing the YTD losses heading into the month. Economic weakness in Europe and concerns over Greece being able to make its debt payments also caused a rotation into dollar-denominated assets.

In July of 1975, the Dollar Index traded higher on 86.4% of the month’s trading days. Back then, the US was emerging from a recession as the economy was beginning to show signs of strength. Inflation was running hot, which caused short-term interest rates to rise and attracted foreign investors, thus boosting demand for the dollar.

Last month, demand for the Dollar moved consistently higher as higher yields attracted foreign investors. In addition, weakness in the Yen attracted foreign capital as well. With just three down days during the month, the Dollar Index was up on 85.7% of the month’s trading days.

In November of 1978, the daily positivity rates for the US Dollar Index hit 80%. The dollar had experienced weakness leading up to November, shedding 13.9% of its value on a YTD basis. Rates continued to tick higher amidst a high inflationary environment.

As mentioned in our Conference Call Recaps, strength in the US dollar acts as a headwind to Corporate America, as constant selling prices in foreign countries leads to less favorable currency conversions. So, how have equity markets performed during and after strong months for the dollar? In May 2012, the S&P 500 lost 6.3% but gained 4.0% in the following month. Three and six months out, the index was up 7.3% and 8.1%, respectively. In July 1975, the S&P 500 traded down by 6.8% and proceeded to lose another 2.1% in the following month. Three months out, the S&P 500 was up just 33 basis points. However, six months out, the index had gained 13.6%. Lastly, in November 1978, the S&P 500 gained just 1.7% after trading down by 9.2% in the previous month. In the following month, the index gained 1.5%. Three and six months later, the index was up 1.7% and 4.6%, respectively. For the sake of comparison, in April of this year, the S&P 500 shed 8.8% of its value, so weakness in equities during months where the Dollar Index has been very consistent to the upside is not necessariliy out of the ordinary.