Chart of the Day – Historical Declines in Headline CPI

Bespoke’s Morning Lineup – 5/10/23 – Under 5

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The higher up you go, the more mistakes you are allowed. Right at the top, if you make enough of them, it’s considered to be your style.” – Fred Astaire

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

As expected, Congressional leaders made little headway on the debt ceiling and then blamed each other for the stalemate. Given the low expectations, the market reaction was muted. Plus, investors have bigger fish to fry with the release of the April CPI which was expected to increase 0.4% on a m/m basis at both the headline and core levels. On a y/y basis, the headline level was expected to increase by 5.0%, while the core was forecast to increase by a more concerning 5.5%. The actual readings came in right in line with expectations although the headline y/y reading was slightly lower at 4.9%.

Equity futures were modestly lower heading into the report, following the lead of Asia and Europe, while treasuries were mixed, and crude oil was lower trading at $73 per barrel. Investors were clearly positioned for a hot reading, so the initial reaction from the market has been for equities and bonds to reverse their pre-market losses as the two-year yield drops back below 4%.

Semiconductors are an area of the market to watch here. After a lousy April where the Philadelphia Semiconductor Index (SOX) fell 7.3%, the index is down about another 1% so far in May, and the technical picture doesn’t look so great. The index broke below its 50-day moving average (DMA) in the middle of April and hasn’t been able to reclaim that level ever since. Not only that, but the SOX also broke its uptrend from the October lows. Last week, it tried to trade back above both its former uptrend and the 50-DMA but was rejected. Subsequently, last Friday it made another attempt at the 50-DMA but failed again. The S&P 500 has been having its own problems trading back above 4200, and unless the semis can regain their March traction, it could be a tough grind. On any downside in the SOX, the first level of support comes into play at around 2,850 (blue line) or about 3.5% below current levels.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day – Housing Market Hotness

Bespoke’s Morning Lineup – 5/9/23 – Less Confidence

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No one knows what interest rate the market would set, it’s always being manipulated.” – William Dunkelberg, NFIB

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After Friday’s surge didn’t have much in the way of follow-through yesterday, bears have the upper hand this morning as futures are decidedly weaker, and treasury yields are lower (although they’re pretty much exactly where they were at this point yesterday morning). Investors will also be looking ahead to this afternoon’s meeting between the President and leaders of Congress over the debt ceiling. Expectations are low, but you never know. The fact that the President and his advisers are willing to meet after already saying they wouldn’t negotiate, is a small sliver of hope.

The performance of individual stocks grouped by market cap has been interesting to watch this year and for now, has laid to waste the notion that big things come in small packages. The chart below summarizes the average YTD performance of stocks in various major US indices, and while it may look at first like it’s sorted left to right from best to worst, it’s actually by the market cap of stocks that each index represents from largest to smallest. On the left, are the Nasdaq 100 and S&P 100 which are comprised of US mega-caps. The average YTD performance of Nasdaq 100 stocks has been a gain of 11.45% while the 100 components of the S&P 100 are up an average of 4.93% YTD. Broadening out a little bit to the large-cap S&P 500, the average YTD return of those stocks has been a gain of 2.58%.

Stepping down the market cap ladder from large caps, the average YTD return of mid-cap stocks in the S&P 400 has been a gain of 2.13%. Finally, at the bottom rungs, we have small and microcap stocks which are the only two of the six indices shown where the average YTD return is negative (-1.89% for stocks in the S&P 600 and -0.28% for stocks in the Russell Microcap index). It’s at these last two indices where the progression of performance getting incrementally weaker also breaks down.

Given its outperformance YTD, it shouldn’t come as a surprise that the Nasdaq 100 is closer to a 52-week high than any of its peers. The index has essentially been rangebound since a breakout on March 31, but after last Friday’s surge and Monday’s follow-through, it’s making its best effort to break out again. Based on where futures are trading this morning, it doesn’t look like it’s going to happen today, but a lot can change over the course of a few hours, and Wednesday’s CPI will most certainly have a say in how things play out.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Triple Play Report — 5/9/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with above-expectations results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features seven stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

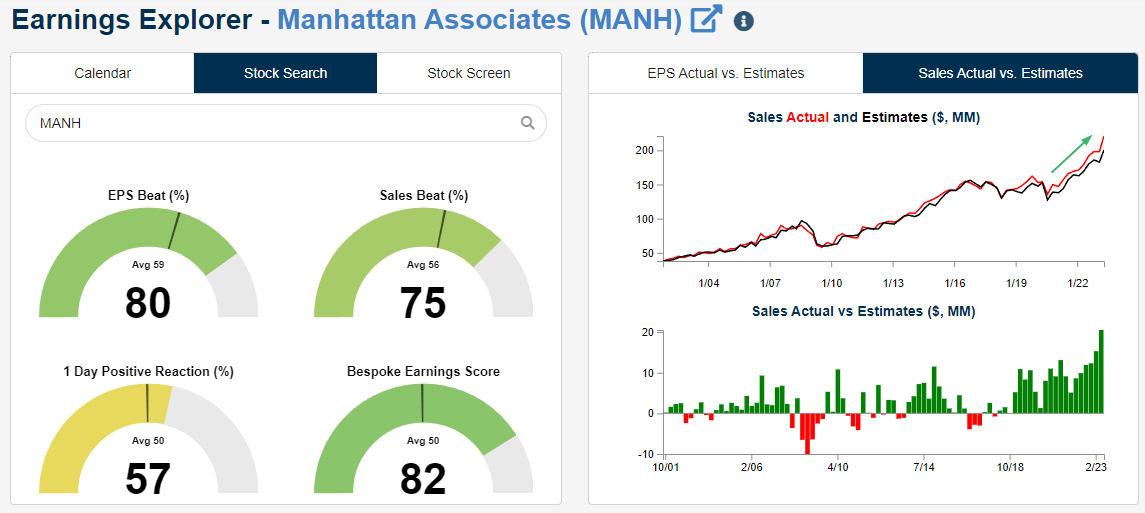

One of the sixteen triple plays featured in our newest report is Manhattan Associates (MANH). MANH has definitely been one of the most consistent reporter of triple plays over the last few years, and its share price is now just 8% below its late 2021 all-time highs after rallying just over 50% from its lows last November.

Manhattan Associates provides software solutions and services to help businesses optimize their supply chain, inventory, and omnichannel operations. Their products include tools for warehouse management, transportation management, order management, and customer engagement, among others. This name has tailwinds as both an infrastructure and an “automation” play. As shown below in the snapshot for MANH in our Earnings Explorer, revenues have re-accelerated to new highs in the last couple of years, even through last year’s bear market for stocks.

In terms of triple plays, MANH has now reported five in a row and 11 in its last 17 earnings reports, with EPS and revenue beats 17 quarters in a row as well.

For a full analysis of all 16 Tech-sector triple plays featured in this report, simply sign up for a Bespoke Institutional trial today and then read on!

Bespoke Investment Group, LLC believes all information contained in these reports to be accurate, but we do not guarantee its accuracy. None of the information in these reports or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

Megacaps Still Carrying Their Weight

Heading into earnings season, there was a considerable amount of angst on the part of investors regarding the mecacap stocks and how they would react to their earnings reports. Given their outperformance in Q1, the prevailing view was that the bar was too high, leaving the megacaps susceptible to disappointment when they reported. Within the S&P 500, there are seven companies whose weighting exceeds 1.5% in the index, and in the chart below we list the performance of each company’s stock (largest to smallest) on the earnings reaction day of their most recent report. Of the seven companies highlighted, only two (Alphabet and Amazon.com) declined in reaction to their reports. Two stocks (Nvidia and Meta) surged more than 10%, one (Microsoft) rallied more than 7%, and Apple, with its weighting of over 7%, managed to rise more than 4.5% following its report last week. There’s still a ton of reports left to get through before earnings season winds down, but on a market cap basis, we’re past the peak, and based on the reactions of the largest companies in the market, it’s been a much better earnings season than most investors expected.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Chart of the Day: Raising Staples

Bespoke’s Morning Lineup – 5/8/23 – Candy Apple

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you know the edge of your own ability pretty well, you should ignore most of the notions of our experts about what I call ‘deworsification’ of portfolios.” – Charlie Munger

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

While the S&P 500 was still down for the week, last Friday’s rally did a lot to boost sentiment as it turned a hole of over 2.5% to a weekly decline of less than 1%. For its part, the Nasdaq actually managed to finish the week marginally higher. This morning, the week is starting off on a relatively quiet but positive note as the economic calendar is light, and the pace of earnings slow. Thankfully, there wasn’t even any stress in the banking sector to have to contend with! Looking ahead, though, earnings activity will pick up after the close, and even though the mega-caps are behind us, we’re still in the peak reporting period, so the number of reports won’t slow down. Then, on Wednesday, the April CPI will likely be the major report of the week, and that will likely dictate how we finish the week.

Over the weekend at the annual Berkshire Hathaway shareholders meeting, Warren Buffett referred to Apple (AAPL) as a better business ‘than any we own’. Apple has worked out better than See’s Peanut Brittle for Berkshire shareholders. The chart below shows the quarterly performance of Berkshire Hathaway (BRK/b) over the last 20 years. From 2003 through the end of 2015, before Berkshire started acquiring Apple, the stock’s average quarterly return was a gain of 2.3%. Since 2016, when Buffett first took a bite out of Apple, Berkshire’s average quarterly gain has been more than a full percentage point higher at 3.4%.

Now, to say that the higher average quarterly return is due entirely to Apple would be too simplistic. After all, S&P 500 returns are higher in the post-2016 period (+2.8%) compared to the period from 2003 through the end of 2015 (+2.3%) but given AAPL’s outperformance of the overall market since the start of 2016 (144%) it certainly hasn’t hurt Berkshire, and the stock would almost certainly be lower now had Buffett not placed the bet on Tim Cook.

Not surprisingly, as Apple has become a much larger part of Berkshire, the stock has tended to trade more in line with Apple as well. The chart below shows the rolling 200-day correlation between the daily percentage changes of Apple and Berkshire over the last 20 years. From 2003 through the end of 2015, the average rolling correlation between the two was +0.256. Since Berkshire started acquiring Apple, even though the correlation immediately dipped in early 2016, the overall average correlation has been considerably higher at +0.453.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 5/7/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Hedge Funds

Big Hedge Funds Face New 72-Hour Deadline to Report Losses by Lydia Beyoud (Bloomberg)

A new SEC rule requires large hedge funds to share news of major losses and margin calls with regulators within 72 hours of realizing declines. That would significantly speed disclosure . [Link; soft paywall]

So You Want to Launch a Hedge Fund? by Marc Rubinstein (Net Interest)

A review of the history of the hedge fund industry as well as an outlook on the performance of the industry going forward given a very poor run of performance for leveraged private stock pickers. [Link]

Baseball

Why Did the Umpire Quit Little League? Nasty Parents by Jason Gay (WSJ)

When a small town New Jersey baseball league got tired of poor behavior from parents during games, organizers developed an interesting punishment system for hecklers: time behind the diamond. [Link; paywall]

Alabama baseball coach Brad Bohannon fired after link to suspicious bets, sources say by David Purdum (ESPN)

Video evidence from a sportsbook in Ohio showed a person placing bets against Alabama’s baseball team at the direction of that team’s coach. An independent monitoring firm identified the bets before further investigation. [Link]

Sports Business

FC Barcelona to Pay €94 Million a Year for Debt to Renew Stadium by Irene Garcia Perez (Bloomberg)

A remarkable debt deal will see the iconic Spanish football club pass enormous risk to private investors, who have loaned almost €1.5bn with no recourse to team general revenues. [Link; soft paywall]

The Audience for Women’s Sports Is Surging. Richer Media Deals Could Follow. by Rachel Bachman (WSJ)

From basketball to soccer, women’s sports from college to the pros to international competition have broadcast rights up for sale in coming years, and with viewership surging those contracts could be lucrative indeed. [Link; paywall]

Social Media

Social Media as a Bank Run Catalyst by J. Anthony Cookson, Corbin Fox, Javier Gil-Bazo, Juan Felipe Imbet, and Christoph Schiller (SSRN)

The authors find social media amplifies the risk of bank runs, with banks under deposit stress leading to larger losses when they’re discussed on Twitter, and especially so when discussed by key communities. [Link]

Bluesky’s best shot at success is to embrace shitposting by Amada Silberling (TechCrunch)

The latest social media site aiming to take advantage of challenges at Twitter made a key decision early that has driven lots of activity: inviting users who are ready to stir the pot and post like they’re not going to be able to post for long. [Link]

Tweet Tweet

SEC Issues Largest-Ever Whistleblower Award (SEC)

An anonymous whistleblower received a massive $279mm payout after coming forward with accurate information about potential securities law violations. [Link]

Commercial Real Estate

European commercial real estate dealmaking falls to 11-year low by Joshua Oliver (FT)

Commercial real estate transactions were down 62% YoY in Q1, with high rates stifling both supply and demand of properties; it may take some time before distressed sales start to pick up. [Link; paywall]

After demolishing swaths of San Jose, Google puts campus project on hold by Ron Amadeo (Ars Technica)

Google had planned to build an 80-acre campus in downtown San Jose. But cost cutting imperatives intervened and put the project on ice after demolition had already started. [Link]

Apple

Apple reportedly attracted $1 billion in deposits into its new high-yield savings account in just 4 days by Matthew Fox (Business Insider)

Apple credit card customers are eligible for a 4.15% high yield savings account from Goldman Sachs offered with Apple branding. Results have been good so far with 240k new customers in the first four days of launch. [Link]

Apple CEO Sees India at ‘Tipping Point’ as China Pivot Quickens by Mark Gurman (Bloomberg)

With Chinese supply chains threatened by geopolitics and saturation, India has become a major focus for the $2trn company. [Link; auto-playing video, soft paywall]

Environmentalism

FAA sued over SpaceX Starship launch program following April explosion by Lora Kolodny (CNBC)

A series of nonprofits have sued SpaceX after its Starship launch sent tons of concrete from the inadequately designed launch pad flying into sensitive and protected habitat surrounding the launch site. [Link]

The Politics of Carbon Capture Are Getting Weird by Emily Pontecorvo (Heatmap)

Before the Supreme Court ruled that EPA regulation of carbon had to take place at the emission site, carbon capture was viewed by environmentalists as something of a snake oil pitch. But that’s all changed as the EPA’s clean power plan rulemaking due next week is likely to show. [Link]

Libations

Where Has All the Chartreuse Gone? by Jason Wilson (Everyday Drinking)

Carthusian monks have made the decision to maintain production volumes of famed green and yellow liqueur Chartreuse, meaning availability may start to decline as demand outpaces the willingness of its silent producers to make millions of cases. [Link]

Technology

Can China’s booming EV industry help it avoid the middle-income trap? By Anthony W.D. Anastasi (South China Morning Post)

Emerging market economies often fail to make the leap from rapid growth to developed market income levels; EVs may be one of the keys to continuing China’s growth out of the middle income trap. [Link]

Labor Markets

Low earners in the US enjoy fastest wage growth (FT)

Real incomes have soared for the bottom 10% of earners over the decade, while those at the median have seen more modest growth largely thanks to post-COVID inflation. Real earnings take home the same per hour that they did from 2016-2020. [Link; paywall]

White-Collar Layoffs are Starting to Show Up in the Household Survey by Preston Mui (Employ America)

A detailed look at the details of several government reports on the labor market shows that layoffs announced over the past year are starting to show up, albeit only modestly so far. [Link]

Policing

More people are getting away with murder. Unsolved killings reach a record high by Eric Westervelt (NPR)

The national murder clearance rate fell below 50% in 2020, a record low dating back as far as records are kept. The number is as low as one-third of murders in some cities. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 5/5/23 — The Worst Is Over

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

Don’t be confused by panicked price action in regional banks: the deposit crisis is subsiding. One example can be found in the reduced balances for emergency lending programs at the Fed. Those have fallen by $100bn since the March 22nd peak, a sign that stress is abating, and after the failure of FRC in the latest weekly data, 74% of the balances are now loans to the FDIC rather than funding for banks that have yet to fail.

Data on bank balance sheets tells the same story. Domestically chartered banks saw deposits up WoW by a total of $21bn. What’s even more encouraging is core loan growth. Total lending across consumer, commercial & industrial, and real estate loans rose by $29.4bn in the week of April 26th. That’s a major acceleration and was led by smaller banks in a sign that the liquidity stress of deposit swings are hitting credit creation less than feared.

Of course, that doesn’t change the fact that the KBW Regional Bank index was down 8% this week…and that’s after a 4.7% rally on Friday. For their part, large cap stocks suffered through four straight losses before a 1.9% surge in response to strong payrolls data Friday. This marks the fifth-straight week that the S&P 500 has reversed direction from the prior week. Of course, banks weren’t the only reversal: front-month WTI collapsed 7.3% in thin liquidity around dinner time Thursday night before a sharp 12% rally from that low through the close on Friday. Add in the Fed, which has raised the bar for further hikes, and we have what looks like three different storms passing this week and clearing the skies for stocks.

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.