Bespoke’s Weekly Sector Snapshot — 3/2/23

Sentiment Back to Bearish

The consistency of declines throughout February and to start the month of March has sent sentiment decisively lower. The latest data from the American Association of Individual Investors (AAII) showed 23.4% of respondents reported as bullish, up modestly from 21.6% last week but still down significantly from 34.1% two weeks ago. With less than a quarter of respondents reporting as bullish, bullish sentiment continues to sit firmly below its historical average of 37.5% for a record 67 straight weeks.

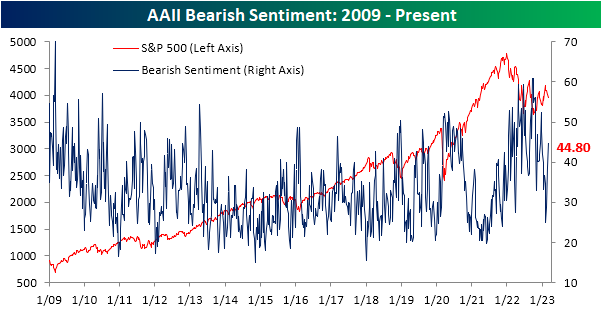

Meanwhile, bearish sentiment has continued to grind higher reaching 44.8% after three straight weeks of increases and hitting the highest level of the short year so far.

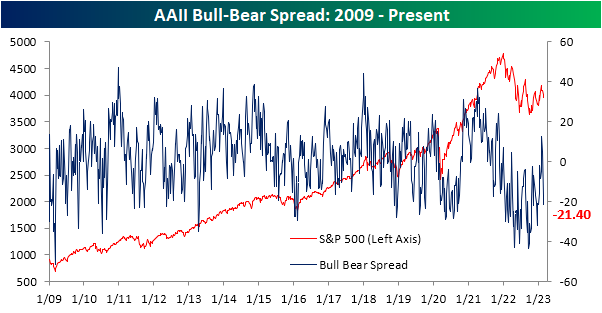

At the start of February, the bull-bear spread ended its record streak of negative readings as bulls finally outnumbered bears. The surge in pessimism in the past couple of weeks, though, has resulted in more negative bull-bear readings.

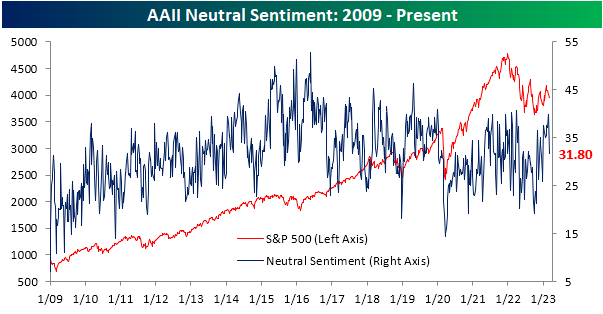

In addition to sentiment taking a more bearish tone, far fewer respondents are reporting neutral sentiment. After the highest reading in nearly a year last week, only 31.8% couldn’t make up their mind this week. That eight percentage point drop from last week was the largest weekly decline since November.

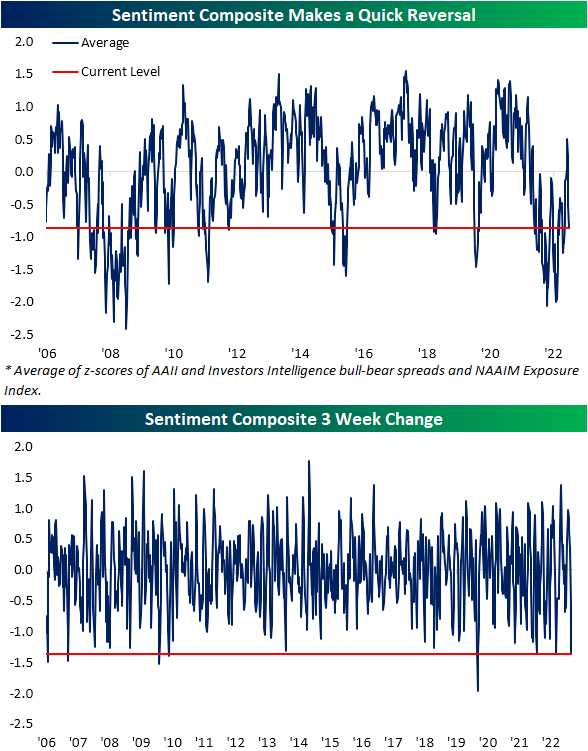

In addition to the AAII survey, other weekly sentiment readings have likewise made a quick reversal back towards negative sentiment. Combining the readings of the AAII survey with the Investors Intelligence survey and the NAAIM Exposure Index, sentiment has gone from the most cheery outlook in over a year down to pessimism right in line with the rest of the past year. In fact, the 1.36 point decline since the high three weeks ago ranks as the seventh largest decline in such a span since the composite begins in 2006.

Since sentiment is a contrarian indicator, the sharp bearish turn across these sentiment indicators ‘should’ be a signal for positive forward performance. However, that has not exactly been the case historically. In the table below, we show each prior week that the index has fallen at least 1.25 points without having done so in the prior three months. Of the dozen prior instances, performance has been mixed going forward. Click here to learn more about Bespoke’s premium stock market research service.

Home Prices Falling Fast

Updated data on home prices across the country came out earlier this week when the newest monthly S&P CoreLogic Case Shiller indices were published. This data is lagged by two months, but it gives us a look at where home prices ended the year in 2022.

Below is a table highlighting the month-over-month (m/m) and year-over-year (y/y) percentage change in home prices across the 20 cities tracked by Case Shiller. It also includes the national and composite 10-city and 20-city readings.

Home prices fell sharply from November 2022 to December 2022, with the national index down 0.81% and 11 of 20 cities down more than 1% sequentially. New York and Miami saw the smallest m/m declines with drops of less than 0.3%.

Looking at y/y price changes, while the national index still showed an increase of 5.76% from December 2021 to December 2022, two cities have now seen prices dip into the red on a y/y basis. Seattle home prices fell 1.78% for the full year 2022, while San Francisco prices fell even more at -4.19%. Given the unrelenting pullback in prices over the last six months, we’ll see more and more cities dip into the red on a y/y basis over the next few months.

Where home price trends get interesting is looking at the post-COVID action. In the aftermath of lockdowns, government stimulus, and the shift to “work from home” in many parts of the labor force, home prices across the country absolutely soared. By mid-2022, the national home price index was up 45% from the level it was at in February 2020 just before COVID hit. Areas on the West Coast and in the Southeast saw prices rise even more, with many cities seeing gains of more than 60% at their peaks.

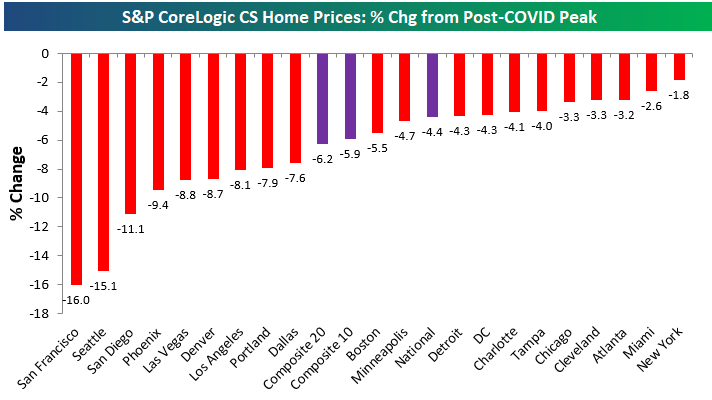

Prices finally peaked last summer, however, as rate hikes by the inflation-fighting Fed quickly pushed mortgage rates to levels not seen in decades. Below is a chart showing how much home prices have fallen from their post-COVID peaks seen in mid-2022. The composite indices are only down 4-6% from their highs, but we’ve seen prices really take a hit out west with cities like San Diego, Seattle, and San Francisco already down double-digit percentage points.

Given the pullbacks in home prices over the past six+ months, below is a look at where prices currently stand relative to their pre-COVID levels at the end of February 2020. Notably, San Francisco — which has seen prices fall the most from their highs — is currently up the least since COVID hit with a gain of 23%. Other cities where home prices are up less post-COVID than the national indices include Minneapolis, DC, Chicago, and Portland. Where home prices are still up the most is in Florida as prices in Tampa and Miami are still up 60% or more. Click here to learn more about Bespoke’s daily premium service.

Another Week Below 200K For Claims

Initial jobless claims continue to impress with this week’s reading being the seventh week in a row of sub-200K prints. Falling another 2K week over week to 190K, adjusted claims are now at the lowest level since the last week of January.

While the seasonally adjusted number is low, before taking that into account claims have actually yet to drop below 200K. Claims are falling as is normal for this point of the year with the past couple of weeks historically being some of the most consistent to experience week-over-week declines on a historical basis. At current levels, claims are comparable to the equivalent week of the year from the past several years excluding 2021.

As for continuing claims, the past couple of weeks have seen the readings begin to pivot lower after rising to the highest level of the year at the start of February. Continuing claims totaled 1.655 million which is the lowest level since the week of 1/21. Albeit claims remain off their best levels of the pandemic (for both initial and continuing claims), they remain healthy headed into next week’s nonfarm payrolls release. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Tesla Gets Boring

Bespoke’s Morning Lineup – 3/2/23 – Leveling Off

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It is amazing how many drivers, even at the Formula One Level, think that the brakes are for slowing the car down.” – Mario Andretti

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If you’re looking at the positive Dow futures this morning, you’re getting a misleading picture of the setup heading into the trading day. That’s because a 15%+ rally in salesforce (CRM) is responsible for about 100 points of the rally. Without CRM, the Dow would also be poised to open lower. Both the S&P 500 and Nasdaq are trading lower with Tesla (TSLA) acting as a bigger drag on the Nasdaq.

Stocks have been in a bit of a rut ever since the Presidents Day weekend as the S&P 500 has declined over 3% and closed lower than its opening print on all seven trading days. In total now, we’ve seen a pullback of just over 5% since the recent peak in early February. Today, the focus of investors will be on Non-Farm Productivity, Unit Labor Costs, and jobless claims all at 8:30.

The year is only two months old, but already some of the typical seasonal trends in the economy seem to be bucking the trend. Whether it was due to the weather, seasonal adjustments, or just underlying strength, economic data surprised to the upside after a December that was mostly weaker than expected.

One area where the pattern has been the opposite of the seasonal norms at this point in the year is gasoline prices. While national average prices, as tracked by AAA, typically only see marginal gains in the month of January, this year prices surged more than 9%, which ultimately translated to higher levels of inflation. In February, though, we saw much of the increase in prices from January reverse itself, and prices finished the month down more than 4% for the largest February decline since 2006. As a result of that pullback, the national average price, which was up way more than normal YTD at the end of January, is now actually up slightly less YTD this year than in an ‘average’ year. While gas prices were an accelerant for inflation in January, they’re likely to be a damper on it in February.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Manufacturing Construction Surge, PMI Upturn, Flow Show – 3/1/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a recap of notable earnings and natural gas export volumes (page 1). We then dive into the latest construction spending figures (page 2) followed by a rundown of the S&P Global and ISM Manufacturing readings (page 3). Afterward, we dive into the latest trends in mutual fund and ETF flows (page 4) before closing with a look at the record crude exports number from today’s EIA release (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/1/23

Bespoke All Access

Bespoke Investment Group’s daily research for investors is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Daily Research

Our daily research is published and emailed to members every trading day of the year.

Market Outlook

Bespoke takes a “fusion” approach in its research, forming its overall view of the market using inputs from market fundamentals and the economy, market technicals and breadth, historical and seasonality trends, and investor sentiment. We keep clients informed of our market views through monthly, quarterly, and annual outlook publications in addition to our daily reports.

Stock, ETF, and Asset Allocation Ideas

Clients looking for stock, ETF, and asset allocation ideas can find them throughout Bespoke’s research product:

- Conference Call Recaps – Throughout earnings season, Bespoke publishes 2-page conference call summaries of the most important companies to report each quarter. These recaps highlight key topics and trends discussed by management on earnings calls and during the analyst Q&A.

- Bespoke Stock Scores – Our quantitative Stock Scores database covers every company in the S&P 1500 based on proprietary fundamental, technical, and sentiment measures.

- Bespoke Baskets – Each month, Bespoke provides an updated list of 15 intriguing large-cap Growth stocks and 15 large-cap Dividend Income stocks.

- The Bespoke 50 – Our Bespoke 50 is a list of 50 stocks in the Russell 3,000 with positive growth and momentum characteristics. This list began in 2012 and is updated weekly.

- Interactive Tools – Bespoke’s website contains numerous tools to help clients analyze price action, momentum, and much more across 1000s of stocks and ETFs.

Data and Charts

Along with Bespoke’s daily research, clients have access to a unique set of interactive tools for analyzing trends across financial markets.

Bespoke’s suite of research and tools keeps clients fully informed and engaged with financial markets, and it’s consumed in quick and easy fashion, which saves time in a world where every minute counts. Our research gets published on our website and emailed directly to client inboxes for those that wish to receive our reports via email.

If you would like to give Bespoke a try, sign up here for our Bespoke All Access research service and get a one-month complimentary trial. You can also reach us at 914-315-1248 if you’d like to schedule a meeting or request more samples.

Fixed Income Weekly: 3/1/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report, we look at the bills market and the debt ceiling.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!