Chart of the Day – Industrials Closing in on 52-Week Highs

B.I.G. Tips – Q4 2022 Earnings; Triple Plays

Today we published our newest Earnings Triple Plays report. This season there were a total of 105 earnings triple plays out of just under 2,000 individual quarterly earnings reports from US-listed stocks.

What is a triple play? When a stock reports quarterly earnings, it registers a “triple play” when it beats analyst EPS estimates, beats analyst revenue estimates, and raises forward guidance. We coined the term back in the mid-2000s, and you can read more about it at Investopedia.com. We consider triple plays to be the cream of the crop of earnings season, and we’re constantly finding new long-term opportunities from this basket of names each quarter. You can track the newest earnings triple plays on a daily basis at our Triple Plays page if you’re a Bespoke Premium or Bespoke Institutional member. To read our newest report and see some of the triple plays with intriguing charts at the moment, start a two-week trial to Bespoke Premium!

Bespoke’s Morning Lineup – 3/6/23 – Take Two of These and Call Me in the Morning

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Nothing a couple of aspirin can’t cure.” – Peggy Olson, Mad Men

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The headlines say that the market’s fate all comes down to the next 13 trading days, but this ‘important’ period for the market is starting off slowly. Equity futures are oscillating around the unchanged line even as Treasury yields and commodities have pulled back. Crude oil down over 1% while natural gas plunges more than 12% on little news. Just to illustrate how quiet things are this morning, bitcoin is down less than 5 dollars – not percent – but dollars!

It may be quiet this morning, but the market has been giving headaches to both bears and bulls in the last several weeks. A quick look at a chart of the S&P 500 illustrates the frustration being felt on both sides. On a side note, it was ironic to see this morning that Bayer filed its patent for the ultimate headache cure (or at least one of them), aspirin, on this day in 1899.

In late January/early February, the S&P 500 broke above its December highs and its 200-day moving average forming what looked like the first real higher high since the peak in early January. At that point, the S&P 500 was further above its 200-DMA than at any point since it first broke below that level early last year. Then, the January employment report was released.

January’s much stronger-than-expected employment report coupled with a strong Retail Sales report and higher-than-expected inflation data, shifted the narrative quickly back to one where things were overheating and inflation was going to turn higher. The market quickly reacted with a radical shift in market pricing for Fed policy as Treasury yields surged. Stocks immediately reversed much of the gains from January, and the Dow actually ticked into the red for the year. The S&P 500’s pullback wasn’t as bad, but late in the month, it was back below its 50-DMA and once again testing its 200-DMA.

An intraday bounce on that first test briefly rekindled some optimism, but by last Thursday morning, the S&P 500 was back below its 200-DMA and both bears and bulls started to prepare for another leg lower. As hope was fading, stocks staged an intraday rebound that continued right into Friday. Now, heading into the new trading week, the S&P 500 is back above its 200-DMA and 3% above Thursday’s lows. Bulls are feeling confident again, but with Jay Powell scheduled to testify tomorrow, the employment report coming out Friday, and then CPI next week, don’t start snorting at the bears just yet, they may just need that aspirin back by next week.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 3/5/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Climate Disruption

As Oil Companies Stay Lean, Workers Move to Renewable Energy by Clifford Krauss (NYT)

While energy companies avoid adding headcount and keep a laser focus on cashflows, renewables are rapidly scaling up and are poaching talent in the process, meaning American jobs are rapidly shifting from the oilpatch to wind and solar farms. [Link; soft paywall]

California senate pushes to stabilize the homeowners insurance market by Morgan Rynor (MSN/KFMB San Diego)

After a catastrophic run of forest fires, fire insurance in California is either not available at all or becoming prohibitively expensive, making homeowners far more vulnerable to the still-significant fire risk that has beset much of the state. [Link]

Prices

Column: With winter almost over, Europe’s gas stocks are at seasonal record high by John Kemp (Reuters)

With winter winding down, EU and UK gas storage is still 61% full, with more than 680 terawatt hours worth of gas in inventory. That offers hope that building supplies ahead of next winter will be a much easier task. [Link]

Sellers’ Inflation, Profits and Conflict: Why can Large Firms Hike Prices in an Emergency? by Isabella M. Weber and Evan Wasner (UMass Amherst Economics Working Papers)

New research that argues post-COVID inflation is mostly about expanding market power and margins rather than excessive demand. [Link]

Lilly to cut some list prices by 70% and offer $25 insulin by Bhanvi Satija and Patrick Wingrove (Reuters)

After a $35 price cap on insulin was extended to most Americans who have insurance, drugmakers have made equivalent cuts to the out-of-pocket costs of their drugs in a move that will make it much easier for diabetics to access insulin. [Link; registration required]

Ukraine

In an Epic Battle of Tanks, Russia Was Routed, Repeating Earlier Mistakes by Andrew E. Kramer (NYT)

The latest egregious blunder from Russian war planners: massed tank attacks with little infantry support or tactical flexibility to deal with ambushes, mines, and Ukrainian anti-tank doctrine. [Link; soft paywall]

Trapped In The Trenches In Ukraine by Luke Mogelson (NYer)

Remarkable dispatches from the front lines of the war in Ukraine. A very long read, but filled with incredible and engaging detail about the soldiers and environment on the battlefield. [Link; soft paywall]

National Defense

‘Havana Syndrome’ Not Caused By Energy Weapon Or Foreign Adversary, Intelligence Review Finds by Shane Harris and John Hudson (WaPo)

The malady blamed on some sort of energy weapon wielded by foreign adversaries is much more quotidian than science fiction, an embarrassing challenge to a narrative that had treated ‘Havana syndrome’ as some sort technological wonder. [Link; soft paywall]

The First Battle of the Next War by Mark F. Cancian, Matthew Cancian, and Eric Heginbotham (CSIS International Security Program)

This report summarizes the findings of a wargame run by the CSIS and designed to simulate Chinese invasion of Taiwan. The result of US/Taiwanese/Japanese resistance to a Chinese invasion is typically success but at massive cost; generally, the failure is thanks to stiff Taiwanese resistance once Chinese troops have landed. [Link; 165 pg PDF]

Crypto

Crypto Companies Behind Tether Used Falsified Documents and Shell Companies to Get Bank Accounts by Ben Foldy and Ada Hui (WSJ)

One of the owners of Tether Holdings, issuer of the tether stablecoin, admitted an effort to “circumvent the banking system by providing fake sales invoices and contracts for each deposit and withdrawal” per emails review by the WSJ. [Link; paywall]

ETFs

Are you short Jim or long Jim? by Alexandra Scaggs (FTAV)

Want to bet on or against the stocks that are mentioned by CNBC personality Jim Cramer? Luckily there are now ETFs for each. [Link; soft paywall]

Time Marches On

US senators reintroduce bill to make daylight saving time permanent by David Shepardson (Reuters)

A bipartisan group of 12 Senators wants to do away with twice-per-year clock changes in favor of a year-round constant time. [Link; registration required]

Guns

74,000 & growing: Some NC police departments stockpile guns rather than release them by Virginia Bridges (The Charlotte Observer)

Police departments in the 10 largest cities across North Carolina number 74,000 and counting as firearms seized during police actions sit in storage. State law bans cops from destroying guns for any reason. [Link; soft paywall]

Social Media

I Gave Into The New Twitter Algorithm And I Went Way Too Viral by Ryan Broderick (Garbage Day)

An anecdotal but convincing analysis of what is making Twitter’s algorithm tick these days, and a depressing accounting of how much the site has deteriorated. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 3/3/23 – The Seuss is Loose

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

If you’re confused, join the club. Sweat is beading up on the foreheads of investors on both sides of the bull-bear debate lately. There are enough bearish headlines out there to make anyone question why in the world they would ever want to own stocks. Meanwhile, just as it seems as though the market is about to break down, Thursday and Friday happen. Seems to us like the market is doing its job!

In honor of Dr. Seuss’ 119th birthday this week, we thought it would be fun to write a description of the stock market channeling his writing style. With a tool like ChatGPT, we figured it would be easy enough. Unfortunately, the results were lacking, so in the spirit of Napolean Bonaparte who once said, “If you want a thing done well, do it yourself,” we did just that. We’ll let you judge for yourself if it was done ‘well’! But if you’re short on time this weekend, the story will tell you all you need to know about the stock market.

View this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Daily Sector Snapshot — 3/3/23

February 2023 Headlines

Bespoke’s Morning Lineup – 3/3/23 – Three Was Enough?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“For the execution of the journey to the Indies I did not make use of intelligence, mathematics or maps.” – Christopher Columbus

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After three weeks of declines, it was looking like March would only add to the tally. Thursday’s rally pushed the S&P 500 into positive territory for the week, though, and with futures indicated higher now, equities are on pace for a positive week…if they can get through today. It’s a relatively quiet day on the economic calendar today with PMIs for the services sector, the only reports scheduled for release. These are important indicators to watch for signs of whether or not the economy is running too hot, and the international versions of these reports released this morning showed strength. January’s economic data fed a narrative that the economy just wouldn’t quit even as the Fed tried its best to squash it. This week’s data for February like Consumer Confidence, Chicago PMI, and ISM Manufacturing, though, weren’t exactly positive, and they all missed expectations.

One area of the markets not rallying this morning is crypto. After a 50% rally through its high over Presidents’ Day weekend, bitcoin has been correcting for the last two weeks capped off with a 4%+ decline in early trading today. After today’s drop, the pullback is close to 10%, and bitcoin is on pace to close below its 50-day moving average (DMA) for the first time in nearly two months.

A break below the 50-DMA is typically considered a bearish signal, but in bitcoin’s case, this type of pattern hasn’t been followed by a clear trend. During the parabolic runup from 2016 through 2017, any time bitcoin closed below its 50-day moving average after trading above it for at least 50 days it almost always immediately recovered to new highs. Beginning in 2018, though, bitcoin was slower to recover following these types of breaks. In three of the four periods since the start of 2018, prices experienced pretty sizable pullbacks at least in the short term, but they were still always followed by new highs. In dollar terms, last year’s pullback in bitcoin was unlike any other, but in percentage terms, it has been in this type of situation before. As bitcoin has ‘matured’ it has tended to follow more typical technical patterns versus the early days when all it did was win, so a pause in this year’s rally, at least in the short-term, wouldn’t be surprising.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

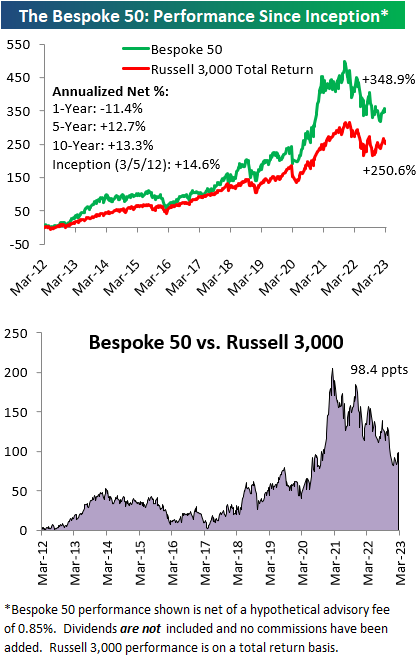

The Bespoke 50 Growth Stocks — 3/2/23

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were three changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

The Closer – Factor Fudging, Auto Sales, Openings, Realtors – 3/2/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, following recaps of today’s market moving Fedspeak, we run through the major earnings reports out after the closing bell (page 1). We then check in on various factors’ performance since the October lows (page 2). Turning to macro data, we then look at the latest vehicle sales figures from around the world (page 3) followed by US job postings from Indeed.com (page 4 and 5) before closing with a look at February housing inventory data from Realtor.com (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!