The Bespoke Report — 5/5/23 — The Worst Is Over

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

Don’t be confused by panicked price action in regional banks: the deposit crisis is subsiding. One example can be found in the reduced balances for emergency lending programs at the Fed. Those have fallen by $100bn since the March 22nd peak, a sign that stress is abating, and after the failure of FRC in the latest weekly data, 74% of the balances are now loans to the FDIC rather than funding for banks that have yet to fail.

Data on bank balance sheets tells the same story. Domestically chartered banks saw deposits up WoW by a total of $21bn. What’s even more encouraging is core loan growth. Total lending across consumer, commercial & industrial, and real estate loans rose by $29.4bn in the week of April 26th. That’s a major acceleration and was led by smaller banks in a sign that the liquidity stress of deposit swings are hitting credit creation less than feared.

Of course, that doesn’t change the fact that the KBW Regional Bank index was down 8% this week…and that’s after a 4.7% rally on Friday. For their part, large cap stocks suffered through four straight losses before a 1.9% surge in response to strong payrolls data Friday. This marks the fifth-straight week that the S&P 500 has reversed direction from the prior week. Of course, banks weren’t the only reversal: front-month WTI collapsed 7.3% in thin liquidity around dinner time Thursday night before a sharp 12% rally from that low through the close on Friday. Add in the Fed, which has raised the bar for further hikes, and we have what looks like three different storms passing this week and clearing the skies for stocks.

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Daily Sector Snapshot — 5/5/23

Seasonal Mid Point

Today marks the midpoint of spring, so from here on, we can say that we’re closer to summer than winter. Summer isn’t typically thought of as a positive time for equities, but as highlighted in the “Seasonality” section of our Morning Lineup today, the next three months, which is the period straddling the back half of spring and the first half of summer, has been relatively strong in the last ten years. The table and charts below summarize the performance of the S&P 500 ETF (SPY) and each sector-tracking ETF from the close on May 5th through August 5th. The S&P 500’s median performance during this period over the last ten years has been a gain of 5% with positive returns 90% of the time. Leading the way higher, Health Care (XLV), Real Estate (XLRE), and Technology (XLK) have all experienced median gains of over 5% with positive returns 85% of the time or more. In addition to XLV and XLK, Consumer Discretionary (XLY) and Consumer Staples (XLP) have also been up during this period in nine of the last ten years. On the downside, the only sector that has had a negative return on a median basis has been Energy (XLE). Ironically, even last year when the sector outperformed the broader market by a significant degree, it not only declined (-8.3%), but it also underperformed the S&P 500 by a wide margin during this three-month stretch.

Looking at the last ten years, in every year since 2013, there have only been two years that the majority of sectors in the S&P 500 declined during this period (XLRE price data doesn’t begin until 2016 while XLC didn’t start trading until June 2018). Last year, six of eleven sectors traded lower even as the S&P 500 had a marginal gain, while in 2019, eight of eleven sectors declined as the S&P 500 fell 3%.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 5/5/23 – Unlucky Thirteen?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Employment is nature’s physician and is essential to human happiness.” – Galen

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

You’ve likely seen a few headlines this morning discussing the ‘rebound’ and ‘surge’ in regional bank stocks led by shares of PacWest (PACW) which are trading up 26% in pre-market trading. Any staunching of the bleed in these stocks is welcome, but when PACW is only back to levels where it was trading at in the final hour of trading yesterday and still down over 60% on the week, it’s hard to call it a surge.

With bank stocks showing some stabilization, equity futures are taking the opportunity to rebound. European stocks are all firmly higher this morning, and that comes despite what has been mostly a round of weaker-than-expected economic data as European Retail Sales, German Factory Orders, and Industrial Production in France all came in significantly weaker than expected.

With the Fed on Wednesday and Apple (AAPL) earnings after the close yesterday, you may have forgotten about today’s April Non-Farm Payrolls, but those numbers were just released. Economists were expecting the total change in Non-Farm Payrolls to come in at 185K with the Unemployment Rate increasing to 3.6% from 3.5%. The actual readings came in stronger than expected with payrolls increasing by 253K and the Unemployment Rate falling to 3.4%. Average hourly earnings were also two-tenths stronger than expected at 0.5% m/m. One caveat to the stronger headline print, though, was that prior month readings were revised lower by about 150K.

The monthly payrolls report has been important because, in its quest to bring down inflation, the Federal Reserve has been on a mission to crush employment. Because of that, the chart below continues to give members of the committee nightmares. While other areas of the economy have clearly shown signs of rolling over, up until recently, employment has been humming along. Recently, we have started to see some signs of cooling as jobless claims (after a major revision) have been trending higher while JOLTS has been rolling over, but the Non-Farm Payrolls report has been another story. With this month’s stronger-than-expected print, we have now seen a record 13 straight months where the headline change in Non-Farm Payrolls was better than expected.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Consumer Pulse Report — May 2023

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

The Closer – Bull-Steepening, Markets versus Data on Bank Stress – 5/4/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick off with earnings recaps (page 1) followed by a dive into the the steepening of the yield curve (pages 2 and 3). We then take a look at the latest nonfarm productivity and costs numbers (page 4), money market fund flow (page 5), and global supply chain pressures (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Weekly Sector Snapshot — 5/4/23

Initial and Continuing Claims in Opposite Directions

The latest reading on initial jobless claims disappointed coming in at 242K versus expectations of 240K. That is up from last week’s downward revision to 229K. As shown in the inlaid chart below, claims have moved up to some of the highest levels in a over a year with the past several weeks marking relatively range bound readings. This week’s increase to 240K marks a move to the high end of that recent range.

Before seasonal adjustment, claims came in at 219K. That is roughly in line with the readings of the comparable week off the year for the past few years excluding 2020 and 2021 when claims were more elevated due to the pandemic. Claims are also generally following seasonal trends with the current week having consistently seen declines week over week historically. With that said, claims have yet to make a new low on the year.

Whereas initial claims were a slight disappointment, continuing claims surprised with an improvement this week. Rather than the increase to 1.865 million that was expected, they dropped all the way down to 1.805 million, the lowest reading in three weeks. Albeit improved in the near term, the uptrend in continuing claims remains in place as claims are around the highest levels since early 2022.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

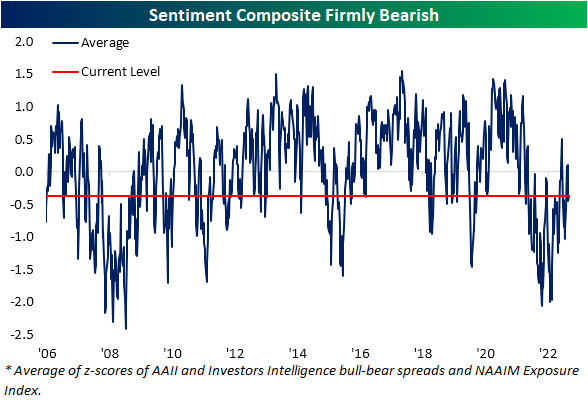

Sentiment Slouches

The S&P 500 has firmly turned lower in the past few days and is nearing the lows from last Wednesday. In spite of that turn lower, bullish sentiment was unchanged at 24.1% per the latest AAII sentiment survey. Although less than a quarter of respondents reported as bullish, that reading is only in the middle of the past year’s range of readings as bullish sentiment has consistently been hard to come by.

With no change to bullish sentiment, all of the moves occurred for neutral and bearish sentiment. Neutral sentiment has declined for three weeks in a row, coming in at a six week low of 31% this week.

All of those declines to neutral sentiment were picked up by bears as that reading rose 6.4 percentage points to 44.9%. That is the highest reading since the end of March and right in line with the average reading of bearish sentiment since the beginning of 2022.

With bearish sentiment moving higher, the bull-bear spread moved more firmly into negative territory. This week, bears outnumbered bulls by 20.8 percentage points; the widest spread in five weeks. That indicates the predominant share of respondents continue to expect the S&P 500 to head lower over the next six months.

That negative outlook by individual investors is nothing new. Following the record streak of 44 straight weeks of a negative bull-bear spread that ended in February, the spread has resumed another lengthy streak of negative readings. This week marked the eleventh straight negative reading in the bull-bear spread. Even in the more recent context of the aforementioned record streak and another double-digit streak in the first quarter of last year, the AAII survey has seldom seen bears outnumber bulls on such a consistent basis.

Factoring in other sentiment surveys like those from Investors Intelligence and NAAIM reaffirms the bearish tones of sentiment. With all three surveys combined, our sentiment composite remains firmly negative meaning sentiment is more bearish than average. We would also note that due to the timing of the collection of these surveys, they would have mostly missed any reaction to the FOMC’s rate decision and market response yesterday. As such, next week’s surveys will be the first to fully reflect the latest 25 bps hike and subsequent market declines.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.