Bespoke’s Morning Lineup – 5/10/23 – Under 5

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The higher up you go, the more mistakes you are allowed. Right at the top, if you make enough of them, it’s considered to be your style.” – Fred Astaire

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

As expected, Congressional leaders made little headway on the debt ceiling and then blamed each other for the stalemate. Given the low expectations, the market reaction was muted. Plus, investors have bigger fish to fry with the release of the April CPI which was expected to increase 0.4% on a m/m basis at both the headline and core levels. On a y/y basis, the headline level was expected to increase by 5.0%, while the core was forecast to increase by a more concerning 5.5%. The actual readings came in right in line with expectations although the headline y/y reading was slightly lower at 4.9%.

Equity futures were modestly lower heading into the report, following the lead of Asia and Europe, while treasuries were mixed, and crude oil was lower trading at $73 per barrel. Investors were clearly positioned for a hot reading, so the initial reaction from the market has been for equities and bonds to reverse their pre-market losses as the two-year yield drops back below 4%.

Semiconductors are an area of the market to watch here. After a lousy April where the Philadelphia Semiconductor Index (SOX) fell 7.3%, the index is down about another 1% so far in May, and the technical picture doesn’t look so great. The index broke below its 50-day moving average (DMA) in the middle of April and hasn’t been able to reclaim that level ever since. Not only that, but the SOX also broke its uptrend from the October lows. Last week, it tried to trade back above both its former uptrend and the 50-DMA but was rejected. Subsequently, last Friday it made another attempt at the 50-DMA but failed again. The S&P 500 has been having its own problems trading back above 4200, and unless the semis can regain their March traction, it could be a tough grind. On any downside in the SOX, the first level of support comes into play at around 2,850 (blue line) or about 3.5% below current levels.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Investor Movement and Consumer Confidence, Record 3Y Note Sale – 5/9/23

Log-in here if you’re a member with access to the Closer.

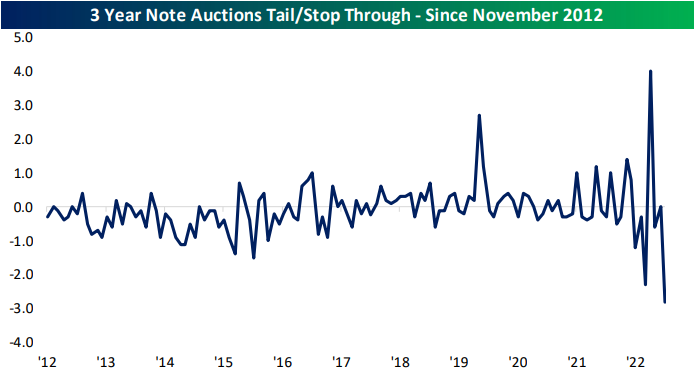

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with recaps of the latest earnings (page 1) followed by a preview of performance on CPI days of the S&P 500 and its industry groups (page 2). We then dive into the latest sentiment figures for investors (page 3), potential homebuyers (page 4 and 5), and consumers (page 6). We finish with a review of today’s record setting 3 year note auction (page 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 5/9/23

B.I.G. Tips — 2011 Was Different

Chart of the Day – Housing Market Hotness

Bespoke Stock Scores — 5/9/23

Bespoke’s Morning Lineup – 5/9/23 – Less Confidence

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No one knows what interest rate the market would set, it’s always being manipulated.” – William Dunkelberg, NFIB

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After Friday’s surge didn’t have much in the way of follow-through yesterday, bears have the upper hand this morning as futures are decidedly weaker, and treasury yields are lower (although they’re pretty much exactly where they were at this point yesterday morning). Investors will also be looking ahead to this afternoon’s meeting between the President and leaders of Congress over the debt ceiling. Expectations are low, but you never know. The fact that the President and his advisers are willing to meet after already saying they wouldn’t negotiate, is a small sliver of hope.

The performance of individual stocks grouped by market cap has been interesting to watch this year and for now, has laid to waste the notion that big things come in small packages. The chart below summarizes the average YTD performance of stocks in various major US indices, and while it may look at first like it’s sorted left to right from best to worst, it’s actually by the market cap of stocks that each index represents from largest to smallest. On the left, are the Nasdaq 100 and S&P 100 which are comprised of US mega-caps. The average YTD performance of Nasdaq 100 stocks has been a gain of 11.45% while the 100 components of the S&P 100 are up an average of 4.93% YTD. Broadening out a little bit to the large-cap S&P 500, the average YTD return of those stocks has been a gain of 2.58%.

Stepping down the market cap ladder from large caps, the average YTD return of mid-cap stocks in the S&P 400 has been a gain of 2.13%. Finally, at the bottom rungs, we have small and microcap stocks which are the only two of the six indices shown where the average YTD return is negative (-1.89% for stocks in the S&P 600 and -0.28% for stocks in the Russell Microcap index). It’s at these last two indices where the progression of performance getting incrementally weaker also breaks down.

Given its outperformance YTD, it shouldn’t come as a surprise that the Nasdaq 100 is closer to a 52-week high than any of its peers. The index has essentially been rangebound since a breakout on March 31, but after last Friday’s surge and Monday’s follow-through, it’s making its best effort to break out again. Based on where futures are trading this morning, it doesn’t look like it’s going to happen today, but a lot can change over the course of a few hours, and Wednesday’s CPI will most certainly have a say in how things play out.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Triple Play Report — 5/9/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with above-expectations results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features seven stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

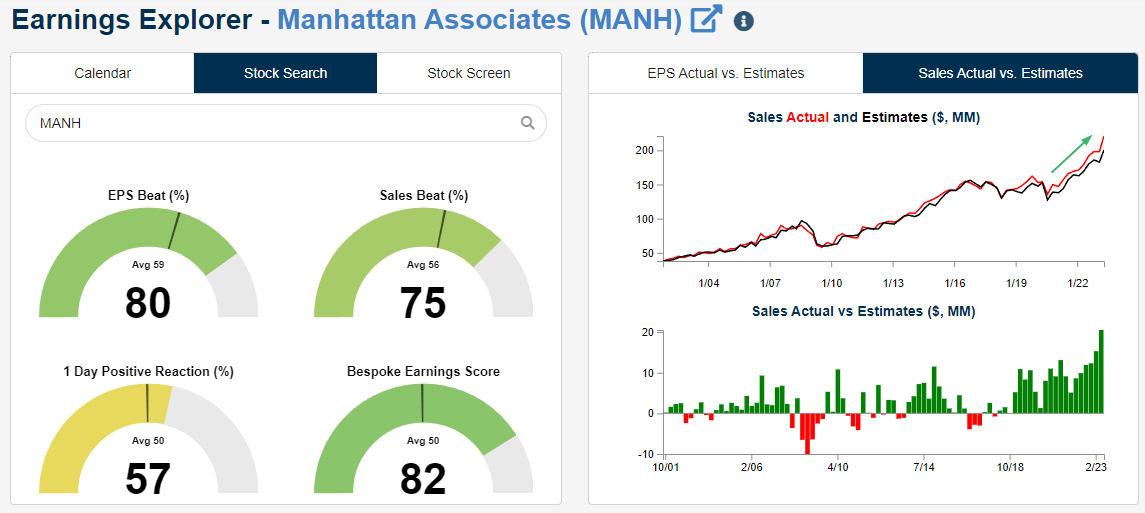

One of the sixteen triple plays featured in our newest report is Manhattan Associates (MANH). MANH has definitely been one of the most consistent reporter of triple plays over the last few years, and its share price is now just 8% below its late 2021 all-time highs after rallying just over 50% from its lows last November.

Manhattan Associates provides software solutions and services to help businesses optimize their supply chain, inventory, and omnichannel operations. Their products include tools for warehouse management, transportation management, order management, and customer engagement, among others. This name has tailwinds as both an infrastructure and an “automation” play. As shown below in the snapshot for MANH in our Earnings Explorer, revenues have re-accelerated to new highs in the last couple of years, even through last year’s bear market for stocks.

In terms of triple plays, MANH has now reported five in a row and 11 in its last 17 earnings reports, with EPS and revenue beats 17 quarters in a row as well.

For a full analysis of all 16 Tech-sector triple plays featured in this report, simply sign up for a Bespoke Institutional trial today and then read on!

Bespoke Investment Group, LLC believes all information contained in these reports to be accurate, but we do not guarantee its accuracy. None of the information in these reports or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

The Closer – Berkshire Holdings, Loan Officer Outlook, Consumer Expectations – 5/8/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the latest earnings including those of a couple of Berkshire Hathaway (BRK/B) holdings (pages 1 and 2). We then dive into the weakness in wholesale trade sales data (page 3) before flipping over to the latest SLOOS data (pages 4 and 5).We then review the latest Consumer Expectations survey from the New York Fed (pages 6 and 7). We close out with a rundown of this week’s Treasury auctions (page 8) last week’s positioning data (pages 9 – 11).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!