Daily Sector Snapshot — 5/19/23

Stocks and Bonds Part Ways

Ever since the Federal Reserve started talking about hiking rates at the start of 2022, stocks and bonds have been joined at the hip. Using the iShares 20+ Year Treasury ETF (TLT) as a proxy for the bond market, the correlation between its closing prices and the S&P 500 (using SPY) has been +0.79, implying a very strong correlation. Visually, it’s also easy to see the relationship as the two sold off throughout most of 2022 and then bottomed out early in the fourth quarter. From those lows through early April, the positive correlation between the two continued, but ever since then, the paths of the two ETFs have diverged. Since April 6th, TLT is down 6.8% while the S&P 500 is up 2.7%. As the sell-off in Treasuries has picked up steam in recent days, market watchers have been expecting stocks to start following suit. Bulls, on the other hand, are hoping that this is the start of an amicable separation between the two.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 5/19/23 – Big is Better

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Think big and don’t listen to people who tell you it can’t be done. Life’s too short to think small.” – Tim Ferriss

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Following the Nasdaq 100’s rally to a 52-week high yesterday, investors are in the buying mood once again this morning as futures are modestly higher across the board, and that follows another new high in Japanese stocks which are trading at the highest level since 1990 while Germany’s DAX is at all-time highs. There are no economic reports on the calendar this morning, so the only potential catalysts for the market this morning are various Fed speakers sprinkled throughout the morning with Powell capping things off at 11 AM when he is scheduled to participate on a panel with former Fed Chair Ben Bernanke.

In the fixed income space this morning, Treasury yields are just modestly higher while cyclical commodities like crude oil and copper are both up over 1%. Gold is also higher but only fractionally so.

With earnings season mostly behind us, we wanted to expand on a chart we showed earlier in the month summarizing the one-day performance of mega-cap stocks in reaction to their earnings reports. In the original chart, we looked only at the seven stocks in the S&P 500 with a weighting of more than 1.5% in the index. This morning we expanded the chart to the 20 largest in the index. As shown, 65% of the stocks shown rallied in reaction to their earnings reports, and the average one-day return of the 20 stocks was 2.0% compared to an average return of just 0.37% for all stocks reporting earnings since the end of Q1.

There’s been more than a lot of discussion surrounding the outperformance of mega-cap stocks this year and whether it’s deserved or not. However, when the largest stocks in the index are reporting results that result in a market reaction that’s more than five times larger than the average of all stocks, maybe that outperformance is warranted.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: 52-Week High for QQQ

The Closer – Fedspeak Keeps Coming, FAANG+ Flies, 5 Fed Fumbles, Home Sales – 5/18/23

Log-in here if you’re a member with access to the Closer.

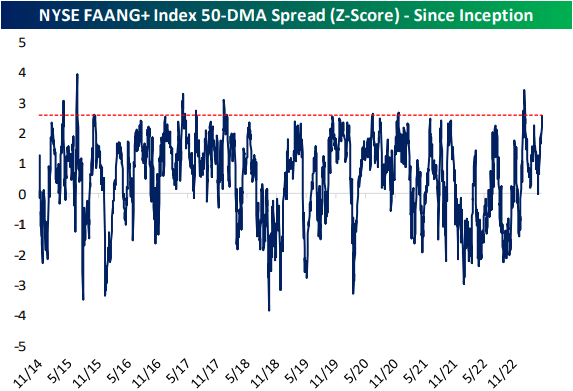

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a recap of the next dose of Fedspeak followed by a look into the surge in mega caps proxied by the NYSE FAANG+ index (page 1 and 2). We then recap the latest data on existing home sales (page 3), regional Fed manufacturing indices (pages 4 and 5), and leading indicators (page 6). We finish with a review of today’s 10 year TIPS sale (page 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Weekly Sector Snapshot — 5/18/23

Nasdaq Outperforms The DJIA By a Bull Market

Every day it seems the gap just keeps getting wider, and today the YTD performance spread between the Nasdaq and the DJIA widened out to over 20 percentage points – or the equivalent of the traditional threshold for a bull market. As of Thursday afternoon, the Nasdaq was up 20.4% YTD while the DJIA was barely hanging above the unchanged line with a gain of 0.3%. Since the Nasdaq launched in early 1972, there have only been three other years where the index outperformed the DJIA by more than 15 percentage points YTD through 5/18, but 2023 is on pace to go down as the only year where the performance gap exceeded 20 percentage points.

The question going forward is, will the Nasdaq continue its outperformance for the remainder of the year, or will the DJIA step up and play catch up? There have only been three other years where the Nasdaq even outperformed by 15 percentage points at this point in the year, but below we have provided a snapshot of both indices during those three years. For each set of charts, we show the performance of each index in the top charts where the gray shading shows the period from the start of the year through 5/18. Underneath each of those charts, we also show the relative strength of the Nasdaq versus the DJIA where a rising line indicates outperformance on the part of the Nasdaq and vice versa.

Of the three years shown, the Nasdaq continued to outperform the DJIA by a wide margin for the remainder of the year in two of them (1991 and 2020). In 1983, on the other hand, the Nasdaq actually declined 8.2% for the remainder of the year giving up all of its prior outperformance as the DJIA rallied 4.6%.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

The Bespoke 50 Growth Stocks — 5/18/23

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were ten changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

To see all 50 stocks that currently make up the Bespoke 50, simply start a two-week trial to Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Morning Lineup – 5/18/23 – A Facebook Anniversary

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

““This was not our finest hour, we’re not happy with our performance.” – Robert Greifeld, Nasdaq CEO May 2012

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In addition to Walmart (WMT) earnings, which were released earlier this morning, we have a busy day of economic data. Jobless claims and the Philly Fed were just released, and at 10 AM we’ll get the release of Existing Home Sales and Leading Indicators. Existing Home Sales are expected to decline from 4.4 million down to 4.3 million, and Leading Indicators are also expected to decline 0.6 points continuing what has been a miserable stretch for that series.

Jobless claims were modestly lower than expected on both an initial and continuing basis, and the Philly Fed report was less bad than forecast, coming in at -10.4 versus forecasts for a reading of -20.0 and last month’s very weak reading of -31.3. In reaction to the reports, futures have sold off modestly, and are currently pointing to a flat open.

Eleven years ago today, officials from the Nasdaq, as well as reporters from every business network and many other mainstream news outlets, flew to Menlo Park for the “remote” IPO of Facebook. The company raised $16 billion in what was the largest technology offering of all time. In the 11 years since its launch, Facebook (FB) – now Meta Platforms (META) – has rallied 538% for an annualized gain of 18.3%. Over that same period, the S&P 500 gained ‘just’ 290% which works out to an annualized gain of 13.2%. Based simply on the performance of the stock relative to the S&P 500, the Facebook IPO was a huge thumbs up.

It hasn’t been a smooth ride for the company, though – both in and out of the market. Right from the start of the company’s life as a public company, Facebook has had more than its fair share of drama. On the day of the IPO, trading was delayed by over a half hour due to a technical glitch, and while the stock initially rallied, it quickly sold off and struggled to hold its IPO price by the close of trading. Without underwriter support, the stock wouldn’t have held its IPO price on its first day of trading which is considered a cardinal sin for underwriters. From there, it only got worse as the stock traded steadily lower. In the first three months of trading after the IPO date, FB traded lower on over 60% of trading days for a total decline of over 60% from the intraday IPO day high. Facebook was quickly looking like the Titanic of IPOs.

Obviously, we all know with hindsight that Facebook recovered from that rocky start, and while that 61% peak-to-trough decline was extreme, it wasn’t even the largest drawdown in the stock’s history. As shown below, the most recent decline of over 75% from the 2021 high blows that initial decline out of the water. Even now with the stock up over 175% from its low last November, META is still down 37% from its all-time high, which would still rank as one of the larger drawdowns in the stock’s history.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Nothing Happening Without Mega Caps, Residential Construction, EIA – 5/17/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at where the S&P 500 would be this year without the mega caps (page 1) followed by a dive into today’s residential construction numbers (pages 2 – 4). We finish with a recap of today’s EIA data (page 5) and 20 year bond auction (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!