Chart of the Day – More Participation Trophies Ahead?

Bespoke’s Morning Lineup – 5/24/23 – European Hangover

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency.” – John Maynard Keynes

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

You may be looking at the drop in futures and think that there has been some bad news regarding the debt ceiling. Since there has been no breakthrough agreement on that front, the lack of progress is probably playing a partial role, but the real culprit appears to be the hotter-than-expected inflation reading in the UK. That report has both the FTSE 100 and Europe’s STOXX 600 down sharply and trading below their 50-day moving averages.

Here in the US, investors will continue to watch DC for signs of where negotiations over the debt ceiling are going, but other than the Fed Minutes at 2 PM, there are no significant economic data releases on the calendar, so given that European stocks have been leading things lower, it will be hard for bulls to make any headway while those markets remain open for trading.

Getting back to the UK inflation report, economists were forecasting headline inflation to rise 8.2% which would have been a nearly two-percentage point decline relative to March’s reading of 10.1%. The actual reading, however, came in 0.5 percentage points higher at 8.7%. Outside of the last year when every other reading was higher than April’s, it was the highest y/y reading since May 1982 and came up just shy of falling below the peak of 8.4% from June 1991. If there could ever be a way during a period when high inflation was the market’s major concern that a 52-week low reading in inflation would not be considered a good thing, this was it.

Regarding the UK, we wanted to look at how UK stocks have performed relative to the US over the long term. Even though it’s spring, the first thing that comes to mind is skiing. The chart below shows the relative strength of the MSCI United Kingdom ETF (EWU) versus the S&P 500 SPDR ETF (SPY) over the last ten years. For much of this period, it has been a straight downhill for UK stocks relative to the US. Over the last two years, though, the slope has flattened out, and the two ETFs have essentially performed in line with each other (lower chart). While bulls on international stocks may be hoping the last two years have been the early stages of a base to rally from, more inflation prints like today’s could signal more downhill ahead.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Fixed Income Weekly: 5/24/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit each week. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

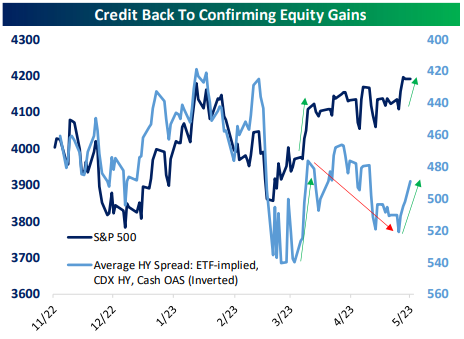

In this week’s report, we discuss the performance of credit in a cross-asset context.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

The Closer – Technicals Turn, Strong Demand for 2s, New Home Sales Not Started – 5/23/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin tonight with the technical developments in the wake of today’s declines (page 1) followed by a look at the very strong demand for two year notes at auction (page 2). We then recap today’s new home sales data (pages 3 and 4) and how home affordability has shifted (page 5). We then take a look at the latest PMI data (page 6) and update our Five Fed Manufacturing Composite (page 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 5/23/23

Bespoke Stock Scores — 5/23/23

B.I.G. Tips – Sector Technicals

Chart of the Day – An Alphabet Pattern From the Past

Bespoke’s Morning Lineup – 5/23/23 – Permission for Takeoff

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You need to get one thing done well, or else you don’t have permission to do anything else.” – Larry Page

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After a strong week, equity futures are taking a breather this morning as they await an agreement progress on the debt ceiling. Interest rates are higher once again this morning, and European stocks are lower following the release of PMI data for May. Those indices for the US will be released at 9:45, and then at 10 AM, we’ll get the releases of New Home Sales and the Richmond Fed Manufacturing reports.

How many times over the last six months have you heard someone say that Alphabet (GOOGL) missed the boat on AI to Microsoft (MSFT)? Things really got bad for GOOGL after the rushed launch of Bard, its answer to ChatGPT, earlier this year. At that point, GOOGL was underperforming MSFT by a high single-digit percentage margin since the launch of ChatGPT at the end of November, and more than a few were questioning the company’s future. At its I/O event two weeks ago, though, GOOGL had a much more impressive presentation related to how it was incorporating AI tools into its services, and the stock has come climbing back nearly erasing all its post-ChatGPT underperformance gaining 24% compared to MSFT’s 26% since the launch on 11/30/22. While Alphabet may not have originally done AI well, after the improved showing at the I/O event, the market is giving the stock, to borrow from the Page quote above, ‘permission’ to rally.

GOOGL’s recent performance hasn’t just been notable in that it has made up much of the ground that separated it from MSFT, but also, over the last ten trading days, it has rallied over 15% taking the stock to 52-week highs. While the stock remains more than 17% below its all-time highs from 2021, when a stock is trading at its highest levels in over a year, ‘missing the boat’ is not the first phrase that comes to mind.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

None of the information in this report or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

The Closer – Even More Fedspeak, Leading Group Gamble, Positioning – 5/22/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a look at today’s Fedspeak and market pricing of FOMC decisions to come (page 1). We then show the disconnect between two leading industry groups (page 2) followed by a dive into the latest housing data from Redfin (page 3). Afterward, we preview this week’s Treasury auctions (page 4) and the latest positioning data (pages 5-7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!