Trend Analyzer – 8/6/19 – What A Difference One Week Makes

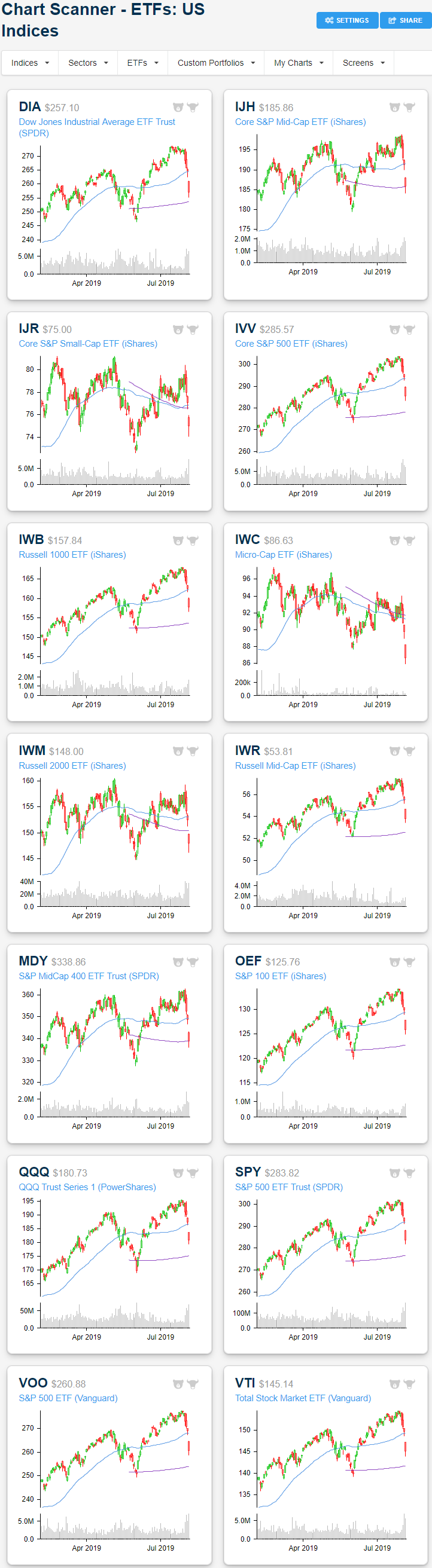

As we mentioned in a series of tweets earlier this morning, our Trend Analyzer one week ago looked a bit different than it does now. Last week, before the FOMC rate decision and the escalation of tariff tensions sent markets into a tailspin, almost all of the major US indices were overbought and had distanced themselves above their 50-DMAs. Now, in the Trend Analyzer, the reverse is true as every major index ETF has crashed through their respective 50-days, leaving ten of the fourteen oversold. Leading the way to the downside, the Micro-Cap (IWC) ETF is about as oversold as it gets as it has fallen over 3 standard deviations below the 50-DMA. With the most recent move lower, IWC is now showing a downtrend as well; the only one to show this. The four that are not oversold are just barely neutral and it would take only a little more downside for them to join the others. Ironically, one of these is the Nasdaq 100 (QQQ). While not by any significant degree, QQQ is just above oversold levels even after a 7.14% decline over the past week; the most of any major index ETF. The Nasdaq 100 has fallen more sharply than its peers as all of the others have seen declines of somewhere between 4.75% and just over 6% in that same time frame.

The past week’s steep declines have done some damage to the chart setups of these same ETFs. Across all of these ETFs, recent shorter-term uptrends have all been broken in addition to the 50-DMAs providing little to no support after yesterday’s steep gap lower at the open. For small caps like the Core S&P Small-Cap ETF (IJR) or the Micro-Cap (IWC), the 200-DMA did not provide any support either. But for mid-caps like the Core S&P Mid-Cap (IJH), buying during the day brought the ETFs off of the day’s lows and back near the 200-DMA. With equities seeing strong pre-market trading today, mid-caps could see a bounce off of this support at the open. Large caps, on the other hand, are more or less in no man’s land between the 50-DMA, 200-DMA, and prior highs and lows. While the past few days’ declines have been steep, we must also note that every major index ETF (except for IWC) is still above the lows from late May/early June. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup – Round and Round She Goes…

Where she stops nobody knows. US futures have moved all over the place overnight but are currently pointing to a modestly higher open after Monday’s plunge. Things looked like they would be a whole lot worse shortly after the close yesterday when the US Treasury officially designated China a currency manipulator in what was basically a “surprising-not surprising move.” Surprising in that the timing wasn’t entirely anticipated but not surprising as it’s nothing the President hasn’t been saying incessantly going all the way back to his days on the campaign trail. Well, the initial response from the algos was to sell spoos lower to the tune of 2%, but after the Chinese government fixed the yuan under 7 later on in the night, futures have been grinding higher, erasing all of the initial knee-jerk reaction.

With equity futures rallying, we’re seeing the usual risk-on assets rallying while treasuries and gold ease off their overnight highs. During rudderless times like this, though, it’s important to remember that up futures are as meaningless as down futures in terms of where things will be when we close out the day or even at the open for that matter.

Continue reading in today’s Morning Lineup.

The Closer – The Few, The Proud – 8/5/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, as markets were sent reeling today in response to further escalations in the trade war, we show just how few stocks moved higher in today’s session and what performance has looked like following similar weak breadth readings. We also show how substantial the weakness has been across industry groups with a particular focus on semiconductors. We then look at some of the drivers and technicals of the yuan before finishing on some macroeconomic data including the ISM and Markit PMIs and the Sentix investor sentiment survey.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Investors Turning to Safe Havens

As equities sell-off sharply, cyclical and trade-sensitive businesses, in particular, have fallen on hard times as investors rotate into defensives. While still down today, sectors like Utilities, Consumer Staples, and Real Estate have held up slightly better. In commodities, this same dynamic has played out. Copper, which is a bellwether for global manufacturing activity, has fallen sharply in response to trade tensions and concerns over global growth. Meanwhile, gold’s safety status has led it to rally. In Monday’s session, gold has been one of the few assets to rally, rising 1.84% from Friday’s close. Looking at the ratio between the two commodities over the past few years shows just how much gold has been outperforming. While it has been rising slowly over the past year, the ratio has really ripped higher in the past week. In fact, over the past week, the relative strength of gold versus copper has seen its largest short-term move since February 2016.

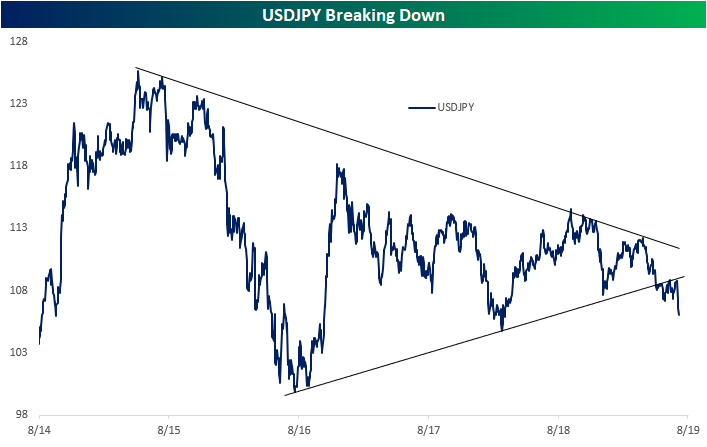

Similarly, the Japanese Yen which is commonly viewed as a safe haven currency has been surging versus the dollar. Over the past several years, USDJPY has been in consolidation. After bottoming this time of year in 2016, the cross made a series of higher lows and lower highs. Earlier this year, USDJPY failed to take out the downtrend line, continuing to move below the uptrend line. Now, over the past few sessions, the Yen has further appreciated as global trade tensions mount. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

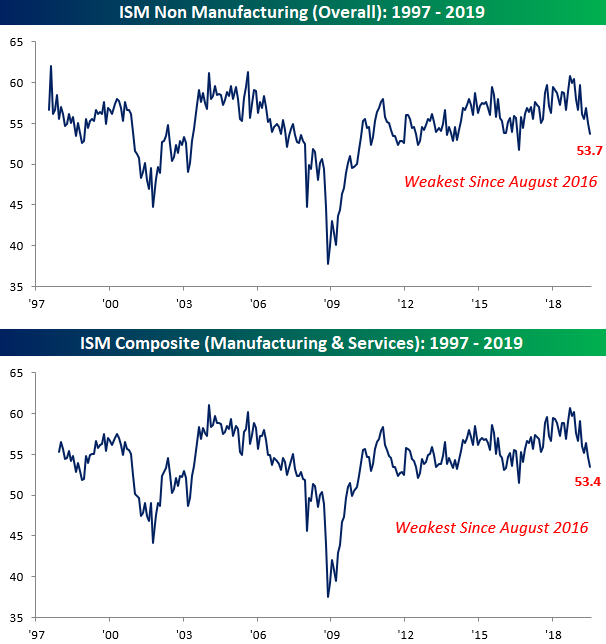

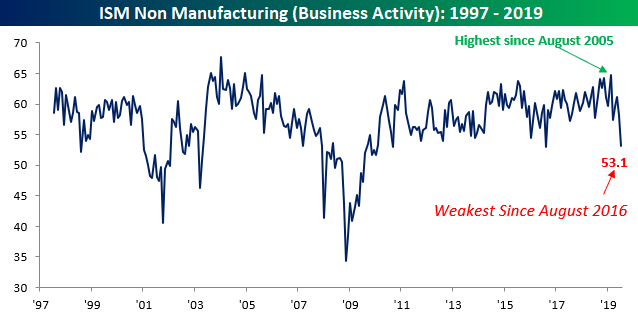

ISM Non Manufacturing Index Near a Three Year Low

Just like its manufacturing counterpart last week, the July release of the ISM Non-Manufacturing survey came in shy of consensus expectations. While economists were expecting the headline reading to increase slightly from 55.1 to 55.5, the actual reading came in at 53.7. That’s a level that is still consistent with steady growth, but it is also the weakest reading since August 2016. Similarly, on a combined basis and accounting for each sector’s share in the economy, the combined Composite PMI for July came in at 53.4, which was the lowest reading since August 2016.

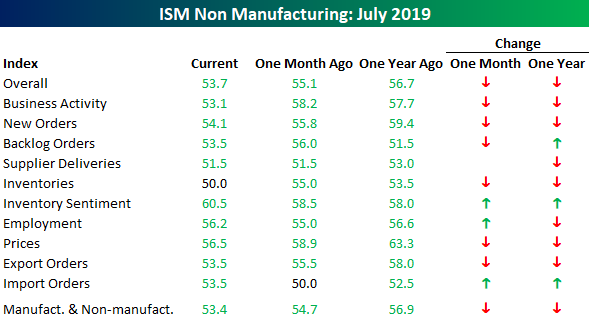

The table below breaks down the July ISM Services report by each of its sub-components and shows their m/m and y/y changes. Breadth in this month’s report was biased to the downside. Compared to June and last year, just three components showed increases.

One of the biggest decliners on both a m/m and y/y basis was Business Activity. After hitting its highest level since August 2005 back in March, the index is now at its lowest level since August 2016. Overall, the July ISM Services report wasn’t a disaster, but it certainly wasn’t a picture of strength either. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup – “…verge of a very dangerous situation.”

“…verge of a very dangerous situation.” Take your pick as to the litany of issues here at home and around the world that this statement could be referring to this morning, but in this case it was a quote from the Chief Executive of Hong Kong, Carrie Lam, describing the current state of tensions in that city following what has now become nine straight weeks of protests.

The big issue this morning, however, is the further escalation of the trade war as China responded to President Trump’s tweets from Thursday by reportedly instructing state-owned corporations to halt imports of US agricultural products, and more importantly, allowing the yuan to float above 7.

After a weak session of trading on Friday, global equities are in further liquidation as major Asian and European equity benchmarks are down close to 2% and US futures are trading down over 1%. Keep in mind too, that US stocks were down every day last week with the S&P 500 falling over 3%. Treasury yields are down sharply again this morning with the 10-year down to 1.77%, and the yield curve (10y/3m) is at new extremes in terms of inversion.

Continue reading in today’s Morning Lineup.

Bespoke Brunch Reads: 8/4/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

ETFs

Saudi stocks attract billions of dollars in inflows by Richard Henderson (FT)

Despite a relatively narrow market, MSCI’s inclusion of Saudi Arabia in its Emerging Markets Index has driven massive inflows via passive buying of Saudi stocks. [Link; paywall]

For Monster Gains With World’s Largest ETF, Trade It After Hours by Olivia Rinaldi and Vildana Hajric (Bloomberg)

Using Bespoke data, the authors highlight huge gains for after-hours outperformance for the world’s largest ETF (the S&P 500 tracker SPY). [Link; soft paywall]

Politics

Detailed Maps of the Donors Powering the 2020 Democratic Campaigns by Josh Katz, K.K. Rebecca Lai, Rachel Shorey and Thomas Kaplan (NYT)

Detailed maps that reveal the geographic strengths and weaknesses of various candidates – including the overwhelming small donor advantage of Bernie Sanders across the entire country – contesting the Democratic nomination for President. [Link; soft paywall]

Meet the people working to kick Chicago out of Illinois by Cindy Dampier (Chicago Tribune)

Despite Chicago funding huge swathes of state expenditure downstate, rural denizens of Illinois are trying to cast themselves loose of the city. [Link]

Disaster

A Natural Disaster Wipes Out Your Home. Then the Buyers Come Calling. by Konrad Putzier (WSJ)

Hurricanes, wild fires, and other catastrophes are becoming a catalyst for speculation on real estate; buyers swoop in with ready checks for homeowners who have lost everything. [Link; paywall]

The Mosquitoes Are Coming for Us by Timothy C. Winegard (NYT)

If you had to pick a cause of death for half of the humans who have ever lived, you could do worse than the mosquito, which bring malaria, yellow fever, dengue, West Nile, Zika, and more. [Link; soft paywall]

Economics

Hotels: Occupancy Rate Decreased Year-over-year, “Hotels’ rocket is losing fuel” by Bill McBride (Calculated Risk)

After years of grinding improvements in occupancy rates, revenue per available room, and prices per room, the hotel industry is starting to show its limits. [Link]

Financialisation as structural change: measuring the financial content of things by Marwil J. Dávila-Fernández and Lionello F. Punzo (Taylor & Francis)

The authors analyze the financial content (that is, value-add from financial activities) in various industries, showing a new measure of financialization and its impacts. [Link; paywall]

Opioids

The Opioid Crisis Is About More Than Corporate Greed by Zachary Siegel (The New Republic)

Headline quotes may point the finger at the pharmaceutical industry, but similar to the mortgage crisis there is no simple answer to “who is at fault” when considering the havoc wrecked by addiction to painkilling drugs. [Link]

Disabilities

A Wisconsin lawmaker who’s paralyzed isn’t allowed to call into meetings; he says that keeps him from doing his job by Patrick Marley (Milwaukee Journal Sentinel)

In Wisconsin, a state legislator has been told by other lawmakers that he cannot call in to meetings, an accommodation he requested related to the fact that he is paralyzed. [Link]

Munchies

A shocking number of delivery drivers admit doing this to your food by C. W. Headley (The Ladders)

28% of delivery drivers admit to nibbling at customers’ orders, with more than half reporting that they simply couldn’t resist the smell. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 8/2/19

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we provide our thoughts on where the market is headed following Powell’s presser and Trump’s tariffs this week. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 8/2/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

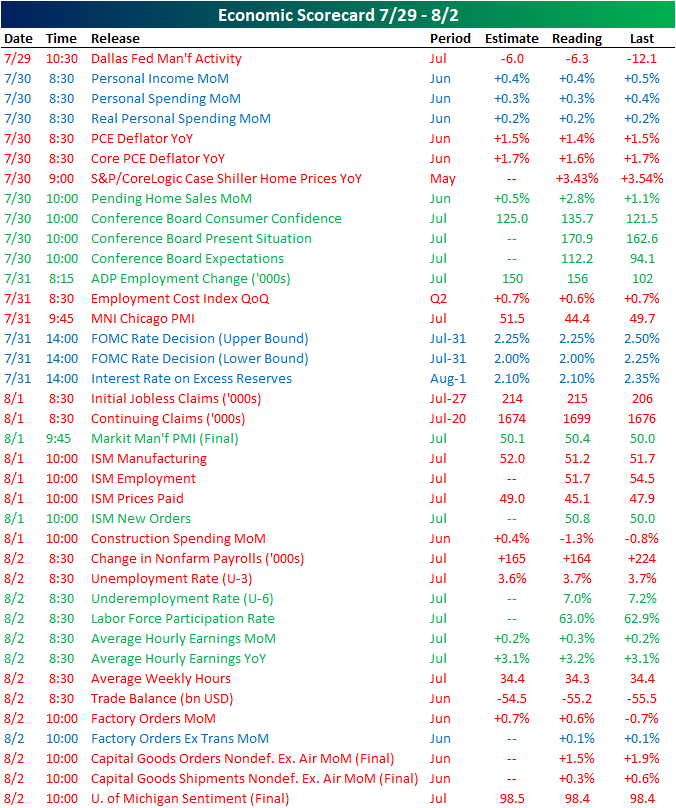

Next Week’s Economic Indicators – 8/2/19

Economic data may have taken a bit of a backseat amidst the FOMC meeting Wednesday and tariff headlines at the tail end of the week, but the US still had a heavy slate with 38 total releases.

Data was broadly weaker with almost twice as many releases coming in weaker (20) than stronger (11) relative to forecasts (or the prior release when there was no consensus forecast). The Dallas Fed kicked off the week with a weaker than expected reading on manufacturing activity, but it was an improvement from June’s level of negative 12.1. In other manufacturing data, on Thursday we got Markit and ISM PMIs which were mixed. While Markit was stronger, the headline reading of ISM was weaker; new orders did improve, however. Headline factory orders were also weaker, but excluding transportation they were unchanged. As forecasted, personal income and spending weakened while inflation came in at a slower than expected pace on Tuesday. The Conference Board’s Consumer Confidence indices were the main bright spot of the week with stronger readings across the board. Claims data continued to show a slower pace of improvement on Thursday as both initial and continuing claims came in above expectations. Meanwhile, Friday’s Nonfarm Payrolls report was the most inline with expectations since October 2012, coming in only 1K below forecasts of 165K.

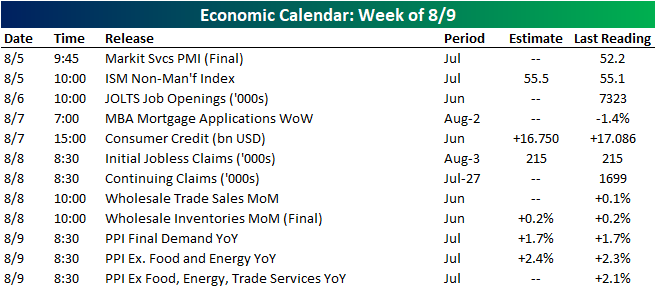

Economic data is much lighter next week. The non-manufacturing portions of ISM and Markit PMIs are due on Monday. JOLTS and consumer credit are out on Wednesday. Producer inflation gauges are set to be released Friday. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.