The Closer – Two Year Fibs, Solar Surge, Home Sales Surge, CBO Forecast, EIA – 8/21/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick things off with a look at the movement in the VIX relative to the move for equities. We also review the technicals of the 2-year yield and crude before moving onto the surge in solar stocks this year. Turning onto macroeconomic data, we look at today’s stronger than expected existing home sales and we take an in-depth look at the CBO’s economic projections. We finish with our weekly recap of EIA petroleum stockpile data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

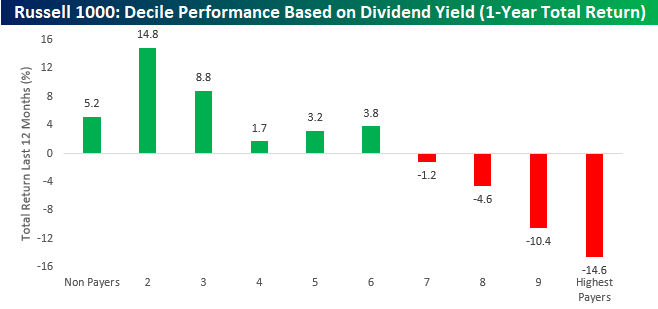

High Yielders Feeling Low

With plunging interest rates around the world continuing to mystify investors, one would think that high yielding stocks would be a primary beneficiary as investors search for alternative sources of yield. The fact is, though, that stocks with high dividend yields haven’t been very good performers over the last year. As shown in the chart below, the deciles of Russell 1000 stocks with the highest dividend yields are all down over the last year, including the deciles of the two highest yielders which are down an average of over 10%! Meanwhile, the deciles of stocks with little or no yields are all up. Start a two-week free trial to one of Bespoke’s premium equity market research services.

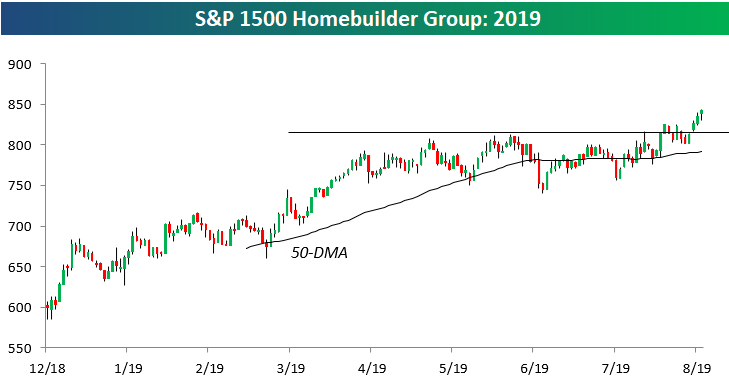

Homebuilders Still Cruising

The S&P 1500 Homebuilder group has had a great 2019 as mortgage rates have fallen over 100 bps from their highs in late 2018. As shown below, the group just recently broke out to new 2019 highs after a 3-month sideways period, and as of this morning, it was up 40% year-to-date.

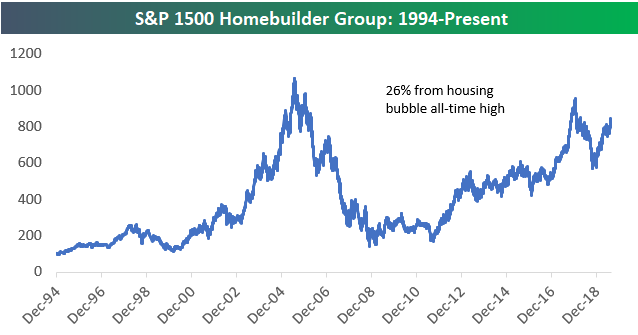

While 2019 has been a great year for homebuilders, remember that the group had a terrible 2018. As shown below, the group actually hit its peak of the current cycle in January 2018 when it actually got relatively close to its housing bubble highs from 2005. From high to low in 2018, however, the group was down 40%. That’s how you get a 40% YTD gain in 2019 without managing to re-take 2018 highs. At current levels, the homebuilders are roughly 26% from their bubble highs made in mid-2005.

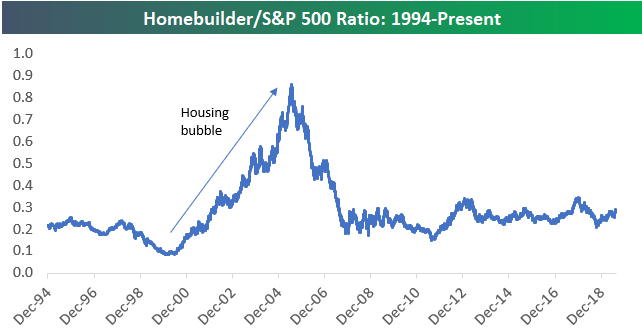

In an earlier post today, we looked at the ratio of the Nasdaq 100 to the S&P 500. While the Nasdaq has outperformed the S&P 500 by a wide margin throughout the current bull market, the homebuilders have basically traded back and forth with the S&P for the last 10 years with periods of ups and downs. From a relative strength perspective, the homebuilders are nowhere close to recovering the gains they made versus the S&P during the housing bubble. Start a two-week free trial to one of Bespoke’s premium equity market research services.

Nasdaq 100 to S&P 500 Ratio

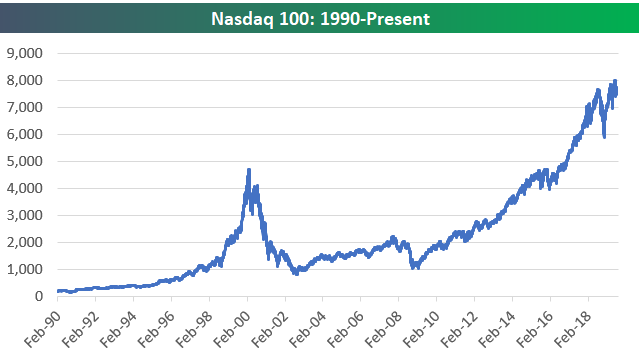

Below is a chart of the Nasdaq 100 going back to 1990. While it took 15+ years for the index to make a new all-time closing high following its March 2000 peak, the index is currently 65% above those March 2000 highs.

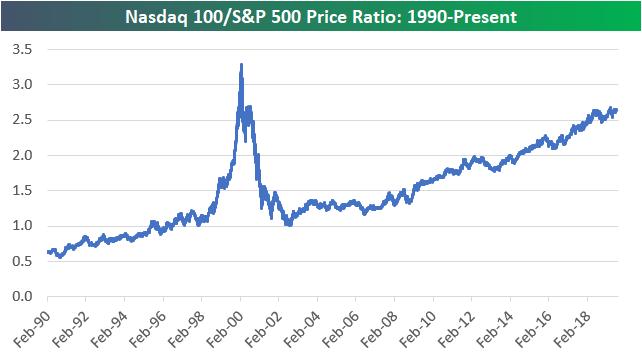

Below is a ratio chart of the Nasdaq 100’s price versus the S&P 500’s price since 1990. The ratio started well below 1 in early 1990 but quickly overtook the S&P in price by the mid-90s. As you can see, the ratio spiked dramatically above 3 during the peak of the Dot Com bubble in late 1999. The Nasdaq 100 then gave up much of that outperformance versus the S&P 500 over a 2-3 year period where the ratio got all the way back down to 1, but since then it has been steadily trending higher to its current level of 2.65. While it went through a bubble and a burst over a 5-year period, the Nasdaq has been outperforming the S&P 500 for a long time now. Start a two-week free trial to one of Bespoke’s premium equity market research services.

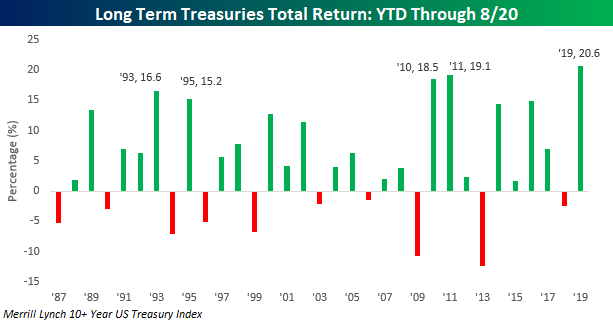

Chart of the Day: A Record Year For Long Term Bonds

August has been an exceptionally strong month for long-term US Treasuries, adding to what has already been an extremely strong year. Through yesterday, the Merrill Lynch 10+ Year Treasury Index’s YTD total return crossed 20%, making it the first year since at least 1987 that long-term US Treasuries were up over 20% YTD through 8/20. What does that kind of move in US Treasuries mean for the equity market going forward? In today’s Chart of the Day, we shed some light on this question through an analysis of equity market performance following similar intermediate and short-term moves in the past.

To view the report and see what history suggests going forward, start a two-week free trial to any of our research membership levels. You’ll be glad you did!

Fixed Income Weekly – 8/21/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we show the compression of yields on USD assets after accounting for currency hedging costs.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Middle of the Pack

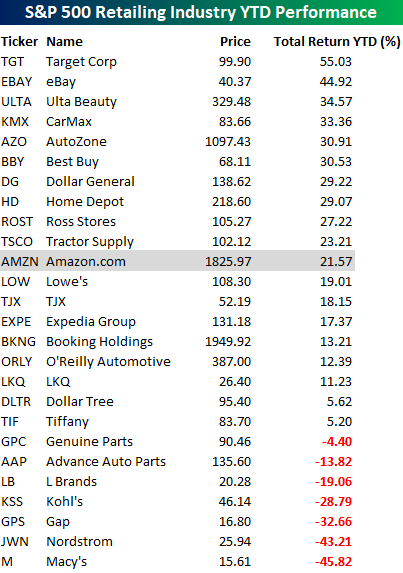

There’s a phrase usually not associated with Amazon (AMZN). While CEO, Chairman, and Founder Jeff Bezos was hob-nobbing with A-List celebrities last night at the company’s post-Prime Day concert, Amazon’s stock has been more of an ‘average Joe’ this year. With a YTD total return of 21.6%, AMZN is still modestly outperforming the S&P 500, but relative to other companies in the S&P 500 Retailing industry, its performance has been pretty much right in the middle of the pack. What’s even more surprising about performance among stocks in the S&P 500 Retailing industry is how many traditional brick and mortar retailers are outperforming AMZN this year. Target (TGT) — buoyed by strong earnings this morning — is at the top of the list and up more than double than AMZN on a year-to-date basis.

AMZN may be trailing some traditional retailers so far this year, but there have still been plenty of losers in the group. Both Macy’s (M) and Nordstrom (JWN) are down over 40%. The fact that more than 100 percentage points separate the biggest winner and loser in terms of performance this year shows just how bifurcated the sector has become. And this doesn’t even cover the horrific performance of mall REITs that provide space for brick and mortar retail. Start a two-week free trial to one of Bespoke’s premium equity market research services.

Retail Soars, Mall REITs Stumble

So far this week, second-quarter results for major US retailers have been generally positive. Yesterday saw solid results from the likes of TJX (TJX) and Home Depot (HD) and this morning Lowe’s (LOW) and Target (TGT) are looking at their largest gap up in response to earnings since at least 2001.

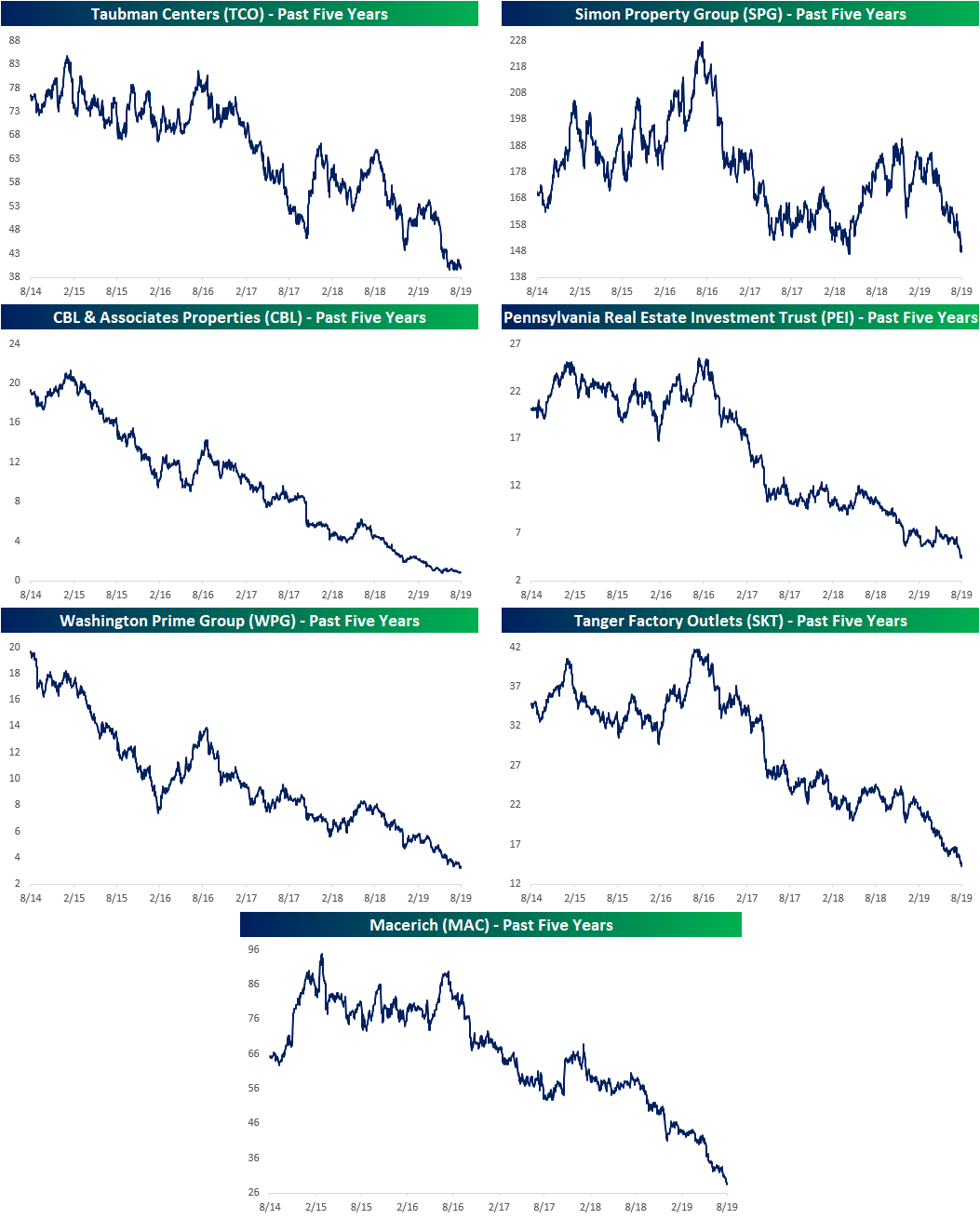

Despite this strong price action from retailers, an adjacent group, shopping center REITs, has continued to suffer. If you want to see some truly awful long-term price charts, these have you covered.

Below we show the charts of a handful of REITs with a particular focus on shopping centers. Each one is in a long-term downtrend over the past five years and is currently around the lows of this timeframe. The worst of these has been CBL & Associates (CBL) which has fallen 96% over the past five years! Meanwhile, Washington Prime (WPG) and Pennsylvania REIT (PEI) have both lost over 75% of their value. While performance is still not good, Simon Property Group (SPG) has held up relatively well compared to its peers, only declining 13.4%. The rest have fallen around 50%.

Given the stocks’ decimated price over the past few years, dividend yields of this group have become astronomical. CBL & Associates (CBL), Pennsylvania REIT (PEI), Washington Prime (WPG) and Macerich (MAC) each have double-digit dividend yields. CBL and WPG’s yields are actually now over 30%! Unfortunately, none of these yields are likely to remain high as future dividend cuts are all but certain. Start a two-week free trial to one of Bespoke’s premium equity market research services.

Bespoke’s Global Macro Dashboard — 8/21/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

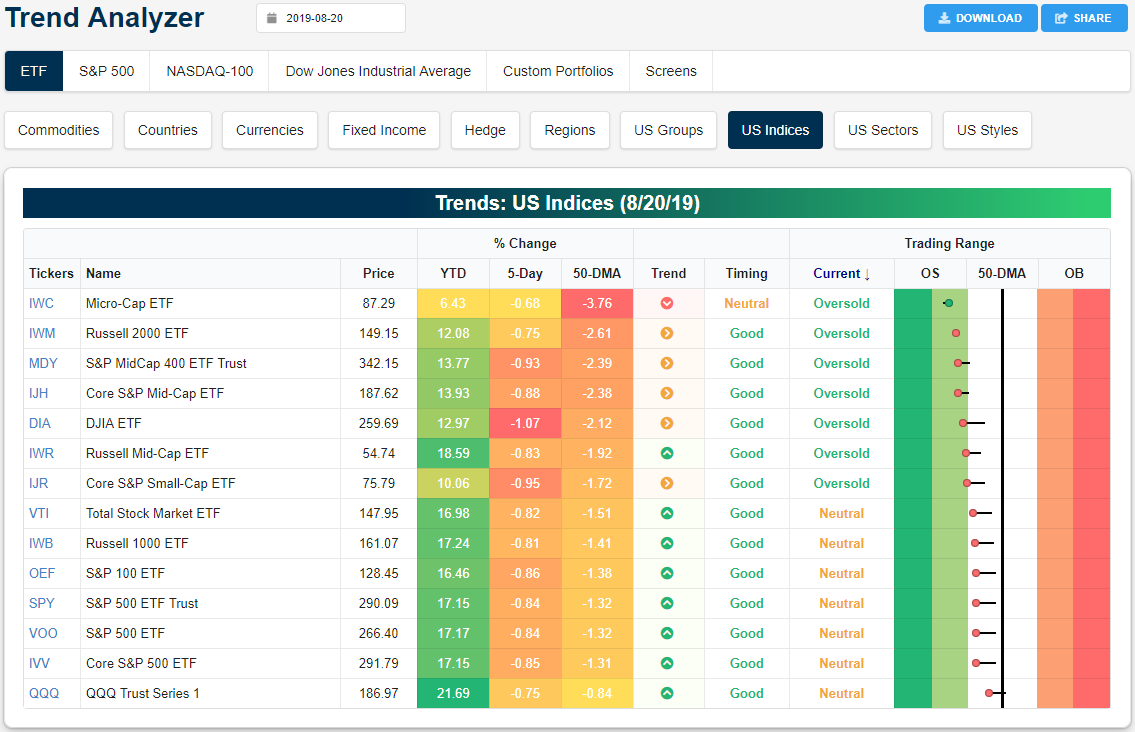

Trend Analyzer – 8/21/19 – Nasdaq (QQQ) Back Below Its 50-Day

Declines yesterday left the major US index ETFs all below their 50-day moving averages. As shown in our Trend Analyzer snapshot below, about half of them are oversold while the other half are in neutral territory. With equity futures pointed higher this morning, we’ll see if any of these ETFs can regain their 50-day moving averages by the end of the trading day.

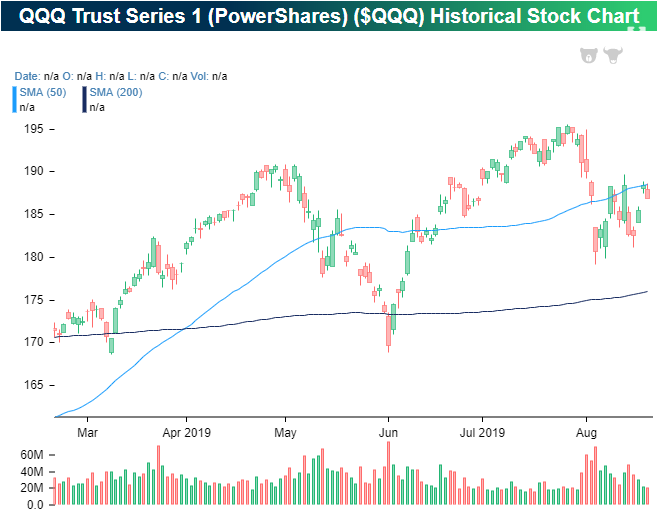

For the Nasdaq (QQQ), yesterday’s move lower marked yet another failed attempt to break and hold above its 50-DMA. Since reaching a low on August 5th, the ETF has made multiple attempts to retake the 50-DMA without any considerable push above these levels. With QQQ trading up 1% ahead of today’s open, we’ll get yet another test of the 50-day shortly. Bulls will be looking for resistance at the 50-day to finally break. Start a two-week free trial to Bespoke Institutional to access our Chart Scanner and much more.