Fund Flows Still Feeble

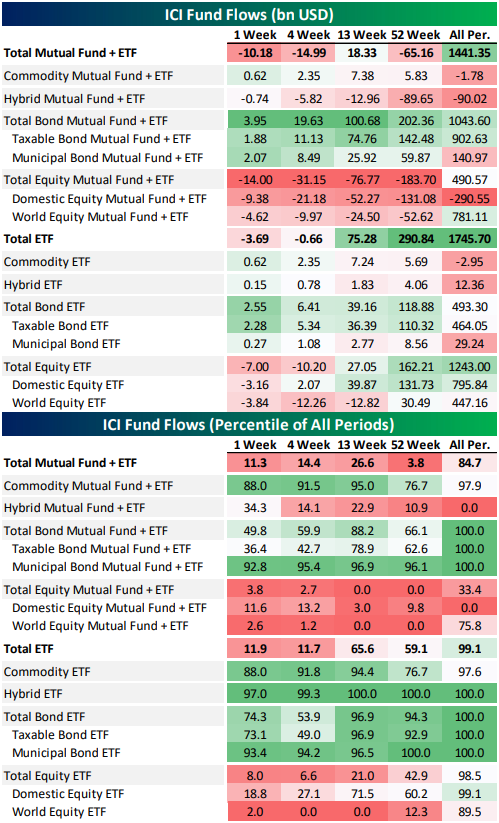

Below is an update of fund flows data from the Investment Company Institute including mutual funds and ETFs. In the tables below, we show dollar fund flows for total mutual funds plus ETFs along with ETFs alone. Obviously, mutual fund flows have been persistently negative for a long time now, but ETF flows are making up for that in many ways. The combined data only goes back to 2013, but over that period total ETF flows are in the 99th percentile for all ETFs…and that includes a string of drawdowns in domestic equity ETF flows over the last few weeks. Combined, ETF plus mutual fund flows are a better measure of total sentiment than mutual funds alone. While ETF fund inflows are only just off record highs, combined mutual fund and ETF fund flows are down across the past week, month, three months, and year for all equity funds, domestic only equity funds, and global equity funds. On the other hand, bond funds have seen the same torrid inflows that have been picked up in mutual fund flows for a long time now: since 2013, total bond inflows to ETFs are near the 97th percentile for all periods. For ETFs plus mutual funds, recent inflows are less dramatic but still very, very large; that’s especially true for the municipal bond space. We also note commodity funds have seen a pickup in net flows of late. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

To provide further context, below we show rolling 13 week fund flows for the total equity space as well as domestic funds only. While ETFs have seen material inflows, combined mutual and ETF flows are still materially negative, with total equity mutual fund plus ETF flows at a record size.

Bespoke Market Calendar — September 2019

Please click the image below to view our September 2019 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three premium research levels.

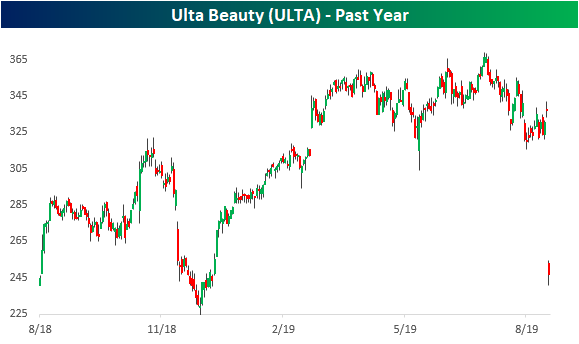

Ulta (ULTA) Ugly and Other Earnings Losers

Last week, retail had been showing some strength with solid earnings results and solid price action to match. While stocks like Target (TGT) and Lowe’s (LOW) saw record positive price reactions in response to their earnings reports, Ulta Beauty (ULTA) reported after the close last night and is seeing quite the opposite result. ULTA’s quarter left a lot to be desired. In addition to lowering guidance, the company missed EPS estimates by 4 cents while revenues were also weaker than estimates. In response to this negative “triple play” report, investors are dumping the stock. ULTA gapped down 25.1% at the open and has fallen another few percentage points lower intraday as the stock now sits down 28.7% as of this writing. This is the worst stock price reaction to earnings that ULTA has ever seen, surpassing the previous worst 21.81% gap down and 20.5% full-day decline in response to its December 5th, 2013 report. As shown below, 10 months of strength for the stock have been wiped out in one morning. It doesn’t get much more depressing than that for a shareholder.

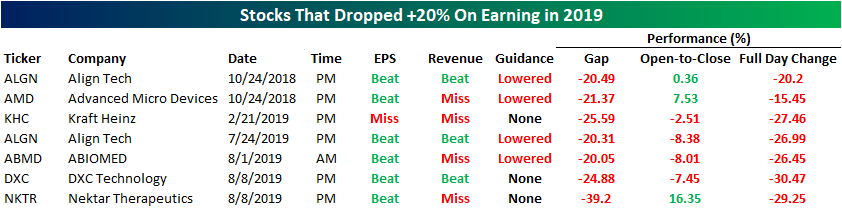

Since this time last year, other than ULTA, there have only been six other S&P 500 stocks that gapped down over 20% in response to earnings, and only two of these—Kraft Heinz (KHC) and Nektar Therapeutics (NKTR)—gapped down over 25%. Align (ALGN) is the only stock to have gapped down over 20% in two different quarters in the past year.

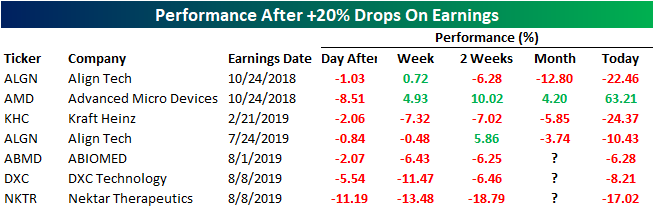

For these stocks that have experienced severe declines in reaction to earnings, forward performance has not been great. The next day after earnings, each of these stocks has fallen further with declines ranging from 0.84% all the way to -11.19%. The week, two weeks, and month after also see little respite as only Advanced Micro Devices (AMD) moved higher in each of these periods. In fact, AMD is the only stock that is higher today than it was after its large drop in response to earnings. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer and much more.

Bespoke’s Morning Lineup — Three in a Row

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Banks Bumping, GDP Revisions – 8/29/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, as banks begin to gain momentum, we take a look at forward returns following other times bank stocks have risen 1% or more in three of the past four sessions. We also show a potential technical reason for a reversal in yields. Turning to macro data, we take an in-depth look at today’s GDP release including how corporate profits are looking, how wages and salaries have played into national income, and how weak RV data from last week conflicted with today’s consumption data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Sentiment Still Leaning Bearish

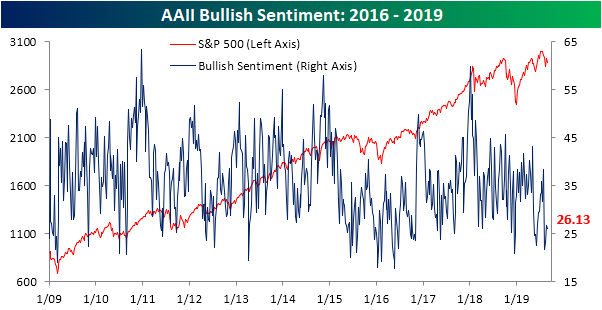

The S&P 500 is up 2.75% since last Friday, which would be the best weekly performance since early June after rebounding from consistent selling in May. Despite this, the index is still range-bound, and sentiment has yet to pick up. This week’s AAII sentiment survey saw the percentage of investors reporting as bullish fall to 26.13% from 26.64% last week. Bullish sentiment has now been more than 1 standard deviation below its historical average for four consecutive weeks. That is only the 12th such streak in the history of the data going back to 1987. The most recent similar streak was an identically long one ending on June 13th of this year.

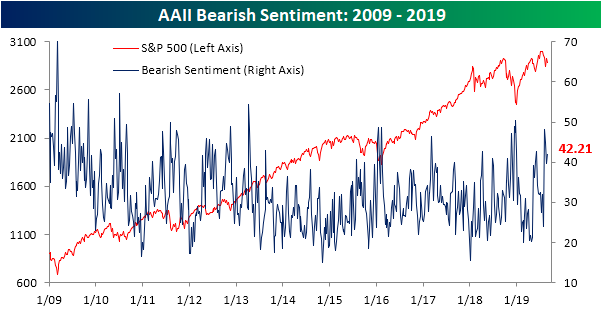

While bullish sentiment saw a fairly mild decline, bearish sentiment rose 3.5 percentage points to 42.21%. Bearish sentiment is still below where it was at the start fo the month when it peaked at 48.2%, but it also remains the predominant sentiment for four weeks running. Negative sentiment is also elevated compared to where it has been historically and has been one standard deviation above the historical average for three of the past four weeks.

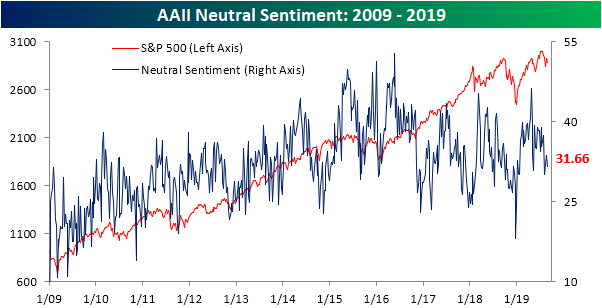

Most of the gains in bearish sentiment came out of the neutral camp. The percentage of investors reporting neutral sentiment fell around 2 percentage points to 31.66%. While this is not a new low, neutral sentiment has been trending lower over the past several weeks after spiking to its highest levels since 2016 earlier this year. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

B.I.G. Tips – Years Like 2019: August Edition

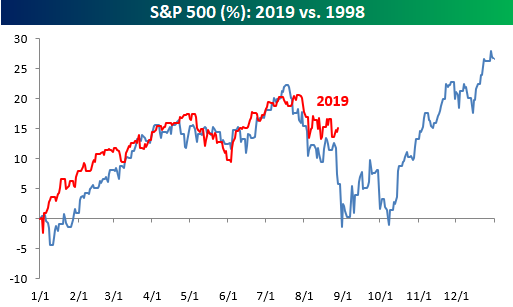

We’ve highlighted the chart below comparing 2019 to 1998 a number of times over the last several weeks, and the similarities between the performance of the S&P 500 in each year has continued right up through the end of August. While the pullback from the highs this Summer hasn’t been as severe as it was in 1998, the timing of both and the subsequent periods of backing and filling has been striking. A continuation of the similar patters certainly wouldn’t be a positive in the short term, but the silver lining is that Q4 1998 was exceptionally strong.

As we do throughout the year, in our most recent B.I.G. Tips report we compared the S&P 500’s trading pattern this year to all other years in order to see which ones were the most similar. With those similar years, we then analyzed how the S&P 500 performed for the remainder of the year in order to help come up with a framework for what to expect for the rest of this year. It shouldn’t surprise anyone that 1998 made the list, but a number of other notable years also had strong similarities to the pattern of 1998 with very different outcomes as well.

For anyone with more than a passing interest in the market’s seasonal patterns, this report is a must-read. To see it, sign up for a monthly Bespoke Premium membership now!

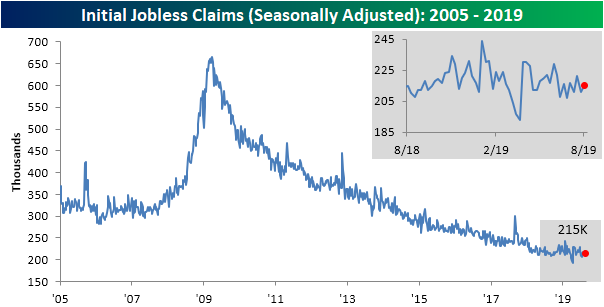

Jobless Claims Snoozefest

Initial jobless claims data were released this morning without any major new developments, largely as a result of seasonal effects. Last week saw claims come in at the lower end of their recent range at 209K. This reading was revised up to 211K and this week’s release showed another small increase to 215K, which was slightly ahead of the 214K forecast. Although claims came in weaker than expected, they remain at strong levels.

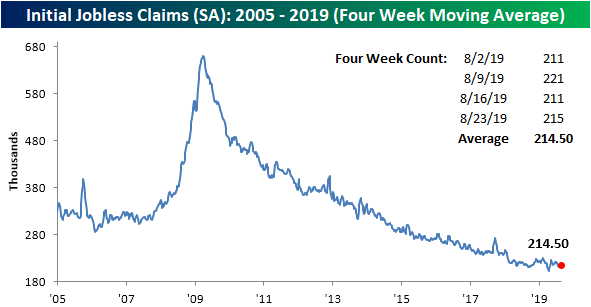

Likewise, the four-week moving average came in pretty flat once again this week only falling by 0.5K. With this modest improvement to 214.5K, through all of August, the moving average has been in a tight 2.25K range. This range is also still off of its lows set earlier this year in April.

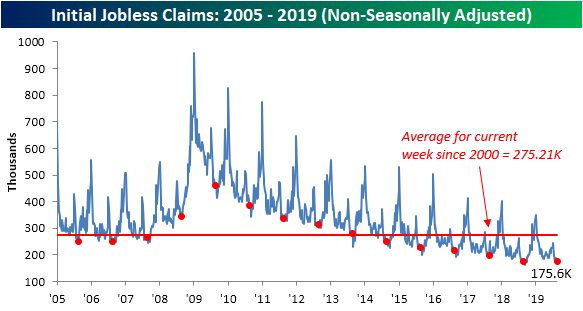

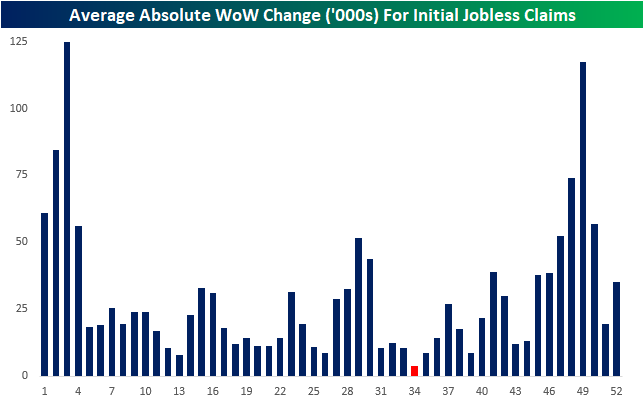

Most of the reason for the lack of movement this week in initial jobless claims data is due to seasonal effects. Looking back at the current week of the year (34th week) over the past ten years, non-seasonally adjusted claims has only seen an average week-over-week change, in absolute terms, of just 3.4K. As shown in the second chart below, that is the smallest change for any given week of the year. That also actually makes this week’s 4.2K increase to 175.6K larger than normal. But still sticking to the script of little changes as well as the broader trend of slowing improvements in labor data, this week’s NSA data was only 0.1K lower year over year. One important thing to consider with this minor improvement from last year, over the next couple of weeks, non-seasonally adjusted claims typically make their yearly low. In other words, in the coming weeks, we should be able to get a pretty good idea on how this year’s low stacks up to prior years of the cycle. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup — Bulls Step In

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Home On The Range, Mexican Macro, ETF Flow, EIA Inventory Crash – 8/28/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, as the S&P 500 remains rangebound in August, we take a look at the recently lower correlation between stocks and rates. Ahead of tomorrow’s GDP release, we also give an updated look at the Atlanta Fed’s GDPNow growth tracker. Next, we review weekly fund flow data, including data on mutual funds and ETFs. We then recap recent Mexican macro data before looking at the impressive results in this week’s EIA data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!