Bespoke Report – 2/7/25 – Five Years Ago

To read our weekly Bespoke Report newsletter and access everything else Bespoke’s research platform offers, start a two-week trial to Bespoke Premium. In this week’s report, we review price action this week, the jobs report, earnings season results so far, and look back at the five years since COVID dealt a massive shock to markets, economies, governments, and societies across the world.

Go Chiefs

As Super Bowl LIX approaches, Americans are quickly finalizing party plans for Sunday, and this year’s spread of just 1.5 points suggests that Sunday’s game could come down to the final seconds. Not only is this year’s Super Bowl expected to be close, but it will also break what is a tie in each conference’s total number of Super Bowl wins at 29 each. In the early years of the Super Bowl, the AFC dominated, but a 13-year drought from Super Bowl XIX to Super Bowl XXXI put the NFC comfortably in the lead.

After Super Bowl XXXI, the NFC had won 7 more Super Bowls than the AFC, which was its widest ever margin. Since then, there has been much more parity between the two conferences where neither has seen a wide cumulative advantage.

Now for the important stuff. Which teams winning the Super Bowl have historically had the most positive and negative impact on the market? The table below lists every team that has won a Super Bowl (20) along with how many each team won and how the S&P 500 performed for the remainder of the year after each team won. With four championships up to this point, the Chiefs are tied with the Packers and Giants for fifth overall, but if they win Sunday, they will move into a tie with the 49ers and Cowboys for third place overall. The Eagles, meanwhile, are one of five teams with just one Super Bowl championship, and if they win on Sunday, they’ll join four other teams (Colts, Ravens, Rams, and Dolphins) with two each.

In terms of market performance, in the four prior years when the Chiefs won, the S&P 500’s average performance for the remainder of the year was a gain of 12.4% with positive returns 75% of the time. Regarding the Eagles, their only win was in Super Bowl LII in February 2018. After that win, the S&P 500 fell by over 9% through year end. Unfortunately, this year’s game isn’t between the 49ers and the Steelers. Both teams have won at least five Super Bowls over the years, and the S&P 500 has traded higher for the remainder of the year after every one of their wins!

In addition to looking at market performance following which team wins the Super Bowl, we also looked at forward returns following different scenarios in the game. While the S&P 500 has rallied an average of 12.4% after the Chiefs won the Super Bowl, after their two losses, the S&P 500 rallied an average of 18.4%! Overall, though, the best scenario for a bull is a high-scoring game. As shown in the chart, in years when the loser scores at least 28 points, the winner scores at least 35, the total is at least 60, or it’s a blowout (21+ points), the S&P 500’s average rest of year gain has been at least 10%. Conversely, in those years when the total is less than 31, the winner scores less than 21, or the loser scores less than 8, the average rest-of-year performance for the S&P 500 was +5.7% or less.

It should go without saying that the score of the game or even who wins has zero impact on how the stock market will perform for the remainder of the year, but some of these online betting platforms have some even crazier bets people can make. At least these figures will give you something to talk about if the game or commercials start to get boring! Enjoy another Super Bowl Sunday!

Bespoke’s Morning Lineup – 2/7/25 – On the Mend

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If your work is so smart that only smart people get it, it’s not that smart.” – Chris Rock

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Whether it’s earnings season or the non-stop whirlwind of activity coming out of Washington, it doesn’t seem like there has been nearly as much attention being placed on this month’s employment report as other recent reports. Last month’s report was a major thud on the market as the S&P 500 declined 1.5%, but did mark a short-term low as the change in non-farm payrolls came in 91K stronger than expected.

The stronger-than-expected labor market last month raised fears among investors that the economy was too strong and would cause the Fed to ratchet back the pace of rate cuts in 2025. The ironic part about this scenario is that just four and five months earlier, weaker-than-expected employment reports in August and September spooked the market on concerns that the economy was sliding into a recession. On 8/2, the S&P 500 fell 1.8% when non-farm payrolls came in 61K below forecasts, and on 9/6, the S&P 500 fell 1.7% when payrolls were 21K weaker than expected.

Like many Americans towards the end of the year, the Health Care sector came down with a case of something around the holidays. We didn’t know if it was a cold, Covid, the flu, RSV, or whatever else was floating around, but not many of us were feeling 100%. For the Health Care sector, things were going around too – sentiment towards the insurance companies, the incoming Trump Administration, RFK being nominated as the HHS secretary, being a defensive sector during a market rally, etc. – and the result was a sharp Q4 decline. From its September high to its December low, the sector was down over 13% during a period in which the S&P 500 was up!

Since that low in December, the sector has been on the mend rallying more than 8%, and its YTD gain of just under 7% ranks as the third best-performing sector of the year behind Communication Services and Financials. A look at the chart of the Health Care sector shows that after moving above resistance levels in the last couple of weeks, the sector has been consolidating just above its 50-DMA and levels that had acted as resistance in the first half of 2024 and most recently late last year.

Bespoke’s Consumer Pulse Report — February 2025

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

The Closer – Productivity & Wages, 6 Months Since AI’s Low – 2/6/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick off with a look into the latest labor productivity numbers (page 1) followed by a rundown of the latest earnings that includes the results of Amazon (AMZN) and more (page 2). We close out with an update on the rally in AI stocks over the past six months (page 3).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

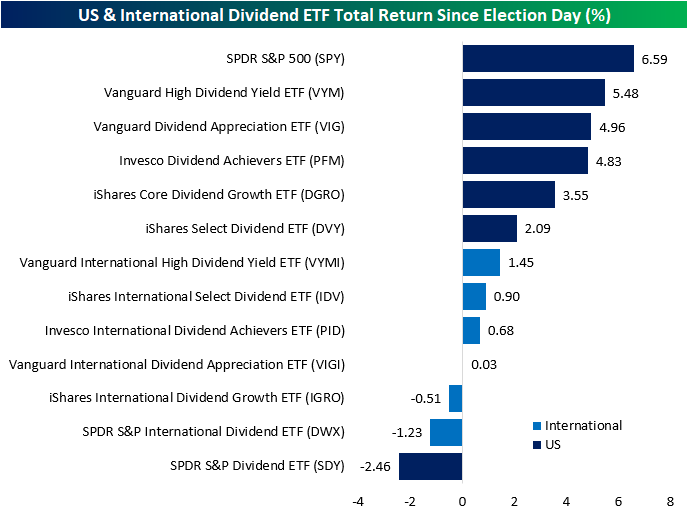

International Dividend Stocks Lag

It’s been three months since the Presidential election, and in that time the S&P 500 ( SPY) has returned a solid 6.59%. That outperformance has been driven by large cap growth, while value indices have lagged behind. US dividend-focused ETFs have likewise lagged the broad market to a degree, but they are still handily outperforming their international peers. In the chart below, we show the total return of US and International dividend ETFs from multiple families of funds. Of course, each of these ETFs have slightly different methodologies. For example, whereas the SPDR S&P Dividend ETF (SDY) is perhaps the most restrictive, only including stocks that have raised dividends for at least 20 years in a row, others like the Invesco Dividend ETFs (PID and PFM) have easier standards requiring only 5 years of dividend history while the Vanguard High Dividend ETFs (VYMI and VYM) takes the stocks with the highest forecasted yields for the 12 months ahead. Regardless of methodology, there has been a clear distinction between US and internationals save for one US ETF. The SPDR S&P Dividend ETF (SDY) is down 2.5% in the past three months, which is the worst performance of those listed.

As is the case with equities in a broader sense, the recent underperformance of international stocks relative to the US is nothing new and consistent with longer term trends. In the charts below, we show the relative strength over the past five years for US versus international dividend ETFs grouped by their issuer/methodologies. No matter which way it is chopped up, international dividend stocks have underperformed US counterparts for much of the past few years. Currently, those relative strength lines are testing 5 year lows for the likes of the Invesco ETFs and Vanguard High Yield ETFs.

Like this post? Join our complimentary Dividend Discovery email newsletter to receive a dividend-centric post in your inbox a couple of times per week. If you’re interested in dividend stocks and ETFs, this newsletter is for you! CLICK HERE to sign up with just your email or click on the image below.

Q4 2024 Earnings Conference Call Recaps: Palantir (PLTR)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Palantir’s (PLTR) Q4 2024 earnings call.

Palantir (PLTR) is a leader in big data and AI, providing advanced software platforms, including its Artificial Intelligence Platform (AIP), that enable government and commercial clients to analyze data and make critical decisions. Known for its flagship platforms Foundry, Gotham, and AIP, PLTR delivers in complex fields such as defense, national security, finance, and healthcare. PLTR’s Q4 was defined by explosive US commercial growth, with revenue up 64% YoY and total deal value hitting $1.8 billion given AI adoption. US government revenue was up 45%, fueled by expanding military AI applications like Project Maven. The Warp Speed manufacturing AI initiative is gaining traction, while international growth lags, particularly in Europe. Management emphasized the AI arms race with China, speaking to the company’s role in national security. PLTR reported its third consecutive triple play, and the stock surged another 24% on 2/4 as a result. Since the beginning of 2024, the stock has grown 525%…

Continue reading our Conference Call Recap for PLTR by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q4 2024 Earnings Conference Call Recaps: Chipotle Mexican Grill (CMG)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Chipotle’s (CMG) Q4 2024 earnings call.

Chipotle (CMG) is a fast-casual restaurant chain specializing in customizable burritos, bowls, tacos, and salads. With over 3,400 locations and a growing presence internationally, CMG has set itself apart as a go-to spot for a range of customer needs. The company is a leader in digital ordering, loyalty programs, and drive-thru formats (Chipotlanes), offering insights into consumer dining trends, digital engagement, and labor efficiency in the restaurant industry. CMG posted 13% revenue growth to $2.8 billion, with comp sales up 5.4% and 4% transaction growth despite holiday volatility. The company continues to push throughput improvements, with general manager (GM) turnover at historic lows and new kitchen equipment like produce slicers, dual-sided planchas, and AI-assisted digital-make lines. Chipotlanes now make up 25% of locations, while international expansion accelerates in Canada and the Middle East. Inflation, avocado price swings, and potential tariffs pose headwinds, but digital marketing and AI-driven personalization are expected to sustain traffic. Chipotle remains bullish on reaching 7,000+ locations and surpassing $4M in AUV long-term. On mixed results, shares fell 2.6% on 2/5…

Continue reading our Conference Call Recap for CMG by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q4 2024 Earnings Conference Call Recaps: Alphabet (GOOGL)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Alphabet’s (GOOGL) Q4 2024 earnings call.

Alphabet (GOOGL) is the parent company of Google and a leader in AI with DeepMind and its Gemini AI, cloud computing, digital advertising, and consumer technology. It dominates global search through Google Search and is a powerhouse in online video with YouTube. It serves billions worldwide, from everyday users to major corporations. Other ventures like Waymo (autonomous vehicles) and quantum computing research are also notable. For Q4, GOOGL posted revenue of $96.5 billion, up 12% YoY. AI was a major theme. Gemini 2.0 launched, AI Overviews expanded, and AI-powered search usage increased. YouTube ad revenue grew 14% to $10.5 billion, fueled by election-related spending and Shorts monetization progress. Capex is set at $75B for 2025, reflecting heavy AI and infrastructure investments, which came as a bit of a surprise as the stock fell 7.25% on 2/5. Waymo completed 4M rides and is expanding into Austin, Atlanta, and Tokyo…

Continue reading our Conference Call Recap for GOOGL by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Bespoke’s Morning Lineup – 2/6/25 – Guidance Takes a Turn

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Status quo, you know, is Latin for ‘the mess we’re in’.” – Ronald Reagan

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Given the sheer volume of earnings reports at this point in the reporting period, it’s hard to keep track of everything hitting the tape. But going through the various headlines since yesterday’s close, we’ve noticed a pickup in the number of companies lowering guidance. Since yesterday’s close, we’ve seen 22 companies lower forecasts going forward compared to just six raising guidance. It’s only one day, but we’ll watch to see if this starts becoming more of a trend. Despite the generally weaker tone from individual companies, equity futures are modestly higher on the day, although they are well off their overnight highs.

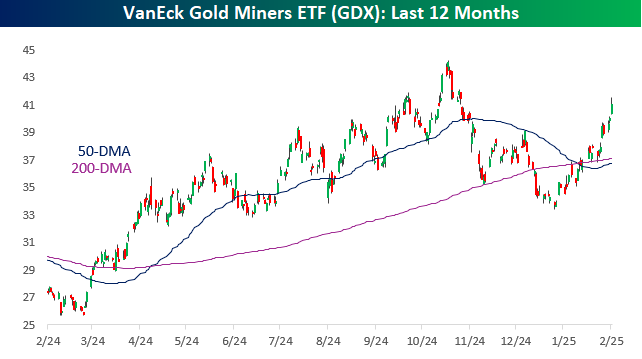

Along with equity prices, gold has also been strong. Prices are up again this morning, and if these gains hold throughout the trading day it would be the sixth straight day of record closing highs for the SPDR Gold Trust ETF (GLD) which would be tied for the longest streak of record closing highs since 2011. If you think the stock market has done well over the last year, GLD has rallied over 40%! In the shorter term, after breaking out of its three-month range in late January, GLD has traded higher every day since then.

Given the strength in the commodity, it’s no surprise that gold mining stocks have been strong, but maybe not quite as strong as you would expect. Over the last year, the VanEck Gold Miners ETF (GDX) has rallied 50%, but unlike GLD, it is still well below its 52-week high from late October, when the commodity peaked before the most recent consolidation phase. So, in some ways it has some catching up to do!

From a long-term perspective, gold mining stocks have underperformed the commodity. The chart below shows the relative strength of GDX vs GLD over the last ten years. From 2016 through 2022, gold miners were pretty consistent outperformers of the commodity, but since the middle of 2022, there’s been a shift where the commodity has started to outperform.