See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Status quo, you know, is Latin for ‘the mess we’re in’.” – Ronald Reagan

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Given the sheer volume of earnings reports at this point in the reporting period, it’s hard to keep track of everything hitting the tape. But going through the various headlines since yesterday’s close, we’ve noticed a pickup in the number of companies lowering guidance. Since yesterday’s close, we’ve seen 22 companies lower forecasts going forward compared to just six raising guidance. It’s only one day, but we’ll watch to see if this starts becoming more of a trend. Despite the generally weaker tone from individual companies, equity futures are modestly higher on the day, although they are well off their overnight highs.

Along with equity prices, gold has also been strong. Prices are up again this morning, and if these gains hold throughout the trading day it would be the sixth straight day of record closing highs for the SPDR Gold Trust ETF (GLD) which would be tied for the longest streak of record closing highs since 2011. If you think the stock market has done well over the last year, GLD has rallied over 40%! In the shorter term, after breaking out of its three-month range in late January, GLD has traded higher every day since then.

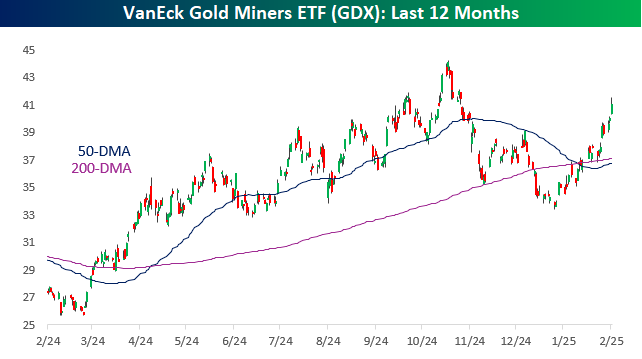

Given the strength in the commodity, it’s no surprise that gold mining stocks have been strong, but maybe not quite as strong as you would expect. Over the last year, the VanEck Gold Miners ETF (GDX) has rallied 50%, but unlike GLD, it is still well below its 52-week high from late October, when the commodity peaked before the most recent consolidation phase. So, in some ways it has some catching up to do!

From a long-term perspective, gold mining stocks have underperformed the commodity. The chart below shows the relative strength of GDX vs GLD over the last ten years. From 2016 through 2022, gold miners were pretty consistent outperformers of the commodity, but since the middle of 2022, there’s been a shift where the commodity has started to outperform.