Sentiment Back to Bearish

The consistency of declines throughout February and to start the month of March has sent sentiment decisively lower. The latest data from the American Association of Individual Investors (AAII) showed 23.4% of respondents reported as bullish, up modestly from 21.6% last week but still down significantly from 34.1% two weeks ago. With less than a quarter of respondents reporting as bullish, bullish sentiment continues to sit firmly below its historical average of 37.5% for a record 67 straight weeks.

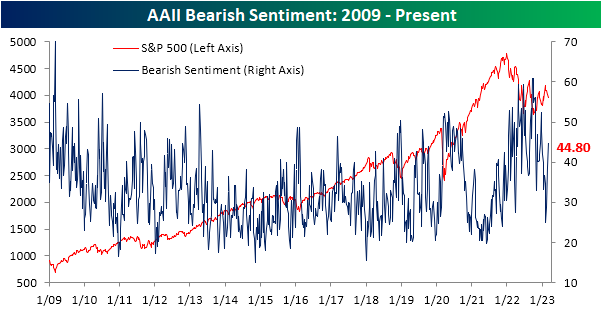

Meanwhile, bearish sentiment has continued to grind higher reaching 44.8% after three straight weeks of increases and hitting the highest level of the short year so far.

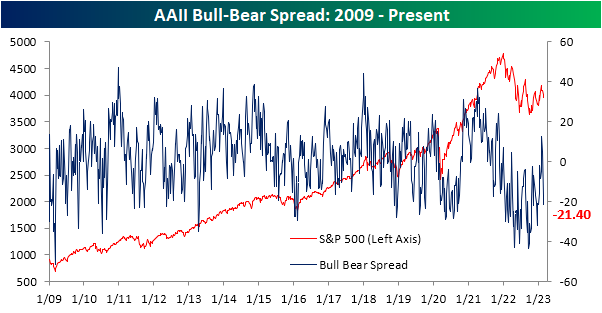

At the start of February, the bull-bear spread ended its record streak of negative readings as bulls finally outnumbered bears. The surge in pessimism in the past couple of weeks, though, has resulted in more negative bull-bear readings.

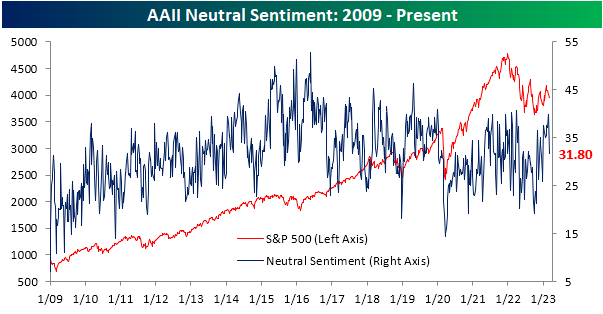

In addition to sentiment taking a more bearish tone, far fewer respondents are reporting neutral sentiment. After the highest reading in nearly a year last week, only 31.8% couldn’t make up their mind this week. That eight percentage point drop from last week was the largest weekly decline since November.

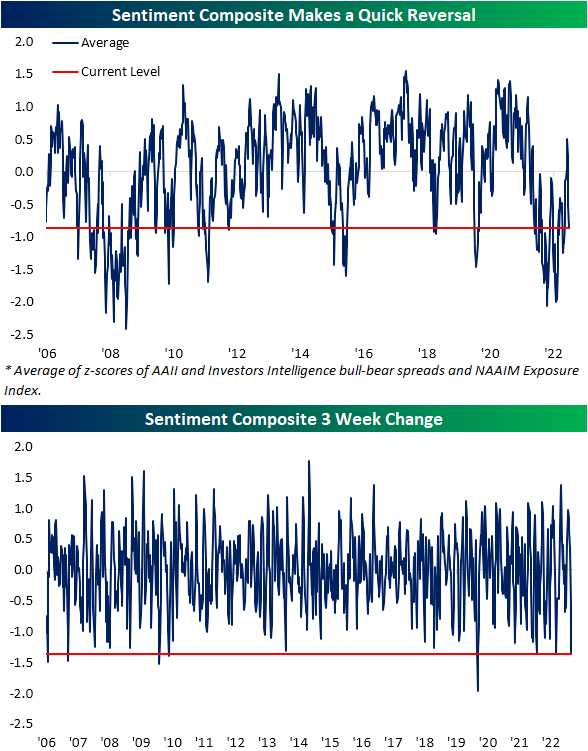

In addition to the AAII survey, other weekly sentiment readings have likewise made a quick reversal back towards negative sentiment. Combining the readings of the AAII survey with the Investors Intelligence survey and the NAAIM Exposure Index, sentiment has gone from the most cheery outlook in over a year down to pessimism right in line with the rest of the past year. In fact, the 1.36 point decline since the high three weeks ago ranks as the seventh largest decline in such a span since the composite begins in 2006.

Since sentiment is a contrarian indicator, the sharp bearish turn across these sentiment indicators ‘should’ be a signal for positive forward performance. However, that has not exactly been the case historically. In the table below, we show each prior week that the index has fallen at least 1.25 points without having done so in the prior three months. Of the dozen prior instances, performance has been mixed going forward. Click here to learn more about Bespoke’s premium stock market research service.

Home Prices Falling Fast

Updated data on home prices across the country came out earlier this week when the newest monthly S&P CoreLogic Case Shiller indices were published. This data is lagged by two months, but it gives us a look at where home prices ended the year in 2022.

Below is a table highlighting the month-over-month (m/m) and year-over-year (y/y) percentage change in home prices across the 20 cities tracked by Case Shiller. It also includes the national and composite 10-city and 20-city readings.

Home prices fell sharply from November 2022 to December 2022, with the national index down 0.81% and 11 of 20 cities down more than 1% sequentially. New York and Miami saw the smallest m/m declines with drops of less than 0.3%.

Looking at y/y price changes, while the national index still showed an increase of 5.76% from December 2021 to December 2022, two cities have now seen prices dip into the red on a y/y basis. Seattle home prices fell 1.78% for the full year 2022, while San Francisco prices fell even more at -4.19%. Given the unrelenting pullback in prices over the last six months, we’ll see more and more cities dip into the red on a y/y basis over the next few months.

Where home price trends get interesting is looking at the post-COVID action. In the aftermath of lockdowns, government stimulus, and the shift to “work from home” in many parts of the labor force, home prices across the country absolutely soared. By mid-2022, the national home price index was up 45% from the level it was at in February 2020 just before COVID hit. Areas on the West Coast and in the Southeast saw prices rise even more, with many cities seeing gains of more than 60% at their peaks.

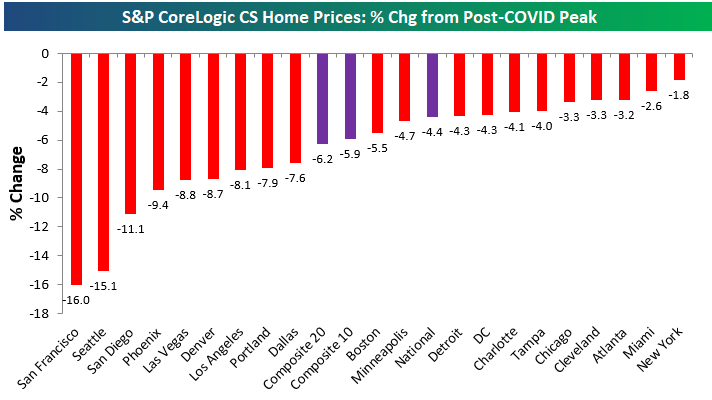

Prices finally peaked last summer, however, as rate hikes by the inflation-fighting Fed quickly pushed mortgage rates to levels not seen in decades. Below is a chart showing how much home prices have fallen from their post-COVID peaks seen in mid-2022. The composite indices are only down 4-6% from their highs, but we’ve seen prices really take a hit out west with cities like San Diego, Seattle, and San Francisco already down double-digit percentage points.

Given the pullbacks in home prices over the past six+ months, below is a look at where prices currently stand relative to their pre-COVID levels at the end of February 2020. Notably, San Francisco — which has seen prices fall the most from their highs — is currently up the least since COVID hit with a gain of 23%. Other cities where home prices are up less post-COVID than the national indices include Minneapolis, DC, Chicago, and Portland. Where home prices are still up the most is in Florida as prices in Tampa and Miami are still up 60% or more. Click here to learn more about Bespoke’s daily premium service.

Another Week Below 200K For Claims

Initial jobless claims continue to impress with this week’s reading being the seventh week in a row of sub-200K prints. Falling another 2K week over week to 190K, adjusted claims are now at the lowest level since the last week of January.

While the seasonally adjusted number is low, before taking that into account claims have actually yet to drop below 200K. Claims are falling as is normal for this point of the year with the past couple of weeks historically being some of the most consistent to experience week-over-week declines on a historical basis. At current levels, claims are comparable to the equivalent week of the year from the past several years excluding 2021.

As for continuing claims, the past couple of weeks have seen the readings begin to pivot lower after rising to the highest level of the year at the start of February. Continuing claims totaled 1.655 million which is the lowest level since the week of 1/21. Albeit claims remain off their best levels of the pandemic (for both initial and continuing claims), they remain healthy headed into next week’s nonfarm payrolls release. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 3/2/23 – Leveling Off

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It is amazing how many drivers, even at the Formula One Level, think that the brakes are for slowing the car down.” – Mario Andretti

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If you’re looking at the positive Dow futures this morning, you’re getting a misleading picture of the setup heading into the trading day. That’s because a 15%+ rally in salesforce (CRM) is responsible for about 100 points of the rally. Without CRM, the Dow would also be poised to open lower. Both the S&P 500 and Nasdaq are trading lower with Tesla (TSLA) acting as a bigger drag on the Nasdaq.

Stocks have been in a bit of a rut ever since the Presidents Day weekend as the S&P 500 has declined over 3% and closed lower than its opening print on all seven trading days. In total now, we’ve seen a pullback of just over 5% since the recent peak in early February. Today, the focus of investors will be on Non-Farm Productivity, Unit Labor Costs, and jobless claims all at 8:30.

The year is only two months old, but already some of the typical seasonal trends in the economy seem to be bucking the trend. Whether it was due to the weather, seasonal adjustments, or just underlying strength, economic data surprised to the upside after a December that was mostly weaker than expected.

One area where the pattern has been the opposite of the seasonal norms at this point in the year is gasoline prices. While national average prices, as tracked by AAA, typically only see marginal gains in the month of January, this year prices surged more than 9%, which ultimately translated to higher levels of inflation. In February, though, we saw much of the increase in prices from January reverse itself, and prices finished the month down more than 4% for the largest February decline since 2006. As a result of that pullback, the national average price, which was up way more than normal YTD at the end of January, is now actually up slightly less YTD this year than in an ‘average’ year. While gas prices were an accelerant for inflation in January, they’re likely to be a damper on it in February.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke All Access

Bespoke Investment Group’s daily research for investors is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Daily Research

Our daily research is published and emailed to members every trading day of the year.

Market Outlook

Bespoke takes a “fusion” approach in its research, forming its overall view of the market using inputs from market fundamentals and the economy, market technicals and breadth, historical and seasonality trends, and investor sentiment. We keep clients informed of our market views through monthly, quarterly, and annual outlook publications in addition to our daily reports.

Stock, ETF, and Asset Allocation Ideas

Clients looking for stock, ETF, and asset allocation ideas can find them throughout Bespoke’s research product:

- Conference Call Recaps – Throughout earnings season, Bespoke publishes 2-page conference call summaries of the most important companies to report each quarter. These recaps highlight key topics and trends discussed by management on earnings calls and during the analyst Q&A.

- Bespoke Stock Scores – Our quantitative Stock Scores database covers every company in the S&P 1500 based on proprietary fundamental, technical, and sentiment measures.

- Bespoke Baskets – Each month, Bespoke provides an updated list of 15 intriguing large-cap Growth stocks and 15 large-cap Dividend Income stocks.

- The Bespoke 50 – Our Bespoke 50 is a list of 50 stocks in the Russell 3,000 with positive growth and momentum characteristics. This list began in 2012 and is updated weekly.

- Interactive Tools – Bespoke’s website contains numerous tools to help clients analyze price action, momentum, and much more across 1000s of stocks and ETFs.

Data and Charts

Along with Bespoke’s daily research, clients have access to a unique set of interactive tools for analyzing trends across financial markets.

Bespoke’s suite of research and tools keeps clients fully informed and engaged with financial markets, and it’s consumed in quick and easy fashion, which saves time in a world where every minute counts. Our research gets published on our website and emailed directly to client inboxes for those that wish to receive our reports via email.

If you would like to give Bespoke a try, sign up here for our Bespoke All Access research service and get a one-month complimentary trial. You can also reach us at 914-315-1248 if you’d like to schedule a meeting or request more samples.

Bespoke Market Calendar — March 2023

Please click the image below to view our March 2023 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/1/23 – Fresh Start

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you find yourself suddenly wearing a hot cup of coffee on the way to work, the day can only get better from there.” – Anonymous

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures were looking to start the new month off on a positive note, but that tone has shifted and the current setup is for a modest decline at the open. Following yesterday’s stronger-than-expected inflation data in France and Spain, this morning it was Germany’s turn to report hot inflation data, and that predictably, has been followed by hawkish commentary from ECB officials. In China, stronger-than-expected Manufacturing PMI data led to a 4% rally in Hong Kong’s Hang Seng, but stronger growth in China will be greeted as inflationary by the market, hence the move higher in US treasury yields. Economic data on the calendar today includes Manufacturing PMI reports from S&P and ISM as well as Construction Spending. Minneapolis Fed President Kashkari will also be speaking this morning, so you can expect the headlines from that even to be hawkish.

2023 is already 16% complete, so we can start to get a read on how trends are shaping up. Below we summarize the performance of S&P 500 sectors through the end of February. On a YTD basis, there’s been quite a bit of disparity in sector performance as four sectors are up over five percent, and two are down over 5%. Between the extremes, more than 20 percentage points separate the best-performing sector (Consumer Discretionary) which is up 12.7% from the worst-performing sector (Utilities) which is down close to 8%. Looking at where sectors finished out February relative to their trading ranges, not a single sector is overbought relative to its 50-day moving average, nearly half are below their 50-day moving averages, and four sectors are oversold. That’s not what you would expect to see in a year where the S&P 500 is up nearly 4% YTD.

While there’s a wide dispersion in sector performance after the first two months of this year, it’s a big improvement versus where the market stood at this time last year. Twelve months ago, more than 40 percentage points divided the best-performing (Energy) and the worst-performing sectors (Consumer Discretionary), six sectors were oversold, and the only sector above its 50-DMA was Energy. February wasn’t a great month for stocks, but it sure beats where things stood last year at this point.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

One of These Indices Is Not Like the Others

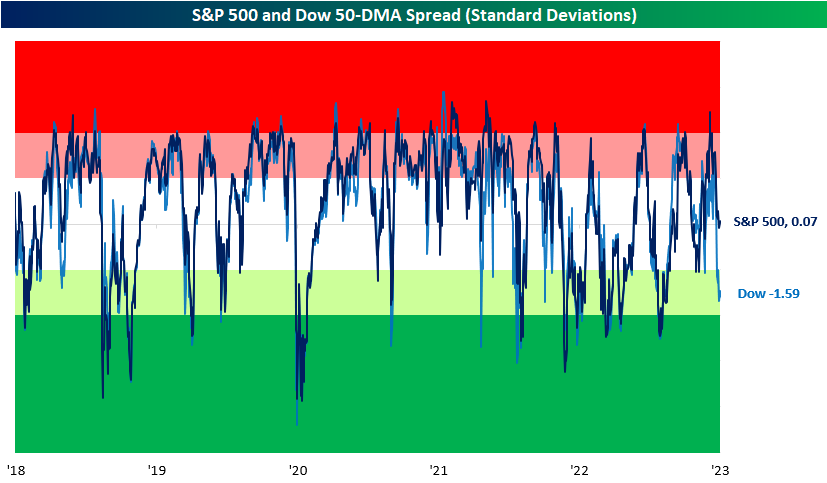

Looking across the major US index ETFs in our Trend Analyzer, one stands out (in a negative way) from all the others. At the moment, the Dow is the only major US index in the red on a year-to-date basis as we close the books on February. Even more notable, is the fact that it’s also the only one below its 50-DMA. Not only is it below its 50-day, but it is trading firmly in oversold territory sitting over 1.5 standard deviations below its 50-day. Today that dynamic of Dow underperformance continues as the index is falling another 0.3% as of this writing while the S&P 500, Nasdaq, and Russell 2,000 are all higher.

In the chart below, we show how far the S&P 500 and Dow are trading (in standard deviations) from their respective 50-DMAs over the past five years. For the most part, the two large-cap indices have tracked one another relatively well in spite of their differences in composition and price calculations. That makes the current situation in which the Dow is oversold without the same applying to the S&P 500 somewhat unusual, albeit not without precedence. While uncommon, there have been periods in which the indices have similarly distanced themselves from one another like most recently in the spring and fall of 2021.

Although there have been other times in which the Dow and S&P’s overbought/oversold readings have deviated from one another, the current example is abnormally large. With a gap of 1.66 standard deviations between the two indices’ overbought/oversold readings versus their 50-DMA spreads, today’s spread ranks in the bottom 1% of all readings since 1952 when the five-day trading week began. Additionally, such low readings have been exceptionally rare in the past 20 years. Outside of June and September of 2021, August 2015 was the last instance of the spread falling this wide with the Dow underperforming. Looking back even further, 2004 was the only other instance of the past 20 years. Click here to learn more about Bespoke’s premium stock market research service.

Tech Relative Strength Still Negative

Each day in our Sector Snapshot, we provide updated charts of the relative strength lines of each sector versus the S&P 500. Outside of a brief period last summer, Technology, the largest sector in terms of market cap, has seen its relative strength line sit in negative territory for nearly the whole of the past year. In other words, the broader market has outperformed the Tech sector almost every day for a year straight. In the chart below, we show the one-year relative strength line of Tech versus the S&P going back to 1991. After some of the most dramatic underperformance of the past couple of decades, Tech rebounded, and the sector has now only underperformed the broader market by a little less than 3% in the past year. While Tech’s relative strength is not as weak as it once was and is closing in on the first positive readings since the mid-summer, today marks the 131st trading day of consecutive negative readings. That is handily the longest streak in nearly a decade and one of only six other times a streak has eclipsed 100 trading days.

The current streak has yet to come to a close, but in the chart below, we show the performance of Tech and the S&P 500 following the conclusion of each of those prior streaks of 100 or more days. Overall, performance does hold a positive bias with positive returns a vast majority of the time. That being said, the average size of those gains is not exactly impressive. In the case of Tech, the average and median gains are smaller than the norm across these time periods. One year out is the starkest difference with an average gain of less than 5% compared to what has typically been a gain that sits in the mid-teens. Likewise, the S&P 500 tends to underperform the norm one year later, but short to medium-term performance is stronger than the norm. Six-month returns, in particular, have been impressive with a move higher every time and an average gain that is more than double that of the typical six-month performance since 1991. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 2/28/23 – “What?”

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Life, Liberty, and the Pursuit of Happy Hour.” – Hawkeye Pierce

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After yesterday’s rally that lost momentum throughout the trading day, futures are looking to start the day higher again today as positive and not as bad as feared earnings have lifted the mood in early trading. Treasury yields are modestly higher but mostly behaving while crude oil is up close to 2%. European stocks are modestly higher and well off their lows of the morning as investors shake off stronger-than-expected inflation data out of France and Spain. On the economic calendar in the US, Wholesale Inventories were just released (weaker than expected; down 0.4% versus +0.1% consensus), and later this morning we’ll get Case Shiller data, Chicago PMI, Consumer Confidence, and Richmond Fed.

40 years ago, tonight, nearly half of all Americans and three-quarters of all TVs in the United States were tuned into the same channel. Never had such a large number of Americans watched the same event at the same time. What were they watching? It wasn’t the Super Bowl. The Redskins had already beaten the Dolphins a month earlier after the strike-shortened season. No, on this Monday night, they were watching Hawkeye Pierce leave the 4077th Mobile Army Surgical Hospital for the last time on the series finale of M.A.S.H. Outside of its first season in 1972, when the show was almost canceled, M.A.S.H. was one of the top-rated shows on TV in every other season of its eleven-year run. M.A.S.H. fans watched the series finale and were sad to see it go, but subconsciously many of them were probably saying good riddance.

M.A.S.H. coincided with a dark period in the American economy, and its end can be looked back on as being symbolic of throwing some of the last vestiges of the 1970s behind us. The fact that the most popular comedy of the 1970s and early 1980s was set on a hospital base in a war zone where the plot of nearly every episode was interrupted by an incoming influx of war casualties says all you need to know about the psyche of Americans in the 1970s.

The chart below shows the performance of the S&P 500 from the first episode of M.A.S.H in September 1972 to the series finale in February 1983. Less than four months after the show first aired, the S&P 500 peaked and went on to lose nearly half of its value over the next 18 months before bottoming out and slowly reclaiming the declines of the bear market over the next several years. In fact, it took three-quarters of a decade before stocks finally made new highs again, and the real breakout of the 1980s bull market wasn’t for another two years after that in August 1982, six months before the show ended.

The performance of the S&P 500 during M.A.S.H. was bad enough in nominal terms, but when you factor in the crushing inflation of that period into the equation, performance was even weaker. After deflating the S&P 500 by headline CPI during the 1970s and early 1980s (gray line), you can see why M.A.S.H was a period of American history many were happy to forget. Is it any surprise that after a decade of high inflation, war, and general economic malaise, that as M.A.S.H. was getting ready to sign off, Americans were now turning the channel to a washed-up baseball player running a bar in Boston? Americans were ready for a drink. Cheers!

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.