Jan 18, 2017

Earlier today, we sent Bespoke Premium and Bespoke Institutional clients our list of the top stocks trading under $10 per share. To compile the list, we start with all stocks under $10/share in the Russell 3,000 and then filter it based on a number of fundamental and technical criteria. To be included on the list, the stock must also have a market cap greater than $200 million and average daily volume of more than 200,000 shares/day.

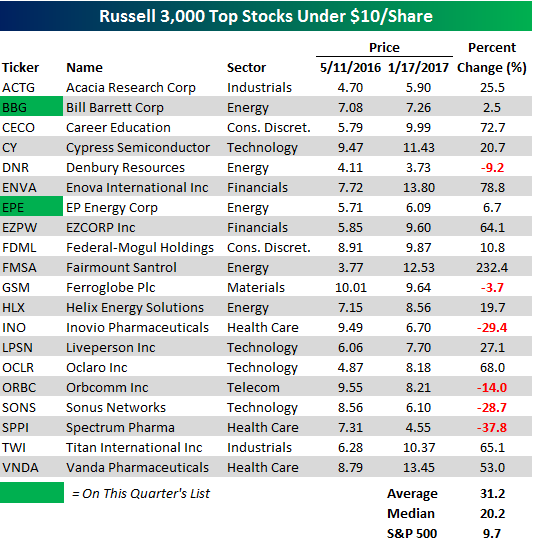

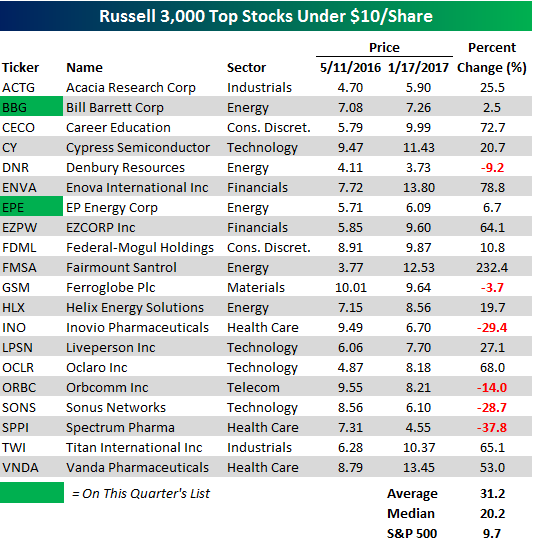

The table below lists the 20 stocks that were included in our last update to this screen back in May 2016. Of those 20 names, two remained on the most recent list (BBG and EPE) and another five ‘graduated’ to double-digit levels. Looking at the performance of the individual stocks, six traded down and fourteen traded up since the list was published. The biggest losers on the list were Spectrum Pharma (SPPI), Inovio Pharma (INO), and Sonus Networks (SONS). On the upside, the biggest winner was Fairmount Santrol (FMSA), which rallied an astounding 232.4%. In addition to that gain, five other stocks saw gains of more than 50%. Overall, the average return of the 20 names listed was a gain of 31.2%, while the median gain was 20.2%. By either measure, the performance of the stocks listed was more than double the 9.7% return of the S&P 500.

To see this year’s list of the “Top Stocks Under $10,” sign up for a monthly Bespoke Premium membership.

May 11, 2016

We’ve just published our newest list of the top mid-cap and small-cap stocks under $10. The 20 names featured have positive valuations/fundamentals as well as attractive price charts. We started with a list of all stocks under $10/share in the Russell 3,000 and then began filtering based on a number of fundamental and technical criteria. To be included on the list, the stock must also have a market cap greater than $200 million but less than $5 billion and average volume of more than 200,000 shares/day.

The list of stocks has broad sector representation, with eight of ten sectors included (there are no Consumer Staples or Utilities stocks). Five Energy stocks that have recently begun trending higher after experiencing severe downtrends are on the list, and four Technology stocks are included as well. On pages two through six of the report, we provide one-year price and volume charts for each stock, and we also provide a company description. The purpose of this list is to provide clients that may be looking for new small-cap and mid-cap opportunities with a basket of names to do additional research on. It is not meant to be a model portfolio or blanket buy list, and any allocation into any of the names should have a very minimal weighting. We also recommend using a stop loss of 10-15% below entry price for all of the names to limit downside exposure.

Sign up below to proceed to our newest list of the top stocks under $10.

See Bespoke’s “Top Stocks Under $10” by signing up for a monthly Bespoke Premium membership now. Click this link for a 14-day free trial.