Jun 4, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you don’t have time to do it right, when will you have time to do it again?” – John Wooden

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view yesterday’s CNBC interview, you can just click on the image below.

Futures were comfortably higher leading up to this morning’s ADP Employment report, but the headline number came in weaker than expected at just +37K versus forecasts for an increase of 110K. This report often varies widely from the Non-Farm Payrolls report, but for investors looking for any sign that the economy is weakening, this gives them something to latch on to. Coming up later, we’ll get the May ISM Services report, which will also likely move markets. Within minutes of the ADP release, President Trump hit the Truth Social account calling on “Too Late” Powell to cut rates.

Despite today’s post-ADP weakness, US equities just recently moved back into positive territory for the year, meaning stocks worldwide are now pretty much higher across the board. But the performance gap remains wide. While Latin American and European equities are sitting on gains of more than 20%, and most other regions of the world are up by double-digit percentages, the US finds itself in the unusual position of looking up to its global peers.

In the short term, though, US stocks have been outperforming. Over the last week, Latin America and Europe are down while the S&P 500 is up nearly 1%. Recent performance looks like it’s been a bit of a mean reversion trade, though, as all seven regional international ETFs shown are between 4% and 7% above their 50-day moving averages (DMA).

Price charts of the regional ETFs over the last six months also illustrate some of the performance disparity on both a YTD basis and over the last week. Over the longer-term, the US is the only one of the seven ETFs shown that hasn’t hit a 52-week high in the last couple of weeks, but whereas Emerging Markets (EEM), Latin America (ILF), and Europe (VGK) have been moving in more of a sideways direction over the last week or two, the S&P 500 just hit a post “Liberation Day” high yesterday.

Jun 3, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“In 1989, we were at a crossroads to see what kind of society China would have. Now it’s settled: You can get rich, but you can’t open your mouth.” – Adi Ignatius

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

US equity futures were under pressure before the sun came up on the East Coast this morning. As the sun rose, though, so too did prices, and based on where things stand now, the S&P 500 and Nasdaq are on pace to open just modestly lower. In China overnight, the manufacturing PMI for May dropped back below 50 for the first time this year, indicating ongoing weakness as the trade war weighs on the manufacturing sector. In Europe, inflation was below the ECB’s 2% target as May CPI rose at just 1.9% y/y.

In the US, the only reports on the calendar are Factory Orders (expected to fall 3.1% y.y) and JOLTS (7.1 million), and the OECD lowered its 2025 GDP growth forecast for the US down from 2.2% to 1.6. On the earnings front, the only major movers this morning are Dollar General (DG) and Signet (SIG), and both stocks are trading up over 10%. While not related to earnings, shares of Constellation Energy (CEG) are also sharply higher after announcing a multi-year deal to supply Meta (META) with nuclear power.

Today also marks the 36th anniversary of the Chinese military’s crackdown on the pro-democracy protest in Tiananmen Square. Even if it has been ‘forgotten’ by the Chinese internet, who can forget the picture of “Tank Man” defiantly standing in front of a row of Chinese tanks? As Adi Ignatius, who covered the protests for the Wall Street Journal, put it, Tiananmen Square was a crossroads in history where citizens had the opportunity to get very rich as long as they could just keep their mouths shut. Jack Ma knows this all too well.

While the government’s actions in 1989 were a big blow to democracy and saw individual freedoms get crushed, China has seen a major surge in its wealth. In 1989, per capita GDP in China was less than $311. Today, it’s $12,614, representing an increase of 3,950%. Over that same period, US per capita GDP increased by less than 260%.

Comparing per capita GDP in China to the US shows how the gap has narrowed. While US per capita GDP is still 6.5 times the level of China, in 1989, US per capita GDP was more than 70 times China’s! While China has narrowed the gap in a big way, its rate of growth relative to the US has slowed considerably in recent years. In the ten years leading up to Xi Jinping becoming President in 2013, the ratio of US to Chinese per capita GDP shrank from 30.6 to 7.6. Since Xi became President in 2013, the ratio has declined from 7.6 to 6.5.

The slowing growth of China has also been reflected in the performance of Chinese stocks. While the iShares MSCI China ETF (MCHI) has seen some big moves, both up and down over the last 10+ years, its price is essentially unchanged from where it was 14 years ago.

Jun 2, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Every strike brings me closer to the next home run.” – Babe Ruth

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Another month has come and gone, and we’re now at the two-month anniversary of the “Liberation Day” ceremony at the White House Rose Garden. The event set off a massive roller coaster in global financial markets, even though markets are little changed from a point-to-point basis. With earnings season largely behind us, economic data and the President’s Truth Social account will be the most closely watched items of the week. While the scheduled start will be at 10 AM with the release of May’s ISM Manufacturing report and the April report on Construction Spending, the timing of headlines related to trade is as predictable as a thunderstorm in the summer. You never know when one will pop up, but you know they always will.

It’s hard to believe that even as the S&P 500 was on the cusp of a bear market in early April, the index’s total return over the last 12 months has been better than average. With a total return of 13.5%, the S&P 500’s gain over the last year outpaced the long-term average by 1.5 percentage points. Over the last two and five years, annualized returns have been even stronger at 20.6% and 15.9%, respectively. Both of those returns are also well above the historical average of about 10.5% for all periods since 1928. Even over the last 10 years, the 12.9% annualized gain is still more than two full percentage points better than average. You have to go out to the 20-year window to find a timeframe where returns are below average, and even there, the 10.5% annualized gain is only slightly less than the long-term average of 10.8%.

The chart below shows how the current one, two, five, ten, and twenty-year returns stack up relative to the long-term average. While the one-year gain is only slightly above the 50th percentile, the S&P 500’s two- and five-year performance is above the 75th percentile.

May 30, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you don’t occasionally make a mistake, you’re not doing your job.” – Jim Sinegal

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

There wasn’t a lot of action going on in the markets this morning. That was up until just a few minutes ago when the President started “truthing” about China, and said “No more Mr. Nice Guy!” Futures on both the S&P 500 and Nasdaq quickly went from unchanged to down about 0.5%. European stocks were higher but have given up some of their gains, while Asian stocks fell on the on/off/now back on Trump tariffs. Like the equity market, treasuries are little changed. Crude oil is one of the bigger movers this morning with a gain of just over 1% while gold, the dollar, and crypto are all in the red.

It may be Friday, but there’s a busy batch of economic data on the calendar with Personal Income and Spending, PCE, Chicago PMI, and Michigan Sentiment.

One of the more high-profile earnings reports since yesterday’s close was Costco (COST), which reported better than expected EPS on inline sales and an 8% increase in comp sales. COST is trading marginally lower in response to the report, with the stock on pace to gap down about 0.5% at the open. What’s notable about this morning’s weakness is that it continues a trend that has been in place for the stock since the start of 2022. As shown in the table below, not including this morning, shares of COST have gapped down in reaction to 11 of its last 13 earnings reports. Another negative open today would make it 12 out of the last 14!

May 29, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No technology has ever had the opportunity to address a larger part of the world’s GDP than AI.” – Jensen Huang

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To see yesterday’s CBNC interview, click on the image below.

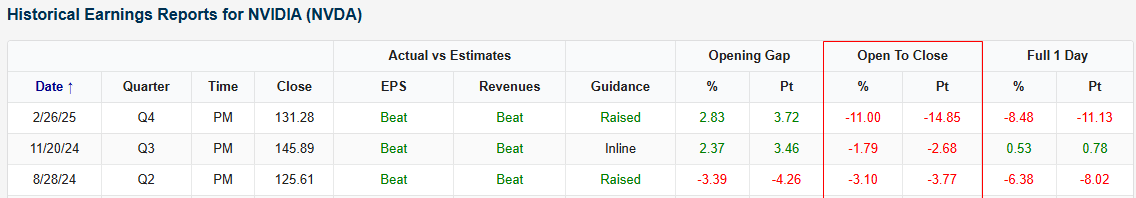

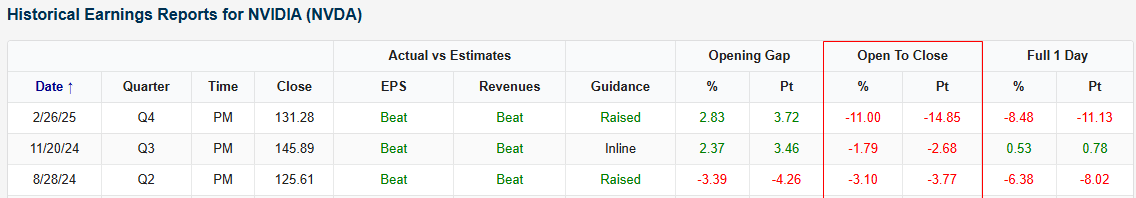

The biggest report of the earnings season has come and gone, but as Nvidia CEO Jensen Huang said on last night’s call, “This is just the beginning.” At least that’s what NVDA bulls are hoping. Based on pre-market levels, shares of NVDA are looking at an upside gap of over 5%. That would be the stock’s biggest upside gap in reaction to earnings since last May, and as we highlighted in Tuesday’s Chart of the Day, would extend its streak of positive reactions to May reports to four.

NVDA’s current pre-market levels are at the high end of the range the stock has traded in since the DeepSeek news first hit markets in late January. If NVDA can build on these gains during the trading day, it would be notable for two reasons. First, it would indicate a breakout from the post-DeepSeek range (shaded area in the chart below). More importantly, it would help to reverse a trend where the stock has repeatedly capped rallies with intraday negative reversals (see arrows in the chart below).

This trend has also been evident on the stock’s recent earnings reaction days. Following the last three earnings reports, the stock has sold off from the open to close, including in February when it sank 11% after initially gapping up nearly 3%.

May 28, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Most ways of making big money take a long time. By the time one has made the money one is too old to enjoy it.” – Ian Fleming

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Today’s the day. The second most valuable company in the world, and the most important company when it comes to AI, reports after the close, and there will be a lot of attention on what Nvidia (NVDA) has to say when the company reports. Ahead of this afternoon’s report, it’s so quiet in the futures market, you can hear a pin drop as markets digest Tuesday’s big gains to kick off the week. The only economic report on the calendar this morning is the Richmond Fed Manufacturing report at 10 AM, while the Minutes of the last FOMC meeting will hit the wires at 2 PM Eastern. While NVDA is this afternoon’s main earnings event, we’ll also get reports from HP (HPQ) and Salesforce (CRM).

Heading into this afternoon’s report from NVDA, the stock has had a wild ride. Although it’s trading right at levels it was at a year ago, the stock has been all over the place, trading from above $140 late last spring to just above $90 early last August. From there, it rallied back to new highs and above $150, but less than two months ago, it was back below $90 amid the chaos of the Liberation Day tariffs. Then, yesterday, it closed back up near $140. For a large-cap stock to see back-and-forth fluctuations of declines over 35% followed by gains of over 60% is wild enough, but when swings like this occur in what is one of the most valuable companies in the world from a market cap perspective, it’s nuts.