Earnings season kicks off this week as the first of the major companies start to report Q1 numbers. Most of the big names reporting are Financials like Blackrock (BLK) on Thursday after the close, and then Citigroup (C), JP Morgan (JPM), PNC, and Wells Fargo (WFC) on Friday morning. Besides these names, the only non-Financials of note are Bed Bath & Beyond (BBBY) on Wednesday and Delta (DAL) and Rite Aid (RAD) on Thursday.

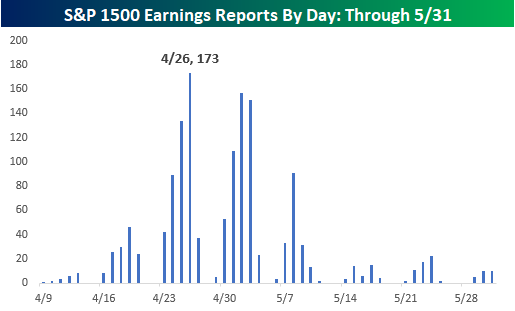

The pace of reports will pick up next week when 134 companies in the S&P 1500 are expected to report, but the peak period of earnings season will be over the following two weeks when more than 450 companies are scheduled to report each week. The busiest day during that period will be on 4/26 when 173 companies in the S&P 500 are expected to report in a single day! For a more detailed rundown of the earnings schedule for the upcoming season, please see our Interactive Earnings Calendar, and to prepare for how individual companies you follow tend to react to earnings, make sure to check out our Earnings Screener (available to all Institutional clients).

We just published our quarterly look at analyst EPS revisions heading into this earnings season. In this report, we look to see if analysts are bullish or bearish on earnings for the upcoming quarter. Analyst sentiment at the start of earnings season has historically had a big impact on the stock market’s performance.

This report is a must-read. To see it, sign up for a Bespoke Premium membership now!