Dec 23, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I put my heart and soul into my work, and I have lost my mind in the process.” – Vincent van Gogh

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s the last trading day before Christmas, but a lot of people who make their living in the financial markets are probably feeling a little like van Gogh after this year. Hopefully, they all handle it better than the artist, though, and keep all of their appendages intact. We have another busy day of economic data in-store with Personal Income, Personal Spending, Michigan Confidence, and New Home Sales among the reports on the calendar. Equity futures are firmly in positive territory, crude oil is pushing $80 per barrel, and yields are higher with the 10-year yield trading back above 3.7%.

The last week of the year is considered a positive one for equities, but how positive has it been? Not as strong as you might think. Since 1980, the S&P 500’s average gain during the last week of December has been a gain of 0.41% with positive returns 57% of the time. Surprisingly, there have only been two other years during that span where the S&P 500 was down more than 15% YTD heading into the last week of the year (this year will be the third). In those two years, performance in the final week was mixed. In 2002, the S&P 500 went on to fall another 1.4% in the last week of the year; in 2008, the S&P 500 rallied 4.0%. So, just because the market is down a lot heading into the final week doesn’t necessarily mean it will bounce back or continue falling to close out the year.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Dec 22, 2022

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out tonight with a glance at performance in the final trading days of the year (page 1). We follow up with a rundown of the latest macro data including a review of the latest GDP print (page 2), an update of our Five Fed Composite (page 3), and the big drop in leading indicators (page 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Dec 22, 2022

The past few weeks had been uneventful when it comes to the AAII’s weekly reading on investor sentiment. As we noted last week, the three-week range that bullish sentiment occupied had reached a record low hovering between 24.3% and 24.7%. In the latest release, sentiment finally moved but not in the most promising direction. Bullish sentiment dropped 4 percentage points down to 20.3% this week to make for the lowest reading since the end of September.

With a decline in neutral sentiment as well, all of the increase went to bears with that reading rising to the highest level and back above 50% for the first time since late October.

As a result of the large inverse moves of the two sentiment readings, the bull-bear spread shows a dramatic tilt towards an even more pessimistic bias with bears outnumbering bulls by 32 percentage points. That is the widest spread since the week of October 20th and lower than most of the past decade’s range.

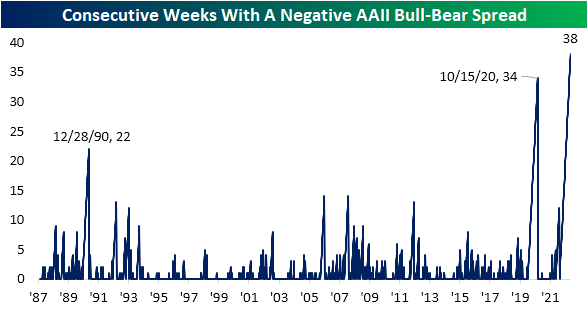

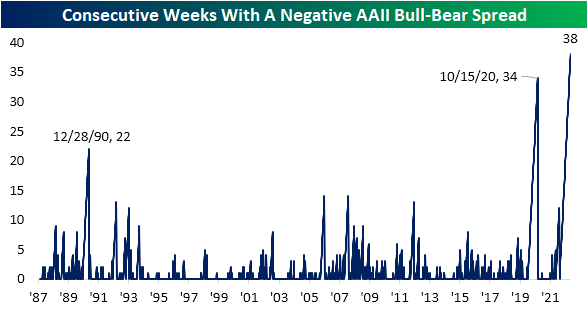

With yet another week of bears outnumbering bulls, the record streak of negative readings in the bull-bear spread has grown to 38 weeks long; a full month longer than the previous record ending in October 2020. Historically, investor sentiment has acted as a contrarian indicator meaning low readings on optimism have typically been followed by stronger returns for the S&P 500. This time around, sentiment and prices have given each other little reason to turn around.

In an earlier post, we noted how there has not even been a single week this year in which bullish sentiment has been above the historical average of 37.6%. Taking another look at just how depressed sentiment has been, the average bullish sentiment reading in 2022 has been less than 25%. The only years that had come close to such a low reading were 1988 (27.29%) and 1990 (27.08%). Playing into that low average has been the fact that there have been a record 30 weeks this year with bullish sentiment coming in below 25%. Meanwhile, bearish sentiment has averaged 46.17% this year, slightly above the previous record of 45.2% in 2008. With bearish sentiment tipping back above 50% once again this week, there have now been 17 weeks with such an elevated reading, tying the record from 2008 with one week to go. Click here to learn more about Bespoke’s premium stock market research service.