Dec 13, 2022

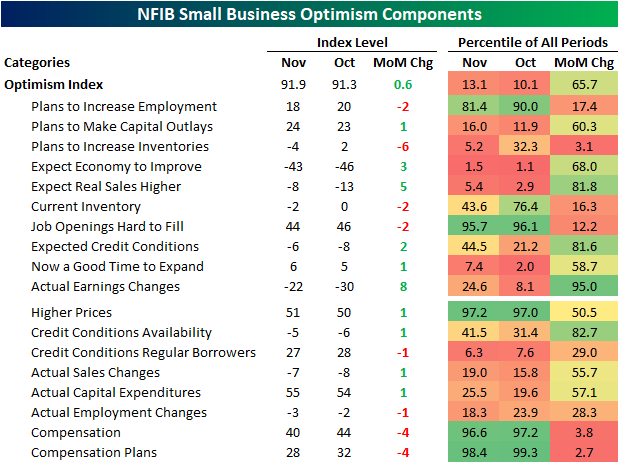

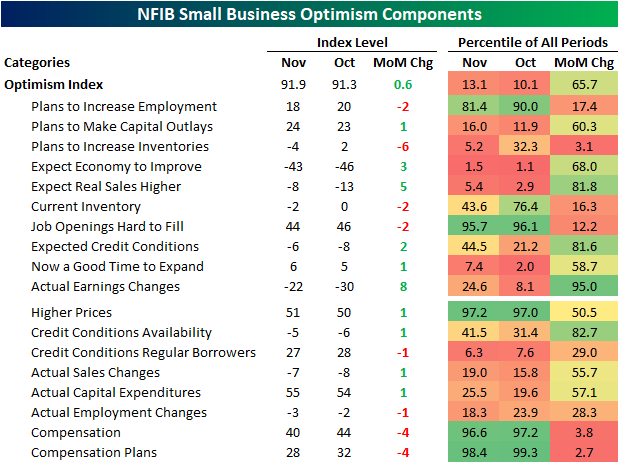

The National Federation of Independent Business (NFIB) released its November read on small business sentiment this morning with the report showing a modest uptick in optimism. The headline index rose from 91.3 to 91.9, but as shown below, that remains at historically low levels.

Across the individual categories of the survey, breadth was mixed with six of the ten inputs to the optimism index moving higher month over month. Multiple sub-indices sit in the bottom decile of their historical ranges, while a handful of others, namely those centered around employment and inflation, are more elevated.

One index that has been well below historical norms has been the outlook for general business conditions (top left chart below). That index plummeted since the fall of 2020 (likely in large part thanks to political sensitivities of this survey), and the rebound over the past few months hasn’t been enough to bring it back up to pre-pandemic record lows. Alongside that rebound, there has been only a very minor jump higher in the share of respondents reporting now as a good time to expand.

As we noted in today’s Morning Lineup, employment metrics in aggregate significantly slowed last month. Hiring plans fell 2 points down to 18; the weakest reading since February 2021. On net, there have also been more firms reporting declines than increases in employment. Given companies appear to be pulling back on hiring, the lowest share reported job openings are hard to fill since April 2021. Not only does it appear that firms are hiring less, but they are also raising compensation less. Both indices for compensation and compensation plans fell sharply in November.

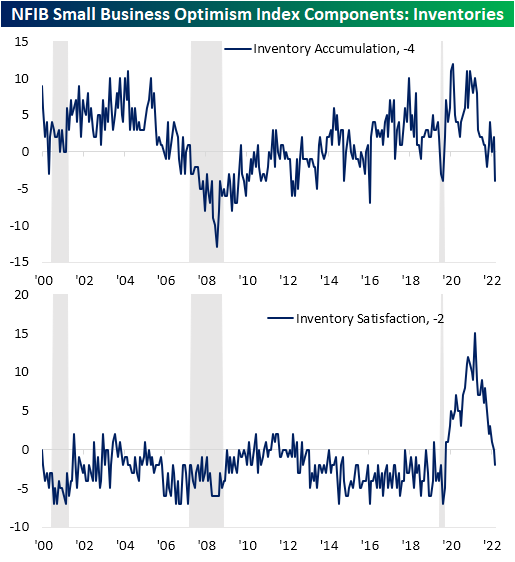

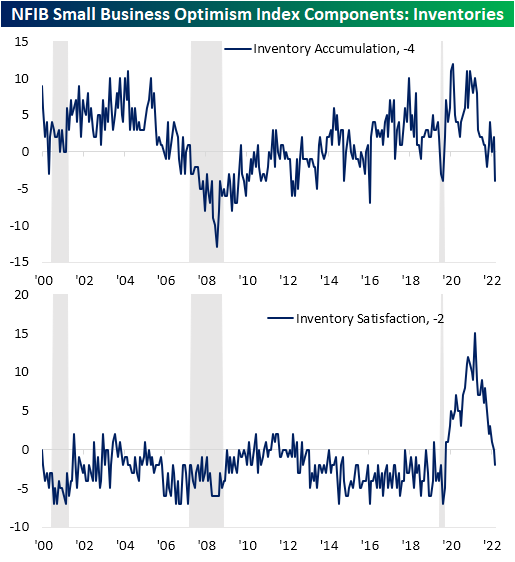

Inventories are yet another area of jarring declines last month. On net 4% more companies reported plans to decrease inventories in the next three to six months making for the lowest reading on inventory accumulation since the depths of the pandemic: April 2020. While there is the potential silver lining that the decline in the reading is a result of improvements in supply chain pressures, it is paired with obvious deterioration in demand. Given this, for the first time since the spring of 2020, a higher share of respondents are reporting their current inventory levels are too high versus too low. Click here to learn more about Bespoke’s premium stock market research service.

Dec 13, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s a proprietary strategy. I can’t go into it in great detail.” – Bernie Madoff

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

One day short of 14 years after Bernie Madoff surrendered to authorities for his Ponzi scheme, Bahamian authorities arrested Sam Bankman-Fried yesterday in connection with his massive fraud in the cryptocurrency markets. Now that he’s behind bars, we can only hope that the nonstop media tour he has been on will come to an end.

We’ve got two very important days ahead for the markets with today’s November CPI and tomorrow’s FOMC rate decision. Futures are sharply higher heading into this morning’s release after a strong day yesterday, but hopefully, the markets haven’t set the bar too high.

While there is optimism among investors that the worst of inflation is behind us, the sentiment from two sectors that stand to benefit the most from inflation – Energy and Materials – has been mixed. The charts below show the relative strength of the S&P 500 Energy (XLE) and Materials (XLB) sectors versus the S&P 500 over the last ten years (top chart) and just the last year (bottom two charts).

Starting with the long-term picture, after years of underperformance, both Energy and Materials made a trough relative to the S&P 500 in 2020. While they have both stopped the bleeding, the rebound in Energy has been much stronger than the improvement in Materials (which never underperformed as much in the first place).

Over the last year, both sectors have significantly outperformed the market. Starting with Materials, its outperformance peaked in the spring and then came crashing back down to earth in the summer. The sector started outperforming again this fall, but in recent weeks it has started to run out of steam again.

The Energy sector has seen a much steadier trend out of outperformance this year, and its relative strength actually peaked in early November. While the sector has been under pressure relative to the market for the last month now, its relative strength uptrend has remained intact.

In the case of both sectors, their relative strength in recent weeks hasn’t been nearly as strong and steady as it was in the first half of 2022, but they are also far from collapsing reflecting the fact that while inflation pressures have not been as intense as they were earlier in the year, they still haven’t gone away.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Dec 12, 2022

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out tonight with a look at the huge divergence between the moves in the VIX and stocks (page 1) followed by some commentary regarding the latest federal budget figures (page 2). Next we review the latest consumer expectations data out of the New York Fed (page 3) before recapping today’s 3 and 10 year Treasury sale (page 4). We finish with our weekly recap of positioning data (pages 5 – 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!