Brunch Reads – 7/6/25

Welcome to Bespoke Brunch Reads — a linkfest of some of our favorite articles over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Life Is Like a Box of Chocolates: When Forrest Gump opened in theaters on July 6, 1994, no one could’ve predicted that a slow-talking Alabama man with a fondness for running would end up reshaping American pop culture. The film debuted in the middle of a blockbuster summer. The Lion King had just roared into theaters a few weeks earlier, and True Lies was waiting in the wings, but Forrest Gump carved out its own space, powered by word of mouth, critical praise, and a once-in-a-generation performance by Tom Hanks.

Audiences walked in expecting a feel-good story and left trying to unpack everything they’d just seen: Vietnam, civil rights protests, Watergate, shrimp boats, ping-pong diplomacy, and a feather that somehow made it all make sense. It struck a nerve. People laughed, cried, and immediately started quoting lines that would live on to this day: “Life is like a box of chocolates,” “Run, Forrest, run,” and even “Stupid is as stupid does.”

Forrest Gump grossed over $24 million in its opening weekend and continued to play for months. It would go on to win six Oscars, including Best Picture and Best Actor for Hanks, but on that first day, it was just another title on the marquee.

AI & Technology

Microsoft Says Its New AI System Diagnosed Patients 4 Times More Accurately Than Human Doctors (WIRED)

Microsoft built an AI system that outperformed human doctors in diagnosing complex medical cases, achieving 80% accuracy compared to their 20%, while also recommending more cost-effective tests. It works by orchestrating a group of top AI models to mimic how a panel of physicians would reason through a diagnosis, step-by-step. Experts caution that real-world clinical trials will be the true test, and that doctors in the study weren’t allowed to use any digital tools, which might’ve tilted the comparison. [Link]

Continue reading our weekly Brunch Reads linkfest by logging in if you’re already a member or signing up for a trial to one of our two membership levels shown below! You can cancel at any time.

The Closer – Jobs and Wages, Claims Demographics – 7/3/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, in a recap of a busy day of economic data, we lead off with a rundown of the June payrolls report (page 1) including an update on wages (page 2). We also check in on ISM Service data and the market’s reaction to today’s releases (page 3). We close out with a look into demographic readings for jobless claims (pages 4 and 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Morning Lineup – 7/3/25 – Beating the Odds

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Governments are instituted among Men, deriving their just powers from the consent of the governed.” – Declaration of Independence

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Happy Fourth! In an outcome that most would not have predicted over the last several days and weeks, the House is likely to pass the Reconciliation Bill ahead of the July 4th holiday. Just yesterday, the odds of passage by that date were less than 50%, but the bill cleared a procedural vote overnight, and Polymarket now has the odds of passage at 91%. Whatever side of the aisle you position yourself, the ability of Speaker Johnson to pass legislation over the last six months with such a slim majority has been impressive.

That’s the biggest news event of the market day so far, but there’s a jam-packed economic calendar this morning that includes Jobless Claims, Non-Farm Payrolls, Factory Orders, and ISM Services. Besides being a busy day for data, it’s also a short session as the equity market closes at 1 PM ahead of the holiday, and the bond market closes at 2 PM.

Despite the big political news and the busy day of data ahead, futures are eerily quiet as the S&P 500, Nasdaq, and Dow are all indicated to open less than 0.10% higher. Crude oil is marginally lower, gold is unchanged, and treasury yields are lower. That last point is notable; for all the talk about how the Reconciliation Bill will be a budget buster and blow out the deficit, the 10-year yield has been going down as passage of the bill has become more likely. From a longer-term perspective, too, the 10-year yield is the same now as it was on Election Day.

Heading into the July 4th holiday, the fireworks of the second quarter have put eight of the eleven sectors into overbought territory. Over the last five sessions, every sector has traded higher, and Utilities (XLU) is the only sector ETF with a gain of less than 1%. Leading the way to the upside, Materials (XLB) have rallied over 5% pushing the sector into extreme overbought territory and a gain of nearly 9% YTD.

The Closer – Gilts, Autos, Health Care Checkup – 7/2/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin by looking at how UK Gilts are digesting the country’s fiscal concerns (page 1). We then check in on Tesla (TSLA) deliveries and collapse in shares of Centene (CNC) (page 2). We continue with a checkup on other Health Care stocks and the industry’s labor figures (page 3). We then finish with a review of brand level breakdowns of vehicle sales (page 4) and remittance data from Mexico (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

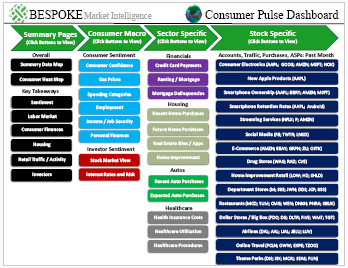

Bespoke’s Consumer Pulse Report — July 2025

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Bespoke’s Morning Lineup – 7/2/25 – The Have-Nots Get Their Chance

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Never do things others can do and will do, if there are things others cannot do or will not do.” – Amelia Earhart

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view yesterday’s CNBC interview from Closing Bell Overtime, click the image below.

US futures are little changed this morning as the S&P 500 looks to erase Tuesday’s modest losses. The major issue of the day will continue to be the Big Beautiful Bill and whether the House can pass the Senate’s version. A vote on that will be held either today or tomorrow, depending on when members can return to DC for the vote. Even when representatives return, passing the bill will be no easy task, as the slim Republican majority means Speaker Johnson can only afford a few no votes from his caucus. Betting against Johnson, however, hasn’t been a profitable strategy so far this year.

Overnight in Asia, equities were mixed with Japan falling just over 0.5% while Hong Kong rallied by a similar magnitude. The weakness in Japan stemmed from comments by President Trump, who expressed doubt that a deal with Japan would be reached by July 9th, in which case he could increase tariffs on the country to 35%.

The tone in Europe has been much more positive, with the STOXX 600 trading up about 0.5%. Unemployment in Europe ticked up to 6.3% which was higher than the 6.2% forecast, while Italy saw its jobless rate surge from 6.1% to 6.5%. That weakness should help to keep the ECB biased towards more easing.

In the US this morning, employment is also at the fore following this morning’s release of the ADP Employment report, which showed a 35K decline in payrolls in June, which was the first decline in over two years and well below the consensus forecast for growth of 95K. The ADP report has been consistently weaker than government data in recent months, and we’ll get the June Non-Farm Payrolls report tomorrow morning, but for now, this weakness lends to concerns over economic growth against a backdrop of uncertainty related to trade. With this report, you can practically hear President Trump’s fingers tapping out the next Truth Social post to Fed Chair Powell.

As we highlighted in the Chart of the Day, yesterday’s trading was all about rotation, where the best-performing areas of the market in Q2 lagged while the Q2 laggards outperformed. Another example of the rotation was in sector performance. The scatter chart below compares the performance of S&P 500 sectors during Q1 (x-axis) versus on 7/1 (y-axis). Here, you can see the rotation from the Q2 haves to the Q2 have-nots. The five worst-performing sectors of Q2 were the five best performers yesterday. Technology and Communication Services, easily the best-performing sectors of Q2, were the only two sectors to trade lower yesterday. As Andy Warhol once said, everyone gets their 15 minutes of fame, and yesterday it was the Q2 laggards’ chance to grab the spotlight.

The Closer – Senate Passage, Jobs, Logistics – 7/1/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with a review of the Senate passing of the spending bill and the latest news on tariffs (page 1). Next, we review the day’s PMI data (page 2) before getting into job openings readings from the JOLTS report (page 3) and Indeed.com (pages 4 and 5). We finish with the June update of the Logistics Managers’ Index (pages 6 and 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke Market Calendar — July 2025

Please click the image below to view our July 2025 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/1/25 – The Spat Resumes

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Every story needs an element of suspense – or it’s lousy.” – Sydney Pollack

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

It’s a new month, a new quarter, and a new half this morning, and while investors would certainly be happy with a repeat in terms of the returns during the half, they would prefer to do without the volatility. This morning, futures are drifting moderately lower after two straight days of record closing highs. The quarter is also getting off to an active start with the June ISM Manufacturing report at 10:00 AM, along with the May reports on Construction Spending and JOLTS.

While these reports will likely impact the market upon their release, so far this morning, there aren’t many headlines driving the market in either direction. While futures are lower, the magnitude of the losses has been pretty modest so far. In Washington, the Senate is still trying to pass the GOP Reconciliation Bill. That ongoing process has led to a resurgence in the war of words between Elon Musk, who hates the bill and is threatening to primary conservatives who vote for it, and President Trump, who responded with comments that Elon owes all his success to government subsidies and said DOGE should look into them.

Besides another flare-up in the spat between President Trump and Elon Musk, Tesla (TSLA) has been in the news this week as the company marked the 15th anniversary of its IPO on Sunday. Based on its performance this year, the stock hasn’t exactly been celebrating the milestone. While well off its April lows, it’s still down over 20% on the year, and this morning, it’s on pace to open down by another 5% after the President ‘truthed’ that DOGE should look into all the subsidies that Musk’s various companies receive. If these pre-market losses hold, it will also put the stock below both its 50 and 200-day moving averages, just as it experiences a ‘golden cross’ where the 50-day moving average (DMA) crosses up through the 200-DMA as both are rising.

Even with its 20%+ decline YTD, TSLA still ranks as the third best performing stock out of the current Russell 1000 members with an eye-popping gain of 19,849% since its IPO. The only two stocks that have performed better are Nvidia (NVDA), which has tripled TSLA’s gain, and Axon Enterprise (AXON), which is up just under 22,000%. Trailing behind TSLA, Broadcom (AVGO), and Texas Pacific Land (TPL) round out the top five stocks that have all rallied more than 10,000%. That’s a 100-bagger!

While the last 15 years have been great for TSLA, the road for traditional auto OEMs hasn’t been much bumpier. While the S&P 500 has rallied nearly sevenfold over the last 15 years, Ford (F) and General Motors (GM) have essentially gone nowhere.

The Closer – First Half Close, Weak Dollar, AI Ideas – 6/30/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a recap of first quarter performance (page 1) including a look at the historically bad start for the dollar (page 2) and underperformance of US equities relative to the rest of the world (page 3). Next, we check in on the performance of our AI baskets (page 4) including a look at some other under the radar AI plays (page 5). We finish with a review of the latest manufacturing data (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!