Log-in here if you’re a member with access to the Closer.

Two days ago on our blog site, in a post titled “What a Difference Less Than Three Months Can Make,” we showed a chart of how quickly the Brazilian Ibovespa recovered from the late May sell-off related to corruption charges against President Temer. In referencing the quick turnaround, we noted that, “The sell-off and subsequent rebound in Brazilian equities serve as an excellent reminder of how quickly sentiment can change in the market for both the good and the bad.” We went on to point out that, “as good as things seem today, it wouldn’t take a lot to have investors looking at the markets from an entirely different perspective.” And that’s exactly where we are today. With a 1% decline in the S&P 500 and a 2% decline in the Nasdaq, investors are looking at equities from a much different perspective today than they were just a couple of days ago.

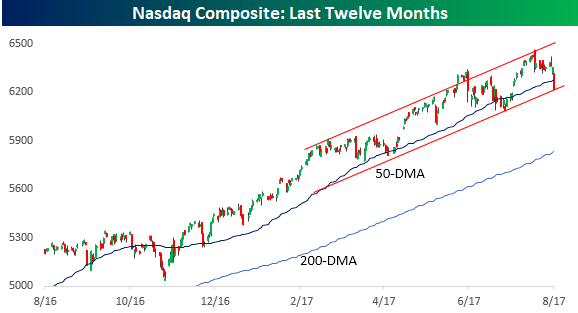

Let’s take a look at the Nasdaq first. After running into resistance at its uptrend channel in late July, it’s the bottom end of that channel that’s coming into play this week. It will be a big test in the coming days to see if this channel can hold, and bulls have their fingers crossed.

In tonight’s Closer sent to Bespoke Institutional clients, we go into more detail on Thursday’s decline and what current trends suggest for the year ahead.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!