Biggest Energy Names See Record Moves

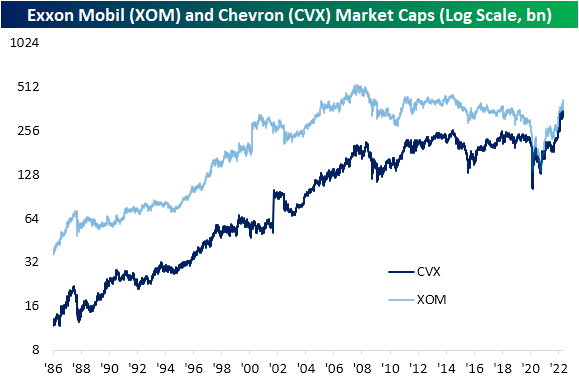

The Energy sector has been on an absolute tear over the pandemic period with a 273% gain since the pandemic lows in March 2020. During the overall market downturn of the past several months, it is the only cyclical sector to have managed to retain its uptrend as it has rallied over 60% year to date compared to a 13% decline for the S&P 500. Taking a look through our Chart Scanner tool, there is not too much variation in the charts of large-cap Energy stocks with strong uptrends across the board and many new multi-year highs as a result. Taking a look at two of the largest members who account for nearly three-quarters of a trillion dollars in market cap, Exxon Mobil (XOM) and Chevron (CVX) are good examples. CVX has reached new all-time highs following its meteoric rise over the past couple of years while XOM has recovered most of the past decade’s declines. Additionally, we would note that XOM has historically tended to be much larger than CVX, but the pandemic and the subsequent rally over the past couple of years have brought the two stocks’ market caps much more closely in line with one another.

Both long-standing staples of the Energy sector, XOM and CVX are also notable in that they are both dividend aristocrats (a group of stocks that have now raised their dividend annually for 25 or more consecutive years). That means on top of massive capital gains, investors have also been rewarded handsomely with dividends. Even after these massive rallies, CVX still yields 3.25% and XOM pays an even better 3.67%. Taking this into account, the two-year runs including dividends that these stocks have been on are unlike anything observed since at least the early 1980s. Given the record two-year run we’ve seen in the Energy space, it’s tough to get super bullish on this area of the market now. Remember, we saw an explosive move higher like this for other areas of the market earlier on in the post-pandemic era (think meme stocks, SPACs, high growth, etc.), but once the tide turned in late 2021, the downside reversal was just as extreme. Energy stocks have completely different fundamental risk profiles than aggressively valued Tech stocks, and ultimately their performance is mostly tied to the price of oil. That being said, investor psychology and herd mentality work the same regardless of the asset class. Click here to learn more about Bespoke’s premium stock market research service.