Jun 7, 2022

The broader retail space has been weak relative to the S&P 500 so far this year. Much of this weakness came after Target’s (TGT) and Walmart’s (WMT) earnings calls, in which management noted margin compression, inventory gluts in certain categories, shifting consumer preferences, and weakness in consumer spending as inflation in food and energy reduces discretionary budgets. Institutional subscribers can view our Conference Call Recaps on these two companies by clicking here. On a YTD basis, the VanEck Retail ETF (RTH) has underperformed the S&P 500 (SPY) by 4.5 percentage points, trading down by 18.2% as of today. A chart of the relative strength of RTH vs SPY over the last year is shown below.

Within the S&P 500, there are 21 stocks that make up the Retailing industry, and in the table below, we have outlined the performance of the 10 largest stocks by market cap. You’ll notice that companies like Costco (COST) and WMT aren’t listed, but that’s because they are actually part of the Food and Staples Retailing industry. As you can see, seven of these ten stocks are down more than the average S&P 500 member on a YTD basis, and six are further from their respective 52-week highs than the average S&P 500 member. However, only two of these stocks are below their pre-COVID highs, whereas more than a third of (35.8%) of S&P 500 components are below their pre-COVID highs.

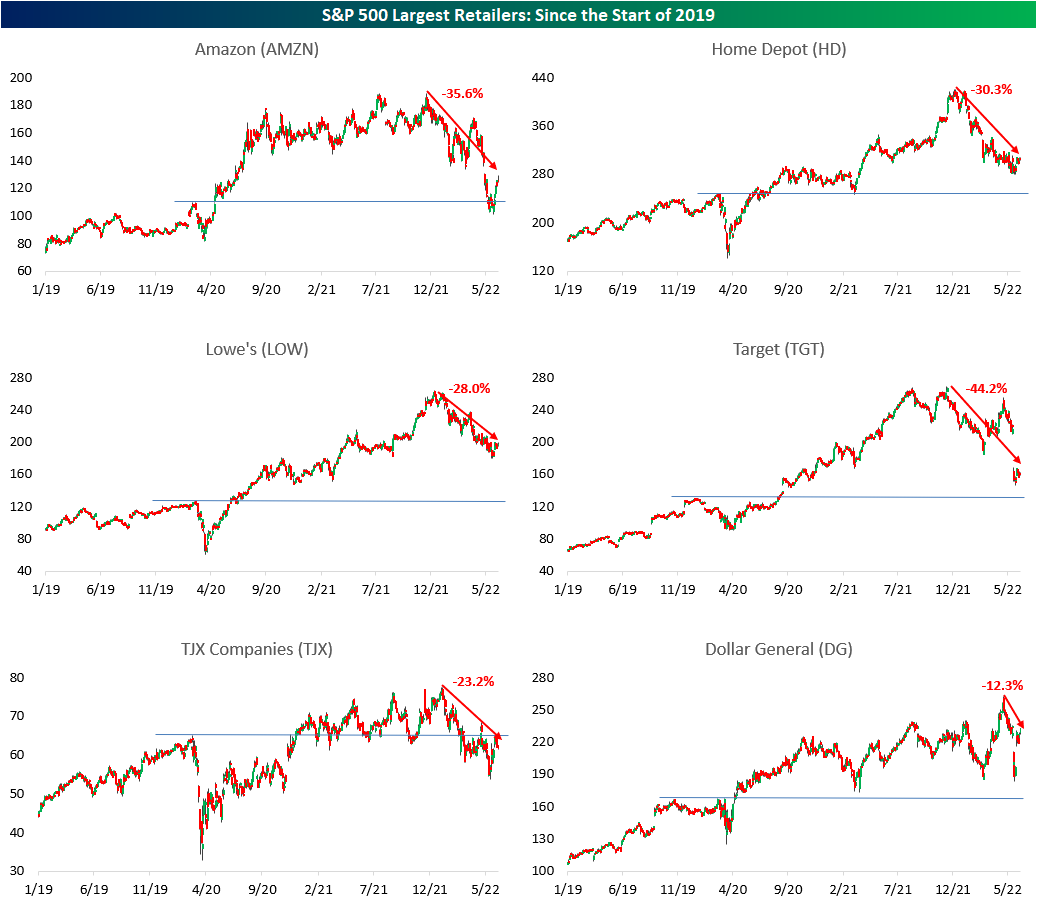

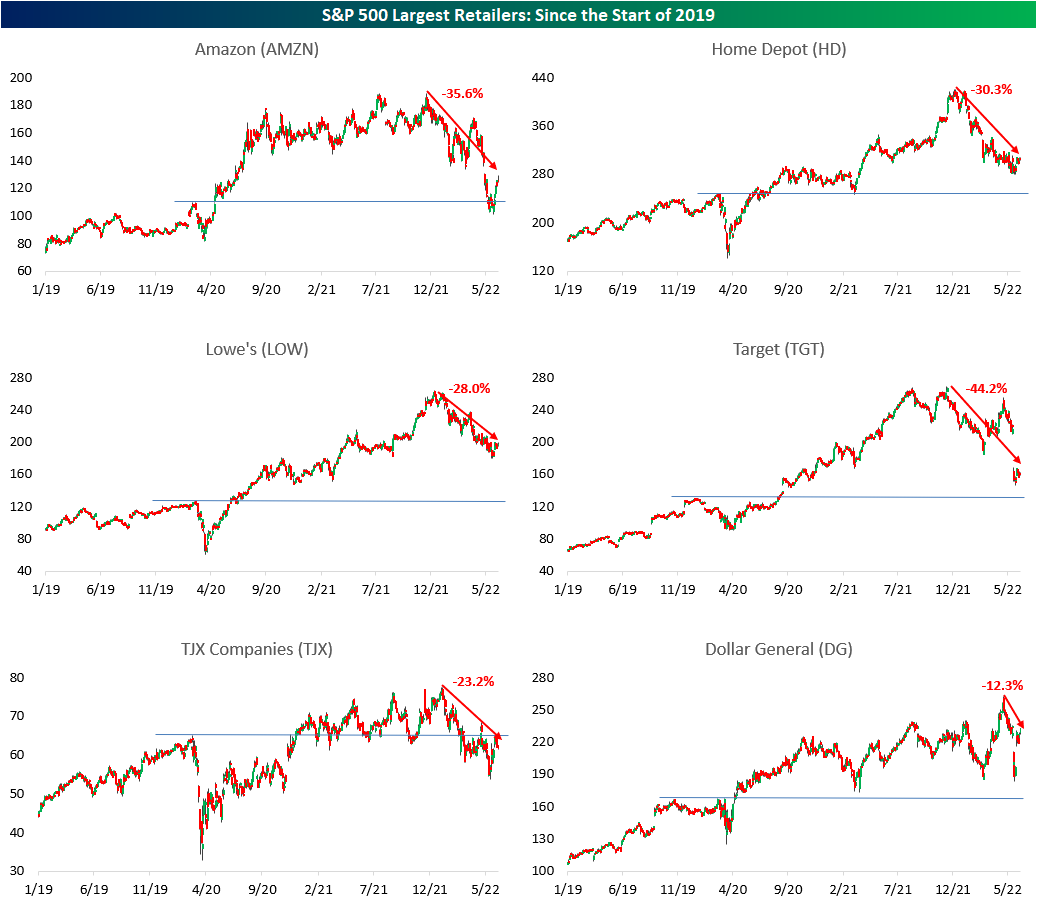

Below are charts of each of the 10 stocks listed above since the start of 2019. Included on each chart is the percentage that each is off its 52-week high. As you can see, AutoZone (AZO), Dollar Tree (DLTR) and Dollar General (DG) have held up relatively well amidst broader market weakness, likely due to their positioning on the value chain. The market seems to believe that consumers will move down the value chain amidst rising inflation, which makes our latest Little Known Stocks Report even more compelling. Click here to become a Bespoke premium member today!

May 18, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Inflation is a form of tax, a tax that we all collectively must pay.” – Henry Hazlitt

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

This week the tax of inflation is being felt most by retailers as two of the nation’s largest retailers have gotten absolutely destroyed in the last two days. Futures are indicated lower this morning, but one could make the case, given the plunge in Target (TGT) shares this morning, that it could even be worse. Oil prices are also trading up close to 2%, the ten-year yield is back up to 3%, and the dollar is trading lower.

On the economic front, we’re about to get the latest updates on Housing Starts and Building Permits for April, but if mortgage data is any indication, the data isn’t likely to be very strong.

In today’s Morning Lineup, we recap the continued developments in retail earnings (pg 4), market action in Asia and Europe (pg 4), economic data in Asia and Europe (pg 5), and a lot more.

If you thought yesterday’s 11% pounding of Walmart (WMT) was bad, meet Target (TGT). After reporting significantly weaker than expected earnings on better than expected revenues, shares are trading down more than 20% in the pre-market. The company blamed ‘unexpectedly high costs’ that it faced throughout the quarter for the earnings miss, and didn’t provide much additional detail in its release. Investors aren’t waiting for further clarity, though. With margins falling more than 400 basis points (bps), the stock is trading down more than 20% in the pre-market and is easily on pace for not only its worst earnings reaction day in at least 20 years, but also its worst one-day drop since the 1987 crash.

Yesterday, WMT had its largest one-day decline since the 1987 crash and now TGT is on pace to do the same! The experiences of both companies further reinforce the point that we are operating in one of the most complicated macro environments that any company or investor has had to deal with. Few companies are so entwined into so many aspects of the US economy as WMT and TGT, and their logistics and supply chain operations rival or exceed those of most other companies. If they’re having these types of issues keeping up with the rapidly changing environment, who isn’t?

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.