Jun 2, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We should take comfort that while we may have more still to endure, better days will return.” – Queen Elizabeth II

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The quote above from Queen Elizabeth was from a speech in the early days of COVID, and with life getting back to ‘normal’ in most western economies, she was definitely right. The Queen’s comments from two years ago can also be attributable to the current market environment. 2022 hasn’t been enjoyable, and it’s more likely than not that investors will still have further volatility and losses to endure, but better days will come, even if – like COVID – those better days take longer than expected to return.

It’s been a busy morning of economic data today with ADP Employment missing expectations and showing the smallest level of job growth since April 2020. Unit Labor Costs were also revised more than a full percentage point higher, while the revision of Non-Farm Productivity showed a slightly less negative number. Jobless Claims were also just released, and on both an initial and continuing basis, the reported readings were lower than expected.

Heading into this morning’s data, futures were already higher, but they’ve given up some of those gains as interest rates ticked higher following the releases.

In today’s Morning Lineup, we discuss recent trends in the oil market (pg 4), activity in Asian and European markets (pg 4), and selected economic data from Asia and Europe, and the US (pg 5).

When it comes to semiconductors, we typically focus on the group’s relative strength versus the S&P 500 as a leading indicator for the broader market. This morning, however, we wanted to highlight the actual price chart of the Philadelphia Semiconductor Index (SOX). The group has been a steady outperformer in recent weeks, and unlike the major averages which are nowhere near their 50-day moving averages (DMA), the SOX has actually traded above that level in each of the last three trading days. The only problem is that it also closed below that level all three times. In market downtrends, declining moving averages often act as resistance, so the failed rallies of the last three days leave the bulls somewhat discouraged.

We were curious to see how common it is for the SOX to repeatedly run into resistance at its 50-DMA, so the chart below shows streaks where the index traded above its 50-DMA intraday but finished the day below that level. The current streak of three trading days is the longest streak since August 2018, and to find a longer streak you have to go all the way back to August 2007. While the current period has often been compared to the early 2000s, bulls can take some solace in the fact that there was never a similar streak in the years from 2000 through 2003.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Jun 2, 2022

With summer underway, we figured that it was an appropriate time to take a look at some of the stocks associated with beach & pool season. As shown below, Google searches for “beach”, “pool”, “boat” and “grill” are all actually elevated relative to historical levels during the week of May 31st, with each hitting a five year high. We’re actually seeing consumers searching for these popular summer activities at record rates, and they usually don’t peak until right around July 4th. This suggests “hot” activity as we roll into the summer months when consumers get outdoors. From an economic standpoint, it’s good to see searches at these levels especially with gas prices continuing to surge.

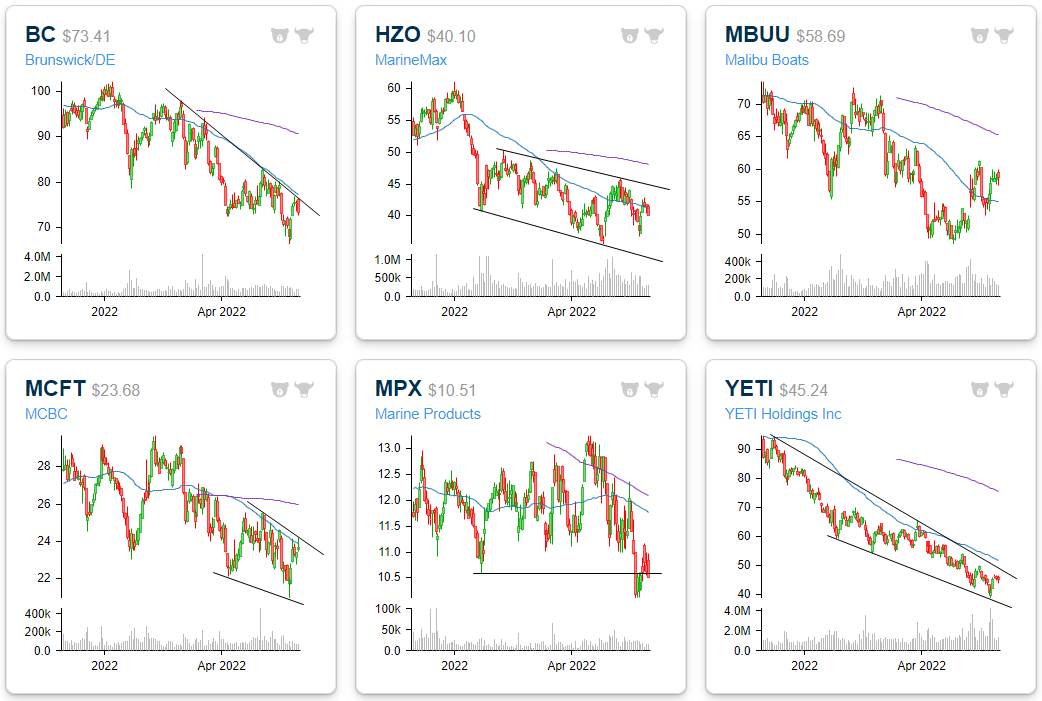

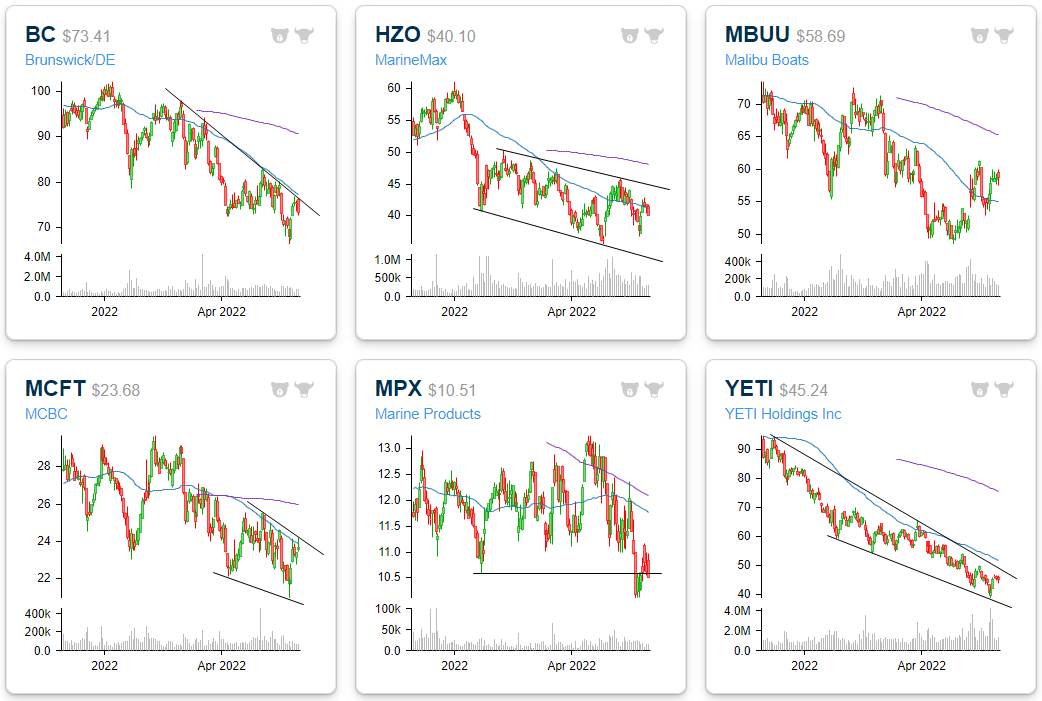

Although searches and interest in these activities are hitting a multi-year high, the prices of stocks with exposure to these industries have gone in the other direction. Starting with beaches and boats, six stocks with direct exposure include Brunswick (BC), Yeti (YETI), MarineMax (HZO), MasterCraft Boats (MCFT), Malibu Boats (MBUU), and Marine Products (MPX). On average, these stocks are down 24.9% year to date (median: -21.6%) and trade 1.2 times last twelve-month sales (median: 1.0). Although these stocks trade just 10.2 times LTM earnings per share (median: 8.5), they saw EPS rise by an average of 15.5% y/y in the most recent quarter (median: 13.4%). In the latest quarter, sales also improved by an average of 17.3% (median: 18.5%). Despite the relatively strong fundamental trends, investors appear to be looking forward anticipating weaker levels of growth once the pent up demand wanes.

Within the pool and grill space, we were able to identify four near-pure plays: Pool Corp (POOL), Leslie’s (LESL), Traeger (COOK), and Weber (WEBR) which is not shown. On average, these stocks are down 37.8% (median: 36.0%) year to date compared to the S&P 500’s decline of just over 14%. These companies saw sales grow by 15.6% y/y on average (median: 18.5%) in the most recent quarter. The average price to sales multiple for this group is 1.6 (median: 1.6). Granted, the weak YTD performance can be largely attributed to WEBR and COOK, as the market has punished recent IPOs. Nonetheless, the underperformance is still notable given the assumed hike in demand.

Over the last twelve months, beach, pool, boat, and grill stocks (on an equal-weighted basis) have underperformed the S&P 500. This underperformance has been consistent. Granted, not all of the names on the list are pure plays, but all of the stocks have exposure to the space in one way or another. As you attend outdoor events at the bool, beach, or on the water in the coming weeks, keep these stocks in mind! Click here to become a Bespoke premium member today!

Jun 1, 2022

Each day in our Sector Snapshot, we provide an update on each sector’s weighting within the S&P 500. Given the astounding rally in Energy stocks, the sector has gone from a record low weighting of only 1.9% in November 2020 up to a high of 4.9% last week. That is back to levels seen in the summer of 2019, and it’s also a level consistent with what we saw in the late 1990s through the first few years of the 2000s. Of course, the larger a sector’s weighting, the more impact its moves have on the broader S&P 500.

Meanwhile, another traditionally cyclical group, the Industrials, has seen its weighting steadily decline. At only 7.76%, the current reading is only about 0.3 percentage points above the pandemic low in weight which also marked a record low going back to at least 1990. Historically, Industrials have had less dramatic fluctuations in weight than Energy, but it has seen a consistent grind lower over the decades, reflecting the broader shift in the US economy from predominately goods to service-based.

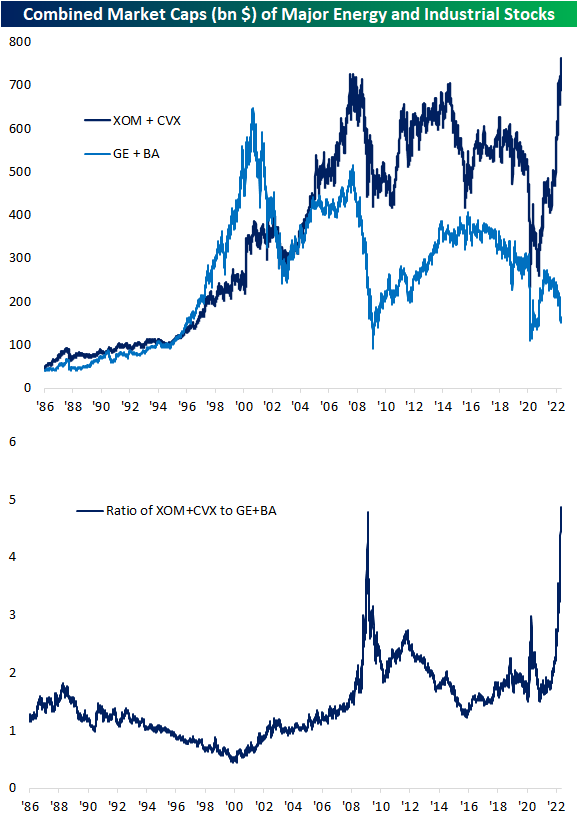

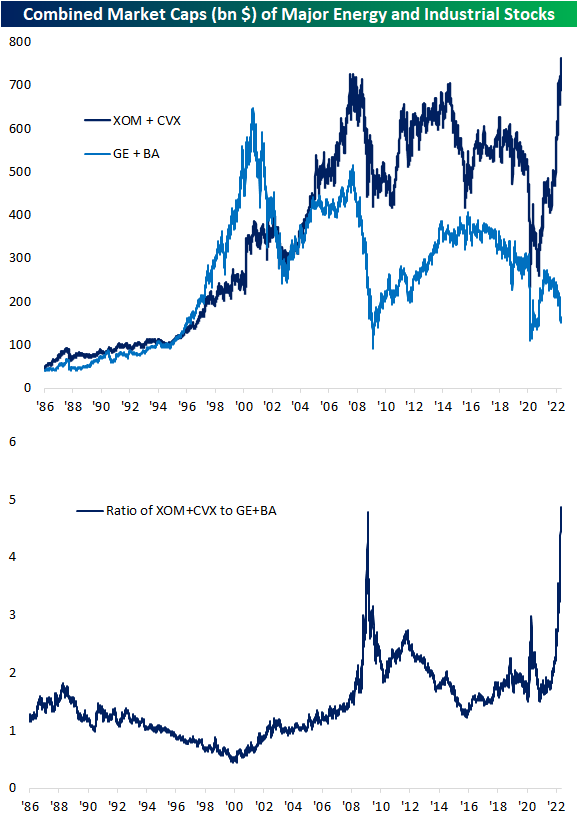

In an earlier post, we noted how two of the biggest stocks in the Energy sector by market cap, Exxon Mobil (XOM) and Chevron (CVX), have seen explosive and unprecedentedly large moves higher over the past couple of years. This is the first time these stocks have seen their market caps rise in any sort of a significant manner since the mid-2000s. As shown below, the two now account for nearly three-quarters of a trillion dollars in market cap, surpassing the previous peak in late 2007. That accounts for roughly 44% of the total size of the S&P 500 Energy sector as well.

Below we compare the combined market caps of XOM and CVX to what have historically been two of the most prominent stocks in the Industrials sector: Boeing (BA) and General Electric (GE). Right around 2000, these two stocks had a combined market cap of ~$650 billion. Over the two decades since then, these two stocks have fallen from grace with their current market caps now totaling just $163.9 billion! Relative to the market cap gains of Exxon Mobil and Chevron, the recent move has been nothing short of exponential as shown in the second chart below. The only comparable period was in 2009 when both groups fell, but the Industrial names were hit much harder.

As we discussed in regards to Tech stocks now versus the Dot Com Peak in March of 2000 in last week’s Bespoke Report (pages 20 & 21), the big declines in the size of GE and BA as XOM and CVX rocket higher are yet more examples of the ebb and flow of market leadership. Click here to learn more about Bespoke’s premium stock market research service.

Jun 1, 2022

Please click the image below to view our June 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Jun 1, 2022

Bespoke’s Conference Call Recaps provide helpful summaries of corporate conference calls throughout earnings season. We go through the conference calls of some of the most important companies in the market and summarize key topics covered by management. These recaps include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. We also identify trends emerging for the broader economy in these recaps.

Bespoke’s Conference Call Recaps are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call recaps. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Below is a list of the Conference Call Recaps published during the Q1 2022 and Q4 2021 earnings reporting period.

Q1 2022 Recaps:

Salesforce — Q1 2023

NVIDIA — Q1 2023

Best Buy — Q1 2023

Zoom — Q1 2023

Deere — Q2 2022

Palo Alto Networks — Q3 2022

Target — Q1 2022

Q1 Previously Published Recaps

Home Depot Q1 Conference Call — 5/17/22

Walmart Q1 Conference Call — 5/17/22

Disney Q2 Conference Call — 5/11/22

Roblox Q1 Conference Call — 5/11/22

Simon Property Q1 Conference Call — 5/9/22

Tyson Foods Q2 Conference Call — 5/9/22

Block Q1 Conference Call — 5/5/22

Albemarle Q1 Conference Call — 5/5/22

Cheniere Energy Q1 Conference Call — 5/4/22

Uber Q1 Conference Call — 5/4/22

Starbucks Q1 Conference Call — 5/3/22

Advanced Micro Devices Q1 Conference Call — 5/3/22

Hilton Hotels Q1 Conference Call — 5/3/22

Amazon Q1 Conference Call — 4/28/22

Apple Q2 Conference Call — 4/28/22

United Rentals Q1 Conference Call — 4/28/22

McDonald’s Q1 Conference Call — 4/28/22

Meta Platforms Q1 Conference Call — 4/27/22

Automatic Data Processing Q3 Conference Call — 4/27/22

Chipotle Q1 Conference Call — 4/26/22

Microsoft Q3 Conference Call — 4/26/22

Alphabet Q1 Conference Call — 4/26/22

United Parcel Service Q1 Conference Call — 4/26/22

Whirlpool Q1 Conference Call — 4/25/22

Coca-Cola Q1 Conference Call — 4/25/22

American Express Q1 Conference Call — 04/22/22

Snap Q1 Conference Call — 04/21/22

Pool Corp Q1 Conference Call — 04/21/22

Alcoa Q1 Conference Call — 04/20/22

Tesla Q1 Conference Call — 04/20/22

IBM Q1 Conference Call — 04/19/22

Johnson & Johnson Q1 Conference Call — 04/19/22

JB Hunt Conference Call — 04/18/22

Citigroup Q1 Conference Call — 04/14/22

UnitedHealth Group Q1 Conference Call — 04/14/22

Taiwan Semiconductor Q1 Conference Call — 04/14/22

BlackRock Q1 Conference Call — 04/13/22

Delta Q1 Conference Call — 04/13/22

JP Morgan Q1 Conference Call — 04/13/22

CarMax Q4 Conference Call — 04/12/22

Constellation Brands Q4 Conference Call — 4/7/22

Walgreens Q2 Conference Call — 3/31/22

Micron Q2 Conference Call — 3/29/22

Lululemon Q4 Conference Call — 3/29/22

KB Home Q1 Conference Call — 3/23/22

Adobe Q1 Conference Call — 3/22/22

Nike Q3 Conference Call — 3/21/22

Recaps published during Q4 2021 are available with a Bespoke Institutional subscription:

Salesforce Q4 Conference Call — 3/1/22

Target Q4 Conference Call — 3/1/22

Zoom Q4 Conference Call — 2/28/22

Moderna Q4 Conference Call — 2/24/22

Home Depot Q4 Conference Call — 2/22/22

Deere Q1 Conference Call — 2/18/22

Walmart Q4 Conference Call — 2/17/22

NVIDIA Q4 Conference Call — 2/16/22

Airbnb Q4 Conference Call — 2/15/22

Marriott Q4 Conference Call — 2/15/22

Advance Auto Parts Q4 Conference Call — 2/14/22

Uber Q4 Conference Call — 2/9/22

Disney Q1 Conference Call — 2/9/22

Chipotle Q4 Conference Call — 2/8/22

Simon Property Q1 Conference Call — 2/7/22

Tyson Foods Q1 Conference Call — 2/7/22

Snap Q4 Conference Call — 2/3/22

Amazon Q4 Conference Call — 2/3/22

Estée Lauder Q2 Conference Call — 2/3/22

Meta Q4 Conference Call — 2/2/22

Ferrari Q4 Conference Call — 2/2/22

Match Group Q4 Conference Call — 2/2/22

Advanced Micro Devices Q4 Conference Call — 2/1/22

PayPal Q4 Conference Call — 2/1/22

Starbucks Q1 Conference Call — 2/1/22

Alphabet Q4 Conference Call — 2/1/22

United Parcel Service Q4 Conference Call — 2/1/22

Visa Q1 Conference Call — 1/27/22

Apple Q1 Conference Call — 1/27/22

McDonald’s Q4 Conference Call — 1/27/22

Intel Q4 Conference Call — 1/26/22

Tesla Q4 Conference Call — 1/26/22

Boeing Q4 Conference Call — 1/26/22

Automatic Data Process Q4 Conference Call — 1/26/22

Microsoft Q2 Conference Call — 1/26/22

Johnson & Johnson Q4 Conference Call — 1/25/22

3M Q4 Conference Call — 1/25/22

Lockheed Martin Q4 Conference Call — 1/25/22

American Express Q4 Conference Call — 1/25/22

Netflix Q4 Conference Call — 1/20/22

Intuitive Surgical Q4 Conference Call — 1/20/22

Union Pacific Q4 Conference Call — 1/20/22

Baker Hughes Q4 Conference Call — 1/20/22

UnitedHealth Q4 Conference Call — 1/19/21

Fastenal Q4 Conference Call — 1/19/22

Procter & Gamble Q2 Conference Call — 1/19/22

Silvergate Capital Q4 Conference Call — 1/18/22

Charles Schwab Q4 Conference Call — 1/18/22

BlackRock Q4 Conference Call — 1/14/22

JP Morgan Q4 Conference Call — 1/14/22

KB Home Q4 Conference Call — 1/12/22

Delta Airlines Q4 Conference Call — 1/13/22

Constellation Brands Q3 Conference Call — 1/6/22

Nike Q2 Conference Call — 12/20/21