Apr 6, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Bond investors are the vampires of the investment world. They love decay, recession – anything that leads to low inflation and the protection of the real value of their loans.” – Bill Gross

It’s looking like it’s going to be one of those days. Futures were just modestly negative overnight but then started to really weaken as Europe opened for trading and things haven’t stabilized since. The S&P 500 faces losses of around 1% at the open with the Nasdaq down over 1.5%. If equities were looking to rally coming into the week, yesterday’s Fed commentary put at least a temporary stop to that. Interest rates are higher across the curve and the 2s10s yield curve has steepened well out of inverted territory, but that comes along with yields on the 10-year above 2.6% to its highest level in just over three years.

The economic calendar is light today as weekly mortgage applications were the only release, and they fell 6.3% following a 6.8% last week and an 8.1% decline the week before that. Besides that, Energy inventories will be released at 10:30 and the Minutes from March’s FOMC meeting will be released at 2 PM. Philly Fed President Harker and Richmond Fed President Barkin will also be speaking this morning.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

For bond investors, these days are tough indeed. With inflation rampant around the world and central banks finally putting the brakes on the gravy train of liquidity, the increase in interest rates has been relentless with bond prices seeing some of their largest declines in years. A case in point is the iShares 20+ Year US Treasury Bond ETF (TLT). It’s already down 13% YTD and indicated to open lower today by another 1%. The chart below shows historical drawdowns from record closing highs in TLT since its inception in late 2002. Based on where the ETF is trading this morning, it has now declined 26% from its last record closing high back in early August 2020. Throughout its history, there have only been a handful of other periods where TLT ever experienced a peak to trough decline of more than 20%, and the only other time it dropped more was coming out of the Financial Crisis.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Apr 5, 2022

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin tonight with an overview of today’s Fedspeak and the price action in response. We then take a look at real rates followed by the US trade deficit before finishing with an update on delinquency data for the month of February.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Apr 4, 2022

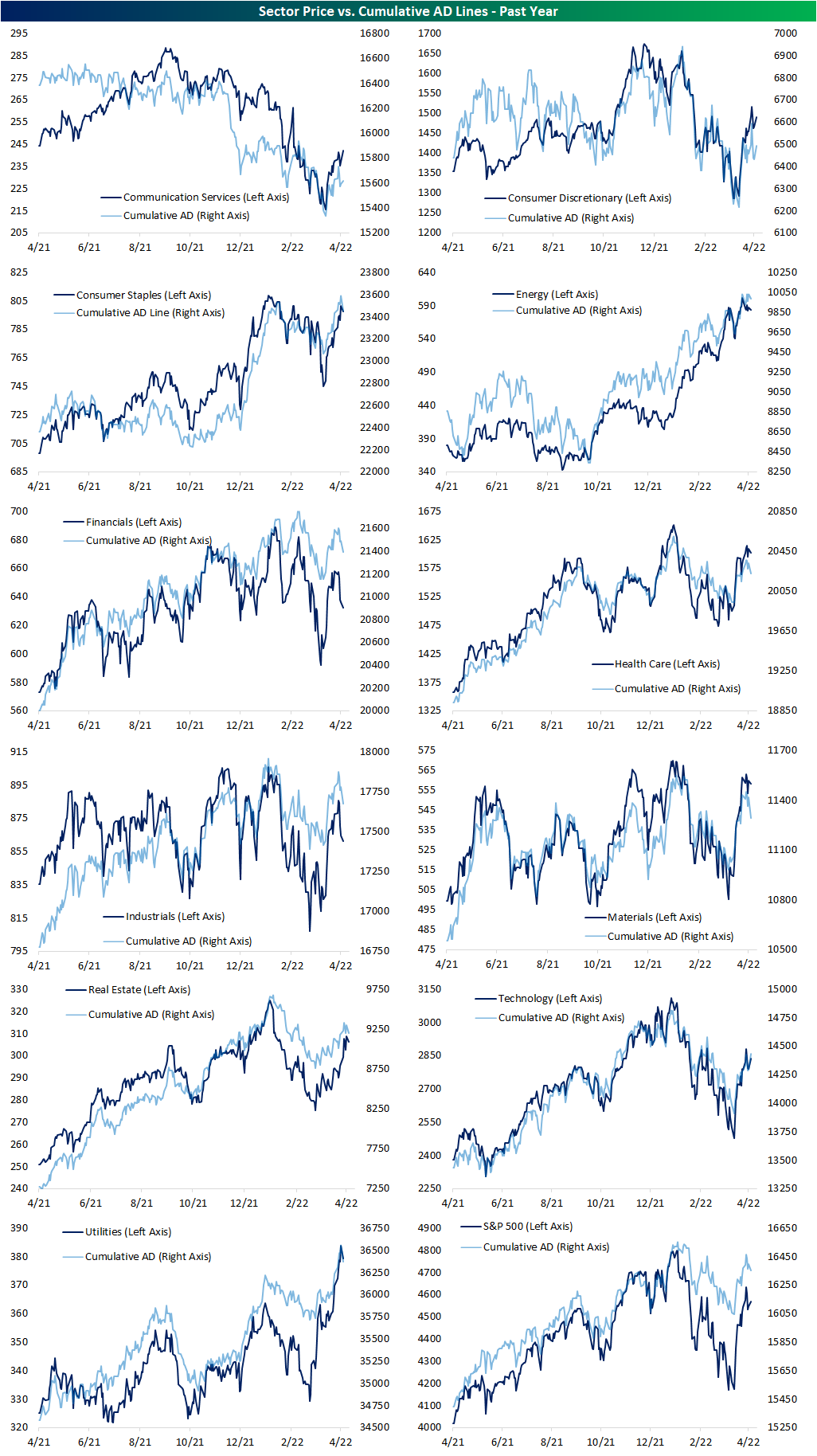

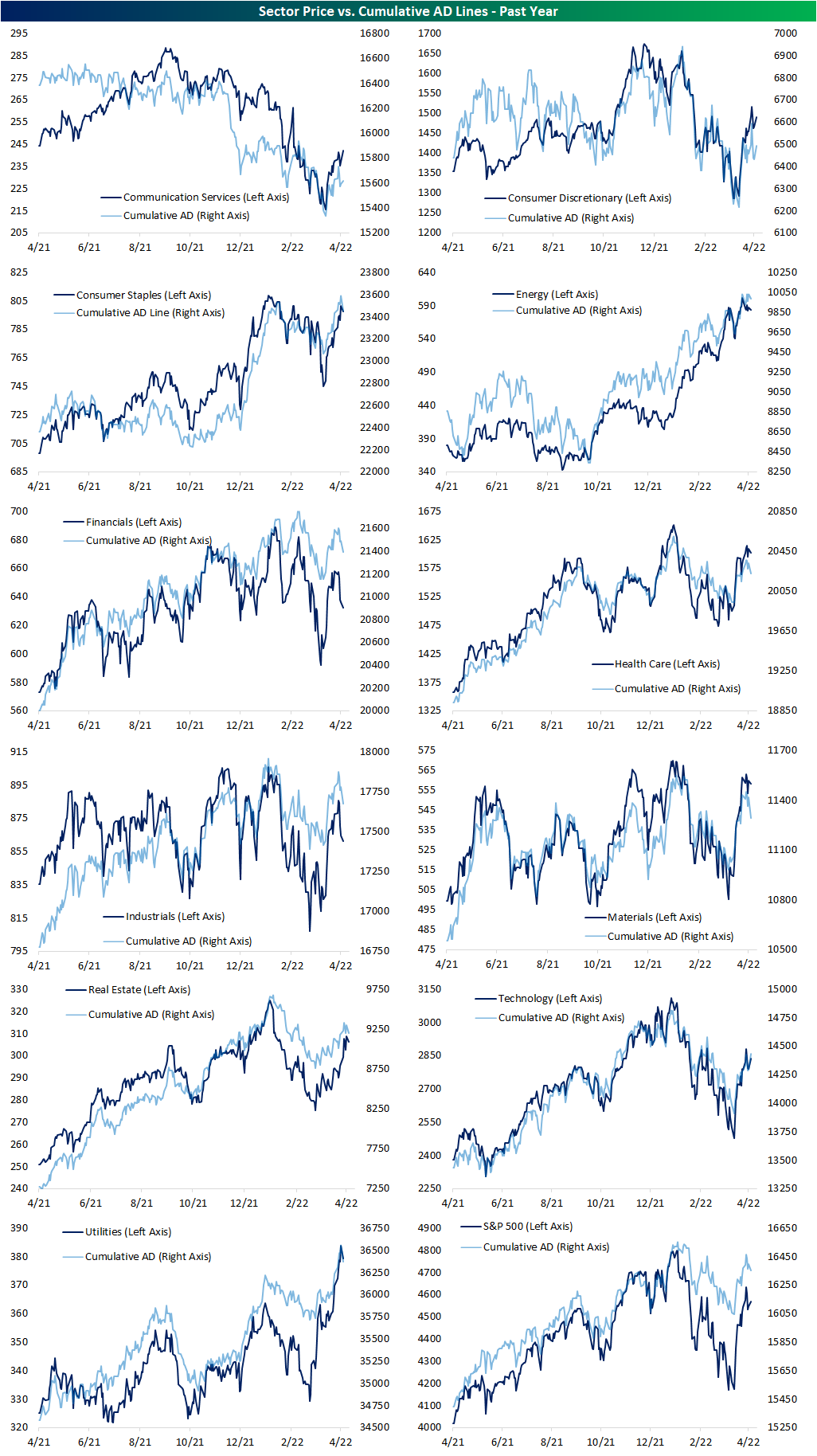

In an earlier tweet, we highlighted some charts from our Sector Snapshot highlighting the new highs in multiple sectors’ cumulative advance-decline (A/D) lines as of Friday. The cumulative A/D line is used to signal confirmation of a trend by indicating broad participation of an index’s underlying stocks in a rally or decline. In the charts below, we show those same A/D lines updated through today with price also included on the opposite axis.

Utilities, Consumer Staples, and Energy are seeing their AD lines pull back from new highs, but price has been somewhat disconnected. On the one hand, for Consumer Staples, unlike the A/D line, price never broke out above the late 2021/early 2022 levels. Energy, meanwhile, has seen breadth hold up fairly well while its price has been experiencing a more consistent decline in recent days. On the other hand, Utilities have seen price and breadth move more healthily in sync with one another. Communication Services has been somewhat the inverse of these three sectors. While breadth is positive today, the cumulative A/D line is not setting any new short-term highs even as the price is. That is mostly a result of the huge gain in Twitter (TWTR) having an outsized impact on the sector.

Most other sectors have recently seen consistent moves between price and breadth without any sort of major new highs or lows. Technology is close to moving above last week’s high on both a price and breadth basis while both readings for Financials and Industrials have been falling sharply. For Materials, another cyclical sector, breadth and price have been moving in the same direction, but the decline in the cumulative A/D line stands out slightly more. Click here to view Bespoke’s premium membership options.

.

.

Apr 4, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Given that Twitter serves as the de facto public town square, failing to adhere to free speech principles fundamentally undermines democracy.” – Elon Musk

Heading into today, it was looking like a quiet start to what was looking like a slow week as the economic calendar is light and earnings season doesn’t kick off for at least another week. That changed a bit following news that Elon Musk had taken a passive 9.2% stake in Twitter (TWTR) pushing the stock up by more than 25% in pre-market trading to its highest level since late November. Last week on Twitter, Musk made the statement at the top of this note and then followed up with the question, “What should be done?” Well, this morning we appear to be getting an answer. Twitter has long been criticized for not realizing its full potential, and TWTR shareholders are hoping Musk can move the company in that direction.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With the stock poised to open up more than 20% this morning, it will be just the fourth time in its history as a public company in 2013 that TWTR has gapped up more than 20%. Two of those days were in reaction to earnings (July 2014 and February 2018), and then on the day of its IPO in November 2013. Today, it’s all Elon.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Apr 1, 2022

Please click the image below to view our April 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.