Jun 13, 2022

Bespoke’s Little Known Stocks (LIKS) report highlights a company that may not be on the traditional radar of most investors. In this report, we provide an in-depth analysis of the little known stock, including industry insights, growth lever analysis, insights to the competitive landscape, equity performance, relative valuation, operational efficiency, pros & cons, and more. Today’s report is about a clean energy company that is well positioned to benefit from the bipartisan infrastructure package.

As always, this report is for informational purposes only and is not a recommendation to buy or sell any specific securities. Investors should do their own research and/or work with a professional when making investment decisions. Highlighting a stock doesn’t mean we are bullish or bearish on it. Our goal is simply to provide readers with facts to help them make informed decisions rather than just opinions.

Bespoke’s LIKS reports are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our LIKS reports. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Jun 7, 2022

The broader retail space has been weak relative to the S&P 500 so far this year. Much of this weakness came after Target’s (TGT) and Walmart’s (WMT) earnings calls, in which management noted margin compression, inventory gluts in certain categories, shifting consumer preferences, and weakness in consumer spending as inflation in food and energy reduces discretionary budgets. Institutional subscribers can view our Conference Call Recaps on these two companies by clicking here. On a YTD basis, the VanEck Retail ETF (RTH) has underperformed the S&P 500 (SPY) by 4.5 percentage points, trading down by 18.2% as of today. A chart of the relative strength of RTH vs SPY over the last year is shown below.

Within the S&P 500, there are 21 stocks that make up the Retailing industry, and in the table below, we have outlined the performance of the 10 largest stocks by market cap. You’ll notice that companies like Costco (COST) and WMT aren’t listed, but that’s because they are actually part of the Food and Staples Retailing industry. As you can see, seven of these ten stocks are down more than the average S&P 500 member on a YTD basis, and six are further from their respective 52-week highs than the average S&P 500 member. However, only two of these stocks are below their pre-COVID highs, whereas more than a third of (35.8%) of S&P 500 components are below their pre-COVID highs.

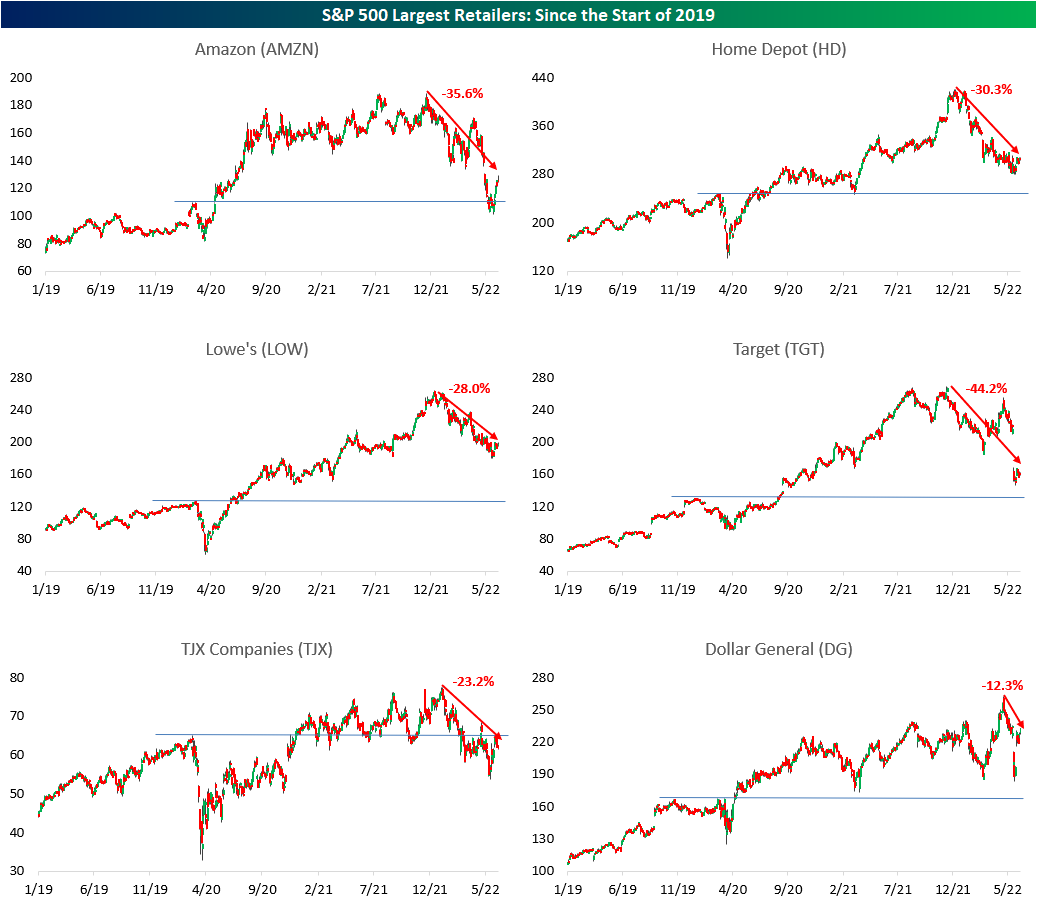

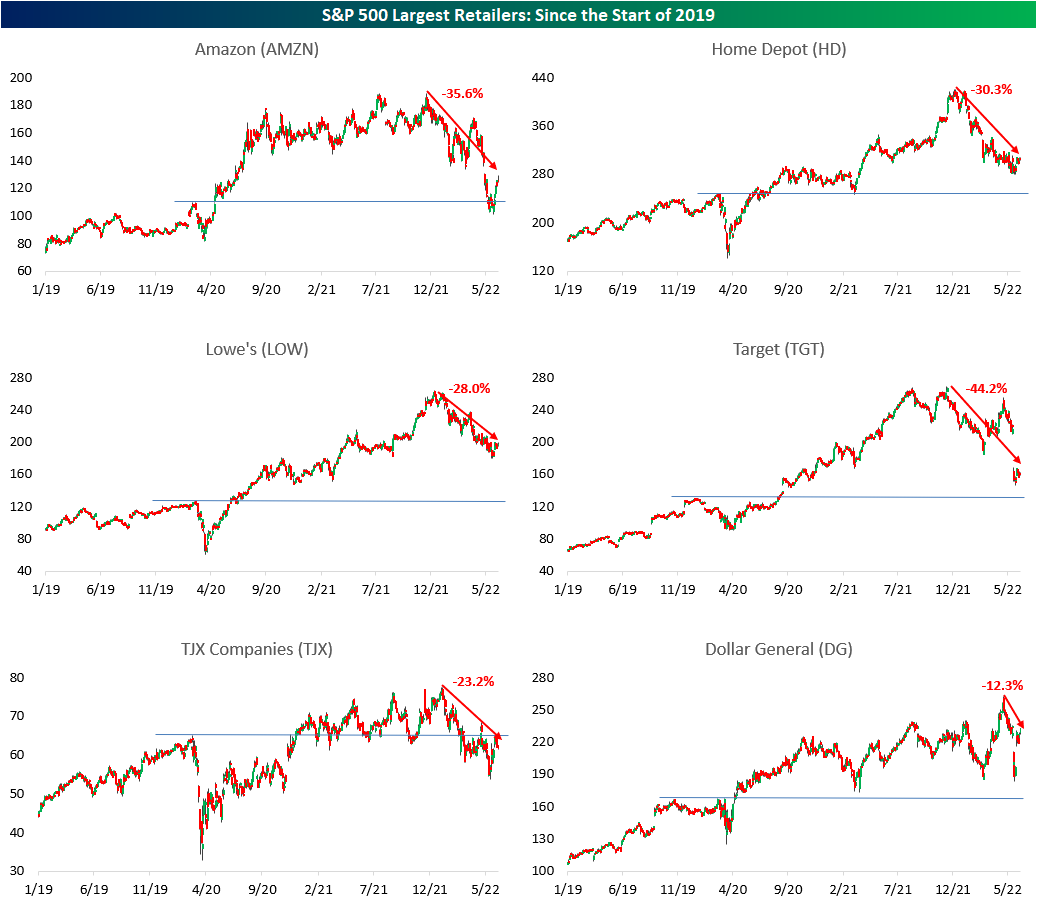

Below are charts of each of the 10 stocks listed above since the start of 2019. Included on each chart is the percentage that each is off its 52-week high. As you can see, AutoZone (AZO), Dollar Tree (DLTR) and Dollar General (DG) have held up relatively well amidst broader market weakness, likely due to their positioning on the value chain. The market seems to believe that consumers will move down the value chain amidst rising inflation, which makes our latest Little Known Stocks Report even more compelling. Click here to become a Bespoke premium member today!

Jun 2, 2022

With summer underway, we figured that it was an appropriate time to take a look at some of the stocks associated with beach & pool season. As shown below, Google searches for “beach”, “pool”, “boat” and “grill” are all actually elevated relative to historical levels during the week of May 31st, with each hitting a five year high. We’re actually seeing consumers searching for these popular summer activities at record rates, and they usually don’t peak until right around July 4th. This suggests “hot” activity as we roll into the summer months when consumers get outdoors. From an economic standpoint, it’s good to see searches at these levels especially with gas prices continuing to surge.

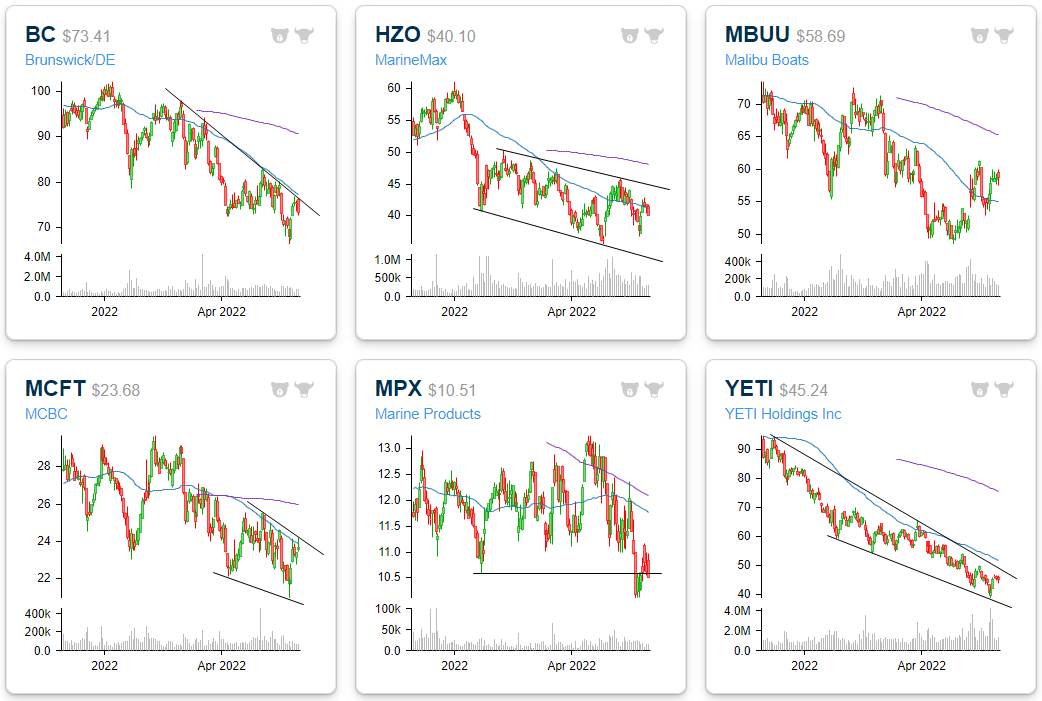

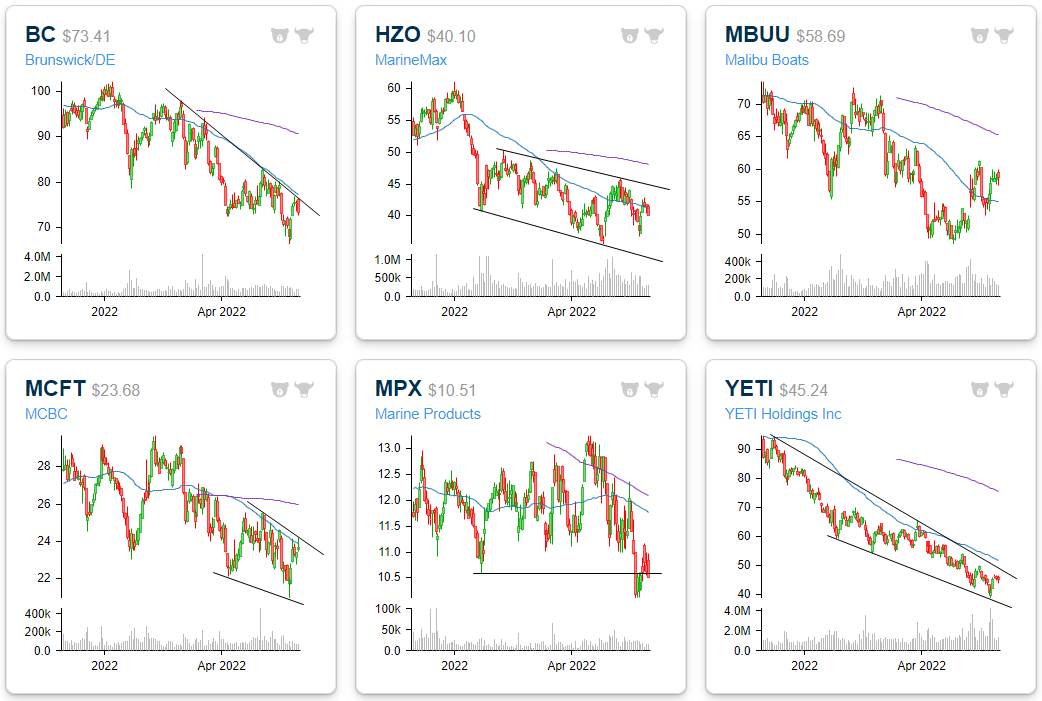

Although searches and interest in these activities are hitting a multi-year high, the prices of stocks with exposure to these industries have gone in the other direction. Starting with beaches and boats, six stocks with direct exposure include Brunswick (BC), Yeti (YETI), MarineMax (HZO), MasterCraft Boats (MCFT), Malibu Boats (MBUU), and Marine Products (MPX). On average, these stocks are down 24.9% year to date (median: -21.6%) and trade 1.2 times last twelve-month sales (median: 1.0). Although these stocks trade just 10.2 times LTM earnings per share (median: 8.5), they saw EPS rise by an average of 15.5% y/y in the most recent quarter (median: 13.4%). In the latest quarter, sales also improved by an average of 17.3% (median: 18.5%). Despite the relatively strong fundamental trends, investors appear to be looking forward anticipating weaker levels of growth once the pent up demand wanes.

Within the pool and grill space, we were able to identify four near-pure plays: Pool Corp (POOL), Leslie’s (LESL), Traeger (COOK), and Weber (WEBR) which is not shown. On average, these stocks are down 37.8% (median: 36.0%) year to date compared to the S&P 500’s decline of just over 14%. These companies saw sales grow by 15.6% y/y on average (median: 18.5%) in the most recent quarter. The average price to sales multiple for this group is 1.6 (median: 1.6). Granted, the weak YTD performance can be largely attributed to WEBR and COOK, as the market has punished recent IPOs. Nonetheless, the underperformance is still notable given the assumed hike in demand.

Over the last twelve months, beach, pool, boat, and grill stocks (on an equal-weighted basis) have underperformed the S&P 500. This underperformance has been consistent. Granted, not all of the names on the list are pure plays, but all of the stocks have exposure to the space in one way or another. As you attend outdoor events at the bool, beach, or on the water in the coming weeks, keep these stocks in mind! Click here to become a Bespoke premium member today!

May 24, 2022

Bespoke’s Metaverse Index tracks 40 companies with exposure to the continued rollout of the metaverse. We outlined seven components of the metaverse and selected the companies that have either spoken about their metaverse plans or have the capabilities to fulfill metaverse needs within these categories.

Bespoke’s Metaverse Index is available at the Bespoke Premium level and higher. You can sign up for Bespoke Premium now and receive a 14-day trial to read our Metaverse report. To sign up, choose either the monthly or annual checkout link below:

Bespoke Premium – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

May 23, 2022

Bespoke’s Little Known Stocks (LIKS) report highlights a company that may not be on the traditional radar of most investors. In this report, we provide an in-depth analysis of the little known stock, including industry insights, growth lever analysis, insights to the competitive landscape, equity performance, relative valuation, operational efficiency, pros & cons, and more. This week’s report is about a discount retailer that has the ability to benefit as household discretionary budgets compress.

As always, this report is for informational purposes only and is not a recommendation to buy or sell any specific securities. Investors should do their own research and/or work with a professional when making investment decisions. Highlighting a stock doesn’t mean we are bullish or bearish on it. Our goal is simply to provide readers with facts to help them make informed decisions rather than just opinions.

Bespoke’s LIKS reports are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our LIKS reports. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan[/MM_Access_Decision]