Precious Metals Harden Up

Little has been safe from heavy selling pressures recently including assets normally considered “safe havens” like precious metals. Gold is currently down over 9% from its March high while silver is down roughly 20% since its spring high. Today, both metals are bouncing from notable levels. For gold, it is finding support at its 200-DMA which also coincides with the rough uptrend line of higher lows of the past year. In addition to dramatic underperformance versus gold, silver’s test of support is perhaps a bit shakier. It is well below its moving averages, but today’s rebound is happening right around the lows from September and December. Granted, on an intraday basis, both yesterday and today’s lows breached those levels.

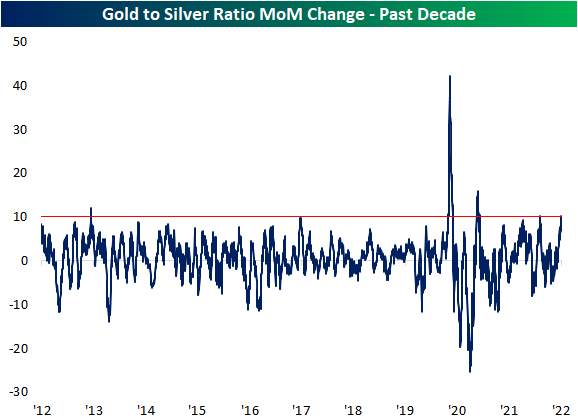

Given silver’s much larger decline, the ratio of gold to silver has ripped higher in the past month. In fact, the ratio has risen over 10% in the past month. The most recent 10% or larger surges were as recent as this past December with two even larger ones in the spring and fall of 2020. Prior to the pandemic, though, these sorts of rapid increases in the gold to silver ratio have been rarer. Before 2020, the only other instances of the past decade were in the springs of 2013 and 2017. Click here to learn more about Bespoke’s premium stock market research service.