Fed Day Follow Up

In last night’s Closer, we recapped the market reaction to the FOMC’s 50 bps rate hike noting that equities really took off once Fed Chair Powell ruled out the possibility of 75 bps hikes on the horizon. By the close, the S&P 500 rallied 2.55% from right before the decision (1:59 PM). As shown below, that marked the third-best S&P 500 reaction to a Fed day since 1994 when the FOMC began to announce its decision on the same day as the meeting.

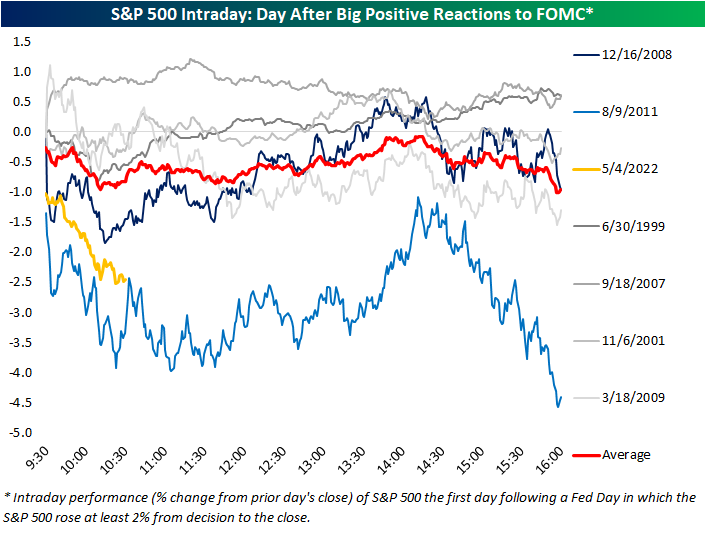

Given today’s massive declines, the S&P has already erased its 2%+ post-FOMC gain. Below we show the S&P’s intraday performance the day after each Fed day when the index rallied over 2% post-meeting (1:59 to the close). For each day, the date shown represents the day of the FOMC meeting. On average, the S&P 500 has tended to gap down the following day and continue to trade lower throughout the first post-FOMC session as we are seeing today.

Today’s performance is certainly on the weaker end of these occurrences, though. In fact, like the other two largest post-FOMC rallies that saw over 3% gains in the afternoon of Fed days, December 2008 and August 2011, today saw a significant gap lower with continued losses through mid-morning. The continued selling today is setting up to more closely resemble the August 2011 occurrence. Following the December 2008 instance, on the other hand, the S&P 500 found a low in the late morning and even briefly went positive the day after the big post-FOMC gain.

While today is shaping up to look like another time the market rallied hard in response to the FOMC, taking a step back to look at all Fed day afternoon performance (1:59 to the close) versus next-day performance (full day), there is not much of a strong trend. As shown below, the S&P 500’s performance from 1:59 to the close on a Fed day is a statistically poor explainer of next-day performance. That being said, today does stand out as one of the worst Fed day follow-ups on record. Click here to learn more about Bespoke’s premium stock market research service.