The Quitter Market

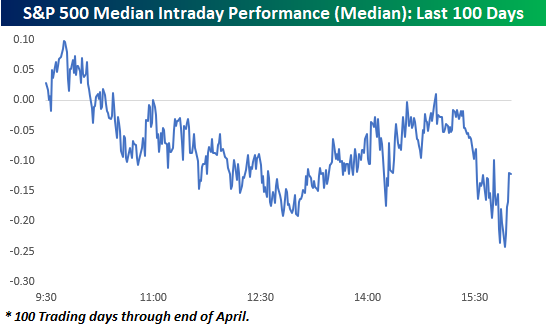

If it seems to you like the market simply can’t hold on to gains this year, you aren’t mistaken. The chart below shows an intraday composite of the S&P 500 on a median basis over the last 100 trading days through the end of April. The general pattern during this period has been for the market to open modestly higher, but then sell off for the remainder of the morning. It has then regained its footing shortly after mid-day but then sells off into the close.

How does the last five months or so compare to history? The charts below really put the recent trend of intraday weakness into perspective.

The first chart shows the number of days over a rolling 100-trading day period that the S&P 500 tracking ETF (SPY) traded in positive territory on an intraday basis but finished the day down. The reading currently stands at 38 and was as high as 40 (red line) in the last week of April. As shown in the chart below, there hasn’t been another period that the S&P 500 has had so much trouble holding onto intraday gains in more than a decade (October 2010)!

For the Nasdaq 100 (QQQ), it has been a similar story. As recently as April 22nd, the trailing number of times in the last 100-trading days that QQQ traded in positive territory on an intraday basis but finished the day lower reached 42 and currently stands at 40. Like SPY, the recent reading of 42 was the highest number of occurrences in a 100-trading day span since October 2010.

For both indices, the currently elevated frequency of giving up intraday gains has been extremely uncommon for the post-financial crisis period. Interestingly enough, though, in the ten years before the financial crisis, these types of periods were a lot more common, especially for the Nasdaq. Could it have anything to do with the fact that the last 12 years have also been one of the more accommodative monetary environments investors have ever experienced? Click here to learn more about Bespoke’s premium financial markets research.