Sep 2, 2022

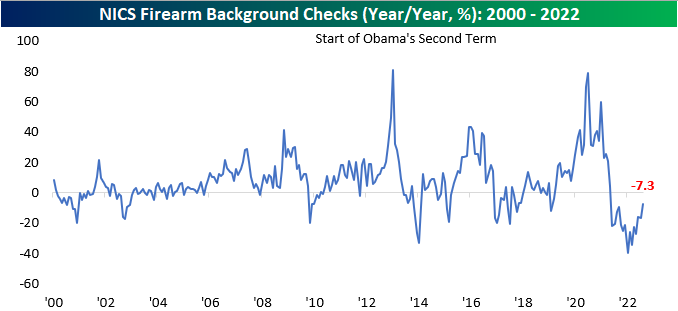

Although not a widely-utilized indicator, we like to look at the number of firearm background checks conducted by the NICS every month to gauge geopolitical uncertainty and volatility within the US. In uncertain times, firearm background checks tend to increase, as individuals increasingly acquire the means to protect themselves in a worst-case scenario. On the contrary, when times are ‘good’, background checks tend to decline. An additional factor that impacts background checks is the outlook on firearms legislation. When the populous fears that they may not be able to purchase certain firearms in the future, they will step up purchases in the short term to ‘stock up’.

At the end of June, the Supreme Court issued a ruling that expanded gun rights, prohibiting certain restrictions on carrying. This may have contributed to the rise in background checks this month, but there are other factors that likely contributed as well. Democrats are now expected to retain control of the Senate according to betting markets, and the Biden administration has proven their ability to enact legislation, so Americans may be worried about further gun control legislation. Additionally, the FBI’s raid of former President Trump’s Mar a Lago home could have added to the perception of domestic political instability. Click here to learn more about Bespoke’s premium stock market research service.

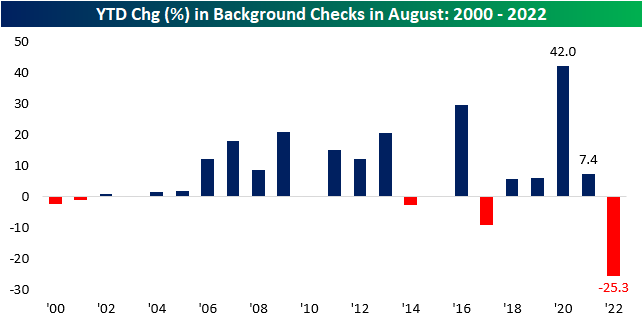

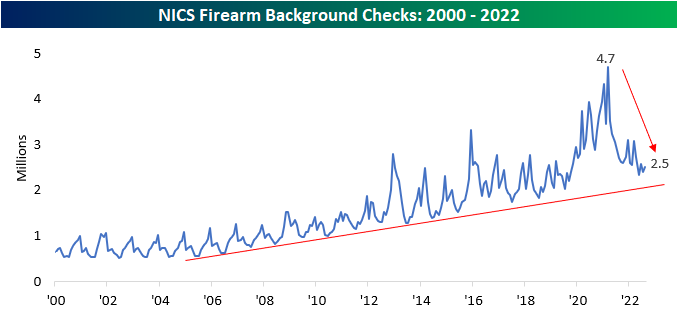

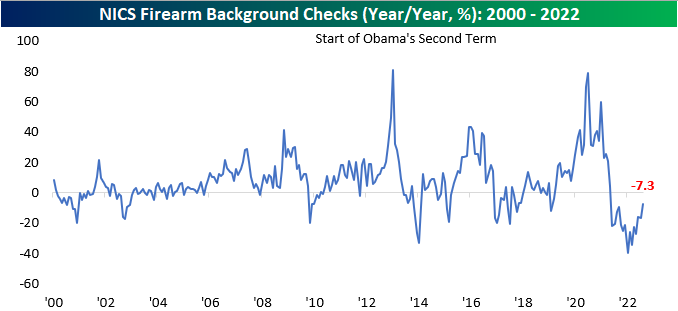

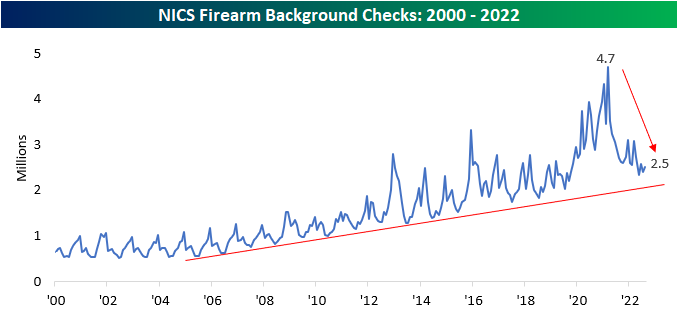

Although background checks rose by 4.7% month over month, they are still down 7.3% y/y. This is largely due to tough comps, as heightened geopolitical uncertainty and volatility in 2020 and 2021 led to extreme increases in background checks. We are now essentially out of the COVID-era, the Russia-Ukraine conflict is no longer top of mind for Americans, and the questioning of 2020 election results appears to be a thing of the past, and a more relaxed state of affairs has led to declines throughout 2022. However, the rate of decline has been leveling out. Through August, the number of background checks on a YTD basis has declined by 25.3%, but the y/y decline of just 7.3% for the month tells us that we have likely already experienced the largest declines in background checks on a percentage basis. It would not be unreasonable to expect checks to rise as we head into midterm elections.

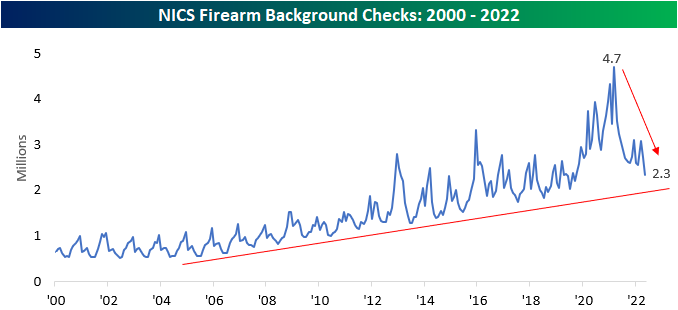

Background checks are still in a longer-term uptrend. At 2.5 million, August’s figure ranks in the top 15.1% of all months since NICS began reporting this data in 1998, and outside of late 2019 through 2021, there were only a few months that the number of checks was higher. Still, they are down 46.3% from the all-time highs seen in March 2021. This may be because demand was pulled forward, but it could also be due to a more normalized domestic situation. Click here to learn more about Bespoke’s premium stock market research service.

Sturm Ruger (RGR) and Smith & Wesson (SWBI) are the two publicly traded stocks with direct exposure to these trends. Historically speaking, the monthly performance of these stocks tends to be correlated to the trailing twelve-month volume of background checks. Although background checks rose month over month, the near-term downtrend persists in checks, which is following through to the performance of these two stocks. Over the last month, RGR and SWBI are down 20.7% and 4.8%, respectively. Click here to learn more about Bespoke’s premium stock market research service.

Aug 2, 2022

Although not a widely-utilized indicator, we like to look at the number of firearm background checks conducted by the NICS every month to gauge geopolitical uncertainty and volatility within the US. In uncertain times, firearm background checks tend to increase, as individuals increasingly acquire the means to protect themselves in a worst-case scenario. On the contrary, when times are ‘good’, background checks tend to decline. An additional factor that impacts background checks is the outlook on firearms legislation. When the populous fears that they may not be able to purchase certain firearms in the future, they will step up purchases in the short term to ‘stock up’. At the end of June, the Supreme Court ruled against the state of New York in regards to carry laws, which could help to expand demand for firearms, at least in that part of the country. Click here to learn more about Bespoke’s premium stock market research service.

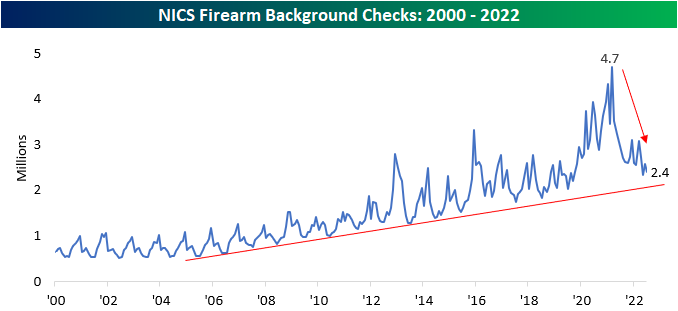

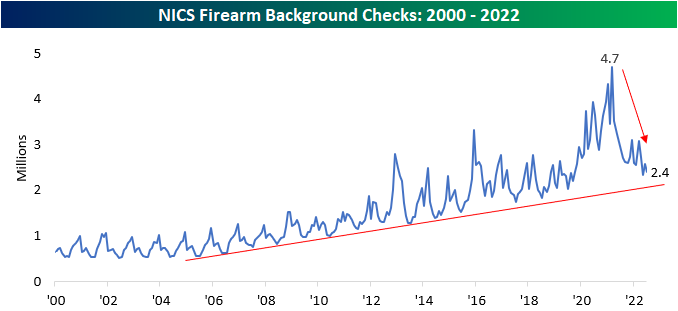

In the month of July, firearm background checks declined by 6.5% sequentially and by 16.6% year over year continuing a recent trend of sharp declines. While checks are down, it followed a period of surging demand in 2020 as geopolitical unrest ran rampant throughout the US (BLM protests, claims of election fraud, COVID lockdowns, etc.). Nonetheless, background checks have declined by 33.9% on a two-year stack.

However, background checks are still in a longer-term uptrend. At 2.4 million, July’s background checks rank in the 16.2% of all months since NICS began reporting this data in 1998, and outside of late 2019 and into early 2021, there were only a few months that the number of checks was higher. Still, they are down 48.8% from the all-time high in March 2021. This may be because demand was pulled forward, but it could also be due to a more normalized domestic situation.

Through July, the 22.4% YTD decline in background checks in July versus December has actually been smaller than average. Background checks in July are practically always lower than in December, and the only year where that wasn’t the case was in 2020 when the country was gripped by riots in cities nationwide. Going back to 2000, background checks in July were typically more than a third (-33.8%) lower than in December. Click here to learn more about Bespoke’s premium stock market research service.

There are two publicly traded stocks directly exposed to these trends: Sturm Ruger (RGR) and Smith & Wesson (SWBI). The monthly performance of these two stocks tends to be highly correlated to trailing twelve-month NCIS background checks, as this is a clear read into the demand picture for these two companies. Just like background checks in general, both stocks are still in sustained downtrends. Click here to learn more about Bespoke’s premium stock market research service.

Jul 5, 2022

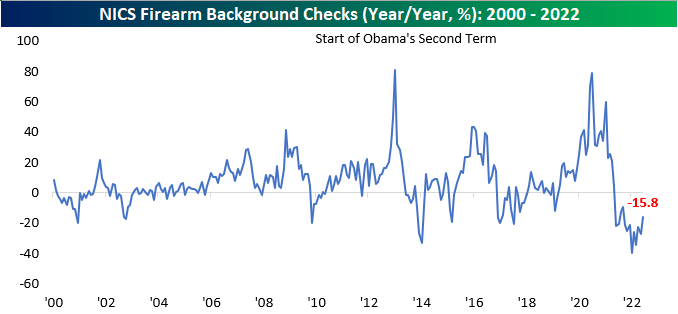

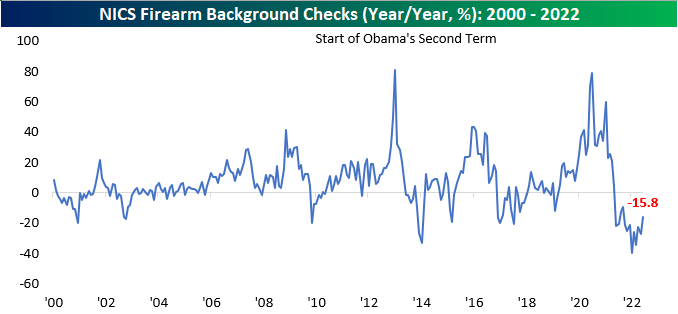

We track the number of NICS firearm background checks on a regular basis as it often provides interesting insights on the mood of Americans or the direction of political winds regarding gun control legislation. In times of higher volatility, uncertainty, or concerns that lawmakers in Washington will enact stricter legislation for firearms, purchases tend to rise. On the other hand, in periods of stability, background checks tend to fall. Ever since June of last year, background checks have been declining on a y/y basis, but the y/y decline moderated in June. Although still down 15.8% compared to last year, purchases moved higher sequentially for the first time in three months. Click here to learn more about Bespoke’s premium stock market research service.

Although checks moved higher month over month, they are likely to rise even further in July due to the Supreme Court’s recent ruling against the state of New York. This case expands the right to carry, and will likely increase firearm purchases in some of the most restrictive cities, such as New York and Los Angeles. In June, background checks rose by over 230K to reach 2.6 million. Although checks are in a near-term down-trend following the COVID spike, the longer-term uptrend is still very much intact.

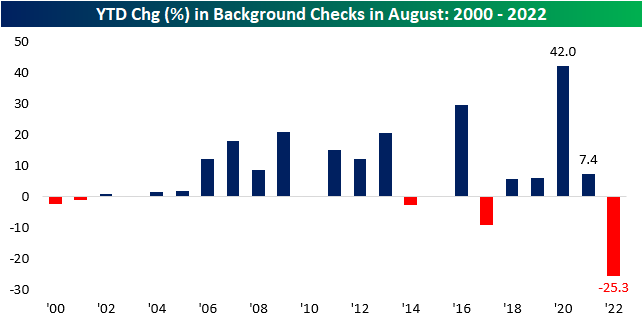

On a YTD basis, background checks have declined at the fastest rate on record. This is largely due to elevated comps, as 2021 saw background checks near record levels due to a growing political divide, COVID lockdowns, and fears over legislation with Democrats in full control of Washington D.C.

Although background checks moved higher month over month, Sturm Ruger (RGR) and Smith and Wesson (SWBI) hit 52-week lows in June. All-in-all, RGR traded 6.3% lower in June, and SWBI declined 15.2%. The stocks have been weighed down by slowing sales over the last couple of quarters, increased legal risk associated with firearm manufacturer liability, and the pull of the overall market tide. Both these stocks are still in sustained downtrends, and even after initially moving higher following the Supreme Court decision, both stocks have essentially come full circle. Click here to learn more about Bespoke’s premium stock market research service.

Jun 2, 2022

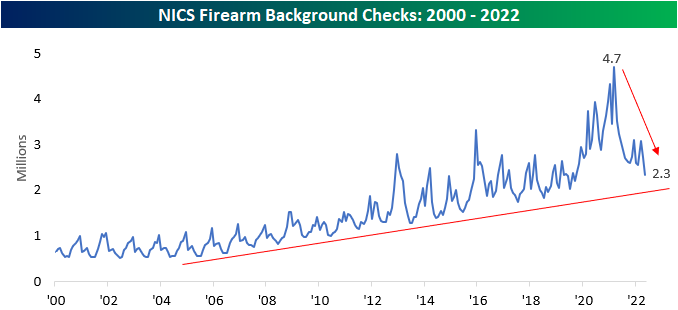

Although not a widely accepted indicator, we like to look at the number of NICS firearm background checks as a barometer for fear and geopolitical volatility for the United States. In uncertain times (like the beginning of government-imposed COVID lockdowns), background checks tend to spike. Inversely, when times are good, background checks tend to decline. An additional causal factor of background check spikes is the outlook on gun policy. When the public feels as if gun policies are going to become stricter, Americans tend to rush to purchase firearms, which is evidenced by the record y/y increase after President Obama was reelected. Recently, several mass shootings have brought gun control regulations back into the news cycle, so one would expect to see background checks tick higher. Granted, much of this rhetoric really picked up towards the end of the month, so any effects will likely be seen in June (or later) numbers. Nonetheless, background checks declined for the second consecutive month after briefly spiking earlier this year. In May, checks declined by 27.4% y/y to just 2.3 million.

On a YTD basis, background checks have fallen by 30.7%, the largest first five-month decline since at least 2000.

Although the decline is certainly significant, monthly background checks are still comfortably above their longer-term trend line. To summarize, although checks are down significantly y/y, the long-term uptrend that was in place prior to the COVID surge is still largely intact.

Although we like to think that the market is forward-looking, the price action of gun manufacturer Sturm Ruger (RGR) tends to be highly correlated with the number of background checks over the prior twelve months. Since the start of 2000, RGR’s end-of-month close and the trailing twelve-month background check figure has held a correlation coefficient of 0.90, a near-perfect positive relationship. Therefore, a reversal in the downside momentum of background checks as Americans step up purchases in advance of perceived or actual new regulations in gun ownership would leave room for upside in RGR.

Looking at the last twelve-month price charts of two firearm manufacturers, a relatively similar pattern emerges. RGR and Smith and Wesson (SWBI) are both in sustained downtrends. However, both have seen consolidation as of late, and SWBI is even testing its trendline. The decline has been warranted due to the significant decrease in background checks (and in turn firearm purchases), but a reversal higher in checks would likely provide a tailwind for both companies. Click here to become a Bespoke premium member today!