Aug 15, 2022

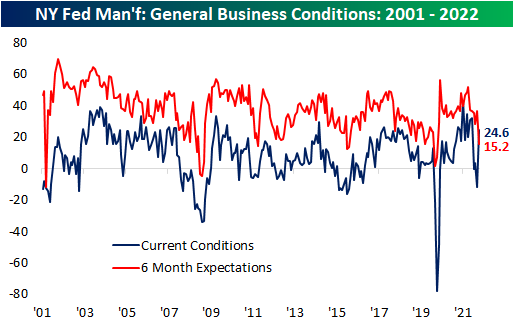

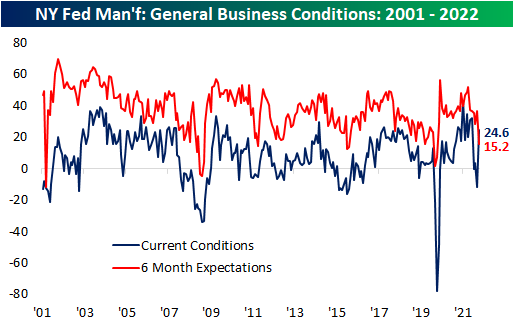

The first regional Fed manufacturing reading for the month of August which came from the NY Fed showed a massive slowdown in general business conditions. The headline number was expected to fall but remain positive at 5. Instead, the index plummeted all the way down to a contractionary reading of -31.3. That is the fourth lowest reading on record, the lowest reading since May 2020, and the largest one-month decline since April 2020. In other words, New York area manufacturers reported rapid deterioration in business conditions in the first half of August.

Breadth was equally horrendous. The sole index that managed to move higher month over month was Prices Received while declines in all of the others resulted in all but four categories falling into contraction territory. Future expectations are only slightly more positive than current conditions, albeit these too are seeing readings in the bottom few percentiles of their historical ranges even after significant moves to the upside month over month.

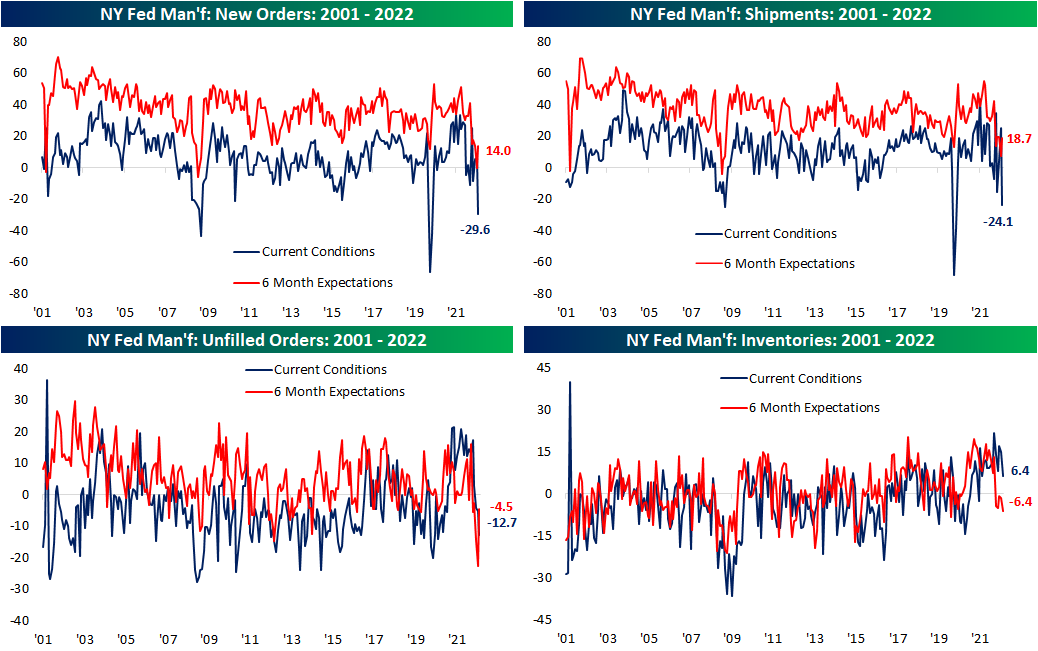

The most pronounced drop of any category was New Orders and Shipments with month-over-month declines of 35.8 points and 49.4 points, respectively. For both, that was the largest month-over-month drop on record with both indices now in the bottom 1% of all readings as a result. Unfilled Orders fell deeper into contraction with a less dramatic 7.5 point decline month over month.

Expectations were the inverse of that story. New Orders, Shipments, and Unfilled Orders all saw upper decile monthly increases with Unfilled Orders’ 18.1 point rise the second largest on record behind May 2010.

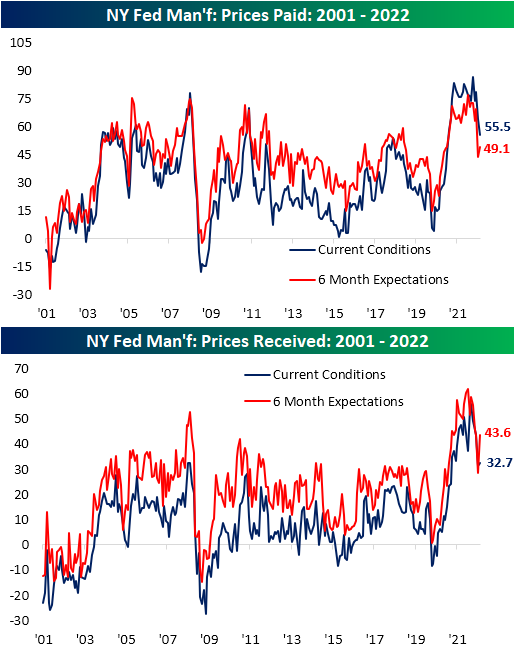

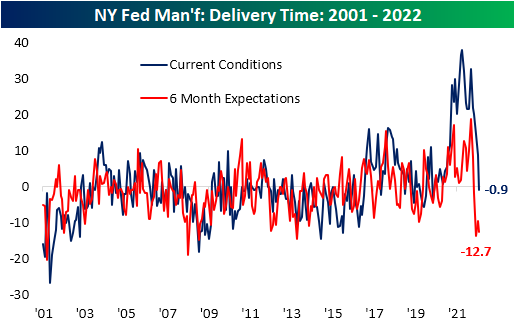

The past couple of months have seen plenty of evidence that supply chain stress has begun to ease, and this month’s report from the NY Fed added yet another data point of evidence. For the first time since May 2020, the Delivery Times index fell into contraction meaning responding firms reported a decline in how long it took for products to reach their destinations. That trend is also expected to continue as six-month expectations continue to hover around the low end of the historical range.

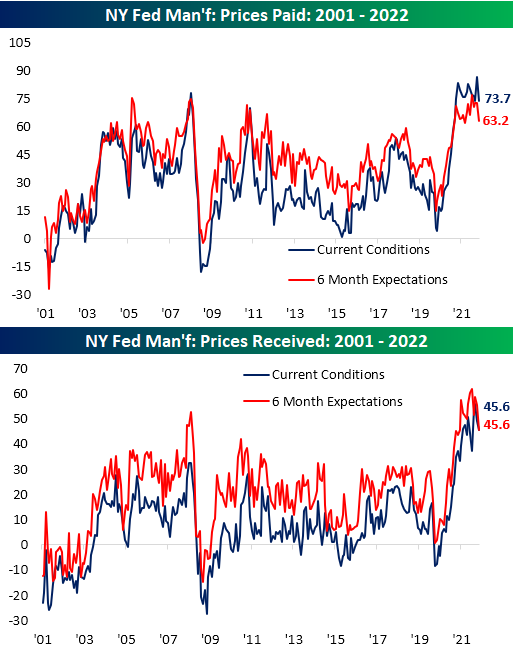

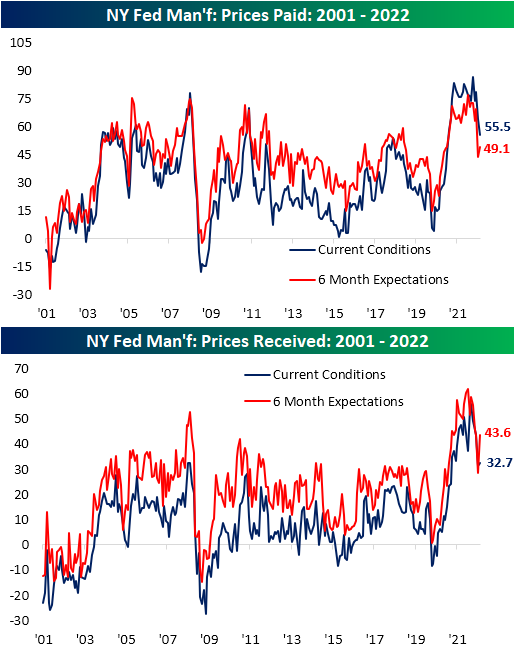

Alongside supply chain pressures, inflation pressures have likewise shown signs of easing. The Prices Paid and Prices Received index have both peaked and come in well off of prior highs of the past year indicating fewer firms are paying suppliers more or raising their prices.

Across manufacturing reports of late, employment metrics have been somewhat of a bright spot as they have managed to hold up in spite of signs of slowing demand. In August, employment did not stand out as strongly. On net, firms continue to increase their number of employees but at the slowest rate since October 2020. Meanwhile, the Average Workweek contracted to an extent not seen since the first few months of the pandemic, late 2015, during the Financial Crisis, or in the aftermath of 9/11. Meanwhile, companies are beginning to pull back on capital spending at a rapid rate as indices tracking plans for Technology Spending and Capital Expenditure have fallen sharply. For the latter, the two-month decline is now the fifth worst of any period on record. Click here to learn more about Bespoke’s premium stock market research service.

May 16, 2022

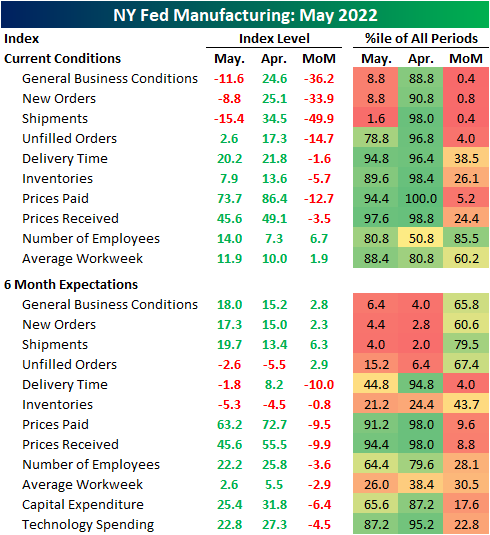

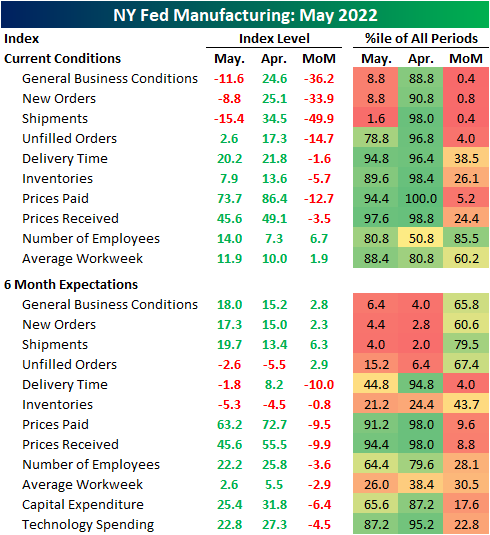

May’s first reading on regional manufacturing activity out of New York showed significant deterioration. The New York Fed’s Empire State Manufacturing survey’s headline index dropped from a solid reading of 24.6 last month down to -11.6 in May. That is only slightly above the low from two months ago that had marked the first significant contraction in activity since the spring of 2020.

Not only are General Business Conditions back into contractionary territory, but the double-digit negative reading sits in the bottom decile of all months on record going back to the start of the index in 2001. That compares to last month’s reading which was just shy of the top decile. Given the total reversal within the historical range, the month-over-month decline of 36.2 points is now the second-largest one-month drop on record behind the 56.7 point decline in April 2020.

Only New Orders and Shipments fell enough to reach contractionary levels this month, but most other categories also saw large month-over-month declines. Expectations similarly saw broad declines, however, the categories that saw the biggest deteriorations in current conditions (General Business Conditions, New Orders, and Shipments) saw improvements in six-month expectations.

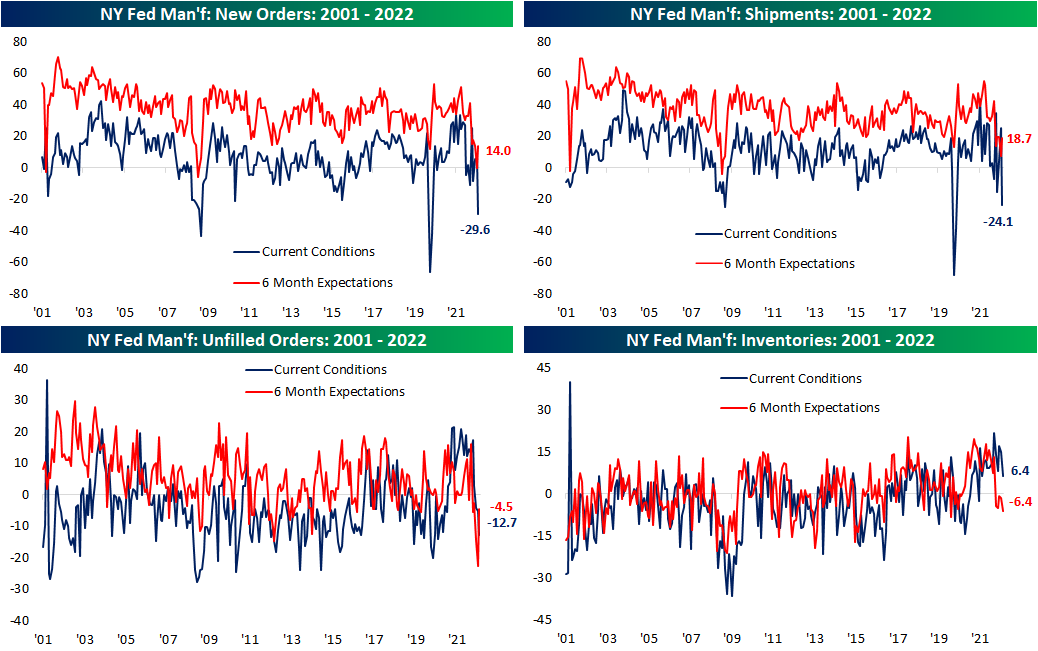

As previously mentioned, the most shocking declines were in demand-related categories, namely New Orders and Shipments. These two indices fell by 33.9 and 49.9 points, respectively. For New Orders, that was the third-largest decline on record outside of the 56-point drop in April 2020 and a 43.1-point decline in the wake of September 11, 2001. The only larger decline in Shipments happened, again, in April 2020. Unfilled Orders also fell dramatically, though the month-over-month decline was not as close to a record, and the actual level of the index is still relatively elevated in the top quartile of its historical range. Although more New York area firms reported declines in new orders and shipments, expectations were each higher month-over-month following sharp declines leading into this month’s report.

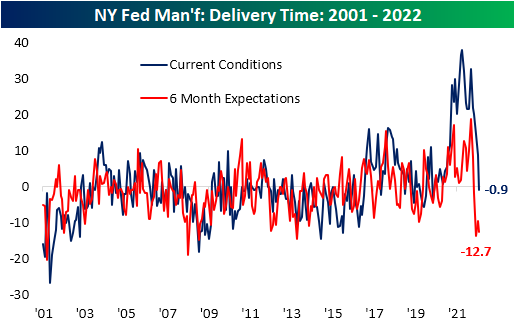

Perhaps in part due to that slow down in demand, Delivery Times continue to decelerate with the index dropping another 1.6 points. That follows a much larger double-digit decline in April. In what could be either a positive sign as a result of finally alleviated supply chains or a negative sign given slowing demand, responding firms also reported that they expect delivery times to finally decline in six months. That was the first negative reading in expectations since October 2020.

Additionally, inflationary pressures appear to be easing as both indices for Prices Paid and Received declined across current conditions and 6-month expectations. Those declines are only small dents in what have been extremely strong runs over the past two years.

Perhaps the only silver lining in this month’s report was in regards to employment. New York area firms accelerated both net hiring and the average workweek. Again though, expectations were less optimistic as those indices continue to roll over alongside plans for Technology Spending and Capital Expenditures. In other words, the employment situation may have improved in May, but that is not expected to improve dramatically in the months ahead as demand has weakened. Click here to learn more about Bespoke’s premium stock market research service.

Apr 18, 2022

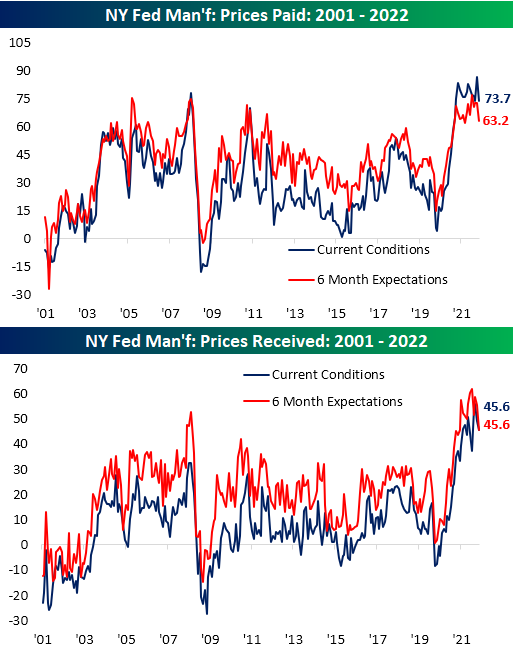

Even though markets were shuttered on Friday for the Good Friday holiday, the New York Federal Reserve branch released the latest update on their monthly manufacturing report with astounding results. Heading into the release, the March reading had shown a significant decline back into negative territory indicating the region’s manufacturers reported contractionary overall activity. In April, activity rebounded substantially with the headline number rising 36.4 points all the way up to 24.6. That set the second-largest month-over-month increase on record behind the 48.3-point jump back in June 2020. In terms of the level of the index, it brought it from a lower decile reading to levels just shy of the upper decile of its historical range going back to the start of the survey in the early 2000s.

Although current conditions were impressive, we would caution that expectations soured in an equally dramatic fashion. The six-month expectation index dropped 21.4 points to 15.2. That was only 0.3 points shy of the second-largest decline on record (21.7 point decline in March 2020) but was far better than the 61 point drop after 9/11 in the early days of the survey.

The move higher in General Business Conditions was thanks to big turnarounds in New Orders and Shipments but breadth elsewhere in the report was not as positive. Of the seven other categories, four declined month over month with three of those declines ranking in the bottom decile of each one’s respective histories. Again, expectations were much more worrisome with large declines across categories and readings in the bottom few percentiles for things like New Orders, Shipments, and Unfilled Orders. Overall, the report showed solid improvements in conditions but how sustainable those improvements will be in the coming months could come into question.

The biggest contributors to the increase in the headline reading were improvements in New Orders and Shipments. Each one crossed back into the top decile of their historical ranges on some of the biggest month-over-month increases on record outside of the spring of 2020. Unfilled Orders were also higher, though, unlike New Orders or Shipments, the index is coming off of already elevated levels. Given the strength in demand and shipments, inventories grew at a slower rate. Expectations were much less optimistic as across all four of these categories there were near-record declines. Unfilled Orders and Inventories even fell into contraction. That means that although New York area firms witnessed solid improvement in business conditions in April, the positive changes are not expected to keep pace or continue in the months ahead.

One likely reason for the big improvements this month was the easing of supply chain stress. The index of Delivery Times fell back down to the low end of its elevated pandemic range in April (higher readings indicate products are taking longer to reach their destination).

Those improvements in current conditions did not filter through to employment. While the region’s firms are on net still increasing hiring, the index for Number of Employees fell to the lowest level since October 2020 after two months of the largest MoM declines since the onset of the pandemic. As hiring decelerates, the average workweek did tick up solidly. That index rose 6.5 points to 10. Click here to view Bespoke’s premium membership options.