Apr 21, 2022

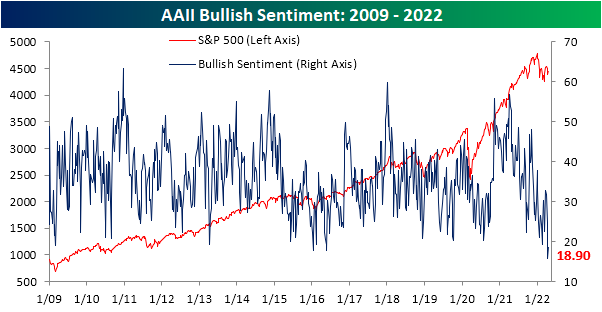

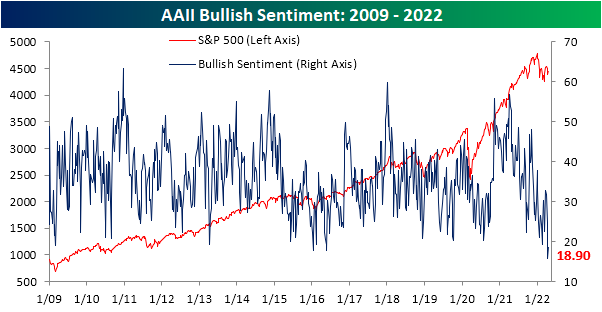

The S&P 500 is once again fighting to gain back some lost ground in the past week. That move higher has been able to lift sentiment slightly, but overall tones remain historically pessimistic. The American Association of Individual Investors weekly sentiment survey showed bulls crawl back up to 18.9% from a historic low of 15.8% reached last week. With less than a fifth of respondents bullish, this remains in the bottom 2% of all weeks on record.

Of course, with bullish sentiment historically depressed, bearish sentiment is historically elevated at 43.9%. That is down from much higher readings of the past year that eclipsed 50% but remains just off the upper decile of its historical range.

As such, bears continue to outnumber bulls by 25 full percentage points. Given the contrarian nature of sentiment indicators, that would still be taken as a positive sign for forward performance of equities as we highlighted on page 6 of last week’s Bespoke Report.

Taking into account other sentiment indicators shows a similar picture. The NAAIM Exposure Index currently sits at 74.05 which is off of the low of 30 from early March while the Investors Intelligence survey saw the first negative bull-bear spread reading in a month this week. Combining these readings, our Sentiment Composite has come off the lows but is still at one of the weaker readings of the past decade. Click here to view Bespoke’s premium membership options.

Apr 20, 2022

US Treasury yields have continued to move higher with mortgage rates rising in tow (we explained some key distinguishing characteristics of mortgages versus Treasuries in last night’s Closer). Bankrate.com’s national average for a 30-year fixed rate mortgage has now eclipsed 5.25% in the past week which is an over 2 percentage point increase year over year. Since the start of this series on mortgage rates going back to the late 1990s, that is by far the largest year-over-year increase on record.

Higher rates mean less attractive affordability so purchase applications have continued to fall per the latest Mortgage Bankers Association data. Seasonally adjusted purchase applications dropped 3% this week and are hovering just above the February lows.

The spring is often the hottest time of the year for housing activity. As shown below, the few weeks surrounding the current one have often marked the annual high (blue dots in chart below) in non-seasonally adjusted purchase applications over the past decade. This year that might not be the case. Activity has been running below that of the prior year and has plateaued more recently as mortgage rates have taken off. At the moment, this year’s high was set a little over a month ago in the second week of March. While a new high for the year is still within tangible reach from current levels—meaning upcoming weeks could still very well experience an uptick to a new high—this year has the potential to see a much earlier than usual high in mortgage purchases.

Refinance applications meanwhile are far weaker with unrelenting declines recently. This week marked the sixth week over week decline in a row leaving the MBA’s refinance index at the lowest level since February 2019. Click here to learn more about Bespoke’s premium stock market research service.

Apr 19, 2022

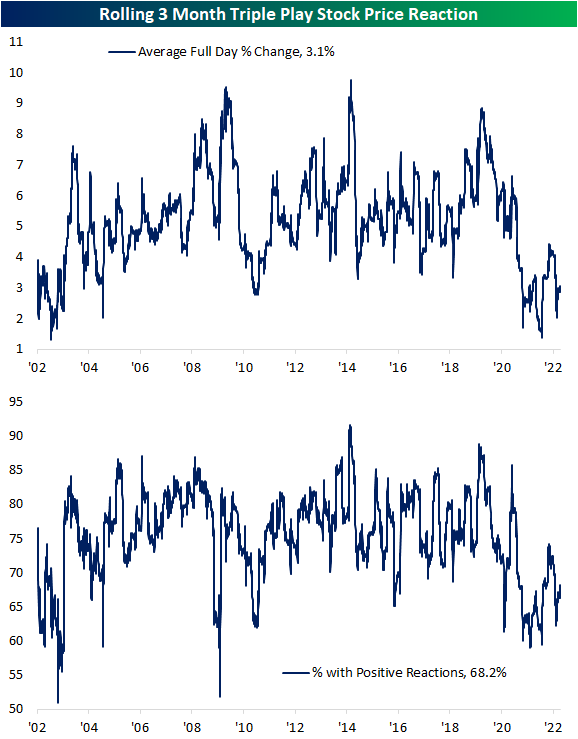

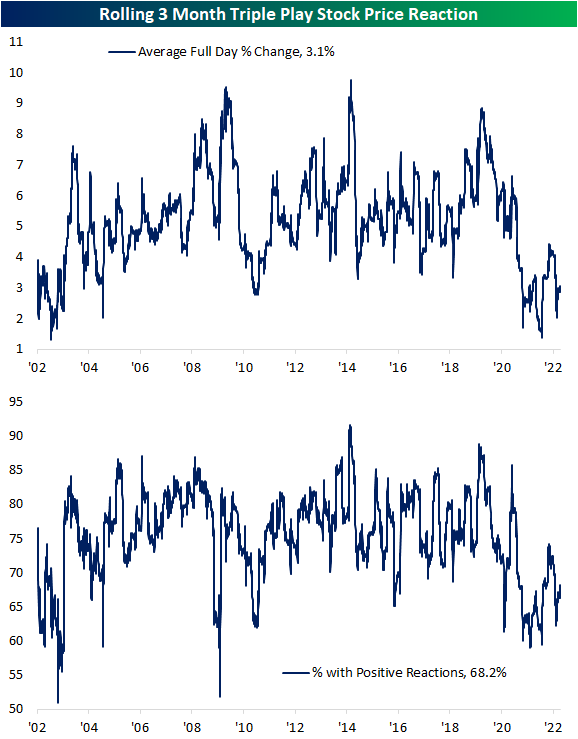

An earnings triple play is when a company beats analyst earnings estimates, beats analyst sales estimates, and also raises guidance. We consider these the gold standard for earnings as these type of results show fundamental strength and are often met with higher share prices. Using data from our Earnings Explorer database, the pandemic years have seen an explosion of triple plays as analyst estimates were too pessimistic/companies rebounded more solidly than expected. As shown below, at the highs last fall, a record of more than 18% of companies reporting earnings (on a rolling 3 month basis) reported a triple play. Over the past several months, though, that reading has pulled back considerably and today is only at 10.5%. While down from its highs, a reading of 10.5% is still elevated relative to history.

As we have noted in the past, when triple plays have been more commonplace, the market response to individual stocks reporting triple plays has been less cheerful. When the rate at which triple plays exploded earlier in the pandemic, the average full-day change on earnings days tanked to some of the weakest in the history of our data. At the low last July, the average stock that reported a triple play over the prior three months only gained ~1.5% on its earnings reaction day. For all earnings triple plays since 2002, the average one-day share price response has been roughly +5%. Recently, stock price reactions to triple plays have been improving with an average gain of 3.1% over the past three months and a little better than two-thirds of triple plays moving higher. As with the triple play rate, that is not fully back to pre-pandemic levels, but it is trending in that direction. With the number of triple plays expected to be light this season, the stocks that do manage to report them should start to be rewarded again. Click here to learn more about Bespoke’s premium stock market research service.

Apr 18, 2022

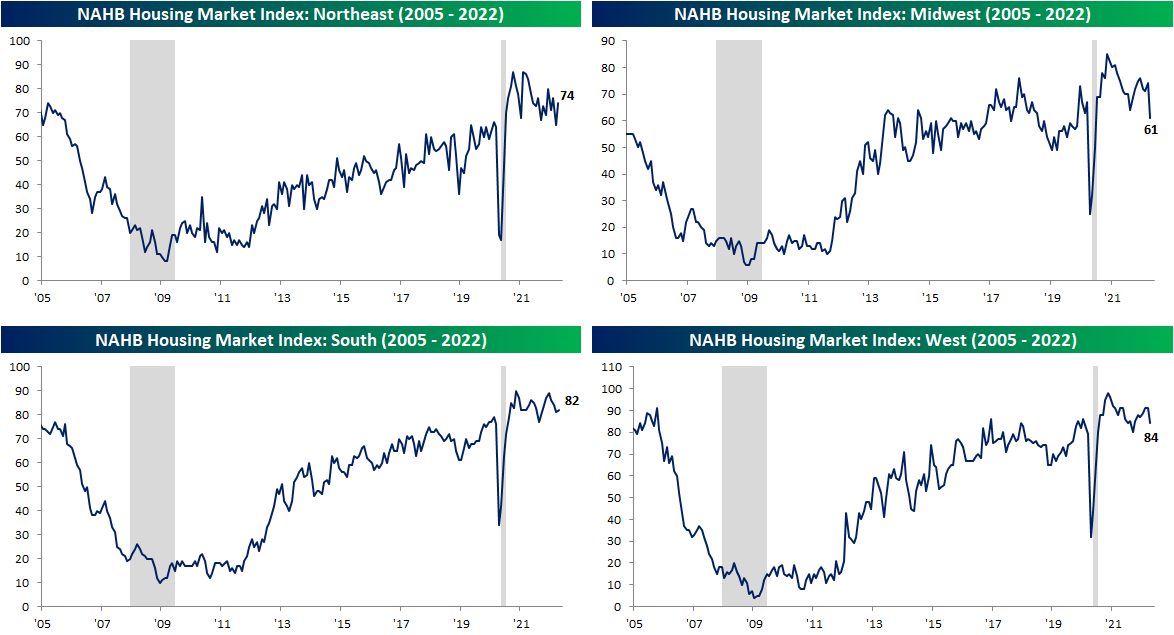

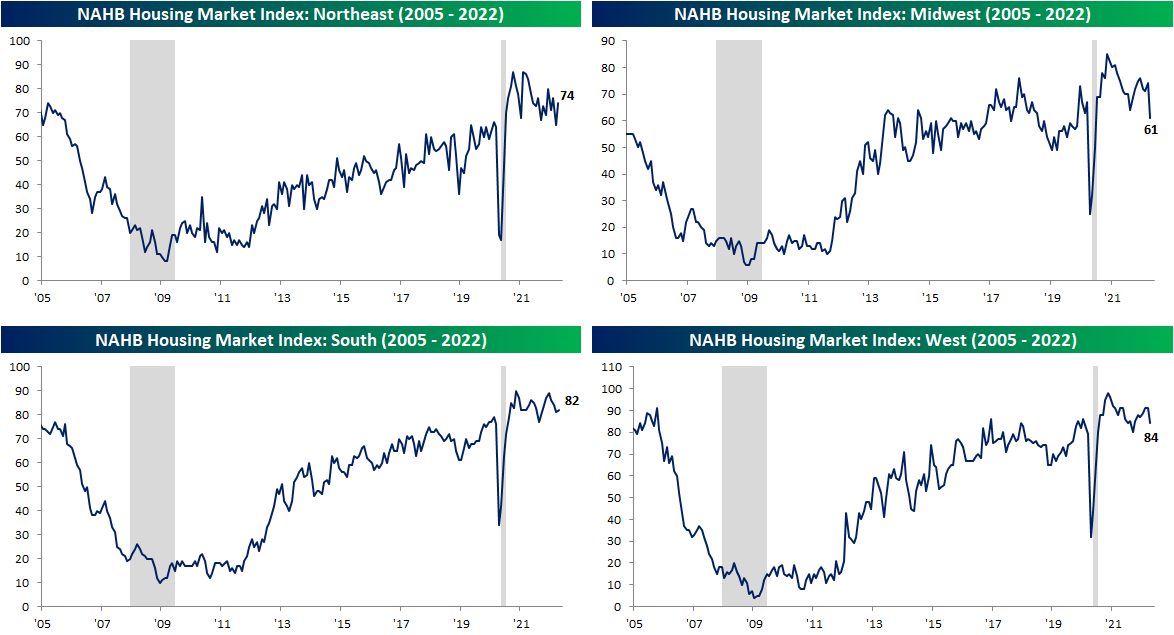

As the national average for a 30-year fixed rate mortgage has risen to and remained above 5%, homebuilder sentiment has been reversing its pandemic gains. The NAHB’s monthly homebuilder sentiment index dropped 2 points in April to 77. That was the fourth decline in a row bringing the headline number to the weakest reading since September of last year. That is also now only one point above the December 2019 pre-pandemic high.

The decline this month was mostly driven by a decrease in traffic. That index dropped 6 points to 66 which is the weakest level and the biggest one-month decline since last August. Meanwhile, present sales dropped 2 points for the second month in a row. On the bright side, future sales actually ticked up 3 points to snap a three-month losing streak. That being said, the current level of this index is much less elevated within its historical range compared to the others.

Geographically, there are some large divergences in homebuilder sentiment. For starters, the Northeast showed the most impressive improvement with the index rising 9 points month over month. Whereas last month it was the lowest within its respective historical range, today it is the most elevated. The South also saw an improvement as this region has perhaps been the most stable across the pandemic years. The West and Midwest were other stories entirely in April. The Midwest experienced its second-largest decline on record behind the 42 point drop in April 2020 and is now at the lowest level since June 2020. Meanwhile, the West fell 7 points. That also was the biggest drop in two years though the index saw an even lower reading as recently as last September.

As homebuilder sentiment drops, so too have homebuilder stocks. The iShares US Home Construction ETF (ITB) — which tracks the space — has been falling sharply since peaking around the turn of the year. Click here to view Bespoke’s premium membership options.

Apr 18, 2022

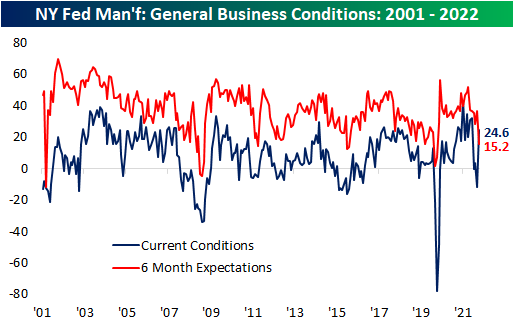

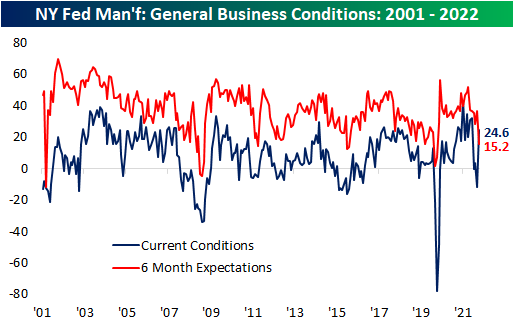

Even though markets were shuttered on Friday for the Good Friday holiday, the New York Federal Reserve branch released the latest update on their monthly manufacturing report with astounding results. Heading into the release, the March reading had shown a significant decline back into negative territory indicating the region’s manufacturers reported contractionary overall activity. In April, activity rebounded substantially with the headline number rising 36.4 points all the way up to 24.6. That set the second-largest month-over-month increase on record behind the 48.3-point jump back in June 2020. In terms of the level of the index, it brought it from a lower decile reading to levels just shy of the upper decile of its historical range going back to the start of the survey in the early 2000s.

Although current conditions were impressive, we would caution that expectations soured in an equally dramatic fashion. The six-month expectation index dropped 21.4 points to 15.2. That was only 0.3 points shy of the second-largest decline on record (21.7 point decline in March 2020) but was far better than the 61 point drop after 9/11 in the early days of the survey.

The move higher in General Business Conditions was thanks to big turnarounds in New Orders and Shipments but breadth elsewhere in the report was not as positive. Of the seven other categories, four declined month over month with three of those declines ranking in the bottom decile of each one’s respective histories. Again, expectations were much more worrisome with large declines across categories and readings in the bottom few percentiles for things like New Orders, Shipments, and Unfilled Orders. Overall, the report showed solid improvements in conditions but how sustainable those improvements will be in the coming months could come into question.

The biggest contributors to the increase in the headline reading were improvements in New Orders and Shipments. Each one crossed back into the top decile of their historical ranges on some of the biggest month-over-month increases on record outside of the spring of 2020. Unfilled Orders were also higher, though, unlike New Orders or Shipments, the index is coming off of already elevated levels. Given the strength in demand and shipments, inventories grew at a slower rate. Expectations were much less optimistic as across all four of these categories there were near-record declines. Unfilled Orders and Inventories even fell into contraction. That means that although New York area firms witnessed solid improvement in business conditions in April, the positive changes are not expected to keep pace or continue in the months ahead.

One likely reason for the big improvements this month was the easing of supply chain stress. The index of Delivery Times fell back down to the low end of its elevated pandemic range in April (higher readings indicate products are taking longer to reach their destination).

Those improvements in current conditions did not filter through to employment. While the region’s firms are on net still increasing hiring, the index for Number of Employees fell to the lowest level since October 2020 after two months of the largest MoM declines since the onset of the pandemic. As hiring decelerates, the average workweek did tick up solidly. That index rose 6.5 points to 10. Click here to view Bespoke’s premium membership options.