Apr 18, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

Bespoke’s Quote of the Day: “The difference between death and taxes is death doesn’t get worse every time Congress meets.” – Will Rogers

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Below is a table we highlight each year showing the S&P 500’s performance in the weeks leading up to and the weeks immediately following Tax Day. As shown, over the last 20+ years, the weeks before Tax Day have been much weaker for the market than the weeks after. This year has been no different thus far with the S&P falling more than 3% in the two weeks leading up to Tax Day. Now we just need the trend of gains in the two weeks following Tax Day to hold as well!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Apr 14, 2022

After coming in at one of the lowest levels on record last week, seasonally adjusted initial jobless claims bounced up to 185K this week. While higher, jobless claims are still historically strong having spent a record eight straight weeks with sub-200K readings.

As we noted last week, seasonal adjustments overstated the strength of claims as unadjusted claims experienced a seasonally unusual decline. This week was more normal from a seasonal perspective with initial claims rising from 194.4K to 222.5K and the first reading above 200K since the week of March 11. As shown in the second chart below, the current week of the year has consistently seen claims move higher week over week marking a temporary high before resuming the seasonal downtrend through the next couple of months. That means the slight uptick this month is likely mostly seasonal and far from any sort of a change in trend.

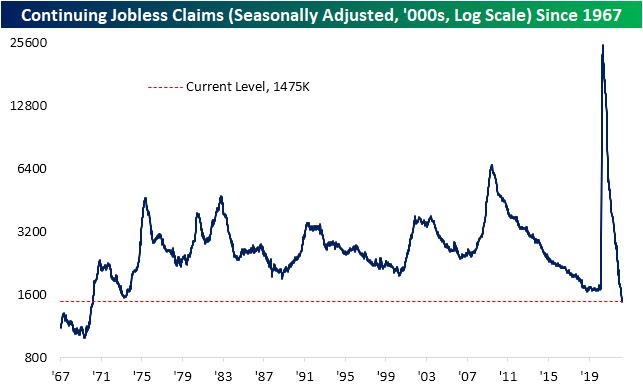

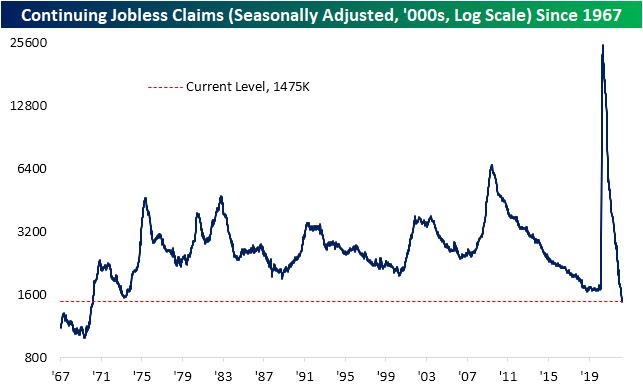

Lagged one week to initial claims, continuing jobless claims fell to a new low of 1.475 million. That is the lowest level of claims since March 1970. Click here to view Bespoke’s premium membership options.

Apr 14, 2022

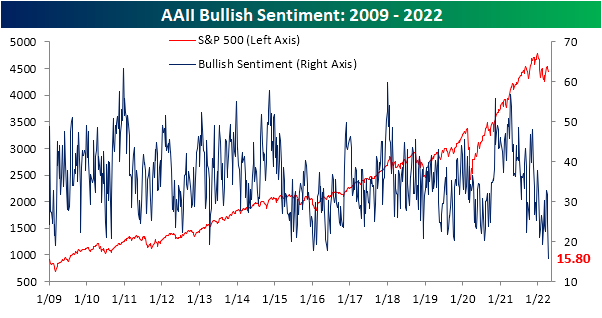

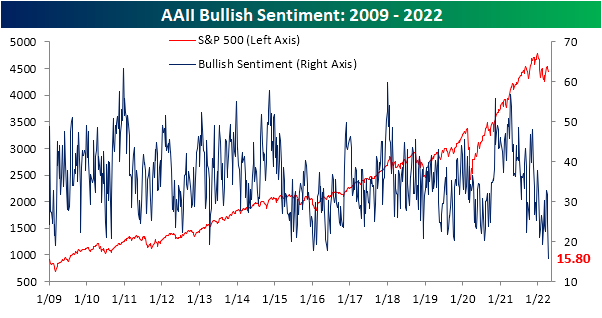

Heading into this week, bullish sentiment on the part of individual investors, measured by the weekly AAII survey, was already depressed with less than a quarter of respondents reporting optimistic sentiment. One week later with the S&P 500 continuing to move lower and a couple of hot, but not exactly unexpected, inflation readings in the interim, bullish sentiment has collapsed another 8.9 percentage points to the lowest level since the week of September 3rd, 1992. That’s right, bullish investor sentiment never got this low even at the depths of the pandemic, during the Global Financial Crisis, or during the Dot Com bubble burst. This week marks one of only 35 weeks since the survey began in 1987 that bullish sentiment was below 20%; the most recent being only back in February when it fell to 19.2%.

As could be expected, the huge drop and the historic low in bullish sentiment was met with a coincident increase in bearish sentiment. Bearish sentiment rose 7 percentage points to 48.4%. While that is an elevated reading, there have been a couple of even more elevated readings as recently as March 17 (49.8%), February 24 (53.7%), and January 27 (52.9%).

Even though bearish sentiment is not at a new high, the still-elevated reading on pessimism paired with the extremely depressed reading on bullishness has resulted in the bull-bear spread to fall much deeper into negative territory. Only two weeks ago, bulls actually outnumbered bears. Today, bears outnumber bulls by 32.6 percentage points. The 37 point drop since that positive reading marks the largest two-week decline in the bull-bear spread since April 2013. It is also the lowest level of the spread since that same period.

While bearish sentiment picked up, not all of those gains came from the decline in bulls. Neutral sentiment was slightly higher rising 1.8 percentage points to 35.7%. That is a few percentage points above the historical average, but it is also well below the multiple highs of the past year. You can read Bespoke’s full analysis of investor sentiment and its contrarian aspects with a two-week trial to Bespoke Premium.

Apr 13, 2022

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we highlight a fixed income investment that has performed beautifully amid extremely high inflation.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Apr 12, 2022

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin tonight with a look at market pricing for policy rates before diving into today’s update of CPI data and some reasons to believe inflation has peaked. We then update the latest data on government receipts and outlays. We round out tonight’s note with a recap of the historically bad reopening of 10 year notes.

If you’re wondering what the Closer is like each day, click here or on the thumbnail image below for a sample of a few pages from the report.

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!