May 19, 2022

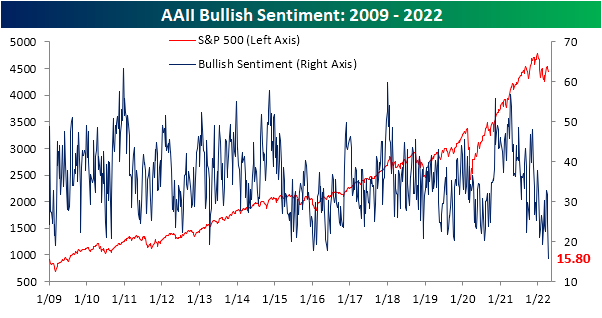

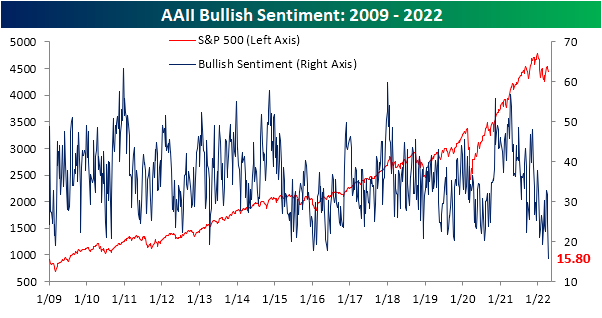

Depending on when a respondent reported their answers to the weekly AAII sentiment survey, they could have been justified in giving either bullish or bearish. From last Thursday’s close to Tuesday, the S&P 500 rallied a little more than 4% but anyone reporting yesterday would have reflected the index giving back all of those gains in a single session. Given that back and forth of equities, sentiment remains little changed. Around a quarter of respondents remain in the bullish camp as has now been the case for three weeks in a row. Albeit a historically low reading, it is a major improvement from readings in the mid-teens only one month ago.

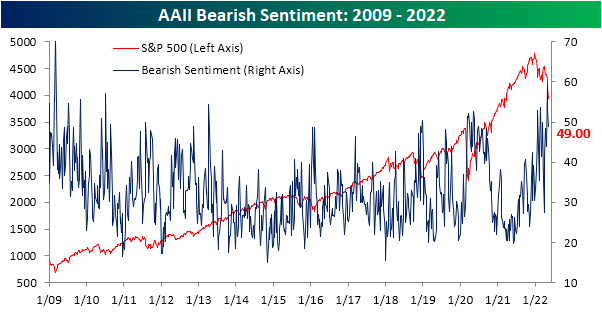

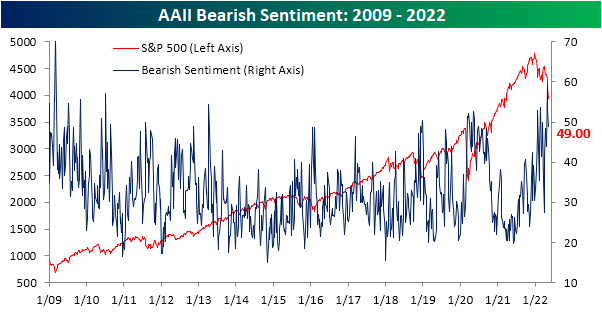

Bearish sentiment meanwhile ticked higher and back above 50% this week. As with bullish sentiment, that is an overwhelmingly pessimistic reading even if it is less extreme than last month when it closed in on a 60% reading.

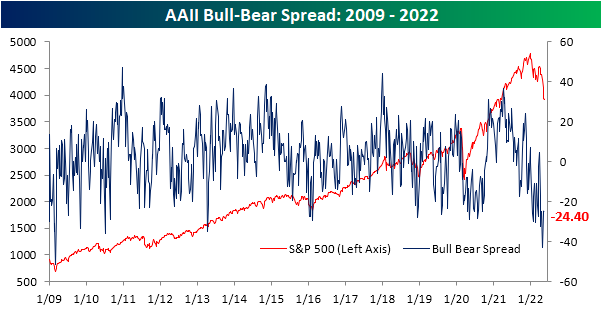

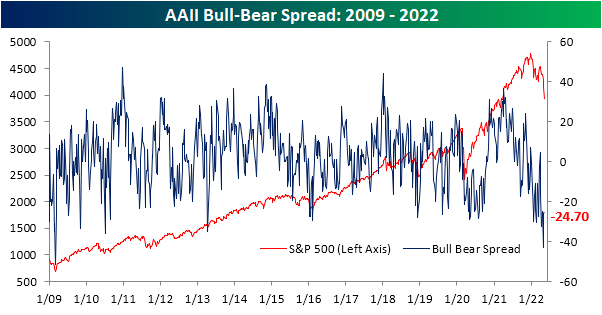

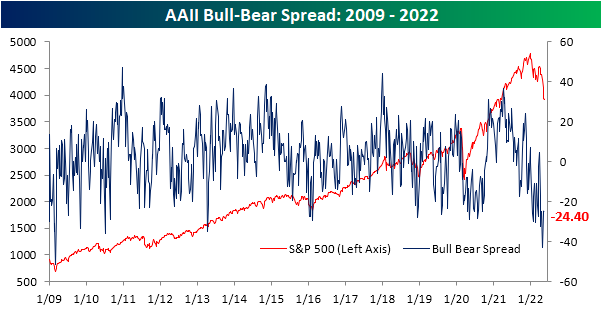

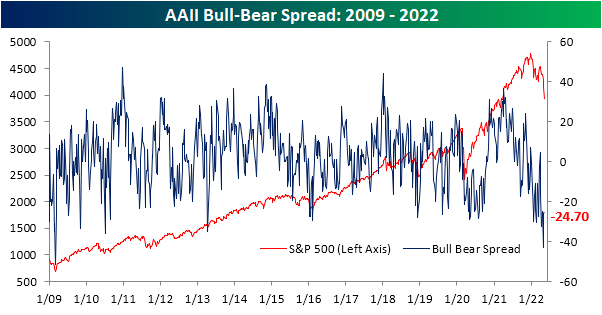

The bull-bear spread in turn was marginally improved rising from -24.7 to -24.4 indicating sentiment stays heavily slated toward pessimism.

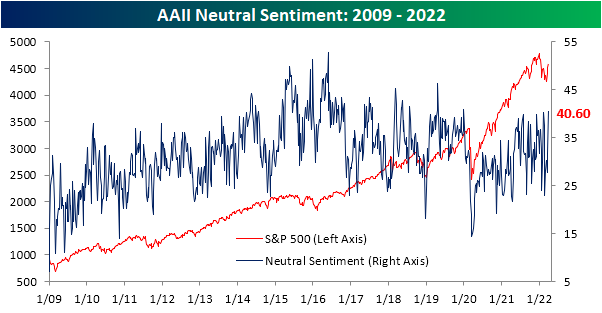

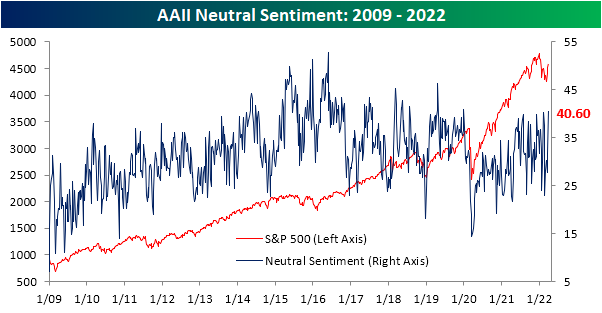

With both bearish and bullish sentiment gaining share this week, the percentage of respondents reporting neutral sentiment fell back below 25% to 23.6%. Click here to learn more about Bespoke’s premium stock market research service.

May 12, 2022

The past week may have seen the S&P 500 and other major US indices breach to fresh lows on steep declines that are nearing bear market territory, but the AAII sentiment survey has not fallen to its own lows as might have been expected. Bullish sentiment fell back below 25% this week but is still several percentage points above the lows in the teens from only a few weeks prior.

Historically, when the S&P 500 has hit 52-week lows as it has in the past week, bullish sentiment has usually been even higher with an average reading of 29.15%. The chart below shows the levels of bearish, bullish, and neutral sentiment in the AAII survey at the time the S&P 500 first traded into bear market territory (down 20% from a prior peak) for each bear market since the survey began in 1987. At 24.3% now, the current reading of bullish sentiment is on the low side compared to prior bear markets. The only two bear markets where bullish sentiment was lower were July 2008 and February 2009.

Although bullish sentiment declined, bearish sentiment also pulled back below 50% for the first time since the week of April 20th. Even with the decline, though, bearish sentiment remains at a historically high level.

Given the moves, the bull-bear spread was higher for a second week in a row after it had reached the lowest level since March 2009 two weeks ago. Again, in spite of those improvements, the current level remains in the bottom 5% of all weeks on record.

The year is already a third over, and sentiment has found no respite after multiple months of declines in equity prices. In fact, bullish sentiment has not seen a single week with a reading above its historical average, and there has only been one such week for bearish sentiment. In the charts below, we show the average bullish and bearish sentiment reading by year since the start of the survey in 1987. While there’s still a lot of time left for things to change, with an average bullish sentiment reading of just 24.42% at this point in 2022, this year ranks as the worst year for bullish sentiment in the history of the survey (since 1987), although 1988 and 1990 have come close with average readings of around 27%. Meanwhile, the average reading on bearish sentiment has been 44.3% this year. 2008 is the only other year with a higher average reading at 45%. In other words, it is hard to find a comparable year since the late 1980s where optimism has been this low and pessimism this high. Click here to learn more about Bespoke’s premium stock market research service.

Apr 14, 2022

Heading into this week, bullish sentiment on the part of individual investors, measured by the weekly AAII survey, was already depressed with less than a quarter of respondents reporting optimistic sentiment. One week later with the S&P 500 continuing to move lower and a couple of hot, but not exactly unexpected, inflation readings in the interim, bullish sentiment has collapsed another 8.9 percentage points to the lowest level since the week of September 3rd, 1992. That’s right, bullish investor sentiment never got this low even at the depths of the pandemic, during the Global Financial Crisis, or during the Dot Com bubble burst. This week marks one of only 35 weeks since the survey began in 1987 that bullish sentiment was below 20%; the most recent being only back in February when it fell to 19.2%.

As could be expected, the huge drop and the historic low in bullish sentiment was met with a coincident increase in bearish sentiment. Bearish sentiment rose 7 percentage points to 48.4%. While that is an elevated reading, there have been a couple of even more elevated readings as recently as March 17 (49.8%), February 24 (53.7%), and January 27 (52.9%).

Even though bearish sentiment is not at a new high, the still-elevated reading on pessimism paired with the extremely depressed reading on bullishness has resulted in the bull-bear spread to fall much deeper into negative territory. Only two weeks ago, bulls actually outnumbered bears. Today, bears outnumber bulls by 32.6 percentage points. The 37 point drop since that positive reading marks the largest two-week decline in the bull-bear spread since April 2013. It is also the lowest level of the spread since that same period.

While bearish sentiment picked up, not all of those gains came from the decline in bulls. Neutral sentiment was slightly higher rising 1.8 percentage points to 35.7%. That is a few percentage points above the historical average, but it is also well below the multiple highs of the past year. You can read Bespoke’s full analysis of investor sentiment and its contrarian aspects with a two-week trial to Bespoke Premium.

Apr 7, 2022

After peaking at 32.8% two weeks ago, bullish sentiment continues to roll over as the S&P 500 has erased some of the March gains this week. After this week’s decline of 7.2 percentage points in bullish sentiment, less than a quarter of respondents reported as bullish. While low, that is still a few percentage points above the weaker levels from February.

Bearish sentiment in turn rose 13.9 percentage points which was the biggest one-week uptick since August 2019 when it rose 24.14 percentage points. At 41.4%, bearish sentiment is now at the highest level since the week of March 17th. That is an elevated reading and a big move week over week, but it is also well off recent highs from the past few months that were more than 10 percentage points higher.

The bull-bear spread tipped into positive territory for the first time in 2022 last week, but the big inverse moves between bulls and bears erased much of the past few weeks’ move. The spread is down to -16.7 which is still 13.6 points above the late February low of -30.3.

The big pickup in the number of respondents reporting as bearish didn’t entirely come from the bullish camp. Neutral sentiment also shed a significant amount falling from 40.6% last week to 33.9%. That is essentially mean reversion as neutral sentiment now sits only a couple of points above the historical average. Click here to view Bespoke’s premium membership options.

Mar 31, 2022

The last couple weeks of the first quarter have seen equities reverse a sizable portion of this year’s losses and sentiment has rebounded in sync, though, bullish sentiment turned slightly lower this week in spite of the S&P 500’s move higher. From the weekly AAII sentiment survey, bullish sentiment shed 0.9 percentage points coming in at 31.9%. Even after that decline, the current level of reported optimism remains above all others (outside of last week) since early January, but bullish sentiment still would need to rise another 6 percentage points to move back up to its historical average.

While more investors are not reporting much optimism, fewer are outright bearish. Bearish sentiment fell for a second week in a row falling another 7.9 percentage points to 27.5%. With a little over a quarter of respondents reporting as bearish, this sentiment reading is at the lowest level since November. That is also now the biggest two-week decline in bearish sentiment (22.3 percentage points) since November 2009 when it had fallen 23.74 percentage points in a two-week span.

Finally, we would note that given bearish sentiment has plummeted at a historic rate without much of an increase in bullish sentiment, neutral sentiment has picked up the difference. That reading clipped above 40% this week for the highest level since January 2020.

Other sentiment surveys like the Investors Intelligence one and NAAIM’s Exposure Index have also pivoted more bullish this week. As a result, our sentiment composite is close to zero meaning across these three indicators, sentiment is now only just slightly below the historical average. Click here to view Bespoke’s premium membership options.